Title: Understanding the North Carolina Contract for Sale of Manufacturing Facility Pursuant to Asset Purchase Agreement Introduction: The North Carolina Contract for Sale of Manufacturing Facility Pursuant to Asset Purchase Agreement is a legally binding agreement that outlines the terms and conditions for the sale of a manufacturing facility and its related assets in the state of North Carolina. This comprehensive contract ensures a smooth transfer of ownership between the buyer and seller, providing a secure framework for the transaction. Below, we delve into the key aspects of this agreement and shed light on different types or variations that entities may encounter. 1. Overview of the North Carolina Contract for Sale of Manufacturing Facility Pursuant to Asset Purchase Agreement: The contract begins with a detailed description of the parties involved, including the buyer (acquirer) and seller (vendor). It outlines the buyer's intention to purchase the manufacturing facility and its assets while providing specific terms and conditions that both parties must adhere to. 2. Asset Purchase Agreement: The North Carolina Contract for Sale of Manufacturing Facility typically references the Asset Purchase Agreement (APA), a critical document explicitly outlining the transfer of assets, liabilities, and other terms associated with the facility to be sold. The APA encompasses details such as the purchase price, payment method, asset valuation, inventory, intellectual property rights, employee considerations, and other provisions essential for a successful transaction. 3. Terms and Conditions: The agreement further establishes various terms and conditions that safeguard the interests of both the buyer and seller. These provisions include but are not limited to due diligence investigations, allocation of purchase price, representations and warranties, indemnification, dispute resolution mechanisms, and applicable governing law. 4. Consideration for the Manufacturing Facility Sale: The consideration provision outlines how the sale price should be paid, be it in cash, through installments, or via assumption of liabilities. It may also cover contingencies, such as adjustments based on financial performance, working capital, or other specified conditions. 5. Seller's Representations and Warranties: To ensure transparency and protect the buyer's interests, the seller provides representations and warranties stating the accuracy and authenticity of the information shared regarding the manufacturing facility being sold. This section covers aspects such as property ownership, compliance with laws and regulations, absence of undisclosed liabilities, intellectual property rights, and other critical factors. 6. Closing and Post-Closing Obligations: The agreement specifies the closing conditions required for the transaction to complete, including necessary approvals, consents, and any other legal requirements. Additionally, it may outline the buyer and seller's post-closing obligations, such as transition assistance, integration processes, non-competition agreements, and other relevant considerations. Types or Variations of North Carolina Contract for Sale of Manufacturing Facility Pursuant to Asset Purchase Agreement: While the core elements of the contract remain consistent, specific variations or types may arise based on the unique circumstances of the manufacturing facility or relevant industry. These may include: 1. Asset Sale Agreement for Manufacturing Facility with Real Estate: A contract that covers the sale of the manufacturing facility along with the associated real estate assets, including land, buildings, and related infrastructure. 2. Distressed/Foreclosure Asset Purchase Agreement: This variation focuses on the acquisition of a financially distressed manufacturing facility, often due to bankruptcy or foreclosure. The contract might have additional provisions related to creditors, outstanding debts, and the unique challenges involved. 3. Intellectual Property (IP) and Technology Asset Purchase Agreement: When the transaction entails the sale of a manufacturing facility with valuable patents, trademarks, trade secrets, or proprietary technology, an augmented contract with specific clauses regarding the transfer of these IP assets may be necessary. Conclusion: The North Carolina Contract for Sale of Manufacturing Facility Pursuant to Asset Purchase Agreement is a comprehensive and vital legal document that facilitates the smooth transition of ownership between buyers and sellers in the manufacturing industry. By addressing crucial elements such as purchase price, terms, warranties, and other considerations, this agreement provides a secure framework for a successful acquisition. The various types or variations of this contract cater to the unique circumstances that may arise during the sale of manufacturing facilities. It is recommended that parties seek legal counsel to ensure compliance with North Carolina laws and to tailor the agreement to their specific needs.

North Carolina Contract for Sale of Manufacturing Facility Pursuant to Asset Purchase Agreement

