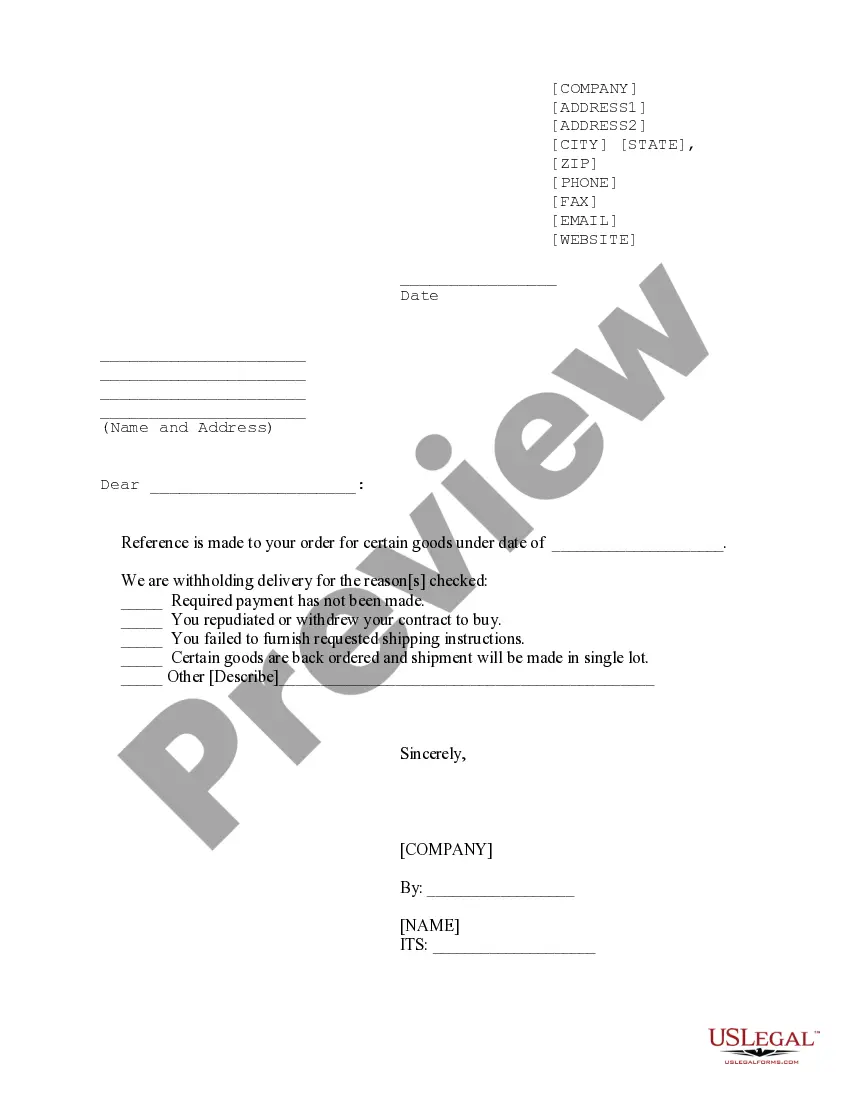

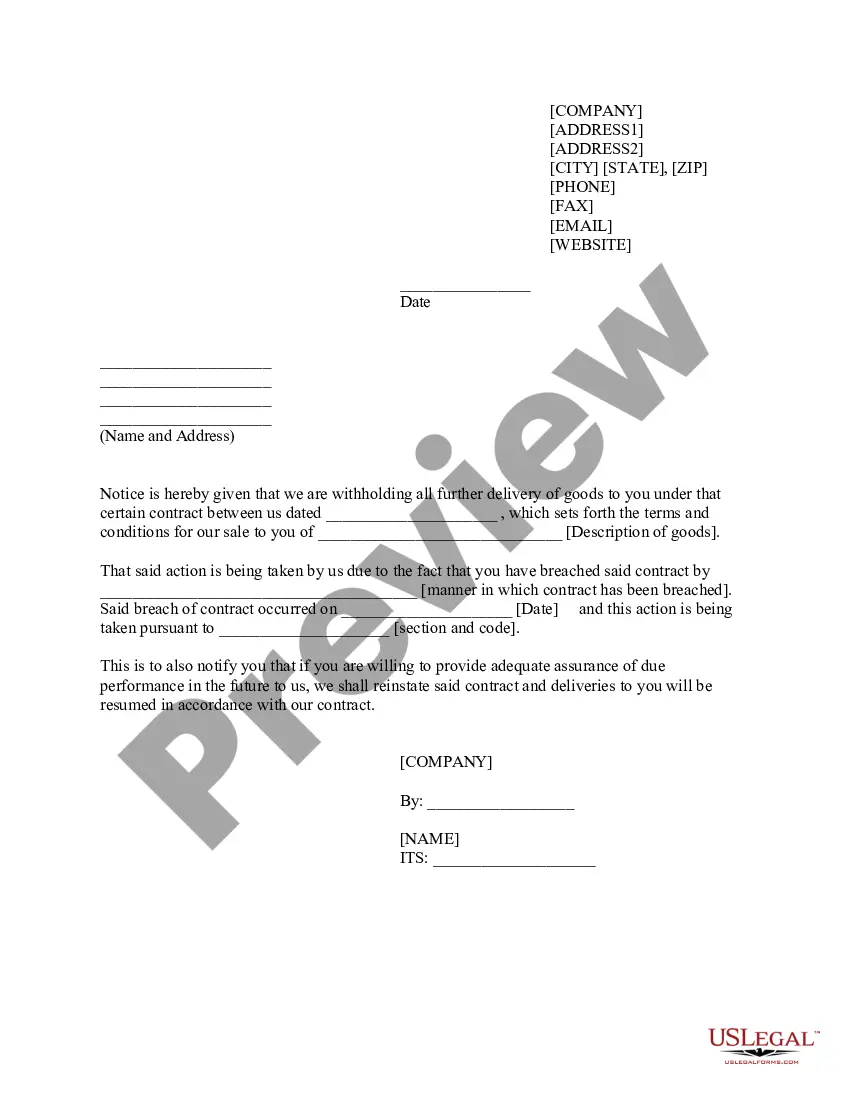

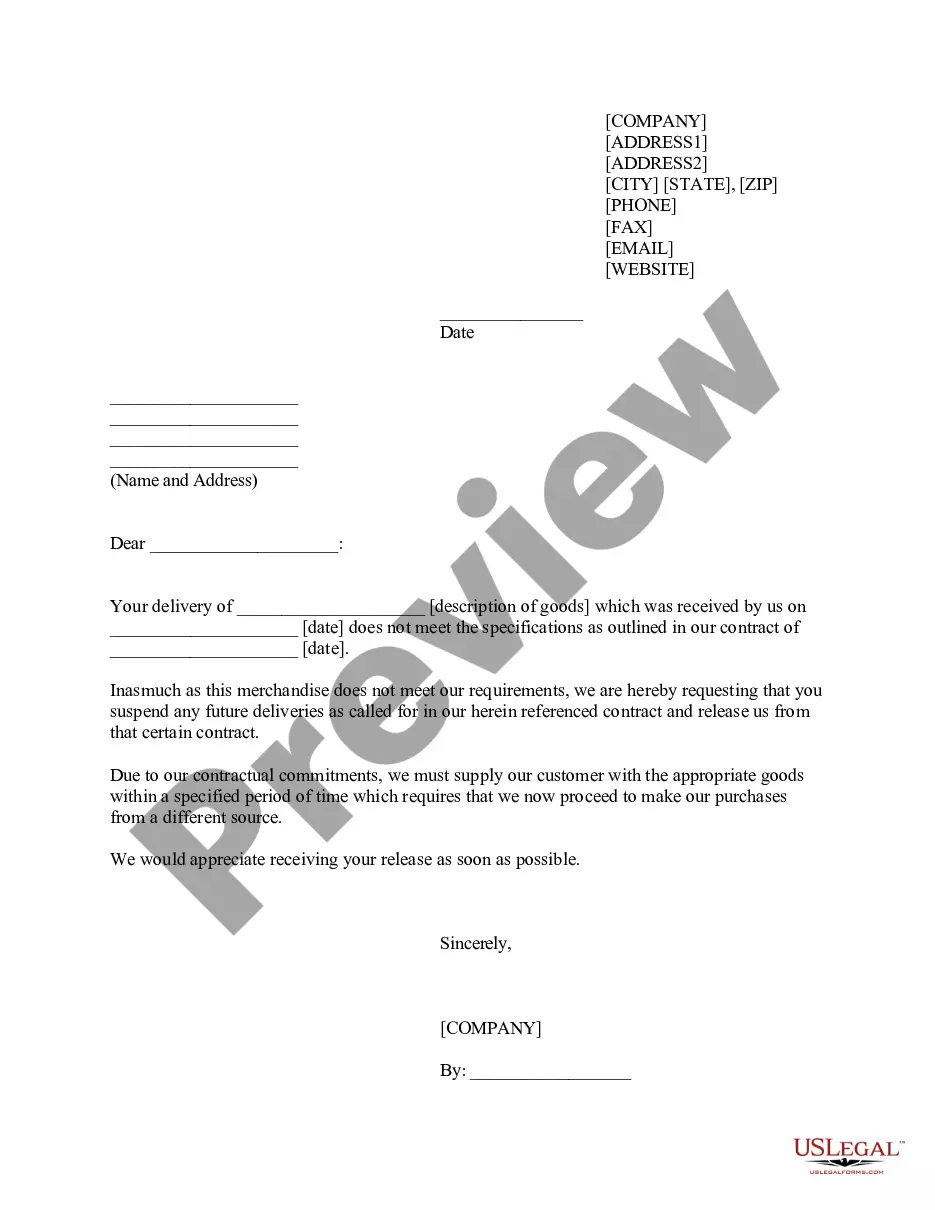

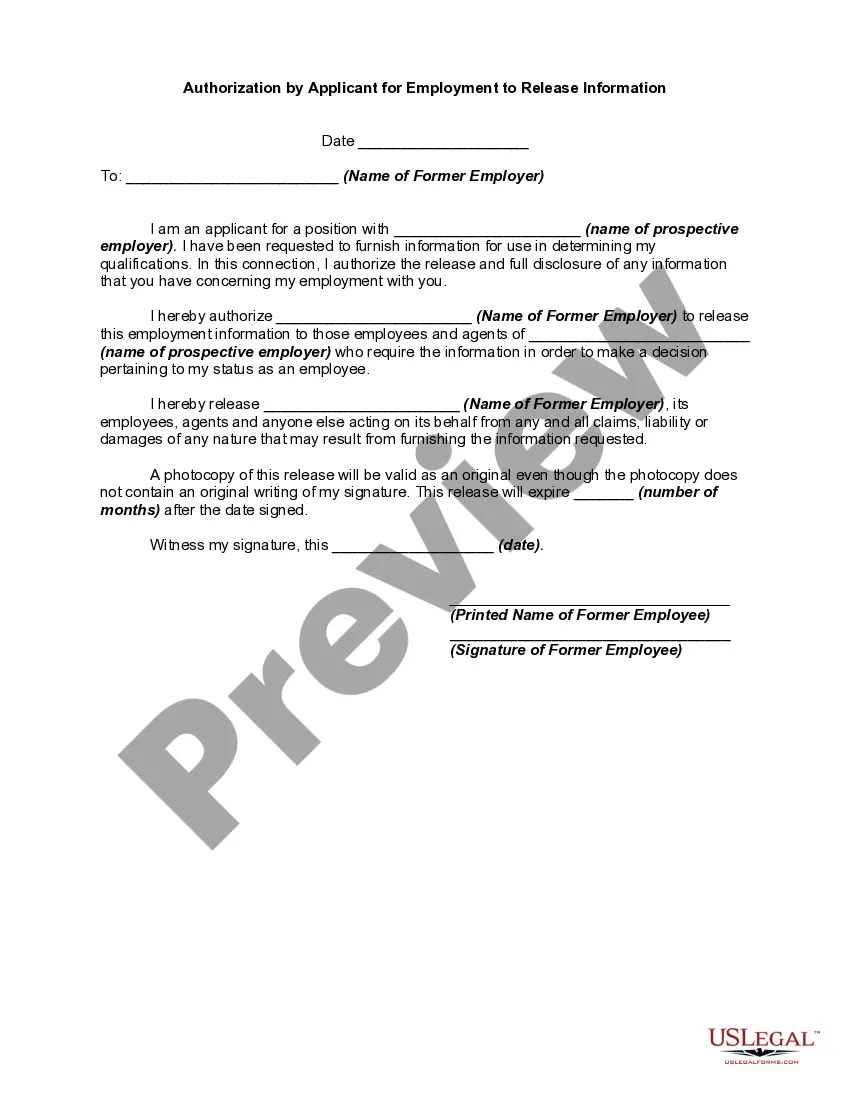

North Carolina Withheld Delivery Notice

Description

How to fill out Withheld Delivery Notice?

If you need to finish, download, or print legal document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Employ the site's straightforward and convenient search feature to find the documents you require.

A variety of templates for business and personal use are categorized by types and states, or keywords.

Step 4. Once you have located the form you need, click the Get now button. Choose your preferred pricing plan and enter your details to create an account.

Step 5. Process the payment. You can use your credit card or PayPal account to complete the transaction.

- Utilize US Legal Forms to locate the North Carolina Withheld Delivery Notice in just a few clicks.

