The North Carolina Master Finance Lease Agreement is a legally binding contract that establishes a long-term financial arrangement between a lessor (the financing company) and a lessee (the business or individual obtaining the lease) for the purpose of leasing certain assets, such as equipment or vehicles. This agreement outlines the terms and conditions under which the lessor agrees to provide financing for the acquisition of assets by the lessee. One of the primary features of the North Carolina Master Finance Lease Agreement is that it enables businesses to acquire necessary assets without the need for upfront cash payments or significant capital investments. Instead, the lessee makes regular lease payments, typically monthly, over an agreed-upon period of time. This arrangement allows for greater flexibility in managing finances and cash flow. The North Carolina Master Finance Lease Agreement also provides the lessee with certain benefits, including potential tax advantages such as deducting lease payments as operating expenses, rather than depreciating the value of the leased assets. This can result in significant savings for businesses, especially when leasing expensive or rapidly depreciating assets. Moreover, the North Carolina Master Finance Lease Agreement offers different types of leases designed to accommodate specific business needs. These include: 1. Capital Lease: A type of lease agreement where the lessee has the option to purchase the asset at the end of the lease term, usually at a predetermined price. This lease is considered long-term and is accounted for as an asset on the lessee's balance sheet. 2. Operating Lease: This type of lease agreement is generally short-term and allows the lessee to use the asset for a specific period without assuming ownership. The lessor retains the ownership and residual value risk of the leased asset. 3. Sale-Leaseback: This arrangement enables a business to sell existing assets to a lessor and then lease them back. This can provide immediate cash influx while still allowing the business to use the assets. 4. Conditional Sale Lease: This type of lease agreement involves transferring the ownership of the asset to the lessee automatically upon the completion of lease payments. It gives the lessee the benefits of ownership while still maintaining the financial benefits of leasing. It is important to note that the North Carolina Master Finance Lease Agreement must comply with the laws and regulations specific to the state, ensuring that both parties are protected and their rights are respected. By carefully reviewing and understanding the terms of the agreement, businesses in North Carolina can benefit from the flexibility and advantages that leasing offers.

