North Carolina Letter to Creditor Confirming Agreement that Monthly Payments be Temporarily Postponed

Description

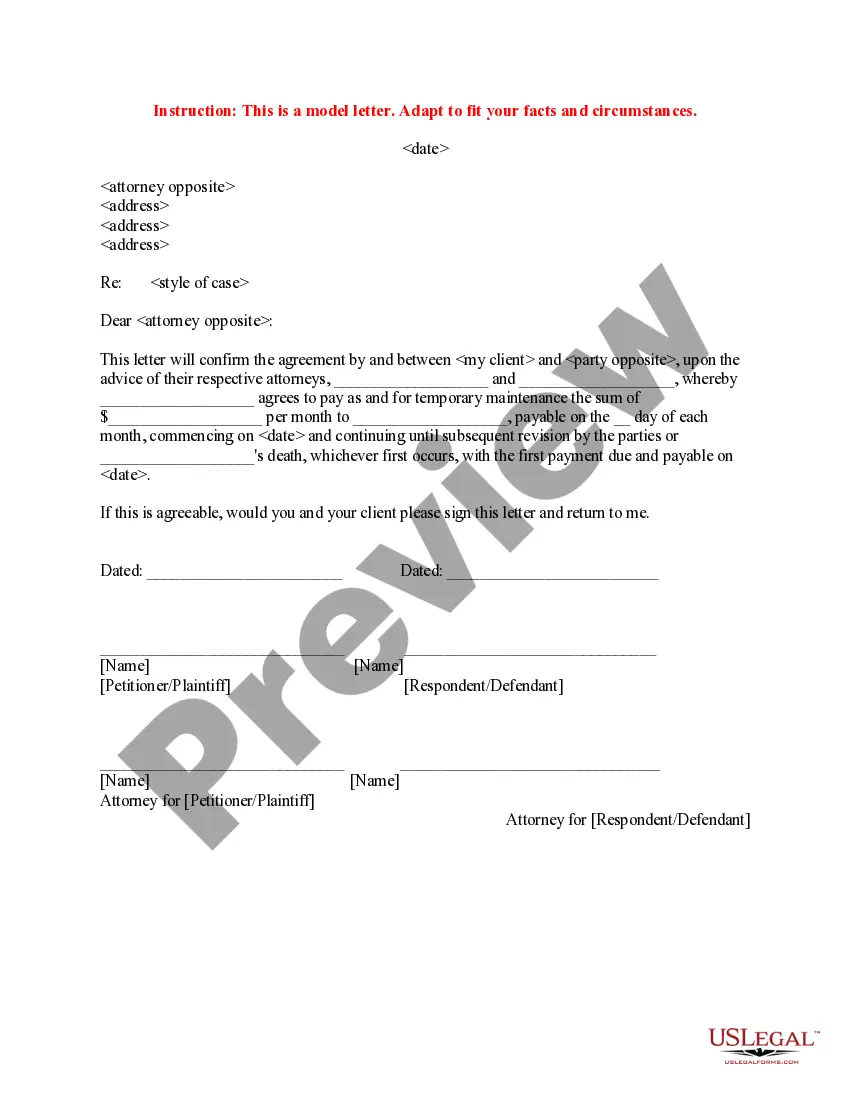

How to fill out Letter To Creditor Confirming Agreement That Monthly Payments Be Temporarily Postponed?

Finding the correct legal document template can be quite a challenge.

Of course, there are many templates available online, but how do you locate the legal form you require.

Utilize the US Legal Forms website. The platform offers a vast selection of templates, including the North Carolina Letter to Creditor Confirming Agreement that Monthly Payments be Temporarily Delayed, which can be used for business and personal purposes.

You can view the form using the Preview button and read the form description to ensure it is the right fit for you.

- All of the forms are reviewed by professionals and comply with federal and state regulations.

- If you are currently registered, Log In to your account and click the Download button to access the North Carolina Letter to Creditor Confirming Agreement that Monthly Payments be Temporarily Delayed.

- Use your account to browse through the legal forms you have purchased previously.

- Visit the My documents section of your account and obtain another copy of the document you need.

- If you are a new user of US Legal Forms, here are some simple guidelines to follow.

- First, make sure you have chosen the correct form for your area/county.

