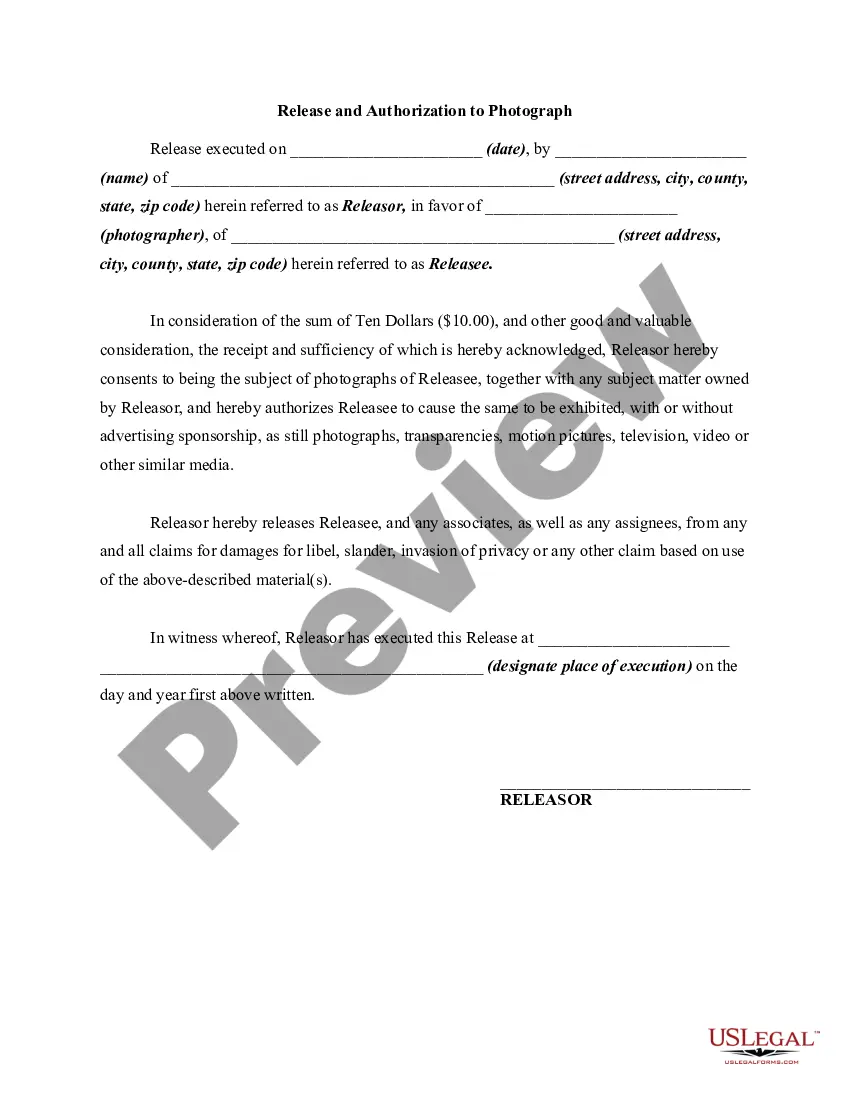

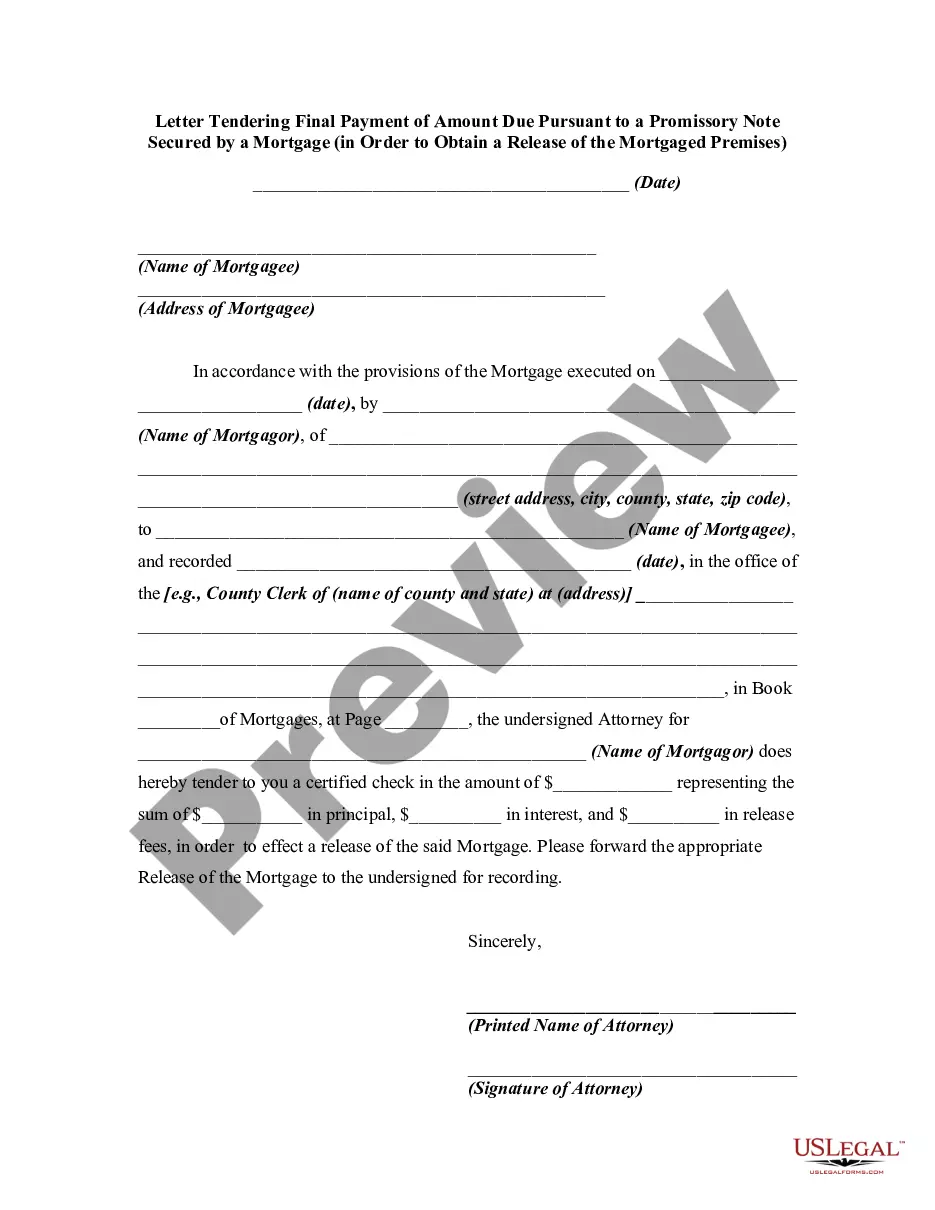

Subject: Request for Refinancing of Loan — North Carolina Sample Letter Dear [Lender's Name], I hope this letter finds you well. I am writing to formally request the refinancing of my existing loan, which is currently held by your esteemed institution. As a North Carolina resident, I am looking to take advantage of competitive refinancing options available in the state and would appreciate your assistance throughout this process. Please find below the relevant details and documentation required for the refinancing application: 1. Personal Information: — Full Name— - Current Residential Address: — Contact Number— - Email Address: - Social Security Number: 2. Existing Loan Details: — Original Loan Amount— - Current Outstanding Balance: — Interest Rate— - Loan Repayment Schedule: — Loan Account Number: 3. Purpose of Refinancing: — State the specific reason for seeking refinancing, such as reducing interest rates, extending the loan term, accessing equity, or consolidating debt. 4. Income and Employment Verification: — Recent pay stubs or income statements. — Copies of the last two years' tax returns. — Employment verification letter or proof of self-employment. 5. Property Information: — Property Address— - Estimated Current Market Value: — Any recent improvements made to the property. — Property appraisal report (if available). 