North Carolina Law Partnership Agreement with Profits and Losses Shared on Basis of Units of Participation

Description

How to fill out Law Partnership Agreement With Profits And Losses Shared On Basis Of Units Of Participation?

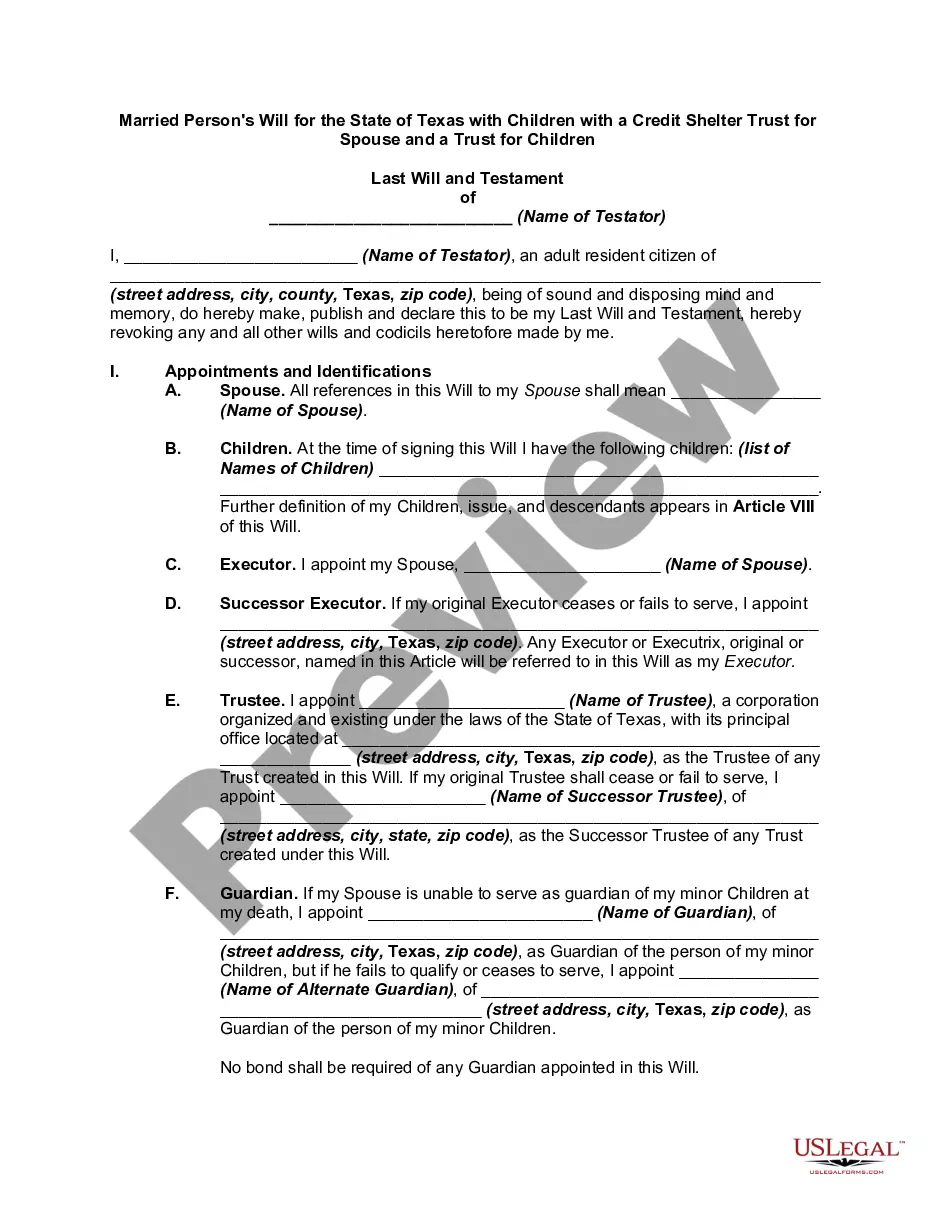

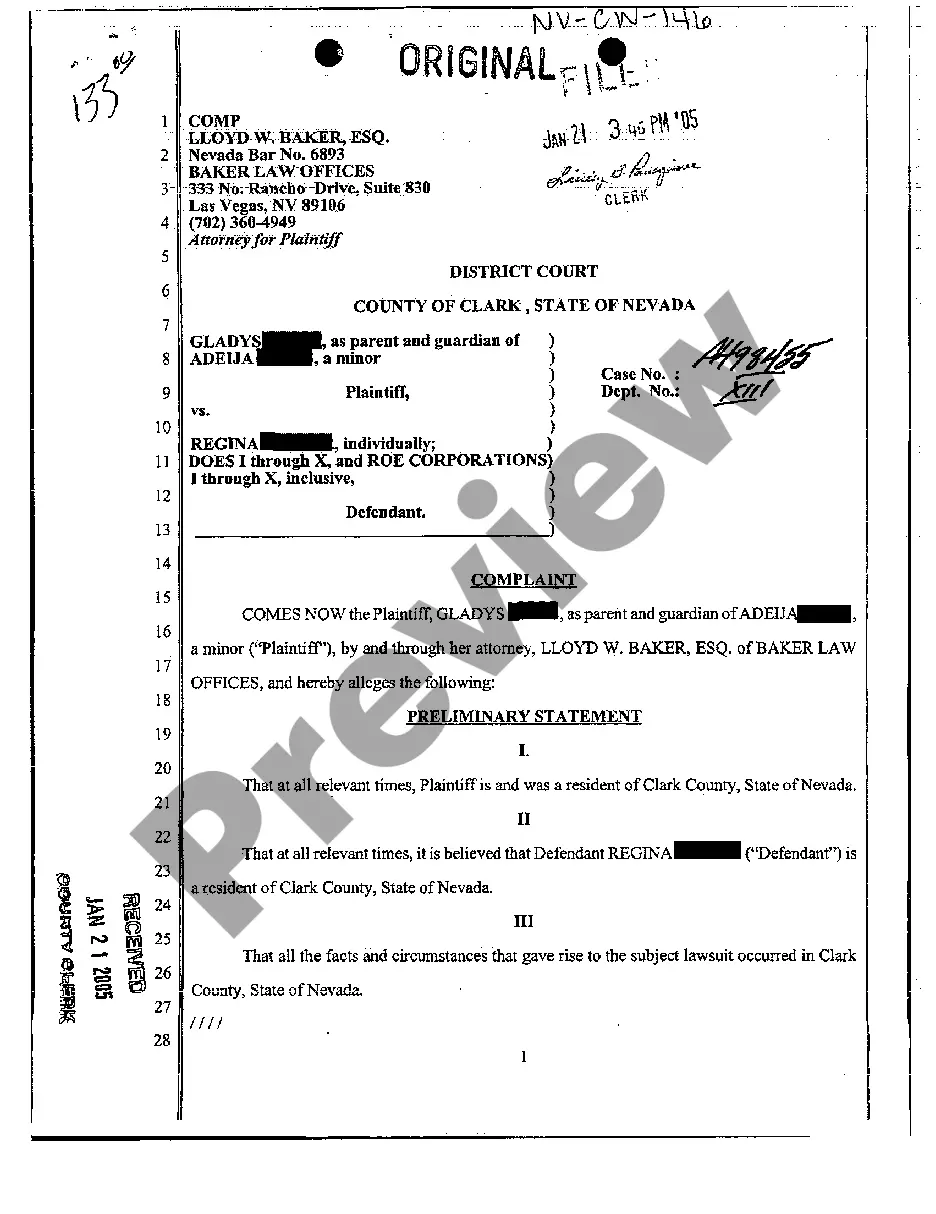

You may spend time on the web searching for the lawful papers format that meets the state and federal specifications you will need. US Legal Forms provides 1000s of lawful types that are examined by pros. You can easily down load or print the North Carolina Law Partnership Agreement with Profits and Losses Shared on Basis of Units of Participation from your services.

If you have a US Legal Forms accounts, it is possible to log in and click on the Obtain option. Afterward, it is possible to complete, revise, print, or sign the North Carolina Law Partnership Agreement with Profits and Losses Shared on Basis of Units of Participation. Every single lawful papers format you buy is the one you have permanently. To obtain one more backup associated with a purchased kind, go to the My Forms tab and click on the corresponding option.

If you are using the US Legal Forms web site for the first time, stick to the easy guidelines under:

- First, make sure that you have chosen the correct papers format for the region/metropolis that you pick. Read the kind description to make sure you have chosen the correct kind. If available, take advantage of the Review option to check through the papers format as well.

- If you wish to find one more version in the kind, take advantage of the Look for discipline to discover the format that meets your requirements and specifications.

- When you have found the format you want, simply click Acquire now to move forward.

- Select the costs strategy you want, type in your accreditations, and sign up for your account on US Legal Forms.

- Complete the purchase. You can use your credit card or PayPal accounts to fund the lawful kind.

- Select the formatting in the papers and down load it in your device.

- Make alterations in your papers if required. You may complete, revise and sign and print North Carolina Law Partnership Agreement with Profits and Losses Shared on Basis of Units of Participation.

Obtain and print 1000s of papers templates using the US Legal Forms site, that offers the largest collection of lawful types. Use specialist and state-specific templates to take on your small business or personal demands.

Form popularity

FAQ

