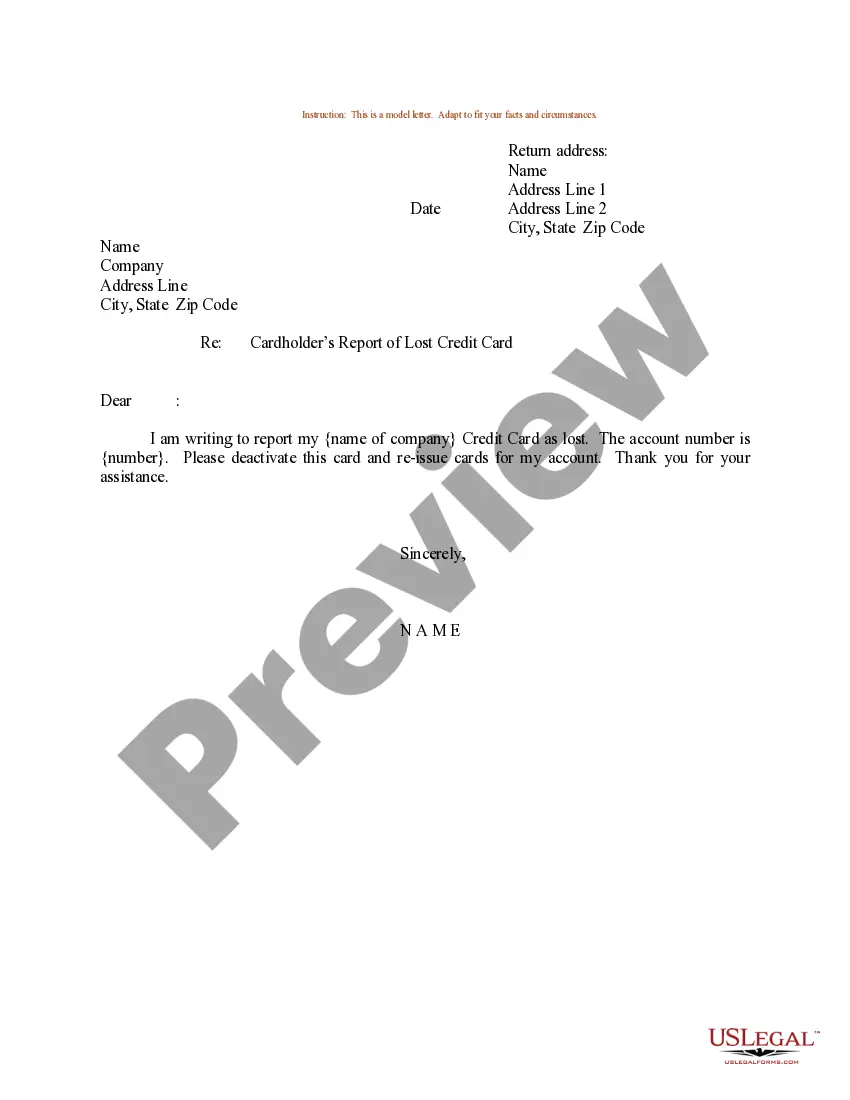

North Carolina Sample Letter for Cardholder's Report of Lost Credit Card

Description

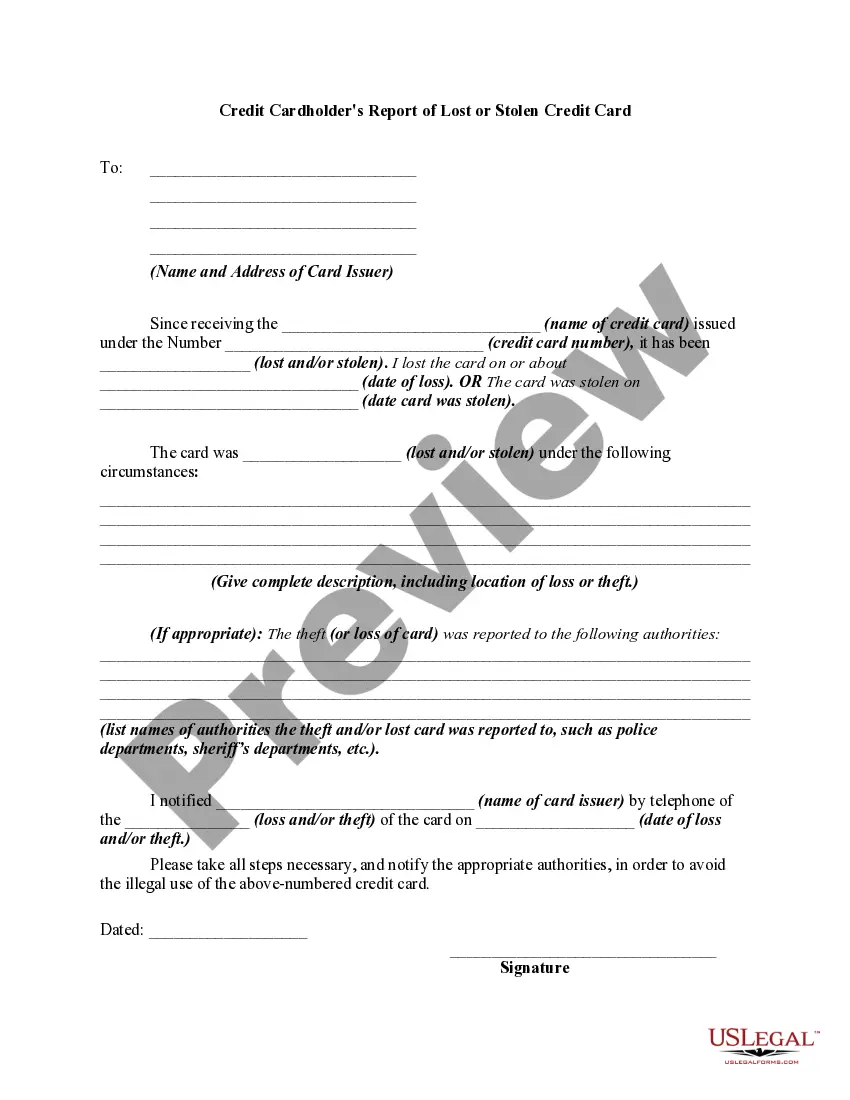

How to fill out Sample Letter For Cardholder's Report Of Lost Credit Card?

Have you found yourself in the circumstance where you need documents for both commercial and specific aims nearly every single day.

There are numerous authentic document templates accessible online, but locating forms you can rely on is challenging.

US Legal Forms offers a vast array of form templates, such as the North Carolina Sample Letter for Cardholder's Report of Lost Credit Card, which are designed to comply with federal and state regulations.

Once you locate the correct form, click Purchase now.

Choose the pricing plan you desire, complete the required details to create your account, and finalize the order using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- Then, you can download the North Carolina Sample Letter for Cardholder's Report of Lost Credit Card template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Locate the form you need and verify that it is for the correct city/region.

- Utilize the Review button to examine the form.

- Read the description to confirm that you have chosen the correct form.

- If the form isn’t what you’re looking for, use the Lookup field to find the form that fits your needs and criteria.

Form popularity

FAQ

This is to inform you that I recently lost or misplaced my ATM Card which is connected with my savings account with A/c No.: 02/123456. The lost card bore the number 1234 1234 1234 1234. I request you to please cancel that card and issue me a replacement card as early as possible.

Key Takeaways. Replacing a lost or stolen credit card does not hurt your credit score, as the account age and other information is simply transferred to a new account. Most credit card issuers will not hold the cardholder responsible for fraudulent charges.