North Carolina Master Finance Lease Agreement

Description

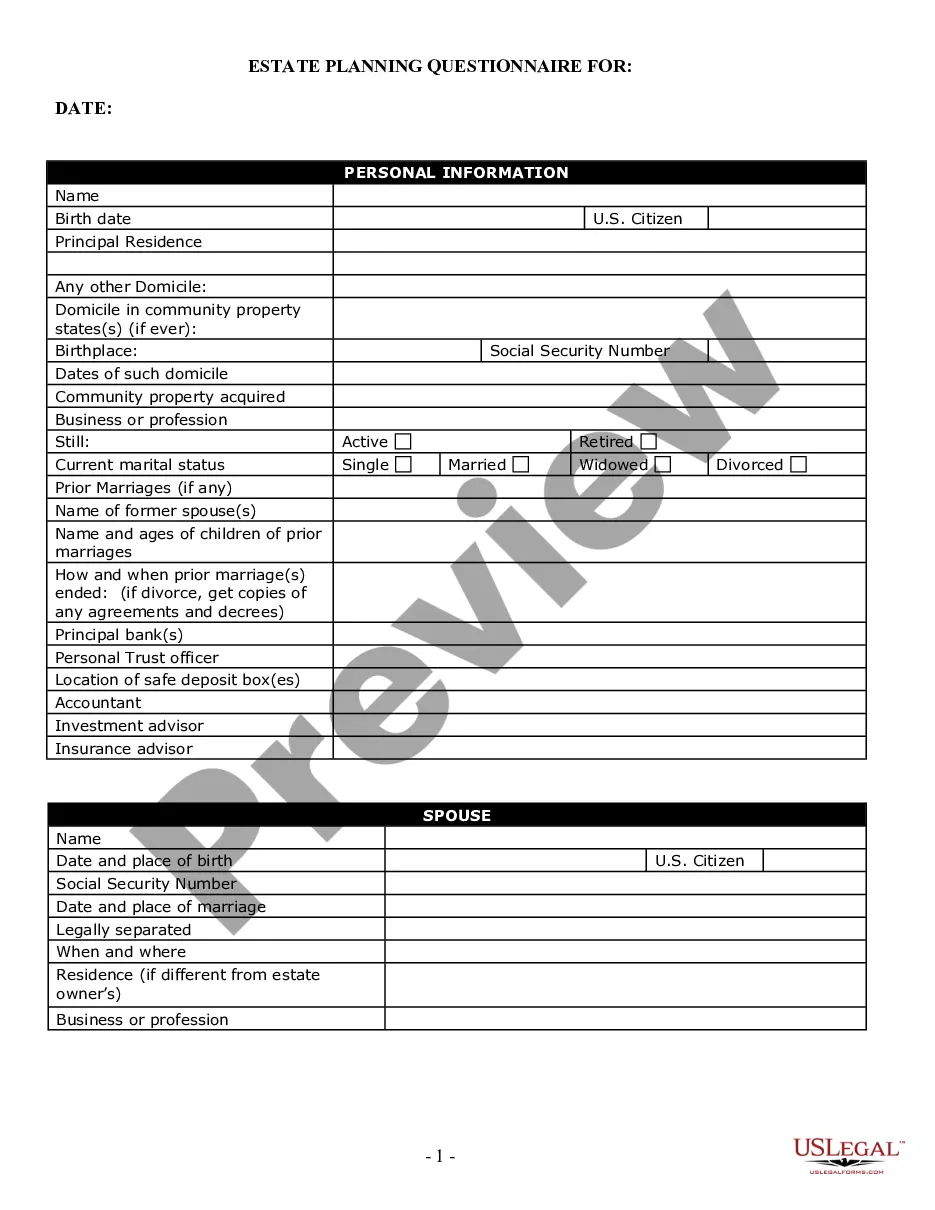

How to fill out North Carolina Master Finance Lease Agreement?

Discovering the right authorized file design could be a struggle. Naturally, there are tons of templates available on the Internet, but how do you get the authorized type you will need? Use the US Legal Forms internet site. The support offers a huge number of templates, for example the North Carolina Master Finance Lease Agreement, that you can use for company and personal requirements. Each of the forms are inspected by specialists and fulfill state and federal needs.

In case you are already authorized, log in to your bank account and click on the Acquire button to find the North Carolina Master Finance Lease Agreement. Make use of bank account to look with the authorized forms you have purchased earlier. Check out the My Forms tab of your own bank account and get one more backup in the file you will need.

In case you are a new user of US Legal Forms, listed here are simple directions so that you can comply with:

- First, be sure you have chosen the appropriate type for your personal area/region. You may look over the form using the Review button and browse the form explanation to ensure this is basically the best for you.

- When the type will not fulfill your needs, use the Seach area to find the appropriate type.

- Once you are sure that the form is proper, click the Acquire now button to find the type.

- Pick the prices prepare you want and type in the needed info. Create your bank account and buy your order using your PayPal bank account or credit card.

- Choose the file format and acquire the authorized file design to your gadget.

- Complete, modify and printing and sign the obtained North Carolina Master Finance Lease Agreement.

US Legal Forms is definitely the greatest local library of authorized forms where you can discover a variety of file templates. Use the company to acquire skillfully-made files that comply with express needs.

Form popularity

FAQ

It lets you live in a property as long as you pay rent and follow the rules. It also sets out the legal terms and conditions of your tenancy. It can be written down or oral (a spoken agreement).

No, residential lease agreements do not need to be notarized in North Carolina. As long as the contract exists and both parties have agreed to it, it is legally binding and it does not have to be notarized. Of course, the landlord and tenant can agree to have the lease notarized if they wish, but it is not required.

A written lease agreement must contain:The names and addresses of both parties;The description of the property;The rental amount and reasonable escalation;The frequency of rental payments, i.e. monthly;The amount of the deposit;The lease period;The notice period for termination of contract;More items...

North Carolina General Statute Chapter 47G governs Option to Purchase Contracts executed with Lease Agreements. The leases that are covered under the statute are residential lease agreements that are combined or executed with an option contract.

These types of tenancy agreements are most commonly used by private landlords who are choosing to forgo using a letting agent or property management firm. People can even draw up their own tenancy agreements based on the free downloadable templates available on the internet.

No, a commercial lease does not need to be notarized in North Carolina in order for it to be considered legally binding; however, any party to the lease may choose to have the lease notarized if they so desire.

North Carolina Landlord Tenant Rights. North Carolina rental agreements are valid if they are written or verbal.

A valid lease of real property in North Carolina -- that land, that building on that land, the space in that building on that land -- that exceeds three (3) years in duration from the making must be in writing and signed by the party to be charged in the enforcement of the lease (which can be either lessor or lessee,

It's good practice for a written tenancy agreement to include the following details:your name and your landlord's name and the address of the property which is being let.the date the tenancy began.details of whether other people are allowed the use of the property and, if so, which rooms.More items...