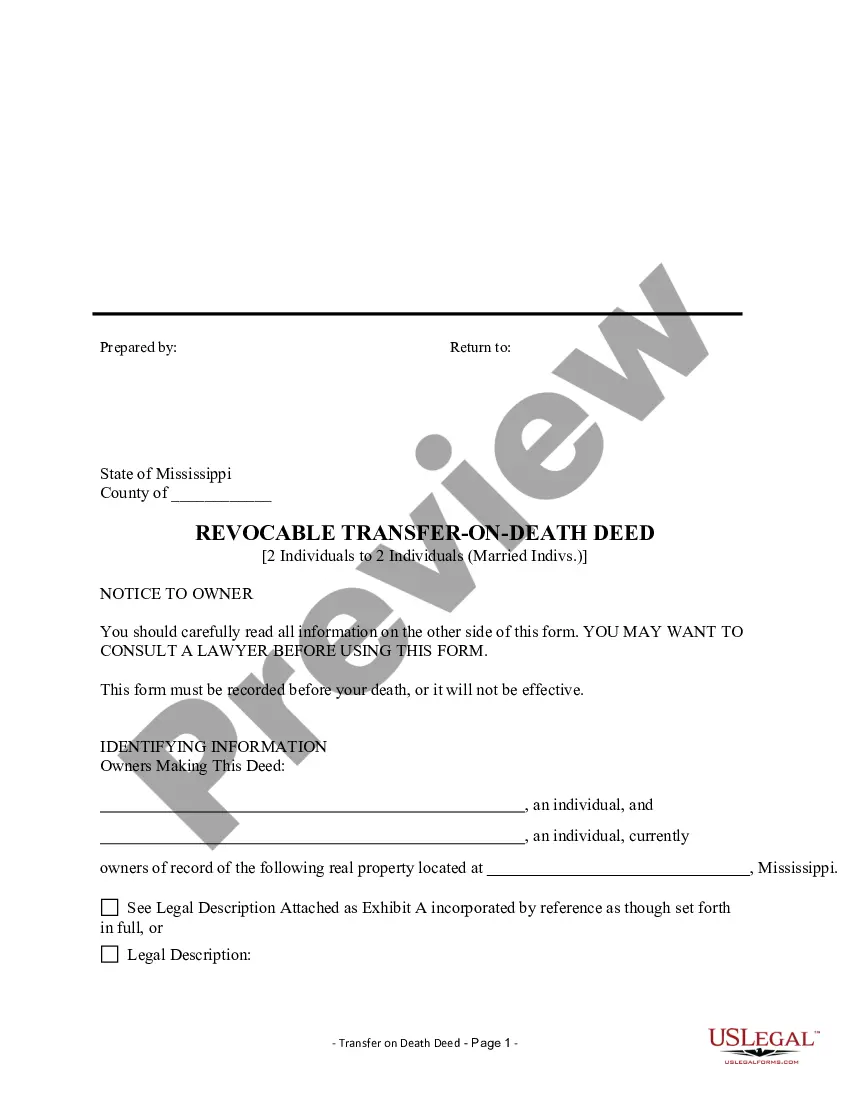

North Carolina Living Trust with Provisions for Disability: A Comprehensive Guide A North Carolina Living Trust with Provisions for Disability is a legal arrangement that allows individuals to maintain control over their assets while planning for potential incapacitation or disability. This type of trust provides individuals the flexibility to manage their affairs during their lifetime, ensuring their assets are well-protected and properly distributed in the event of disability. Living trusts with provisions for disability are particularly popular in North Carolina due to their flexibility, privacy, and protection offered to individuals and their families. These trusts can be customized to meet specific needs and circumstances, making them beneficial for individuals of all financial backgrounds. Two common types of North Carolina Living Trusts with Provisions for Disability include: 1. Revocable Living Trust: This type of trust is created during an individual's lifetime and can be modified or revoked at any time. It allows individuals to maintain complete control over their assets and enables efficient management and distribution of assets in case of disability or incapacitation. A revocable living trust can also help avoid the lengthy and costly probate process, ensuring a seamless transition of assets upon disability or death. This type of trust provides flexibility in designating beneficiaries and includes provisions to ensure the proper management of assets during periods of incapacity. 2. Special Needs Trust: A special needs trust, also known as a supplemental needs trust, is designed to provide for the financial needs of individuals with disabilities without jeopardizing their eligibility for government benefits such as Medicaid or Supplemental Security Income (SSI). This type of trust is essential for individuals with disabilities who may require ongoing support and care. By establishing a special needs trust within a North Carolina living trust, individuals can ensure their loved ones' financial security while preserving their eligibility for critical government assistance programs. Key provisions to consider in a North Carolina Living Trust with Provisions for Disability may include: 1. Successor Trustees: This provision designates individuals or trusted institutions who will assume responsibility for managing the trust and making financial decisions if the granter becomes disabled or incapacitated. 2. Trust Protectors: Trust protectors are individuals appointed to oversee and ensure the trustee's actions align with the granter's intentions. They act as an added layer of protection and can intervene if they believe the trustee is not fulfilling their obligations. 3. Healthcare Power of Attorney: This provision appoints a trusted individual to make healthcare decisions on behalf of the granter if they become incapacitated and unable to communicate their own wishes. 4. Asset Protection: A well-drafted living trust can include provisions to protect assets from potential creditors or lawsuits, providing an additional layer of financial security during times of disability or incapacitation. 5. Distribution of Assets: The trust document should outline clear instructions for the distribution of assets upon disability or death. This provision ensures that assets are distributed according to the granter's wishes, avoiding potential disputes among beneficiaries. In conclusion, a North Carolina Living Trust with Provisions for Disability offers individuals the peace of mind that their assets and financial affairs will be properly managed in case of disability or incapacitation. By customizing the trust to meet specific needs and including key provisions, individuals can ensure the smooth transition of assets, protection of loved ones, and preservation of eligibility for government assistance programs.