- If you are already a US Legal Forms member, Log Into your account and then click the Download button to access the North Carolina Withheld Delivery Notice.

- You can also retrieve forms you have previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow these steps.

- Step 1. Ensure you have selected the form for your specific city/region.

- Step 2. Use the Review option to examine the form's details. Don't forget to check the summary.

- Step 3. If you are dissatisfied with the form, utilize the Search area at the top of the screen to find alternative versions of the legal form format.

Form popularity

FAQ

When a tax liability is in collections: Collection personnel may call or visit a taxpayer's home or business unannounced to collect past due taxes. In the event an in-person visit occurs, NCDOR personnel have been trained to present credentials to validate employment with the agency.

You received this notice because your refund was reduced. There are two common reasons your refund may be reduced: You owe a debt to us, another state agency, a local agency, or the IRS. We are required by law to deduct that debt from your state tax refund.

Quarterly Filers - Employers who withhold an average of less than $250 from wages each month must file Form NC-5 and pay the withheld taxes on a quarterly basis. All quarterly returns and payments are due by the last day of the month following the end of the calendar quarter.

Beginning with tax year 2019, a taxpayer that receives an automatic extension to file a federal individual income tax return will be granted an automatic state extension to file the N.C. individual income tax return, Form D-400.

The Form D-400, Individual Income Tax Return Main Form is the tax return you file for the state of North Carolina. It is estimated to be available for filing on 02/17/2022.

A tax warrant is a request to levy upon and sell any personal property owned by a taxpayer who has failed to pay tax, penalty, interest and fees that have been assessed by the NC Department of Revenue.

The North Carolina Department of Revenue is a cabinet-level executive agency charged with administering tax laws and collecting taxes on behalf of the people of the State. The Secretary of Revenue is appointed by the Governor.

An employee who is a resident of N. C. is subject to N. C. withholding on all of his wages, whether he works in N. C. or in another state. EXCEPTION: N. C. withholding is not required if the other state in which the employee works requires the employer to withhold income for that state.

Important: If you or your spouse were not residents of North Carolina for the entire year, you must complete and attach Form D-400 Schedule PN, Part-Year Resident and Nonresident Schedule, to determine what percent of your total income is from North Carolina sources.

Notices are sent out when the department determines taxpayers owe taxes to the State that have not been paid for a number of reasons.