North Carolina Land Installment Contract

Description

How to fill out Land Installment Contract?

If you wish to compile, obtain, or generate legal document templates, utilize US Legal Forms, the premier collection of legal forms, accessible online.

Employ the site's straightforward and user-friendly search feature to find the documents you require.

Numerous templates for business and personal purposes are organized by categories and jurisdictions, or keywords.

Every legal document template you purchase is yours indefinitely. You have access to every form you have downloaded in your account. Navigate to the My documents section and select a form to print or download again.

Compete and obtain, and print the North Carolina Land Installment Agreement with US Legal Forms. There are millions of professional and state-specific forms available for your personal business or individual needs.

- Use US Legal Forms to locate the North Carolina Land Installment Agreement with just a few clicks.

- If you are a current US Legal Forms customer, Log In to your account and click the Download button to acquire the North Carolina Land Installment Agreement.

- You can also access forms you have previously downloaded within the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have selected the form for the correct state/country.

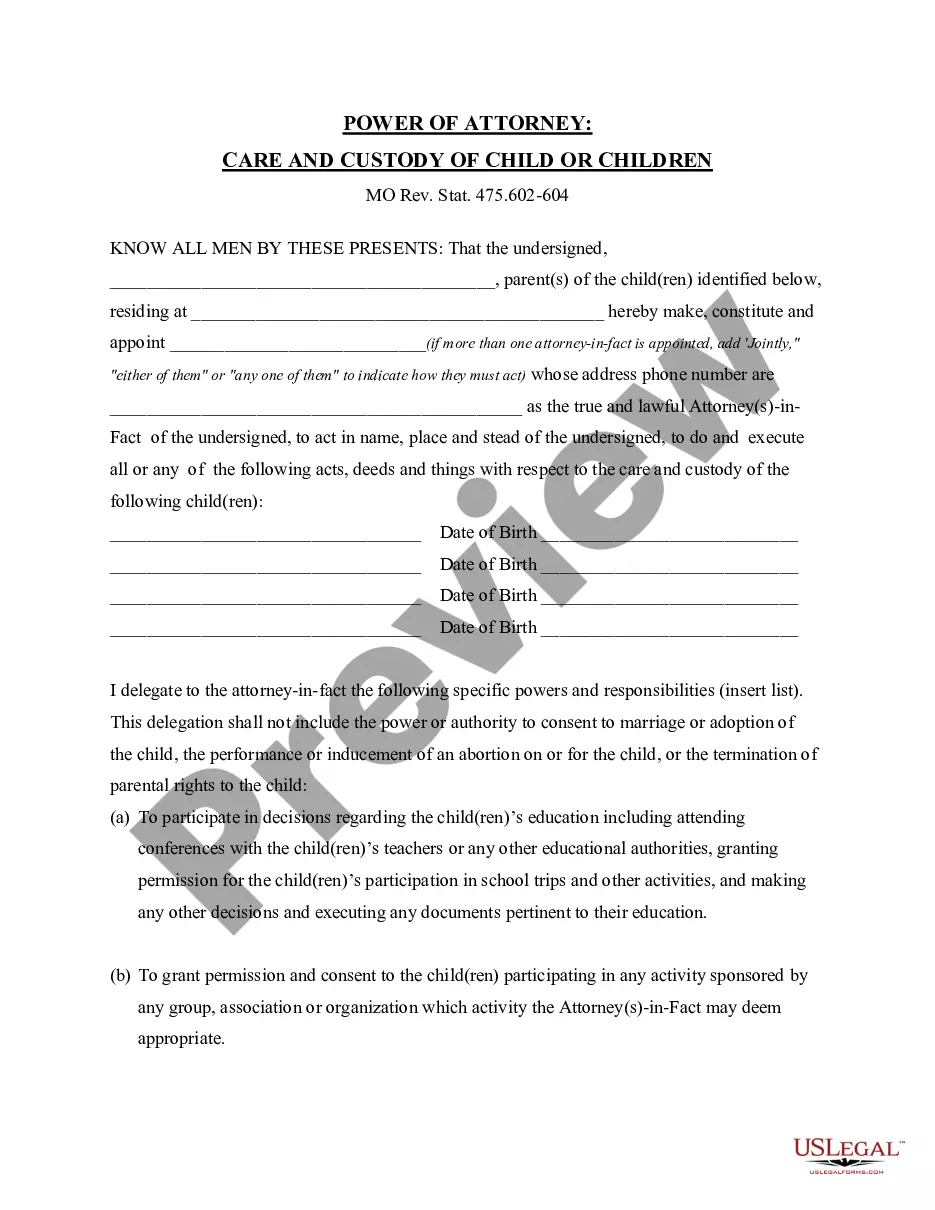

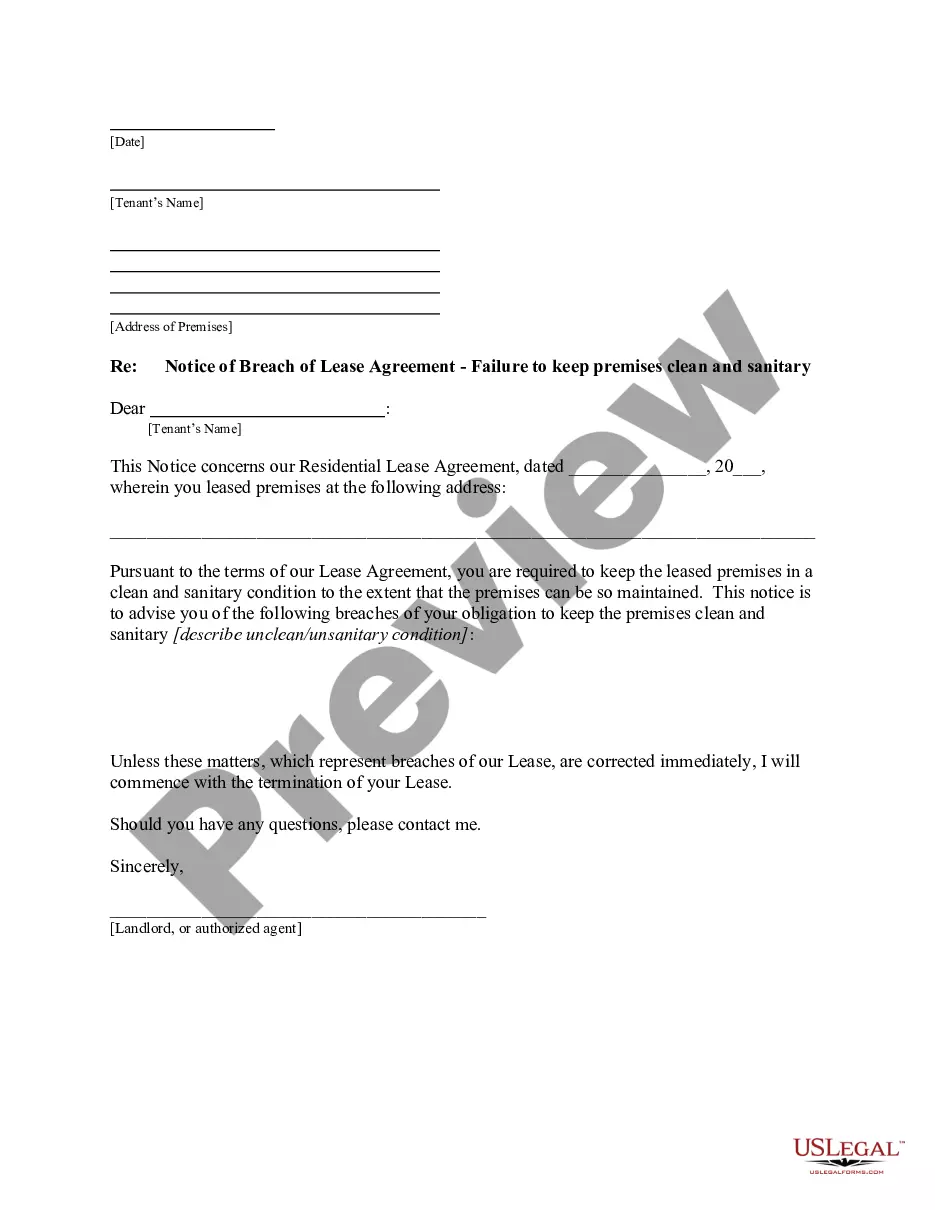

- Step 2. Use the Preview feature to review the form’s content. Don’t forget to check the details.

- Step 3. If you are not satisfied with the form, use the Search bar at the top of the screen to find alternative versions of the legal form template.

- Step 4. Once you have identified the form you need, click the Get now button. Choose the payment plan you prefer and input your information to register for an account.

- Step 5. Complete the payment process. You can utilize your credit card or PayPal account to finalize the transaction.

- Step 6. Select the format of the legal form and download it to your device.

- Step 7. Complete, modify, and print or sign the North Carolina Land Installment Agreement.

Form popularity

FAQ

Parties who only extend financing for the purchase of real estate under land contracts to be licensed. parties who extend financing for the purchase of real estate to be licensed. What is the most prevailing disadvantage of a land contract to the seller? the loan period.