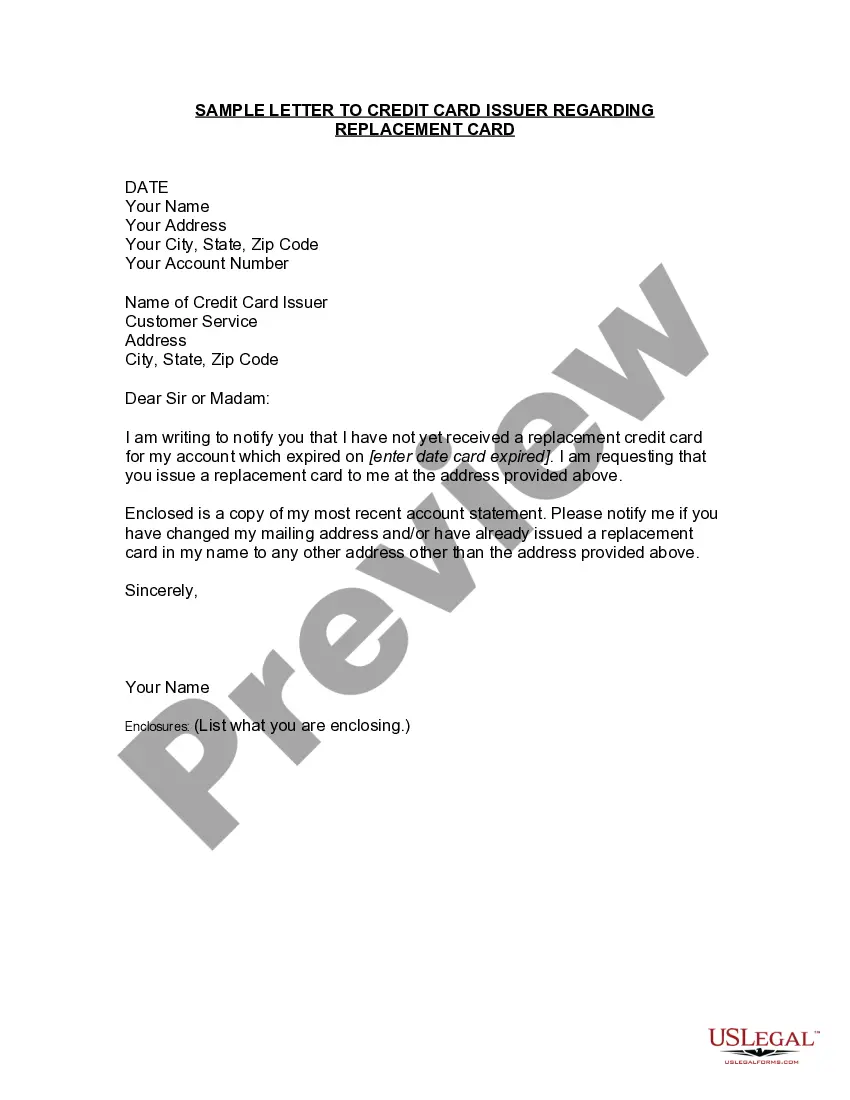

Your issuer will cancel your account and mail you a new credit card with a new account number. Make sure to update your mobile wallet if it also includes the lost card as a means of payment. Getting your lost card replaced should have no effect on your credit report or credit score.

This is to inform you that I (Name) having a (name of credit card) credit card with your bank has lost the credit card bearing number (credit card number). I request you to kindly deactivate the card and stop all the transactions through the card to avoid misuse.

