This is a triple net lease between two Churches. A triple net lease is a lease agreement on a property where the tenant or lessee agrees to pay all Real Estate Taxes (Net), Building Insurance (Net) and Common Area Maintenance (Net) on the property in addition to any normal fees that are expected under the agreement (rent, etc.). In such a lease, the tenant or lessee is responsible for all costs associated with repairs or replacement of the structural building elements of the property.

North Carolina Lease Agreement Between Two Nonprofit Church Corporations

Description

How to fill out Lease Agreement Between Two Nonprofit Church Corporations?

You can spend hours online attempting to discover the authentic document format that meets the state and federal requirements you need.

US Legal Forms offers thousands of valid templates that are reviewed by professionals.

It is easy to obtain or print the North Carolina Lease Agreement Between Two Nonprofit Church Corporations from my service.

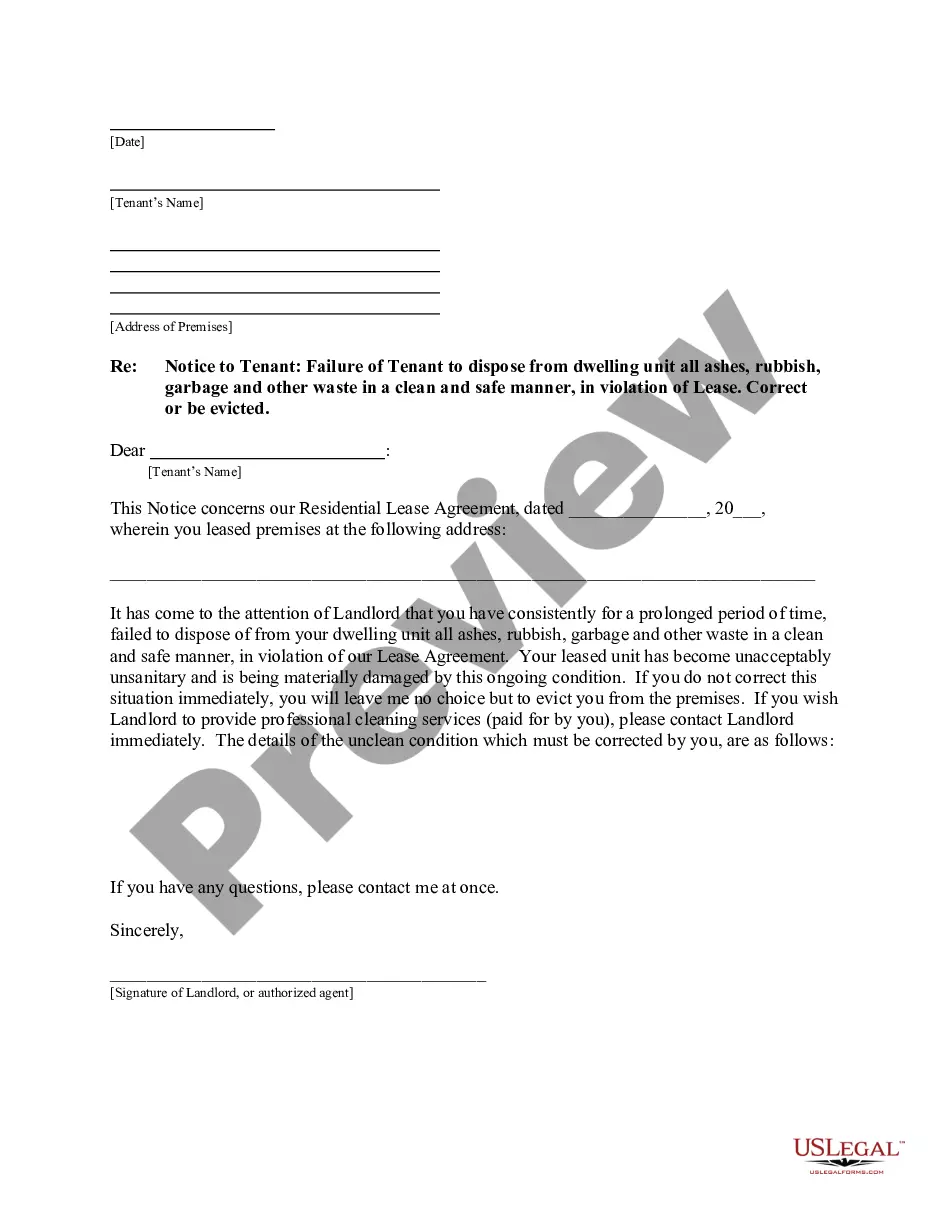

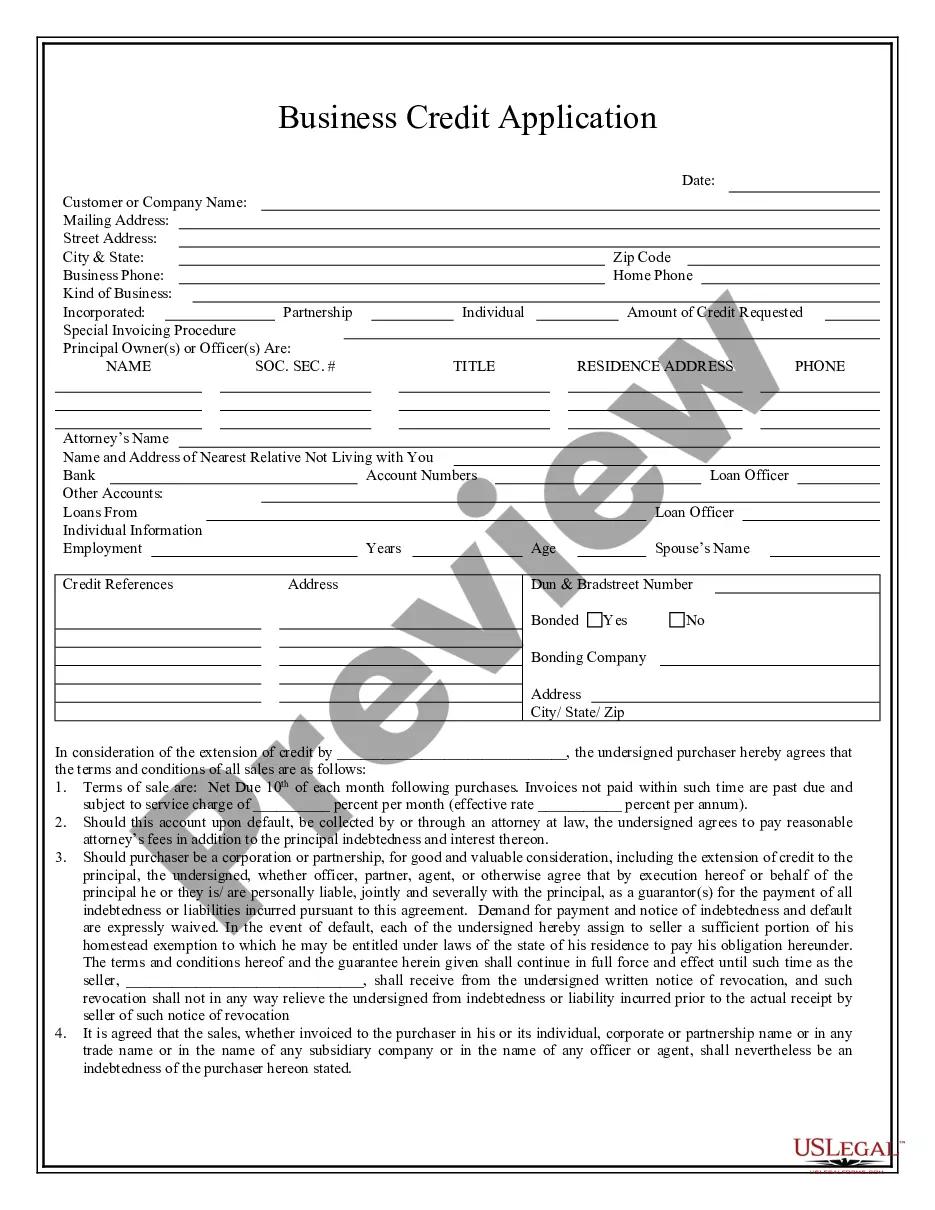

If available, use the Preview option to view the document format as well.

