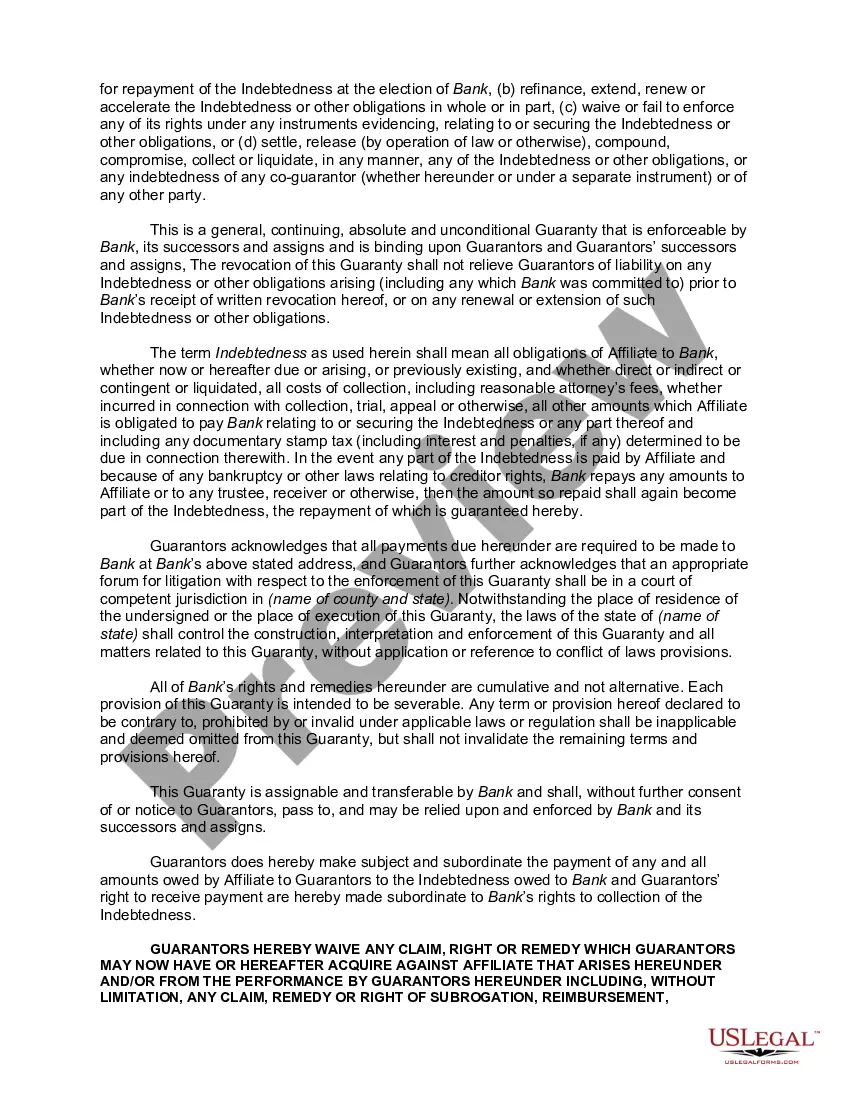

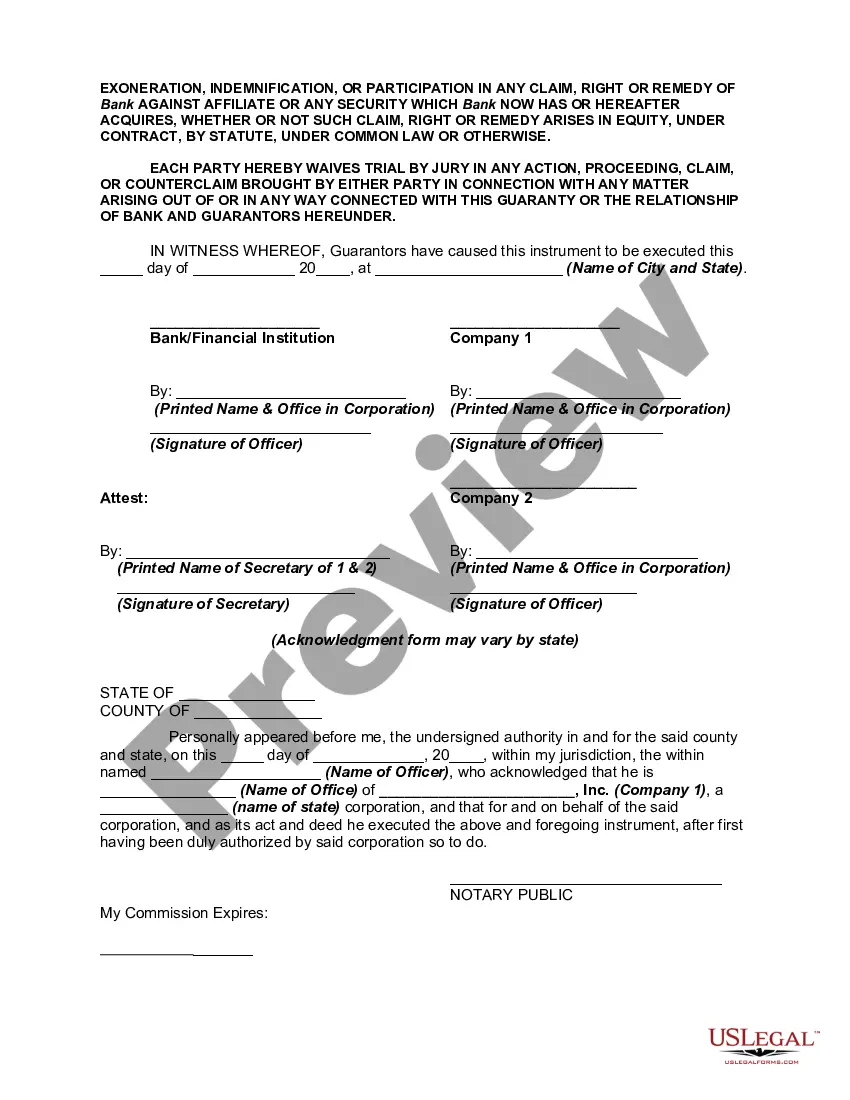

In this guaranty, two corporations guarantee the debt of an affiliate corporation.

North Carolina Cross Corporate Guaranty Agreement

Description

How to fill out Cross Corporate Guaranty Agreement?

Are you currently in a scenario where you require documentation for either business or specific purposes frequently.

There are numerous legal document templates available online, but finding reliable ones can be challenging.

US Legal Forms offers a wide range of form templates, including the North Carolina Cross Corporate Guaranty Agreement, designed to meet state and federal requirements.

If you find the suitable form, simply click Buy now.

Choose the pricing plan you prefer, provide the necessary details to create your account, and make a payment using PayPal or Visa or Mastercard.

- If you are familiar with the US Legal Forms website and have an account, simply Log In.

- You can then download the North Carolina Cross Corporate Guaranty Agreement template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct city/state.