Form popularity

FAQ

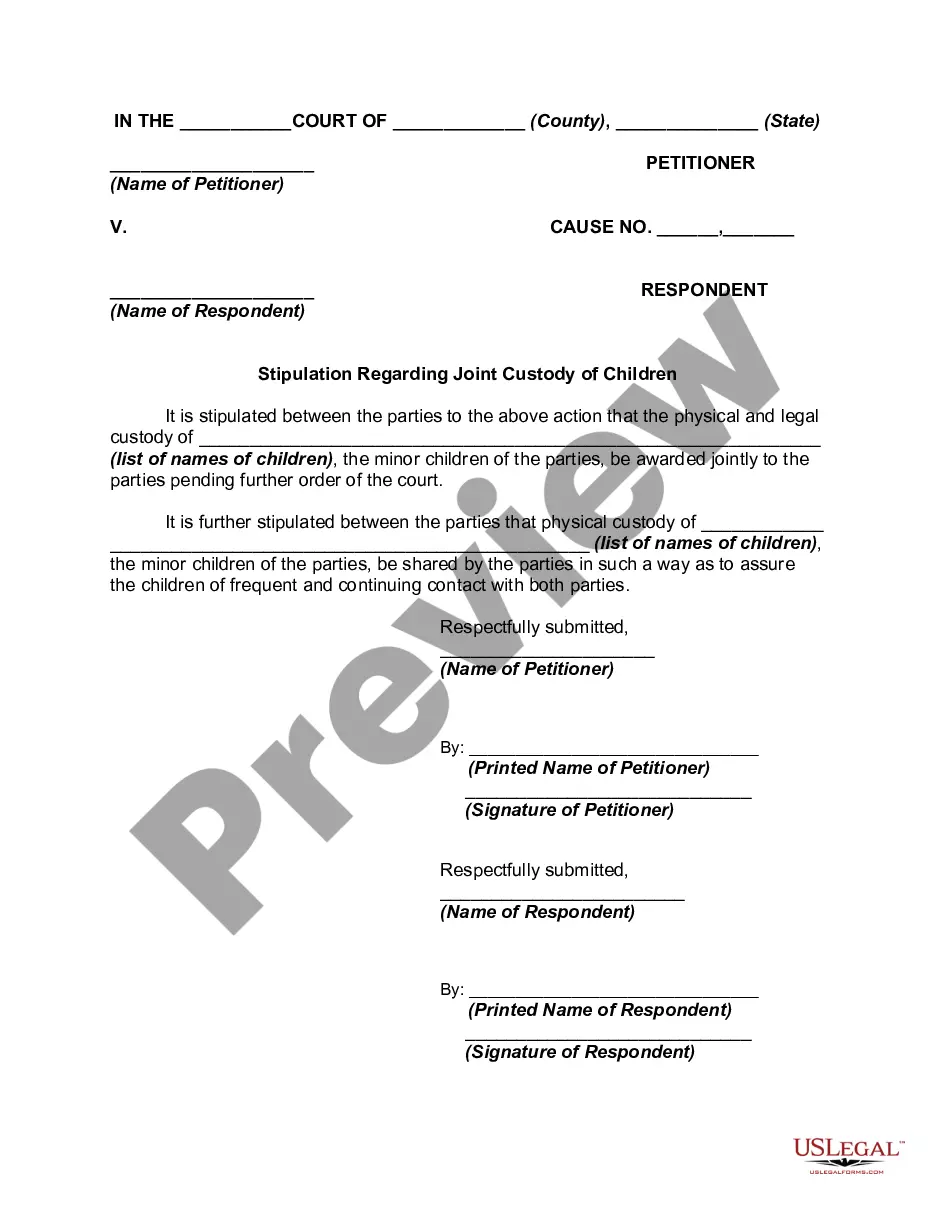

Failing to respond to a Debt Validation Letter while continuing to collect on the debt is a direct violation of the FDCPA. You can report a debt collector's failure to respond to your state's attorney general, the Consumer Financial Protection Bureau (CFPB), or the FTC.

