North Carolina Subordination Agreement to Include Future Indebtedness to Secured Party

Description

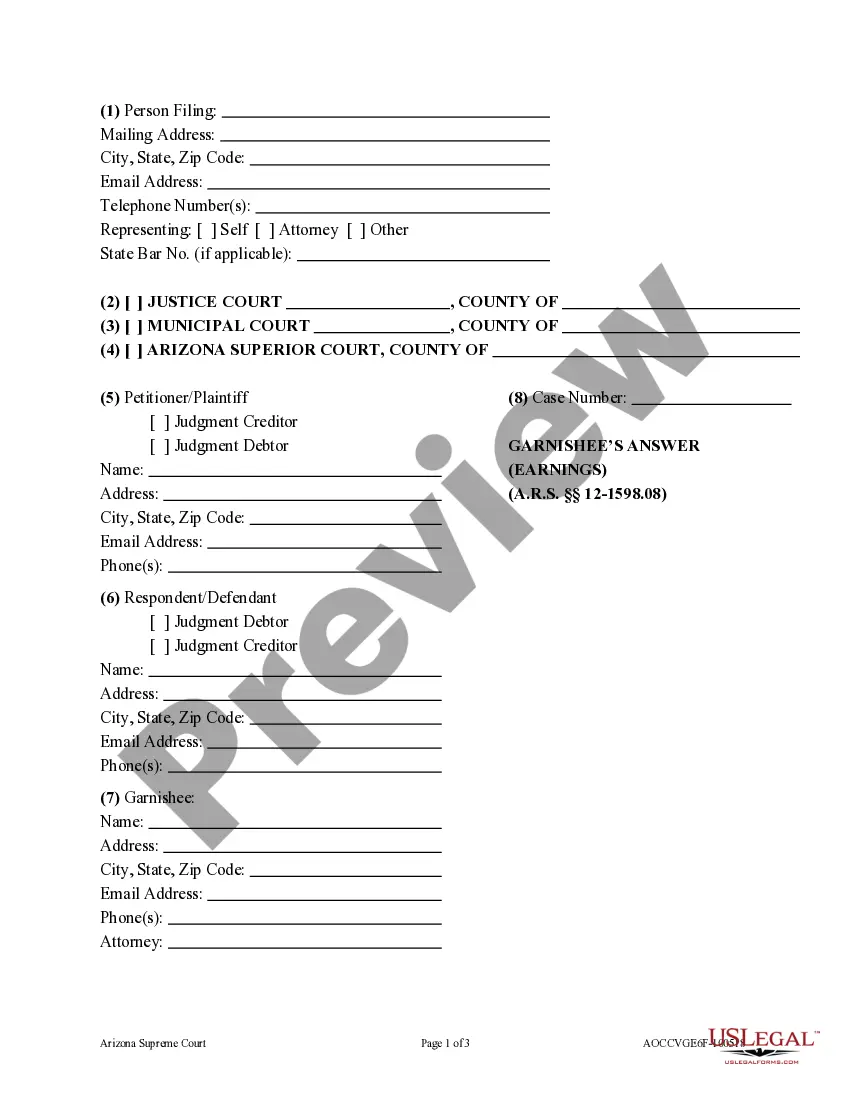

How to fill out Subordination Agreement To Include Future Indebtedness To Secured Party?

Choosing the best authorized file template can be a have a problem. Obviously, there are a variety of templates available online, but how can you obtain the authorized type you need? Use the US Legal Forms web site. The support delivers 1000s of templates, such as the North Carolina Subordination Agreement to Include Future Indebtedness to Secured Party, which you can use for enterprise and personal demands. All of the types are inspected by experts and fulfill federal and state specifications.

Should you be already signed up, log in in your accounts and click the Down load button to have the North Carolina Subordination Agreement to Include Future Indebtedness to Secured Party. Make use of accounts to look with the authorized types you possess bought earlier. Go to the My Forms tab of the accounts and have another copy of your file you need.

Should you be a brand new customer of US Legal Forms, allow me to share basic instructions for you to follow:

- Initially, make certain you have chosen the correct type for the area/region. You are able to check out the shape utilizing the Preview button and study the shape explanation to ensure it will be the right one for you.

- When the type is not going to fulfill your needs, make use of the Seach industry to get the right type.

- Once you are sure that the shape would work, go through the Get now button to have the type.

- Choose the prices strategy you desire and enter in the necessary details. Design your accounts and buy an order utilizing your PayPal accounts or charge card.

- Opt for the document structure and obtain the authorized file template in your system.

- Complete, modify and print out and indicator the acquired North Carolina Subordination Agreement to Include Future Indebtedness to Secured Party.

US Legal Forms may be the largest local library of authorized types where you can discover different file templates. Use the service to obtain appropriately-made paperwork that follow express specifications.

Form popularity

FAQ

Subordinated debt is any debt that falls under, or behind, senior debt. However, subordinated debt does have priority over preferred and common equity. Examples of subordinated debt include mezzanine debt, which is debt that also includes an investment.

A subordination clause is a clause in an agreement that states that the current claim on any debts will take priority over any other claims formed in other agreements made in the future. Subordination is the act of yielding priority.

The terms and conditions of a Subordination Agreement may vary depending on the specific circumstances and the parties involved. It is a legally binding contract that must be agreed upon by all relevant parties, including the existing lender, the new lender or creditor, and the borrower or property owner.

Two types of subordination agreements are: Executory Subordination and Automatic Subordination. These differ in the timing of when priority rights are given and the contractual performance required by the subordinated party.

Subordination agreement is a contract which guarantees senior debt will be paid before other ?subordinated? debt if the debtor becomes bankrupt.

Subordination agreement is a contract which guarantees senior debt will be paid before other ?subordinated? debt if the debtor becomes bankrupt.

A subordination clause ranks lenders by payment-priority order in the event of foreclosure, sale, or liquidation. Subordination clauses are most common in mortgage refinancing agreements, home equity loans, and HELOCs. Subordination clauses don't take effect until a second lien is made on a home.

A subordination clause serves to protect the lender if a homeowner defaults. If this happens, the lender then has the legal standing to repossess the home and cover their loan's outstanding balance first. If other subordinate mortgages are involved, the secondary liens will take a backseat in this process.