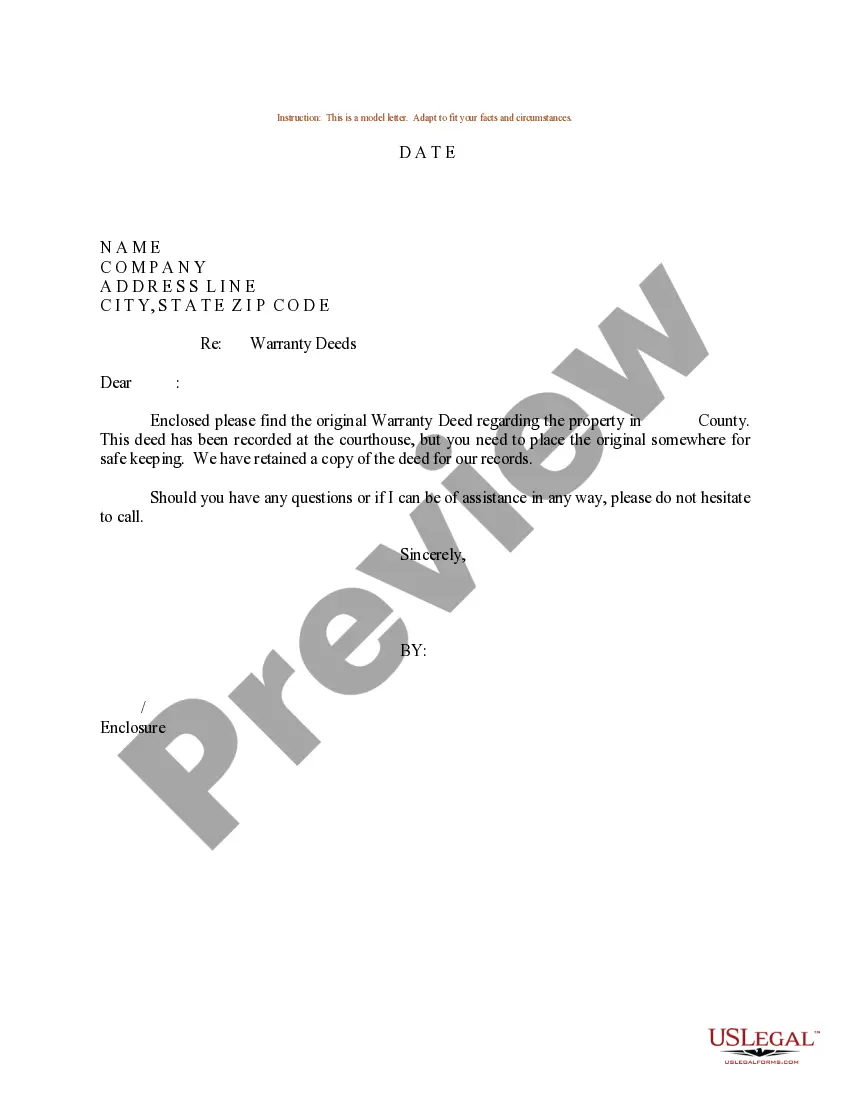

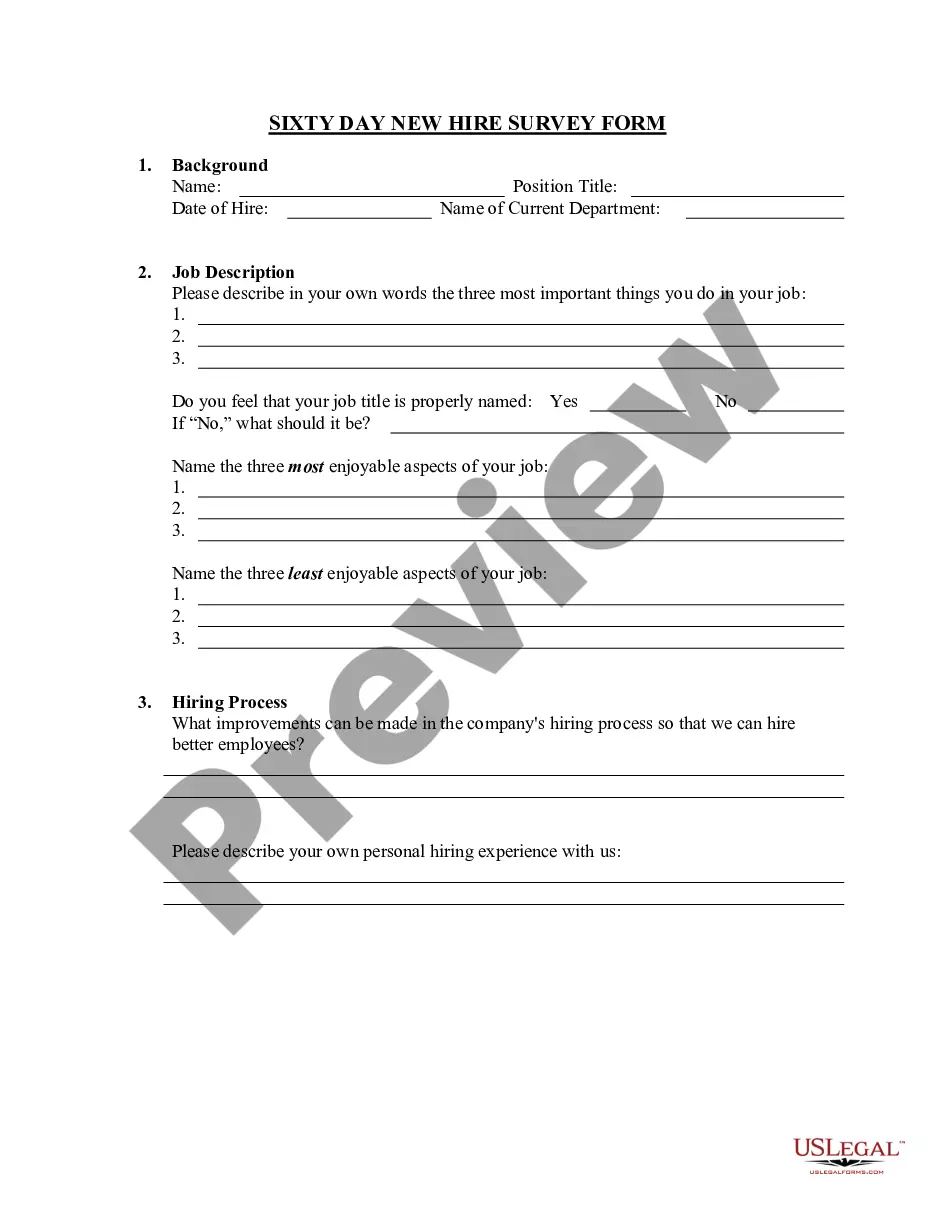

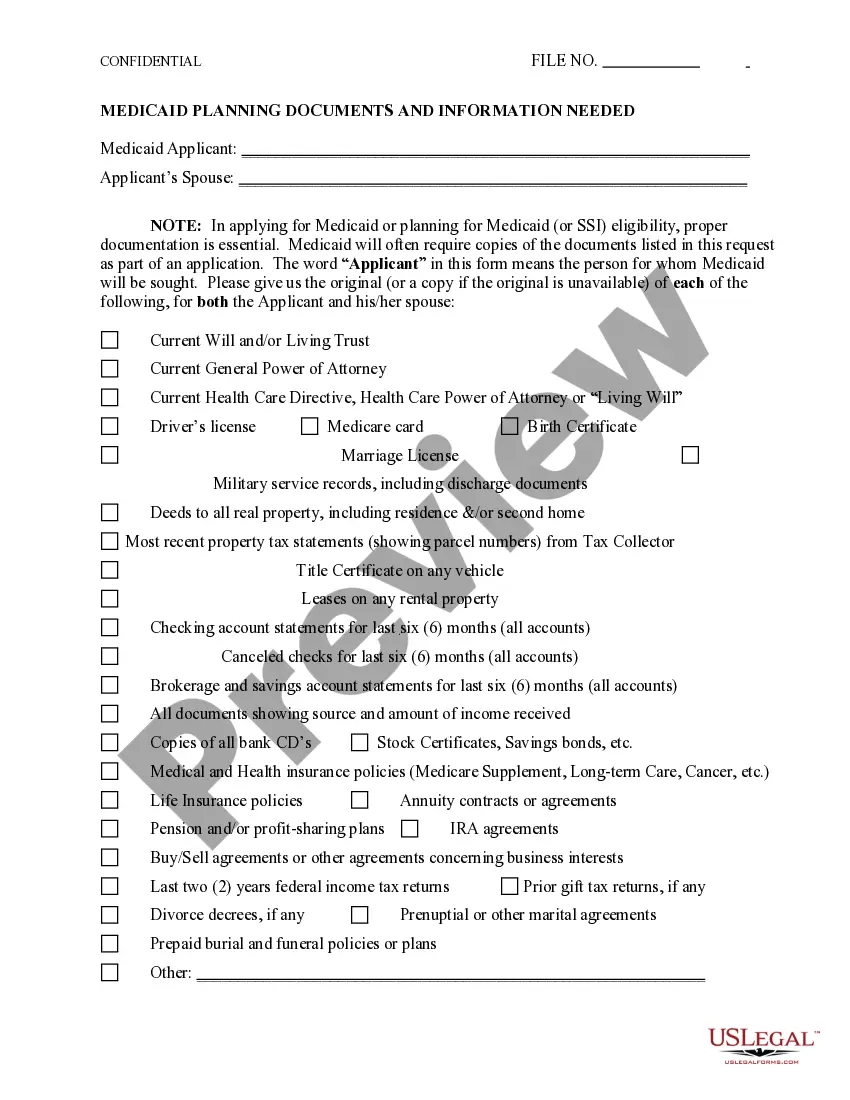

- Use the Preview option to review the document.

- Read the description to confirm that you have selected the right form.

- If the form isn’t what you’re looking for, use the Search field to find a form that meets your needs.

Form popularity

FAQ

Writing a guarantee statement involves outlining the commitment you are making to fulfill another person’s obligation if they cannot. Begin by stating the guarantor's name, the debtor's name, and the nature of the obligation. For clarity and legal protection, incorporate a North Carolina Cross Corporate Guaranty Agreement format; this might help in covering all required legal aspects effectively.

To draft a guarantee agreement, start by clearly identifying the parties involved, including the guarantor and the principal debtor. Next, specify the obligations being guaranteed and include details such as the duration of the agreement and any conditions or limitations. Utilizing a North Carolina Cross Corporate Guaranty Agreement template from a platform like uslegalforms can simplify this process, ensuring all necessary elements are included.

Filling out a personal guarantee involves providing specific personal information, such as your name, address, and Social Security number. You also need to specify the obligations you are guaranteeing and may have to state the maximum amount covered. If you're considering a North Carolina Cross Corporate Guaranty Agreement, ensure that your guarantee is clearly stated, to protect both you and the lender.

