Title: North Carolina Sample Letter for Legal Action Concerning Loan Introduction: In North Carolina, individuals facing situations where legal action is necessary to address a loan dispute or delinquency may need to draft a well-crafted letter. This article will provide a detailed description of what a North Carolina Sample Letter for Legal Action Concerning Loan should include, discussing various types of situations and potential keywords associated with them. 1. North Carolina Demand Letter for Unpaid Loan: If a borrower has failed to fulfill their loan obligations, a North Carolina demand letter seeks immediate repayment. Important keywords: North Carolina demand letter, loan default, non-payment, legal action, loan delinquency, loan repayment. 2. North Carolina Letter to Stop Harassment from Loan Collectors: If a borrower is facing harassment from loan collectors, a North Carolina letter requesting them to cease all communication is essential. Important keywords: North Carolina cease communications letter, loan collector harassment, FD CPA violations, Fair Debt Collection Practices Act, harassment by loan collectors. 3. North Carolina Letter to Dispute Loan Terms: When an individual believes that loan terms are unfair or inaccurate, a North Carolina letter can be written to dispute these terms. Important keywords: North Carolina loan dispute letter, dispute loan terms, unfair loan terms, inaccurate loan terms, loan agreement discrepancies. 4. North Carolina Letter to Negotiate Loan Modification: Borrowers experiencing financial hardship can write a North Carolina letter requesting a loan modification that better suits their current situation. Important keywords: North Carolina loan modification letter, financial hardship, loan modification request, changing loan terms, lower interest rate, reduced monthly payments. 5. North Carolina Letter to File Complaint against a Loan Provider: If a borrower believes they have been a victim of predatory lending practices, they can draft a North Carolina letter to file a complaint. Important keywords: North Carolina complaint letter, predatory lending, loan provider misconduct, North Carolina Attorney General, consumer protection, illegal loan practices. Conclusion: In North Carolina, it is crucial to have a well-written sample letter when legal action concerning a loan becomes necessary. Whether it's demanding payment, disputing terms, seeking modification, or addressing harassment, understanding the different types of sample letters available for various situations is key to ensuring borrowers' rights are protected. Use relevant keywords specific to the situation to increase the effectiveness of these letters.

North Carolina Sample Letter for Legal Action Concerning Loan

Description

How to fill out North Carolina Sample Letter For Legal Action Concerning Loan?