Description

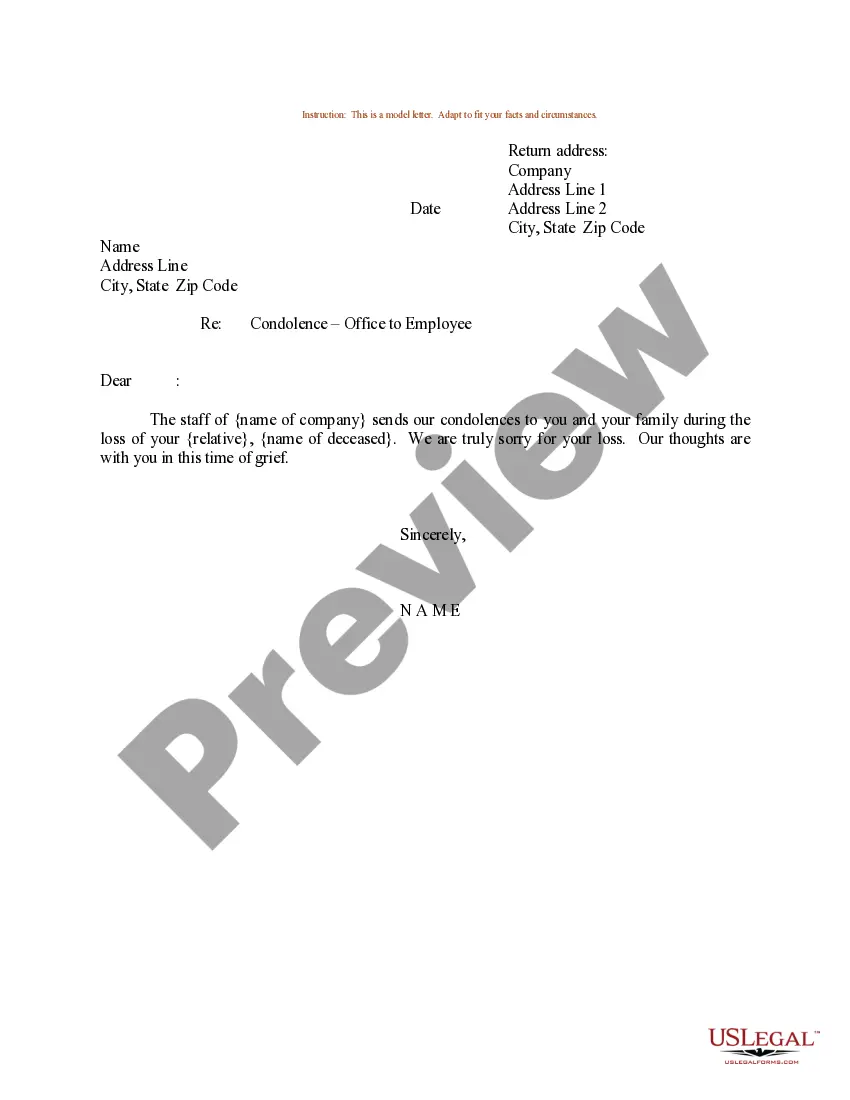

How to fill out Contract For Sale Of Manufacturing Facility Pursuant To Asset Purchase Agreement?

You can spend time on the web attempting to find the lawful papers web template that meets the state and federal requirements you need. US Legal Forms gives 1000s of lawful forms which can be reviewed by pros. It is possible to down load or produce the North Carolina Contract for Sale of Manufacturing Facility Pursuant to Asset Purchase Agreement from our service.

If you currently have a US Legal Forms account, you can log in and click the Download key. After that, you can full, modify, produce, or sign the North Carolina Contract for Sale of Manufacturing Facility Pursuant to Asset Purchase Agreement. Each and every lawful papers web template you purchase is yours for a long time. To get an additional copy of any acquired form, check out the My Forms tab and click the corresponding key.

If you work with the US Legal Forms web site the very first time, keep to the simple recommendations beneath:

- First, make certain you have chosen the proper papers web template to the region/metropolis of your choosing. See the form description to make sure you have selected the right form. If readily available, use the Review key to check through the papers web template as well.

- If you wish to discover an additional variation in the form, use the Search field to get the web template that meets your requirements and requirements.

- Once you have discovered the web template you would like, just click Purchase now to proceed.

- Find the rates program you would like, key in your accreditations, and register for a merchant account on US Legal Forms.

- Total the transaction. You can utilize your charge card or PayPal account to pay for the lawful form.

- Find the formatting in the papers and down load it to the product.

- Make changes to the papers if possible. You can full, modify and sign and produce North Carolina Contract for Sale of Manufacturing Facility Pursuant to Asset Purchase Agreement.

Download and produce 1000s of papers web templates making use of the US Legal Forms Internet site, which offers the biggest assortment of lawful forms. Use skilled and condition-particular web templates to handle your organization or specific demands.

Form popularity

FAQ

Provisions of an APA may include payment of purchase price, monthly installments, liens and encumbrances on the assets, condition precedent for the closing, etc. An APA differs from a stock purchase agreement (SPA) under which company shares, title to assets, and title to liabilities are also sold.

A purchase agreement is a type of contract that outlines terms and conditions related to the sale of goods. As a legally binding contract between buyer and seller, the agreements typically relate to buying and selling goods rather than services.

An asset purchase involves just the assets of a company. In either format, determining what is being acquired is critical. This article focuses on some of the important categories of assets to consider in a business purchase: real estate, personal property, and intellectual property.

An asset purchase agreement, also known as an asset sale agreement, business purchase agreement, or APA, is a written legal instrument that formalizes the purchase of a business or significant business asset. It details the structure of the deal, price, limitations, and warranties.

Essential elements of an agreement of sale of immovable property are: parties (buyer & seller); price (purchase price); subject of sale (immovable property); prescribed formalities (agreement must be in writing and signed by the parties).

An asset purchase agreement is a legal contract to buy the assets of a business. It can also be used to purchase specific assets from a business, especially if they are significant in value.

Also known as a sales contract or a purchase contract, a purchase agreement is a legal document that establishes the parameters of the sale of goods between a buyer and a seller. Typically, they are used when the value is more than $500.

Among the terms typically included in the agreement are the purchase price, the closing date, the amount of earnest money that the buyer must submit as a deposit, and the list of items that are and are not included in the sale.

The asset purchase agreement is often drafted up towards the end of the negotiation stage, so that the parties can have a final record of their agreement. The document essentially operates as a contract, creating legally binding duties on each of the parties involved.

Recording the purchase and its effects on your balance sheet can be done by:Creating an assets account and debiting it in your records according to the value of your assets.Creating another cash account and crediting it by how much cash you put towards the purchase of the assets.More items...