To structure a guarantee effectively, begin by specifying the parties involved, including the guarantor and the guarantee recipient. Next, detail the obligations to be covered by the North Carolina Cross Corporate Guaranty Agreement, ensuring clarity around terms and conditions. A well-organized format makes the document easy to understand, while uslegalforms can assist you with professional templates to create robust agreements.

Writing a guarantee agreement starts with identifying the parties involved and the purpose of the North Carolina Cross Corporate Guaranty Agreement. Include important elements such as the obligations guaranteed, any terms and conditions, and the duration of the guarantee. A clear and concise structure is essential, so consider using templates available on uslegalforms to simplify the drafting process.

To provide a corporate guarantee, you must first draft a North Carolina Cross Corporate Guaranty Agreement. This document should clearly outline the obligations of the guarantor company in relation to the debtor. Ensure both parties understand their responsibilities, and obtain necessary signatures. Using a platform like uslegalforms can streamline the process and ensure your agreement is legally sound.

A cross company guarantee operates by allowing one company to legally commit to fulfilling the debts of another company if it cannot meet its obligations. This agreement usually outlines the specifics of the guarantee, including the amount covered and the duration of the commitment. For businesses looking to formalize such arrangements, the US Legal Forms platform provides the necessary resources and templates to create a North Carolina Cross Corporate Guaranty Agreement with ease.

Yes, under a North Carolina Cross Corporate Guaranty Agreement, one company can guarantee the financial obligations of another company. This practice is common in business partnerships or corporate family structures where financial resources are shared. By entering into such agreements, companies can support each other, thereby increasing their collective access to capital and improving their overall stability.

The purpose of a North Carolina Cross Corporate Guaranty Agreement is to enhance the creditworthiness of a company by allowing it to back the debts of another company. This kind of agreement enables one entity to provide assurance to lenders or creditors that another entity's obligations will be met. As a result, companies can establish stronger relationships with banks and investors, which can lead to better financing terms and lower interest rates.

The structure of a corporate guarantee typically includes the identification of the parties involved, a clear definition of the obligations being guaranteed, and the scope of the guarantee. Additionally, it lays out the events that may trigger the guarantee and the recourse available for creditors. When utilizing a North Carolina Cross Corporate Guaranty Agreement, ensure your document contains all the essential elements to enforceability.