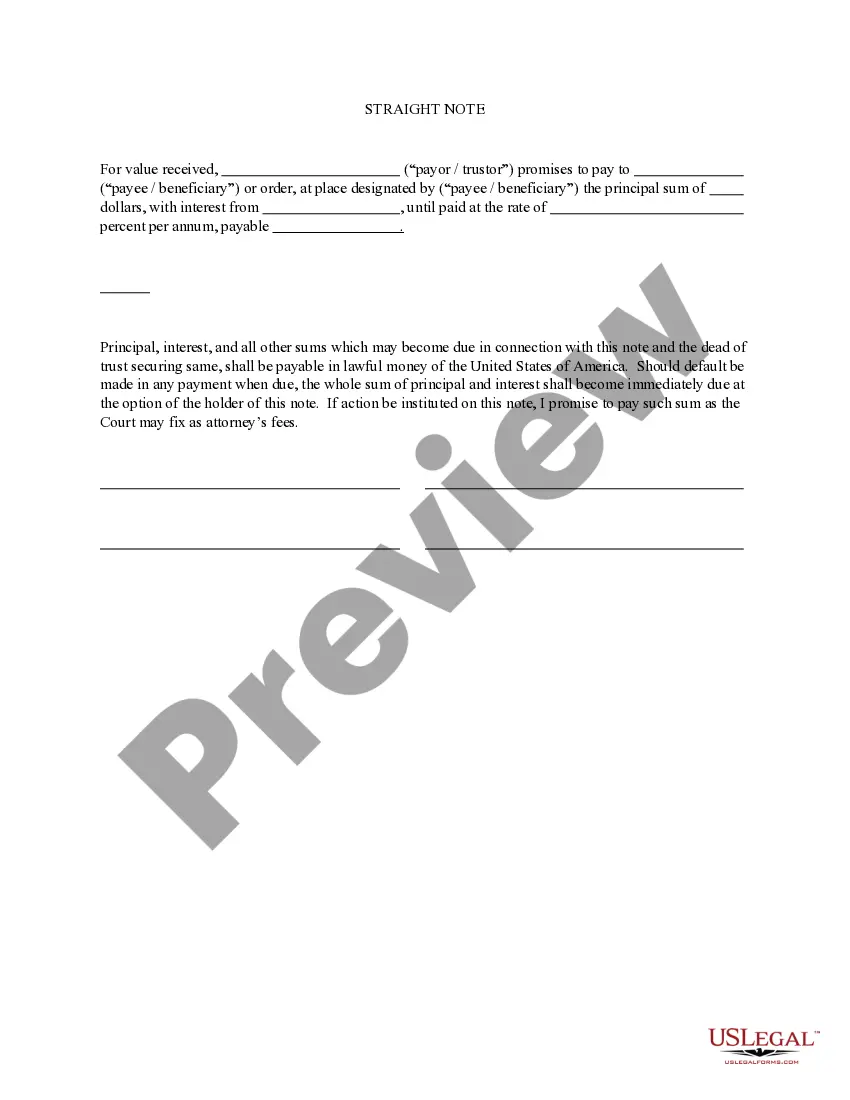

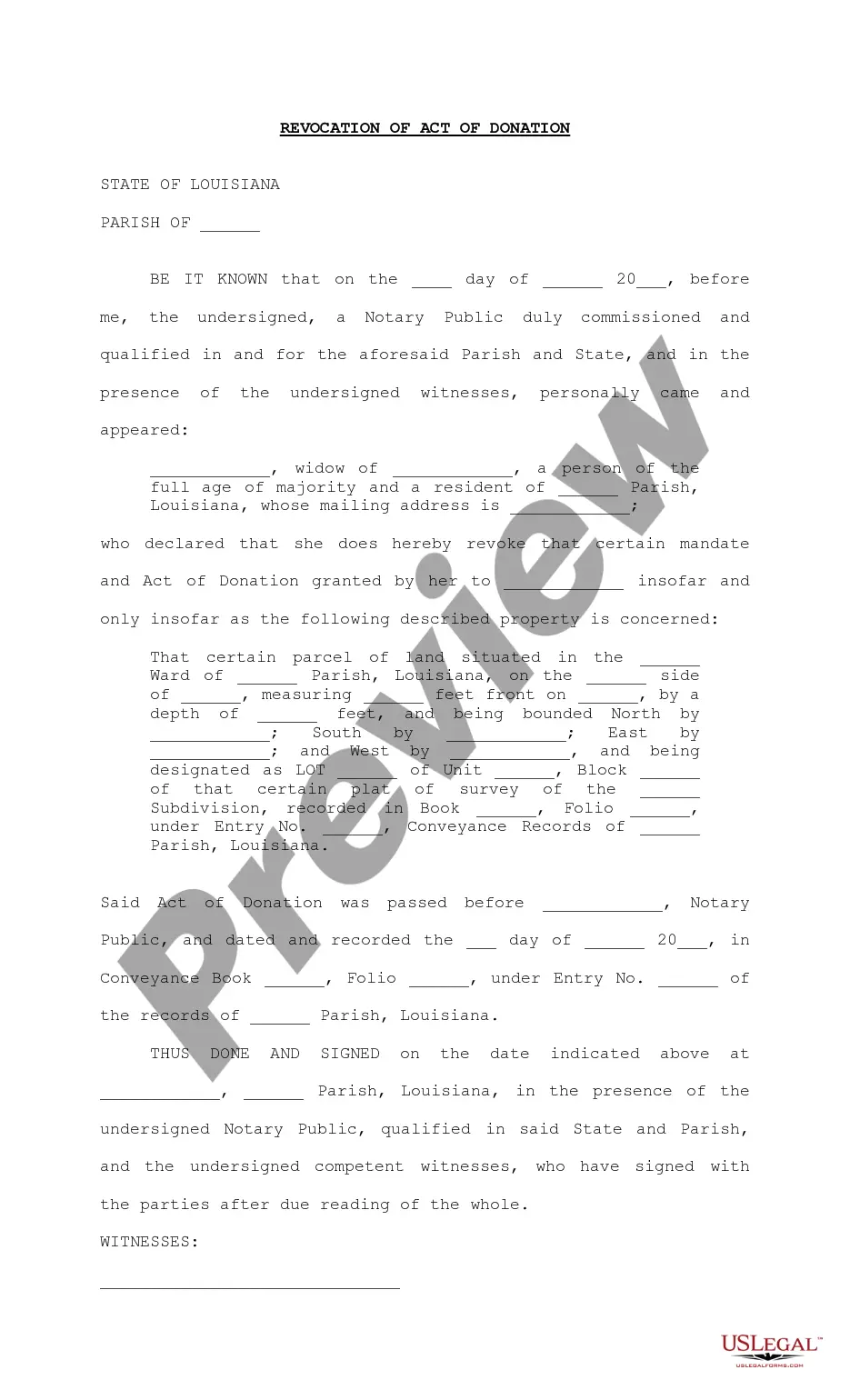

Have you been in the position in which you need to have paperwork for sometimes enterprise or specific purposes nearly every working day? There are tons of legitimate papers templates available on the Internet, but getting versions you can rely on isn`t effortless. US Legal Forms provides a huge number of kind templates, like the North Carolina Sample Letter for Legal Action Concerning Loan, which can be published to fulfill federal and state specifications.

In case you are already informed about US Legal Forms web site and get an account, just log in. Following that, you can down load the North Carolina Sample Letter for Legal Action Concerning Loan template.

Unless you provide an bank account and would like to begin using US Legal Forms, follow these steps:

- Obtain the kind you want and make sure it is to the appropriate town/area.

- Utilize the Review button to check the form.

- See the information to ensure that you have chosen the appropriate kind.

- In the event the kind isn`t what you are trying to find, make use of the Search discipline to get the kind that fits your needs and specifications.

- Once you obtain the appropriate kind, simply click Purchase now.

- Select the prices strategy you need, complete the required details to create your bank account, and pay money for the transaction utilizing your PayPal or credit card.

- Pick a convenient document structure and down load your duplicate.

Locate every one of the papers templates you have bought in the My Forms food list. You may get a extra duplicate of North Carolina Sample Letter for Legal Action Concerning Loan at any time, if needed. Just go through the needed kind to down load or printing the papers template.

Use US Legal Forms, by far the most extensive variety of legitimate varieties, to save lots of time and steer clear of mistakes. The service provides skillfully created legitimate papers templates that you can use for a selection of purposes. Generate an account on US Legal Forms and start generating your life easier.

Form popularity

FAQ

