A North Carolina Loan Commitment Agreement Letter serves as a legally binding document between a borrower and a lender, outlining the terms and conditions for a loan. This letter is an essential component of the loan process as it signifies the lender's commitment to providing funds to the borrower, and the borrower's acceptance of those terms. The Loan Commitment Agreement Letter in North Carolina typically includes important details such as the loan amount, interest rate, repayment schedule, and any additional fees or charges. It explicitly outlines the responsibilities and obligations of both the borrower and the lender. The letter also includes clauses related to late payment penalties, default consequences, and the conditions under which the agreement can be modified or terminated. There are various types of Loan Commitment Agreement Letters specific to different types of loans and purposes. Some key types include: 1. Mortgage Loan Commitment Agreement: This agreement is commonly used for real estate transactions, where the borrower obtains a loan to purchase a property. It specifies the terms of the mortgage loan, including details such as loan duration, interest rate, down payment amount, and any applicable prepayment penalties. 2. Business Loan Commitment Agreement: This type of agreement is prevalent in commercial lending, involving business owners seeking financial assistance for their company's growth, expansion, or working capital. It outlines the terms of the loan, including loan duration, interest rate, collateral requirements, and terms of repayment. 3. Personal Loan Commitment Agreement: Used for personal financing needs, this agreement sets the terms for loans taken by individuals for various purposes such as education, home improvement, or debt consolidation. It outlines the loan amount, interest rate, repayment schedule, and any associated fees. 4. Auto Loan Commitment Agreement: This agreement is specific to loans taken out to finance the purchase of a vehicle. It includes details such as the loan amount, interest rate, length of the loan term, down payment requirements, and conditions for repossession in case of default. In North Carolina, loan commitment agreement letters serve as legally binding contracts, providing protection to both borrowers and lenders. It is essential for borrowers to carefully review and understand the terms before signing the agreement to ensure compliance and mitigate potential risks or disputes in the future. Likewise, lenders must ensure that the terms are in accordance with North Carolina state laws and adhere to responsible lending practices.

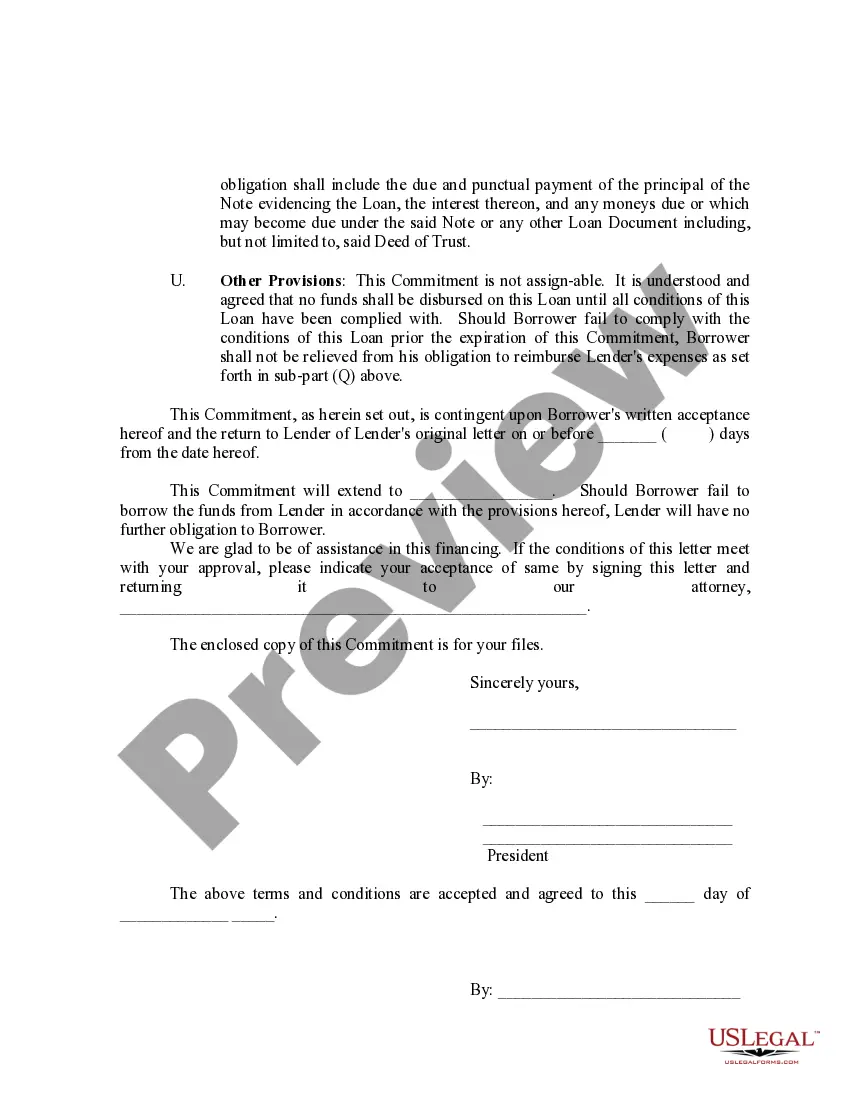

North Carolina Loan Commitment Agreement Letter

Description

How to fill out North Carolina Loan Commitment Agreement Letter?

Choosing the right legal file template could be a struggle. Needless to say, there are tons of layouts available on the Internet, but how would you find the legal develop you need? Use the US Legal Forms web site. The services offers 1000s of layouts, like the North Carolina Loan Commitment Agreement Letter, that can be used for enterprise and personal requires. All the kinds are checked by professionals and fulfill state and federal requirements.

When you are previously authorized, log in to the accounts and click the Acquire option to get the North Carolina Loan Commitment Agreement Letter. Utilize your accounts to check throughout the legal kinds you possess purchased formerly. Go to the My Forms tab of your respective accounts and have another version of the file you need.

When you are a fresh customer of US Legal Forms, listed here are simple guidelines that you can adhere to:

- First, be sure you have selected the appropriate develop for your metropolis/region. It is possible to look through the form making use of the Review option and read the form information to guarantee this is basically the right one for you.

- If the develop is not going to fulfill your preferences, use the Seach field to discover the appropriate develop.

- When you are positive that the form is proper, click the Acquire now option to get the develop.

- Pick the costs strategy you desire and type in the necessary information and facts. Make your accounts and purchase an order with your PayPal accounts or charge card.

- Opt for the file structure and acquire the legal file template to the device.

- Complete, edit and produce and indicator the obtained North Carolina Loan Commitment Agreement Letter.

US Legal Forms is the greatest collection of legal kinds in which you will find different file layouts. Use the company to acquire skillfully-made files that adhere to state requirements.