North Carolina Independent Contractor Agreement with Church: A Comprehensive Overview of Church Contractor Agreements In North Carolina, an Independent Contractor Agreement with a church is a legally binding document that establishes a formal working relationship between a church or religious organization and an independent contractor. This agreement sets out the terms and conditions under which the independent contractor will provide specific goods or services to the church without being classified as an employee. Keywords: North Carolina, Independent Contractor Agreement, Church, religious organization, working relationship, goods, services, employee. Types of North Carolina Independent Contractor Agreements with a Church: 1. General Independent Contractor Agreement: This agreement is the most common type, encompassing a wide range of contractual relationships between churches and independent contractors. It outlines the responsibilities, expectations, and compensation provisions relating to the specific goods or services the contractor will provide to the church. 2. Construction Independent Contractor Agreement: Specifically designed for construction-related projects, this agreement outlines the terms and conditions for contractors engaged in building, renovation, repair, or maintenance work for the church. It encompasses details related to project scope, timelines, materials, safety requirements, and payment terms. 3. Music/Worship Independent Contractor Agreement: This agreement is tailored for independent contractors engaged in providing musical or worship services to the church. It covers aspects such as performance schedules, rehearsals, compensation, copyrights, and any other relevant obligations. 4. Pastoral/Ministerial Independent Contractor Agreement: Targeting independent contractors with pastoral or ministerial roles, this agreement clarifies the relationship between the contractor and the church. It outlines the duties and responsibilities related to pastoral care, religious services, counseling, teaching, and any other relevant activities. It may also address compensation, benefits, and other terms specific to their role within the church. 5. Administrative Support Independent Contractor Agreement: This agreement is suitable for independent contractors providing administrative, secretarial, bookkeeping, or other support services to the church. It outlines the tasks to be performed, expectations for reliability and confidentiality, payment terms, and any other relevant provisions. 6. Event/Special Program Independent Contractor Agreement: Tailored for contractors involved in organizing, coordinating, or providing services for specific events or programs, this agreement outlines the scope of work, responsibilities, timelines, payment terms, and any event-specific customizations required by the church. A North Carolina Independent Contractor Agreement with a Church typically covers the following essential elements: identification of the parties involved, a clear description of the contractor's services, terms of engagement, compensation details, confidentiality and non-disclosure provisions, intellectual property rights, indemnification, termination clauses, and any other specific provisions required by the nature of the contract. Please note that this overview is intended as a general guide, and it is advisable to seek legal advice or consult an attorney to ensure compliance with North Carolina laws and regulations when drafting or using an Independent Contractor Agreement with a Church.

