The North Carolina Real Estate Joint Venture Agreement for the Purpose of Repairing, Renovating and Selling a Building is a legally binding contract between two or more parties who agree to collaborate on a real estate project in North Carolina. This agreement outlines the terms and conditions under which the joint venture will operate, including the responsibilities, liabilities, profit-sharing, and dispute resolution procedures. Keywords: North Carolina, Real Estate, Joint Venture Agreement, Repairing, Renovating, Selling, Building 1. Types of North Carolina Real Estate Joint Venture Agreements for the Purpose of Repairing, Renovating, and Selling a Building: a. Profit-Sharing Joint Venture Agreement: This type of agreement establishes how profits will be distributed among the partners based on their respective contributions and ownership percentages. It also outlines the obligations of each party in terms of repairing, renovating, and selling the building. b. Single Purpose Entity (SPE) Joint Venture Agreement: An SPE joint venture is a separate legal entity created solely for the purpose of undertaking a specific real estate project. This agreement outlines the terms of the joint venture, including decision-making authority, profit-sharing, and liabilities specific to the project at hand. c. Limited Liability Company (LLC) Joint Venture Agreement: This agreement establishes an LLC as the joint venture entity, where each partner contributes capital and shares in profits and losses. It outlines the roles and responsibilities of each member, the procedures for decision-making, and any restrictions or limitations on capital contributions or transfers. d. Development Joint Venture Agreement: This type of agreement is used when partners come together to develop a property, which involves extensive renovation or construction work. It outlines the specific obligations and responsibilities of each partner, funding arrangements, and the profit-sharing structure once the building is sold. e. Equity Joint Venture Agreement: An equity joint venture involves partners pooling their funds and resources to purchase, renovate, and sell a building. This agreement lays out the equity ownership percentages, the roles and contributions of each partner, and the distribution of proceeds upon the successful sale of the property. f. General Partnership Agreement: In this joint venture agreement, partners join forces to collectively repair, renovate, and sell a building. It establishes an equal partnership, where each partner shares equally in profits and losses, has a say in decision-making, and also shares personal liability for any debts or legal obligations incurred. Remember, it is essential to consult with a legal professional specializing in real estate law to ensure the accuracy and validity of any joint venture agreement.

North Carolina Real Estate Joint Venture Agreement for the Purpose of Repairing, Renovating and Selling a Building