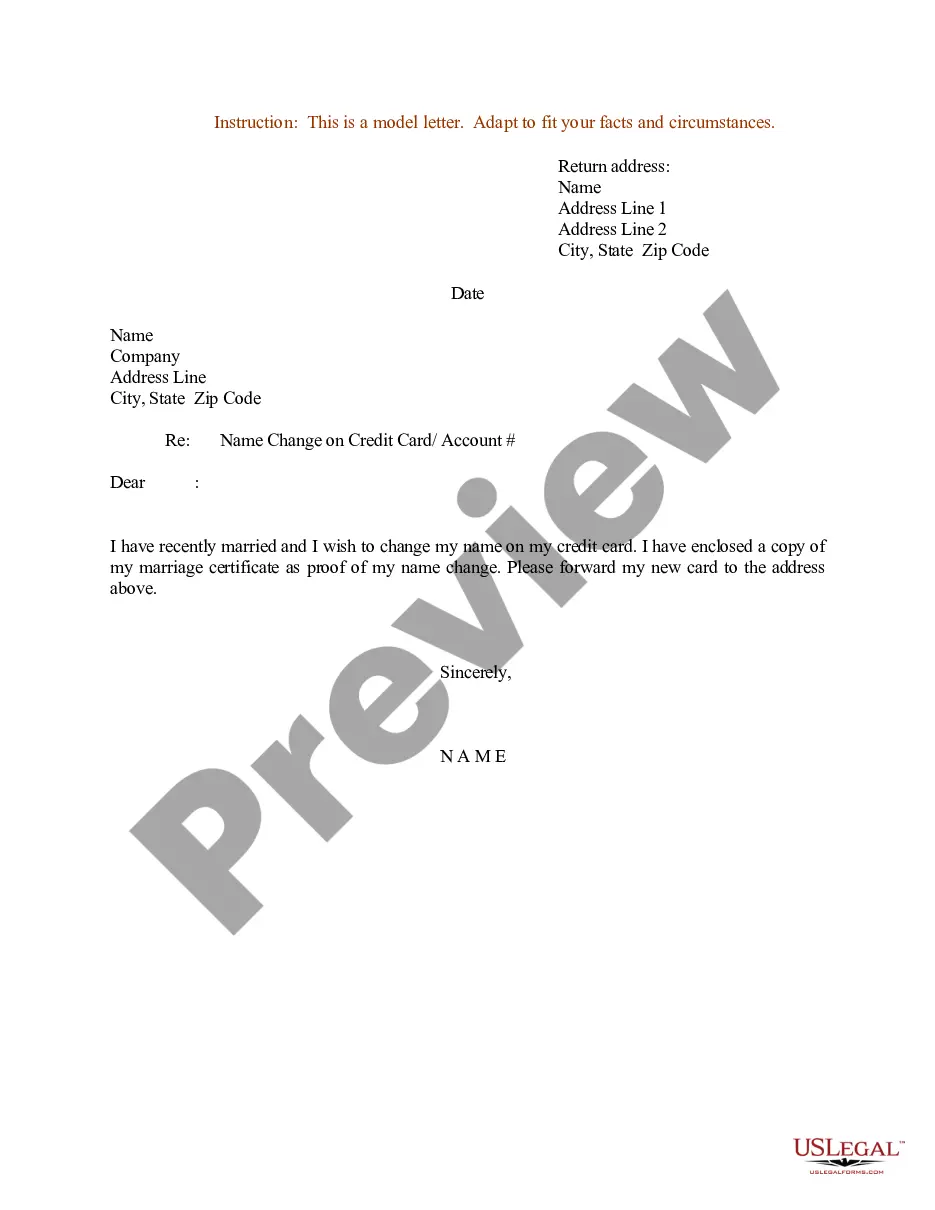

I would like to inform you that I already have an account with your esteemed bank. However, I hadn't applied for a credit card at the time of account opening. I have realised a need for a credit card and would like to make a request for the same.

Respected Sir/Madam, I beg to state that my name is (Name) and I am a (Name of credit card) credit card holder of your bank having credit card number (Credit card number). I am writing this letter to complain about the charges being levied on my credit card.

Call your credit card issuer Call your credit card issuer immediately to report the loss or theft of your missing card. Typically, you would check the back of the card for the telephone number to call. That's not an option when your card has been lost or stolen. Don't panic.

Reporting the Credit Card Fraud to Law Enforcement To begin this process, visit the Federal Trade Commission's IdentityTheft.gov website. The site will then give you the opportunity to file an identity theft report, which is used by law enforcement agencies in their investigation.

If you report the card's theft before any fraudulent use occurs, you'll bear zero liability. Under federal law, if you report it within two business days after the fraud occurs, you will be charged a maximum of $50. If you wait 2 to 60 days after a fraudulent transaction occurs, you could be charged a maximum of $500.

Firstly, inform the bank of the damaged Credit Card. You can call the Customer Care number and report that your Credit Card has been damaged. The bank will then hotlist the damaged Credit Card. Once you report the damaged Credit Card, you can raise a request with the bank to replace damaged Credit Card with a new one.