North Carolina Living Trust with Provisions for Disability

Description

How to fill out North Carolina Living Trust With Provisions For Disability?

Choosing the best legitimate document web template can be quite a struggle. Needless to say, there are a variety of web templates available online, but how will you discover the legitimate develop you want? Use the US Legal Forms internet site. The assistance offers a huge number of web templates, like the North Carolina Living Trust with Provisions for Disability, which you can use for organization and private requires. Every one of the types are checked by experts and fulfill federal and state demands.

If you are currently signed up, log in in your bank account and click on the Obtain switch to have the North Carolina Living Trust with Provisions for Disability. Make use of bank account to search with the legitimate types you have acquired in the past. Proceed to the My Forms tab of your bank account and acquire one more backup of your document you want.

If you are a brand new user of US Legal Forms, listed here are straightforward instructions that you should follow:

- First, ensure you have selected the correct develop for your metropolis/area. You are able to look over the shape making use of the Review switch and study the shape description to make sure it will be the right one for you.

- In the event the develop is not going to fulfill your needs, utilize the Seach discipline to discover the appropriate develop.

- When you are positive that the shape is suitable, click on the Purchase now switch to have the develop.

- Choose the costs strategy you want and enter the needed info. Create your bank account and pay for your order using your PayPal bank account or credit card.

- Opt for the document file format and download the legitimate document web template in your gadget.

- Comprehensive, revise and print out and sign the obtained North Carolina Living Trust with Provisions for Disability.

US Legal Forms will be the biggest collection of legitimate types for which you can see numerous document web templates. Use the company to download appropriately-made files that follow express demands.

Form popularity

FAQ

The first $20 of income received each month is not counted. In addition, with respect to earned income, the first $65 each month is not counted, and one-half of the earnings over $65 in any given month is not counted.

A Special Disability Trust (SDT) is a special type of trust that allows parents and immediate family members to plan for current and future needs of a person with severe disability. The trust can pay for reasonable care, accommodation and other discretionary needs of the beneficiary during their lifetime.

HOW DOES MONEY FROM A TRUST THAT IS NOT MY RESOURCE AFFECT MY SSI BENEFITS? Money paid directly to you from the trust reduces your SSI benefit. Money paid directly to someone to provide you with food or shelter reduces your SSI benefit but only up to a certain limit.

What Assets Should Go Into a Trust?Bank Accounts. You should always check with your bank before attempting to transfer an account or saving certificate.Corporate Stocks.Bonds.Tangible Investment Assets.Partnership Assets.Real Estate.Life Insurance.

Retirement accounts definitely do not belong in your revocable trust for example your IRA, Roth IRA, 401K, 403b, 457 and the like. Placing any of these assets in your trust would mean that you are taking them out of your name to retitle them in the name of your trust. The tax ramifications can be disastrous.

Assets That Can And Cannot Go Into Revocable TrustsReal estate.Financial accounts.Retirement accounts.Medical savings accounts.Life insurance.Questionable assets.

Some of your financial assets need to be owned by your trust and others need to name your trust as the beneficiary. With your day-to-day checking and savings accounts, I always recommend that you own those accounts in the name of your trust.

SSDI is not a needs-based benefit. If you are on that program for two years, you will also qualify for Medicare. Because SSDI is not needs-based, a special needs trust is not necessary to qualify for it.

No Asset Protection A revocable living trust does not protect assets from the reach of creditors. Administrative Work is Needed It takes time and effort to re-title all your assets from individual ownership over to a trust. All assets that are not formally transferred to the trust will have to go through probate.