North Carolina Independent Contractor Agreement with Church

Description

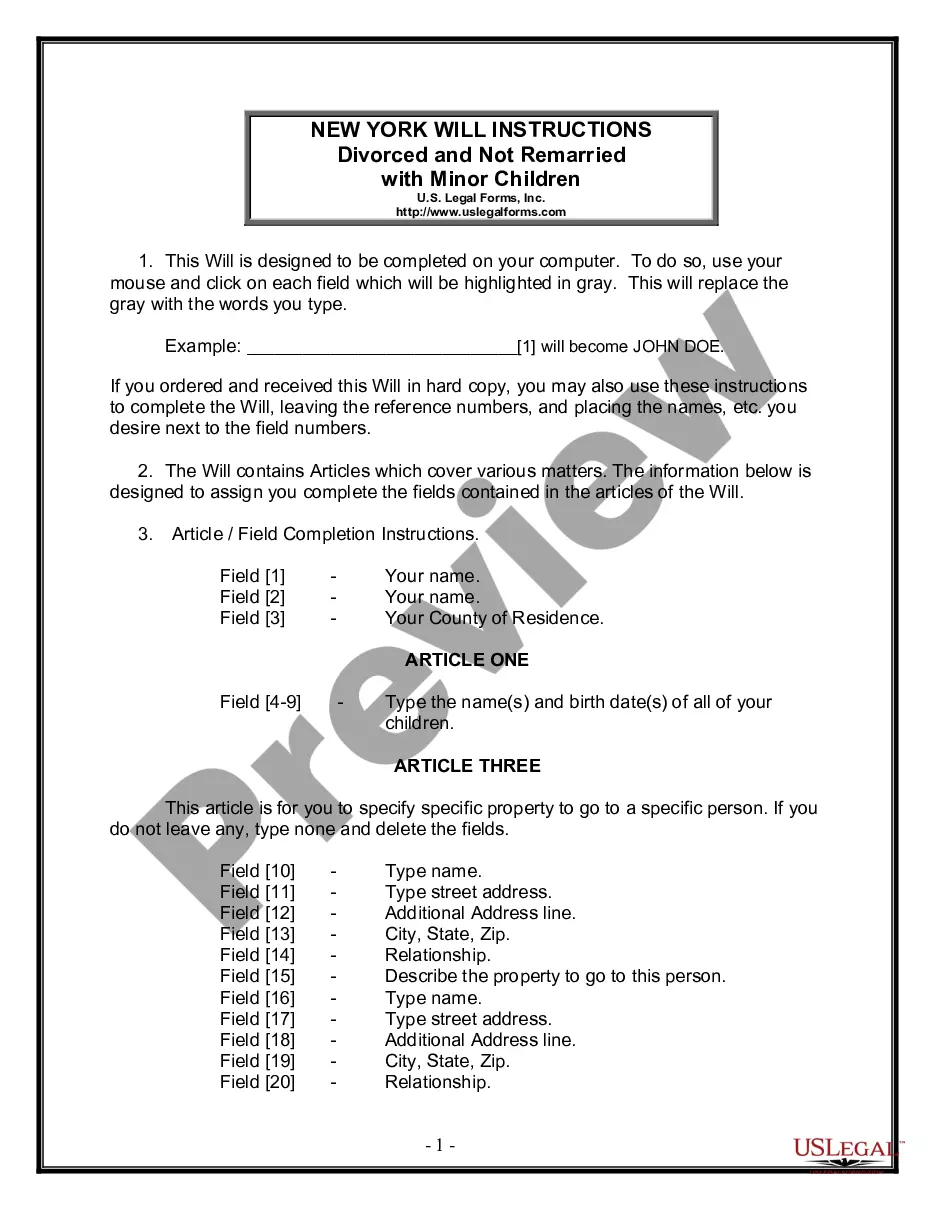

How to fill out North Carolina Independent Contractor Agreement With Church?

US Legal Forms - one of several most significant libraries of legal varieties in the USA - provides an array of legal record layouts you can obtain or printing. While using site, you can get a large number of varieties for enterprise and specific purposes, sorted by classes, claims, or keywords.You can get the newest models of varieties much like the North Carolina Independent Contractor Agreement with Church in seconds.

If you already possess a subscription, log in and obtain North Carolina Independent Contractor Agreement with Church through the US Legal Forms collection. The Down load key will show up on each and every type you perspective. You get access to all in the past acquired varieties from the My Forms tab of your own accounts.

If you wish to use US Legal Forms for the first time, allow me to share easy guidelines to obtain started out:

- Make sure you have selected the right type to your metropolis/region. Select the Preview key to examine the form`s articles. See the type information to actually have chosen the correct type.

- If the type doesn`t match your needs, make use of the Research discipline near the top of the display to get the one which does.

- In case you are satisfied with the form, validate your selection by clicking the Acquire now key. Then, opt for the costs strategy you want and give your qualifications to sign up for an accounts.

- Method the purchase. Use your bank card or PayPal accounts to finish the purchase.

- Select the structure and obtain the form on your own system.

- Make adjustments. Load, edit and printing and indication the acquired North Carolina Independent Contractor Agreement with Church.

Every single template you added to your money lacks an expiration date which is your own permanently. So, in order to obtain or printing one more backup, just proceed to the My Forms section and click on in the type you require.

Obtain access to the North Carolina Independent Contractor Agreement with Church with US Legal Forms, one of the most comprehensive collection of legal record layouts. Use a large number of specialist and condition-specific layouts that satisfy your small business or specific needs and needs.

Form popularity

FAQ

A 1099 employee is a US self-employed worker that reports their income to the IRS on a 1099 tax form. Freelancers, gig workers, and independent contractors are all considered 1099 employees. In contrast, actual company employees are considered W-2 employees.

North Carolina Law reads as follows: To work as a general contractor on projects costing more than $30,000 in North Carolina, you must get a license from the North Carolina Licensing Board for General Contractors.

The three types of self-employed individuals include:Independent contractors. Independent contractors are individuals hired to perform specific jobs for clients, meaning that they are only paid for their jobs.Sole proprietors.Partnerships.

How do I create an Independent Contractor Agreement?State the location.Describe the type of service required.Provide the contractor's and client's details.Outline compensation details.State the agreement's terms.Include any additional clauses.State the signing details.

An independent contractor agreement is a legally binding document signed by a 1099 employee and the company that hires them. It outlines the scope of work and the terms under which that work will be completed, which goes a long way to making sure both parties are on the same page about the project from the start.

Becoming an independent contractor is one of the many ways to be classified as self-employed. By definition, an independent contractor provides work or services on a contractual basis, whereas, self-employment is simply the act of earning money without operating within an employee-employer relationship.

Simply put, being an independent contractor is one way to be self-employed. Being self-employed means that you earn money but don't work as an employee for someone else.

Independent contractors provide goods or services according to the terms of a contract they have negotiated with an employer. Independent contractors are not employees, and therefore they are not covered under most federal employment statutes.

Since the licensure statute requires a license only for projects that cost $30,000 or more, there is arguably a fourth tier which is sometimes known as the "handyman exception"for construction projects that cost under $30,000, no license is required.

There are three easy steps to take when beginning an independent contractor business:Pick a name for your business. The name of your business should shed a little light on what it is you do and who your target clients may be.Get yourself a contracting license.Make sure you figure out your recordkeeping and taxes.