One of the primary benefits of an installment sale is that it gives the seller an opportunity to partially defer capital gains from the sale to future tax years. By using an installment sale, the seller may benefit by: Partially deferring taxes while simultaneously improving cash flow.

A North Carolina land contract documents the terms of a vacant land purchase and sale agreement between two parties. The buying and selling parties must create this contract through negotiating offers, ultimately reaching mutual terms such as the agreed-upon purchase price and any financial contingencies.

An installment land sales contract is an agreement to buy land over time, without transferring title to the land until all the payment have been made. The Seller agrees to allow the Buyer to pay the purchase price over a period of time in installment amounts.

Disadvantage #1: The title does not automatically pass to the purchaser in a land contract. Disadvantage #2: The seller could be held legally responsible for inspection issues with local or state authorities. Disadvantage #3: Forfeiture of a land contract by the purchaser is a fairly common occurrence.

An installment contract is a single contract that is completed by a series of performancessuch as payments, performances of a service, or delivery of goodsrather than being performed all at one time. Installment contracts can provide that installments are to be performed by either one or both parties.

NCGS Chapter 47H: Contracts for Deed Installment land sales contracts or contracts for deed are now governed by State law as of October 1, 2010 if the subject property will be used as the principal dwelling of the purchaser.

In an installment sale contract sometimes called a contract for deed generally the owner agrees to sell the real estate to the buyer for periodic payments to be applied to the purchase price in some fashion.

As a type of specialty home financing, a land contract is similar to a mortgage, but rather than borrowing money from a lender or bank to buy real estate, the buyer makes payments to the real estate owner, or seller, until the purchase price is paid in full.

Drawbacks of a land contract This means your payments may not be reported to the credit bureaus. You may miss out on the benefit of building an on-time payment history with the payments you make.