6. Credit History: — Credit report from all three major credit reporting agencies (Equifax, Experian, TransUnion). — Explanation for any negative marks or discrepancies, if applicable. North Carolina Loan Refinancing Programs: 1. Home Affordable Refinance Program (HARP): Designed to assist homeowners with underwater mortgages, HARP may be an option for borrowers with loans backed by Fannie Mae or Freddie Mac. 2. FHA Streamline Refinance: Specifically for FHA-insured loans, this program offers simplified refinancing with reduced documentation requirements. 3. USDA Rural Refinance Pilot: Intended for borrowers who reside in eligible rural areas, this refinancing program offers competitive interest rates and simplified application procedures. 4. VA Interest Rate Reduction Refinance Loan (IR RRL): Exclusive to military veterans, this program allows for quick and hassle-free refinancing with reduced paperwork and lower costs. I kindly request your guidance in selecting the most suitable refinancing program based on my circumstances. Moreover, I would appreciate receiving an estimate of the new loan terms, interest rates, monthly payments, and closing costs associated with the proposed refinancing package. Upon your review, I am ready to provide any additional information or documentation required to expedite the refinancing process. Your expertise and prompt assistance would be greatly valued and instrumental in achieving my financial goals. Thank you for your time, and I look forward to your positive response. Should you need any clarification or have further questions, please do not hesitate to reach me at the contact details provided above. Sincerely, [Your Name] [Your Address] [City, State, ZIP] [Contact Number] [Email Address]

North Carolina Sample Letter for Refinancing of Loan

Description

How to fill out Sample Letter For Refinancing Of Loan?