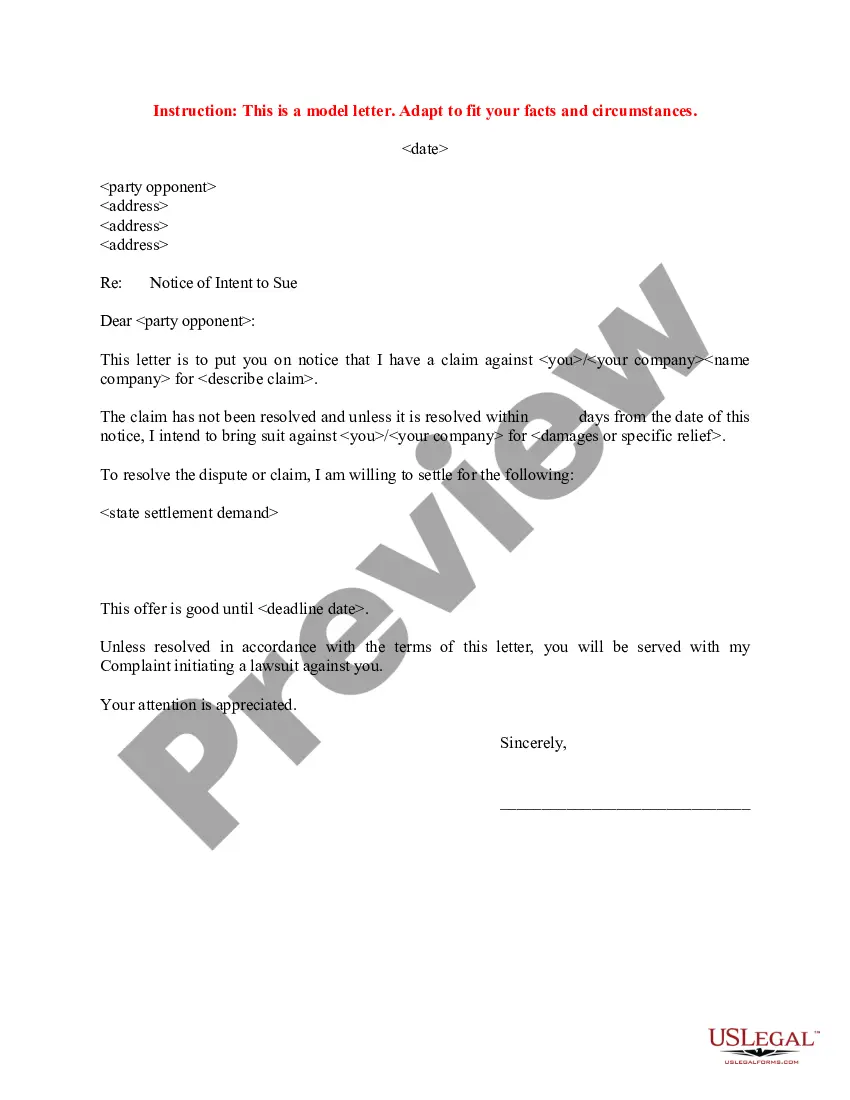

How to Write a Simple Payment Contract LetterThe date that the agreement was signed and thus going into effect.The date of the first payment.The date when each payment after will be made.A grace period, if any.When a payment is considered late.

I am requesting that you provide verification of this debt. Please send the following information: The name and address of the original creditor, the account number, and the amount owed. Verification that there is a valid basis for claiming I am required to pay the current amount owed.

I would like to offer a reduced payment of $ per month. This is the most that I can pay regularly at this time. You can expect this amount as soon as possible until the debt is totally repaid. I hope you find this repayment amount acceptable.

To request verification, send a letter to the collection agency stating that you dispute the validity of the debt and that you want documentation verifying the debt. Also, request the name and address of the original creditor.

How to Write a Debt Verification LetterDetermine the exact amounts you owe.Gather documents that verify your debt.Get information on who you owe.Determine how old the debt is.Place a pause on the collection proceedings.

Whether you're in arrears or struggling to keep on top of your regular payments, asking your creditors to freeze interest and charges can help you clear your debts and get back on track quicker. They may agree to freeze interest for an agreed length of time if you tell them about your financial difficulties.

A debt validation letter should include the name of your creditor, how much you supposedly owe, and information on how to dispute the debt. After receiving a debt validation letter, you have 30 days to dispute the debt and request written evidence of it from the debt collector.

Tips for Writing a Hardship LetterKeep it original.Be honest.Keep it concise.Don't cast blame or shirk responsibility.Don't use jargon or fancy words.Keep your objectives in mind.Provide the creditor an action plan.Talk to a Financial Couch.

How to Ask for Payment ProfessionallyCheck the Client Received the Invoice.Send a Brief Email Requesting Payment.Speak to the Client By Phone.Consider Cutting off Future Work.Research Collection Agencies.Review Your Legal Options.