A nonprofit corporation is one that is organized for charitable or benevolent purposes. These corporations include certain hospitals, universities, churches, and other religious organizations. A nonprofit entity does not have to be a nonprofit corporation, however. Nonprofit corporations do not have shareholders, but have members or a perpetual board of directors or board of trustees.

North Carolina Articles of Incorporation for Non-Profit Organization, with Tax Provisions

Description

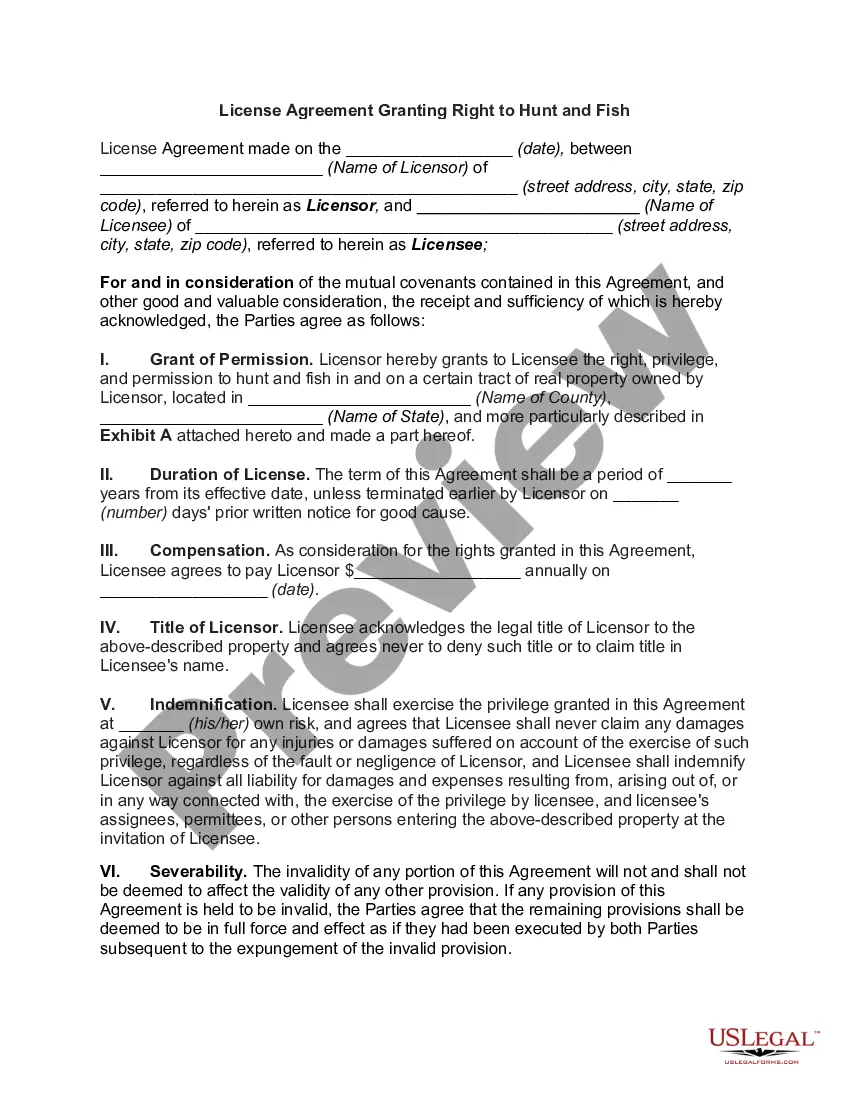

How to fill out Articles Of Incorporation For Non-Profit Organization, With Tax Provisions?

Are you now in a situation where you require documents for either business or personal reasons nearly every workday? There are numerous legal document templates available online, but locating reliable ones is not simple.

US Legal Forms offers thousands of form templates, such as the North Carolina Articles of Incorporation for Non-Profit Organization, which includes Tax Provisions designed to meet both state and federal regulations.

If you are already familiar with the US Legal Forms website and have an account, simply Log In. After that, you can download the North Carolina Articles of Incorporation for Non-Profit Organization, including Tax Provisions template.

- Find the form you need and ensure it is for the correct city/region.

- Utilize the Preview button to view the form.

- Check the details to ensure you have selected the right form.

- If the form isn't what you seek, use the Lookup field to find the form that meets your needs and requirements.

- Once you locate the appropriate form, click Get now.

- Select the pricing plan you desire, provide the required information to create your account, and purchase an order using your PayPal or credit card.

- Choose a convenient file format and download your copy.

Form popularity

FAQ

A 501(c)(3) is a specific type of nonprofit organization that qualifies for tax-exempt status under federal law. While all 501(c)(3) organizations are nonprofits, not all nonprofits are 501(c)(3) organizations. The key distinction lies in the eligibility for tax-deductible donations and specific tax benefits. When you prepare your North Carolina Articles of Incorporation for Non-Profit Organization, with Tax Provisions, consider whether seeking 501(c)(3) status aligns with your organization’s goals.

To incorporate a nonprofit in North Carolina, you need to file your North Carolina Articles of Incorporation for Non-Profit Organization, with Tax Provisions with the Secretary of State. This process involves providing information about your organization's purpose, structure, and initial board members. After filing, you should apply for federal tax-exempt status to benefit from tax provisions. Platforms like uslegalforms can simplify this process by providing templates and guidance.

Yes, you can start and run a nonprofit organization by yourself in North Carolina. However, it is beneficial to have a board of directors to help guide the organization and provide support. When you prepare your North Carolina Articles of Incorporation for Non-Profit Organization, with Tax Provisions, it is essential to outline the roles and responsibilities clearly. This structure helps with governance and accountability, ensuring long-term success.

Your nonprofit may need to file a tax return, depending on its revenue and other activities. It's important to understand that even if your organization is tax-exempt, there are specific regulations regarding reporting income. Consulting resources such as uslegalforms can help you determine your filing obligations based on your nonprofit's unique circumstances.

Yes, nonprofits must file annual reports in North Carolina to remain in good standing. This report typically includes basic information about the organization, such as its status and activities, and must be submitted to the Secretary of State. Maintaining compliance with annual reporting helps ensure the longevity and credibility of your nonprofit.

Writing articles of incorporation for a nonprofit requires clear and specific details about your organization. You need to include the organization's name, purpose, and provisions related to assets and dissolution. Utilizing a platform like uslegalforms can simplify this process, offering templates that guide you through crafting the necessary documents accurately.

Yes, nonprofits often file tax returns in North Carolina, especially if they meet revenue thresholds. Even organizations with tax-exempt status need to comply with certain reporting requirements to maintain their status. Filing ensures transparency and can also serve to build trust with donors and the community.

In North Carolina, nonprofits that have gross revenue of $1,000 or more generally must file a tax return. This includes organizations that are recognized as tax-exempt but may still need to report specific financial activities. However, if your nonprofit operates below the threshold, you may not be required to file a return, which can help reduce administrative burdens.

To incorporate a nonprofit organization in North Carolina, you must first prepare and file the North Carolina Articles of Incorporation for Non-Profit Organization, with Tax Provisions. This involves providing specific information about your organization, such as its name and purpose. After submitting the articles to the Secretary of State, you can apply for an Employer Identification Number (EIN) through the IRS to facilitate tax considerations.

Yes, nonprofits need to file articles of incorporation to officially establish their legal existence in North Carolina. This step allows organizations to operate as a recognized entity, providing liability protection to their members. Additionally, incorporating as a nonprofit organization is essential for obtaining tax-exempt status, which adds more benefits for your cause.