- If you already possess a US Legal Forms account, you may Log In and select the Download option.

- After that, you can complete, modify, print, or sign the North Carolina Lease Agreement Between Two Nonprofit Church Corporations.

- Every legal document template you purchase is yours indefinitely.

- To get another copy of any purchased form, go to the My documents tab and click the relevant option.

- If you are accessing the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure you have chosen the correct document format for the area/city of your preference.

- Review the form description to confirm you have selected the right form.

Form popularity

FAQ

Merging two nonprofit organizations involves several steps, including careful planning and legal considerations. Both organizations must agree on the terms of the merger and file the necessary documentation with state authorities. A North Carolina Lease Agreement Between Two Nonprofit Church Corporations can serve as a foundation for collaborative efforts during and after the merger, allowing for a smooth transition and cohesive objectives.

Two non-profits can definitely form a partnership, creating opportunities for collaboration and resource sharing. Such partnerships often lead to more impactful community services and common goals. A North Carolina Lease Agreement Between Two Nonprofit Church Corporations can help outline the responsibilities and expectations of both parties, ensuring clear communication and cooperation.

You can certainly work for two non-profits simultaneously, as long as there are no conflicts of interest. Many professionals find fulfilling roles in different organizations that align with their values. If both organizations are church-related and utilize a North Carolina Lease Agreement Between Two Nonprofit Church Corporations, they can streamline operations and foster synergy.

Yes, you can establish multiple non-profit organizations. Each organization needs to operate independently under its unique mission and bylaws. If you are part of a network of churches, using a North Carolina Lease Agreement Between Two Nonprofit Church Corporations can help ensure your organizations collaborate effectively and use shared resources.

Yes, nonprofits in North Carolina must file annual reports with the Secretary of State to maintain their good standing. This requirement ensures that the nonprofit remains accountable and transparent regarding its activities and financial health. Furthermore, if your organizations are entering into a North Carolina Lease Agreement Between Two Nonprofit Church Corporations, keeping your status in good standing is essential for lawful operations. Using resources like uslegalforms can help streamline your report filing process and ensure compliance.

A nonprofit board in North Carolina must have at least three members, but having a larger board can enhance governance and provide diverse insights. The ideal number often depends on the size and scope of the organization. When drafting a North Carolina Lease Agreement Between Two Nonprofit Church Corporations, consider establishing a board capable of making informed decisions in a collaborative manner.

Yes, you can operate two separate nonprofit organizations as long as each complies with local and federal regulations. This structure may provide different avenues for funding and mission fulfillment. When considering a North Carolina Lease Agreement Between Two Nonprofit Church Corporations, it's important to clarify the relationship and responsibilities of both entities to prevent confusion.

Nonprofits can engage in various types of contracts, including service agreements, lease agreements, and sponsorship contracts. Each contract type serves specific organizational needs and should comply with legal requirements. When drafting a North Carolina Lease Agreement Between Two Nonprofit Church Corporations, understanding these contracts ensures fair and transparent dealings.

The 49% rule states that a nonprofit should not allow more than 49% of its board to be affiliated with a single organization. This ensures that the board's decisions reflect the broader interests of the nonprofit community rather than just a few stakeholders. When creating a North Carolina Lease Agreement Between Two Nonprofit Church Corporations, following this rule can help maintain integrity and public trust.

Yes, a nonprofit can lease property to fulfill its mission and activities. Leases provide nonprofits with flexibility to use spaces without the financial commitment of purchasing. When executing a North Carolina Lease Agreement Between Two Nonprofit Church Corporations, ensure the lease terms align with your operational needs and compliance requirements.