Description

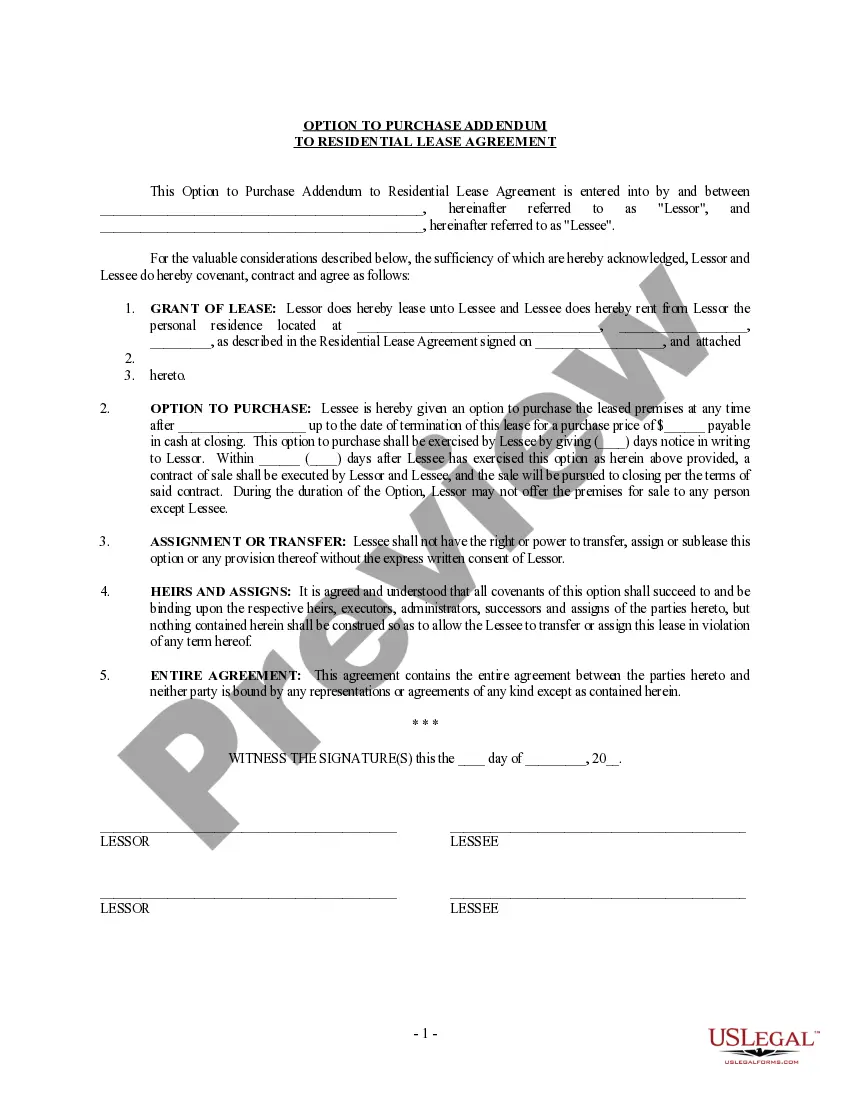

How to fill out Real Estate Joint Venture Agreement For The Purpose Of Repairing, Renovating And Selling A Building?

Are you currently inside a situation the place you need to have files for either enterprise or specific reasons almost every day? There are tons of legal file themes available online, but finding ones you can depend on is not simple. US Legal Forms gives 1000s of type themes, like the North Carolina Real Estate Joint Venture Agreement for the Purpose of Repairing, Renovating and Selling a Building, which can be created to fulfill federal and state demands.

When you are previously knowledgeable about US Legal Forms web site and get a free account, simply log in. Afterward, you are able to download the North Carolina Real Estate Joint Venture Agreement for the Purpose of Repairing, Renovating and Selling a Building template.

If you do not come with an accounts and would like to start using US Legal Forms, abide by these steps:

- Discover the type you require and make sure it is for that proper city/area.

- Use the Review option to check the shape.

- See the outline to actually have chosen the right type.

- In case the type is not what you`re trying to find, utilize the Lookup field to find the type that meets your requirements and demands.

- Once you discover the proper type, simply click Purchase now.

- Choose the rates prepare you would like, submit the specified information and facts to create your bank account, and pay for your order utilizing your PayPal or charge card.

- Pick a convenient data file structure and download your backup.

Locate every one of the file themes you have purchased in the My Forms menus. You can aquire a extra backup of North Carolina Real Estate Joint Venture Agreement for the Purpose of Repairing, Renovating and Selling a Building whenever, if necessary. Just click on the required type to download or print the file template.

Use US Legal Forms, one of the most extensive collection of legal types, to save time as well as stay away from errors. The assistance gives appropriately created legal file themes that you can use for an array of reasons. Make a free account on US Legal Forms and begin creating your lifestyle easier.

Form popularity

FAQ

Generally, the purchase price of tangible personal property or digital property that becomes part of or is applied to a purchaser's property as part of a capital improvement or used to provide an exempt repair, maintenance, or installation service is generally subject to sales and use tax.

Now, for projects such as minor building repairs and cosmetic upgrades, contractors may purchase materials tax free, but will have to charge sales tax (6.75% to 7.5%) on the entire project, materials and labor included.

By: General contractors, subcontractors, and builders providing construction services in North Carolina should be aware that labor charges on certain of their projects may now be subject to sales tax under the state's new repair, maintenance, and installation ("RMI") rules.

The handyman is a retailer and is liable for and should collect sales tax on the total sales price of the repair, maintenance, and installation service.

Prescription Medicine, groceries, and gasoline are all tax-exempt. Some services in North Carolina are subject to sales tax.

Repair, Maintenance, and Installation Services; and Other Repair Information. The sales price of or the gross receipts derived from repair, maintenance, and installation services sold at retail is subject to the general State and applicable local and transit rates of sales and use tax.

Form E-589CI, may be issued to substantiate that a contract, or a portion of work performed to fulfill a contract, is a capital improvement to real property and subject to sales and use tax as a real property contract.

The sales price of or the gross receipts derived from repair, maintenance, and installation services sold at retail is subject to the general State and applicable local and transit rates of sales and use tax. Repair, maintenance, and installation services is defined in N.C. Gen. Stat.

By: General contractors, subcontractors, and builders providing construction services in North Carolina should be aware that labor charges on certain of their projects may now be subject to sales tax under the state's new repair, maintenance, and installation ("RMI") rules.

Form E-589CI, Affidavit of Capital Improvement, may be used to substantiate that a contract, or a portion of work to be performed to fulfill a contract, is to be taxed for sales and use tax purposes, as a real property contract for a capital improvement to real property.