US Legal Forms - one of the greatest libraries of lawful kinds in the United States - offers a wide array of lawful file themes you are able to obtain or print. Making use of the web site, you can find 1000s of kinds for business and specific reasons, sorted by categories, claims, or keywords.You can get the latest types of kinds just like the North Carolina Sample Letter for Refinancing of Loan within minutes.

If you already possess a subscription, log in and obtain North Carolina Sample Letter for Refinancing of Loan through the US Legal Forms library. The Obtain switch will show up on every single develop you perspective. You gain access to all in the past acquired kinds inside the My Forms tab of the account.

In order to use US Legal Forms the very first time, listed below are straightforward guidelines to help you started:

- Make sure you have picked the correct develop to your town/state. Click on the Preview switch to examine the form`s content material. Look at the develop description to actually have selected the proper develop.

- When the develop doesn`t suit your demands, utilize the Look for field near the top of the monitor to discover the the one that does.

- Should you be pleased with the form, affirm your selection by clicking the Get now switch. Then, select the prices prepare you want and supply your accreditations to register on an account.

- Approach the transaction. Use your Visa or Mastercard or PayPal account to complete the transaction.

- Pick the structure and obtain the form on your own gadget.

- Make adjustments. Complete, modify and print and sign the acquired North Carolina Sample Letter for Refinancing of Loan.

Each web template you included with your account does not have an expiry particular date and is also the one you have eternally. So, if you wish to obtain or print an additional version, just proceed to the My Forms portion and then click about the develop you require.

Get access to the North Carolina Sample Letter for Refinancing of Loan with US Legal Forms, one of the most considerable library of lawful file themes. Use 1000s of professional and state-specific themes that meet your small business or specific requirements and demands.

Form popularity

FAQ

What to include in your letter of explanationLay out the letter as you would any other, with your full street address and phone number at the top.Date the letter with the date on which you're writing it.Put in the recipient (the lender's) name and full address.More items...?

Cash-out letters tell the lender your intentions for tapping your home equity. These letters are oftentimes just a formality. But in some cases, they can also be the difference in getting approved for your new refinance or not. Lenders tend to be turned off by homeowners who frivolously use their equity.

Here's what you'll need to include: a subject line with your name and application number; your current mailing address and phone number; outline all of the facts that the lender asked you for; attach supporting documents such as bank statements, financial documents, and tax returns. Keep the letter formal and succinct.

Out Refinance Letter is a formal request drafted by a mortgage borrower who is looking to use the equity they have built for their advantage and replace their old mortgage with a new one, receiving a sum of money to invest in remodeling, repay accumulated debts, or handle other financial issues.

How to write a letter of explanationFacts. Include all the details with correct dates and dollar amounts.Resolution. Explain how and when the situation was resolved.Acknowledgment. It's important that the letter outline why the problem won't arise again. Recognize if and how you could have avoided this mistake.

When you get a cash-out refinance, you pay off your original mortgage and replace it with a new loan. This means your new loan may take longer to pay off, your monthly payments may be different or your interest rate may change. Be sure to look at the Closing Disclosure from your lender and analyze your new loan terms.

Make sure your letter of explanation includes:The current date (the day you write the letter)The name of your lender.Your lender's complete mailing address and phone number.A subject line that begins with RE: and includes your name, application number or other identifying information.More items...?

Commonly referred to as an 'LOE' or 'LOX,' letters of explanation are often requested by lenders to gain more specific information on a mortgage borrower and their situation. An LOX can necessary when there is inconsistent, incomplete, or unclear information on a loan application.

Make sure your letter of explanation includes:The current date (the day you write the letter)The name of your lender.Your lender's complete mailing address and phone number.A subject line that begins with RE: and includes your name, application number or other identifying information.More items...?

How to write a letter of explanationThe lender's name and address.Your name and your application number.The date you're submitting the letter and expected closing date (if you know it)A short statement that helps an underwriter fully understand your situation in regards to the reason for concern.More items...?

More info

InjuredPapers PropertyPensions SocialSecurity Social Security Credit card Get Free Reference Letters on Mortgage Refinance.