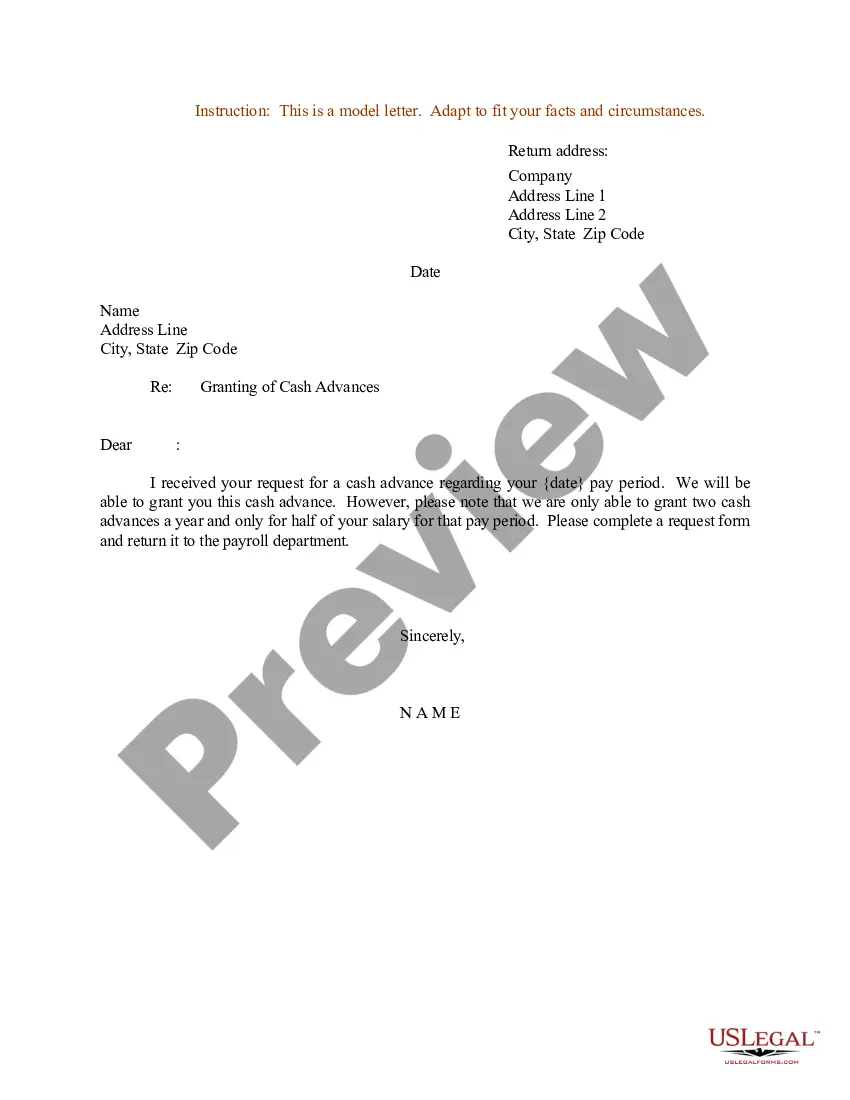

North Carolina Sample Letter for Cash Advances

Description

How to fill out Sample Letter For Cash Advances?

If you wish to finalize, obtain, or print authentic document templates, utilize US Legal Forms, the largest compilation of legal forms available online.

Employ the site's straightforward and user-friendly search feature to locate the documents you need.

An assortment of templates for business and personal use are organized by categories and claims, or keywords.

Step 4. Once you have found the form you need, click the Download now button. Choose the payment plan you prefer and enter your details to register for an account.

Step 5. Complete the purchase. You can use your credit card or PayPal account to finalize the transaction.

- Utilize US Legal Forms to quickly find the North Carolina Sample Letter for Cash Advances with a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click the Download button to obtain the North Carolina Sample Letter for Cash Advances.

- You can also access forms you previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps listed below.

- Step 1. Confirm you have selected the form for your specific city/state.

- Step 2. Use the Preview feature to review the form's content. Be sure to read the description.

- Step 3. If you are not satisfied with the form, utilize the Search field at the top of the screen to find other variations of the legal form format.

Form popularity

FAQ

I request you to kindly make a payment of (Amount) as an advance payment. I believe that you will consider this request as genuine and you will proceed with the same at the earliest. I shall be highly obliged for your kind support. For any queries, you may contact me at (Contact number).

Subject: Application for Advance SalaryDear Sir, I will be grateful to you if you will give me advance salary loan worth of (amount of Money2026for example $500) from my Salary. I need it on urgent situation for some personal domestic reasons. Please deduct a sum of (amount of money2026.)

You can typically get a cash advance in a few different ways:At an ATM: If you have a PIN for your credit card, you can go to an ATM and get a cash advance.In person: Visit your bank and request a cash advance with your credit card.More items...

I am writing this mail to request you for sanctioning advance salary for the month of (Month). As I am in urgent need of money due to (mention reason for requesting advance salary) I request you to do the needful at the earliest. I shall be highly obliged for your kind support.

Respected Sir/ Madam, Most humbly, my name is (Name) and I am working in (Department) as (Designation) for last (Duration Months/ Years). My employee ID is (Employee ID). I am writing this letter with the utmost respect in order to request you for advance cash payment.

Asking for an advance isn't necessarily an issue, but asking for another is likely to throw up red flags for your employer. You're also much less likely to get a second one, so do your very best to not need it.

A cash advance allows you to use your credit card to get a short-term cash loan at a bank or ATM. Unlike a cash withdrawal from a bank account, a cash advance has to be paid back just like anything else you put on your credit card. Think of it as using your credit card to "buy" cash rather than goods or services.

Dear Sir or Madam (or the name of the finance manager), I am writing this email to ask you for the approval of a petty cash request, for the value of (enter requested amount here). This request is for official purposes only and is necessary for the (explain why you need a petty cash withdrawal).

As you know my salary is limited so I request you to kindly approve me of taking advance payment of this month and the next month so that my son's treatment can go smoothly without any issues and stresses in my mind. I hope you will understand my problem and grant me the advance payments as soon as you can.

Asking for payment from clients over the phoneMake sure you're talking to the right person.Introduce yourself.Have a good idea of what you want.Get straight to the point.Speak calmly and clearly.Do not let the emotions get the better of you.Summarize everything at the end of the call.