North Carolina Reorganization of Partnership by Modification of Partnership Agreement

Description

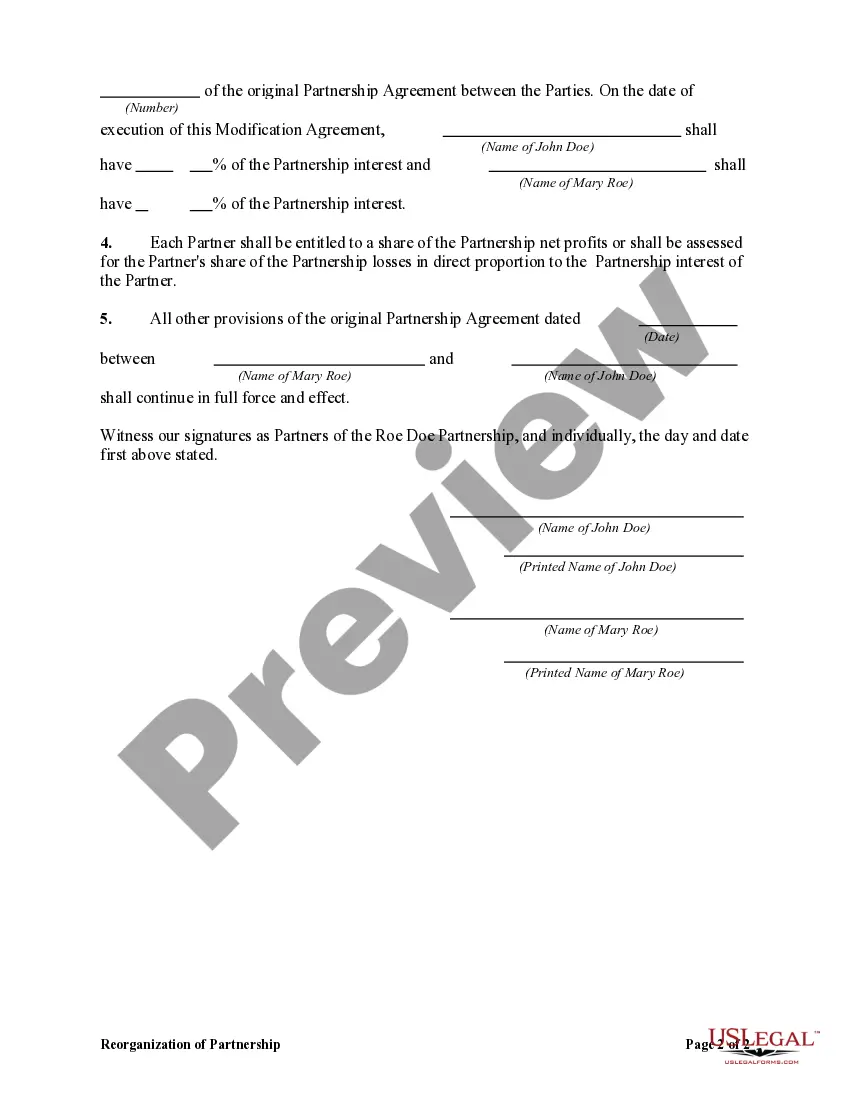

How to fill out Reorganization Of Partnership By Modification Of Partnership Agreement?

You can invest a few hours on the web looking for the official document template that complies with the state and federal requirements you desire.

US Legal Forms offers numerous legal documents that have been evaluated by experts.

You can download or print the North Carolina Reorganization of Partnership by Modification of Partnership Agreement from our service.

If available, utilize the Review button to examine the document format as well.

- If you already possess a US Legal Forms account, you can Log In and hit the Acquire button.

- Subsequently, you can fill out, modify, print, or sign the North Carolina Reorganization of Partnership by Modification of Partnership Agreement.

- Every legal document template you receive is yours indefinitely.

- To obtain another version of any form you've acquired, access the My documents tab and click on the corresponding button.

- If you're visiting the US Legal Forms site for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document format for the state/city of your choice.

- Review the form details to confirm you have chosen the right form.

Form popularity

FAQ

Updating a partnership agreement typically requires drafting an amendment that reflects the desired changes. You should involve all partners in discussions to agree on the new terms that will be incorporated. The North Carolina reorganization of partnership by modification of partnership agreement facilitates this process, ensuring that the revisions are legally sound and clearly documented. Platforms like US Legal Forms can offer templates and guidance to help you through this update seamlessly.

Yes, you can change partners in a partnership, subject to the terms laid out in your partnership agreement. This process may involve the addition of new partners or the exit of existing ones and must be executed in accordance with legal requirements. The North Carolina reorganization of partnership by modification of partnership agreement provides a structured approach to such changes. Utilizing tools from US Legal Forms can help you craft the necessary documentation to ensure compliance.

Changes in the partnership agreement can lead to various outcomes, including revised roles, responsibilities, and profit-sharing arrangements. These modifications often aim to improve operational efficiency or adapt to new business conditions. The North Carolina reorganization of partnership by modification of partnership agreement can provide a legal framework to formalize these changes. It's vital to communicate these changes to all partners to ensure transparency and alignment.

Yes, partners can be changed in a partnership firm, but specific procedures must be adhered to based on the partnership agreement. Changing a partner may involve adding a new partner or removing an existing one, which can significantly affect the firm's structure. The North Carolina reorganization of partnership by modification of partnership agreement allows for such transitions to occur smoothly. Consulting a legal professional or using US Legal Forms can simplify this process.

A change in the existing agreement between partners is often called an amendment. This amendment can take many forms, including adjustments to profit sharing or partner responsibilities. Engaging in the North Carolina reorganization of partnership by modification of partnership agreement is crucial for keeping your partnership aligned with your business objectives. Regularly updating your agreement can help prevent misunderstandings and keep everyone on the same page.

Filling out a partnership agreement involves several key steps. First, you need to outline the roles and responsibilities of each partner, reflecting the terms you all agree upon. Utilizing a platform like US Legal Forms can streamline this process, as they provide templates tailored for the North Carolina reorganization of partnerships by modification of partnership agreements. Ensure all partners review the document thoroughly to prevent future disputes.

A change in a partnership agreement is typically referred to as a modification or amendment. This process is essential when partners want to adjust terms to better reflect their current business needs. In North Carolina, the reorganization of a partnership by modification of the partnership agreement allows stakeholders to adapt to changing circumstances effectively. Keeping your agreement current ensures a smoother operation for all partners involved.

To change the terms of a partnership agreement, partners should first discuss and agree on the desired alterations. It is crucial to document these changes in a partnership amendment, which outlines the new terms explicitly. All partners must sign this amendment to ensure its validity. For assistance, the North Carolina Reorganization of Partnership by Modification of Partnership Agreement provides valuable resources to guide you through this process.

NC Form D 403 is a document filed with the North Carolina Secretary of State that pertains to the reorganization of partnerships. This form is essential for partners looking to restructure their partnership agreement legally. Submitting this form ensures compliance with local laws and regulations while reflecting the changes made in partnership terms. It's an important step in the North Carolina Reorganization of Partnership by Modification of Partnership Agreement process.

Yes, parties can change the terms of a contract, provided all involved parties consent to the modifications. Creating an addendum or modification agreement is a common way to document these changes clearly. This modification should specify the exact adjustments to avoid any confusion in the future. Utilizing the North Carolina Reorganization of Partnership by Modification of Partnership Agreement streamlines this process for partners in North Carolina.