If you decide to ask for payment in writing, you can use a demand letter. A demand letter is a short, clear letter demanding payment. Bring a copy of it to your court hearing to show the judge. You can also attach it to your court papers.

A demand letter is a document that you give to the person that you think owes you money. Within the letter, you set out why you are entitled to the payment and demand it. You'd be surprised how often a simple demand letter can work without you having to go to court.

The state can convict defendants just for making a threat. But to win a lawsuit, the plaintiff must have paid the defendant. Receiving threats is not enough.

Although demand letters are commonplace and often afforded legal protection, their legality has drawn increasing scrutiny. In 2006, the California Supreme Court held that a lawyer's prelitigation communications including demand letters can constitute extortion.

How to Fill Out a Letter of Intent to Sue. A letter of intent to sue is usually a single-page letter. It should be written in a respectful manner and include only important details the illegal activity, actions that can help settle the dispute, and the ways to cover damage to avoid the lawsuit.

Frequently Asked Questions (FAQ)Type your letter.Concisely review the main facts.Be polite.Write with your goal in mind.Ask for exactly what you want.Set a deadline.End the letter by stating you will promptly pursue legal remedies if the other party does not meet your demand.Make and keep copies.More items...

Short answer yes. It is actually quite common and completely acceptable to threaten legal proceedings if and only if, the individual's intention is in good faith to resolve a dispute.

How to Write a Letter of Intent to Sue?Information of the person who is sending the letter.The date from which the letter is deemed as effective.The subject of the letter: the notice of your intention to make a claim against the defendant.Outlining the party to whom the letter is intended (the defendant).More items...

How to Write a LawsuitDesign the caption. The caption is the top of the lawsuit that identifies the parties.Identify the Parties.Next, tell the story.Now explain how you were damaged or injured.Finish up with your Prayer for Damages.Sign and date your lawsuit and identify who you are.