In the general partnership, the limited liability partnership, the limited liability limited partnership and the limited partnership, profits and losses are passed through to the partners as specified in the partnership agreement. If left unspecified, profits and losses are shared equally among the partners.

There's no right or wrong way to split partnership profits, only what works for your business. You can decide to pay each partner a base salary and then split any remaining profits equally, or assign a percentage based on the time and resources each person contributes to the company.

A partnership enables all partners to share equally in the capital and profits of the business and contributes equally to the losses whether the business incurs losses in its course or not. Neither partners nor themselves must agree on how profits and losses should be split.

This means that in a partnership there is more than one owner, and the profit is shared between the owners. In a partnership, it is the residual profit which is divided between the partners in the profit and loss sharing ratio.

Are there rules on how partnerships are run? The only requirement is that in the absence of a written agreement, partners don't draw a salary and share profits and losses equally. Partners have a duty of loyalty to the other partners and must not enrich themselves at the expense of the partnership.

When forming a partnership, the business owners have the option of creating an agreement that dictates how profits or losses pass through to members of the partnership. Absent an agreement, the partners will share profits and losses equally. If an agreement exists, partners divide profits based on the terms specified.

The net loss is divided according to each partner's contribution percentage, according to Henssler Financial. For example, Partner A gets 50 percent of the profits and losses, Partner B gets 30 percent and Partner C gets 20 percent of the partnership's profits and losses. The partnership net loss is $80,000.

Absent an agreement, the partners will share profits and losses equally. If an agreement exists, partners divide profits based on the terms specified. Any reason can be used as the basis for establishing a profit-sharing ratio, but the two main factors are responsibility and capital contributions.

In a business partnership, you can split the profits any way you want, under one conditionall business partners must be in agreement about profit-sharing. You can choose to split the profits equally, or each partner can receive a different base salary and then the partners will split any remaining profits.

In a business partnership, you can split the profits any way you want, under one conditionall business partners must be in agreement about profit-sharing. You can choose to split the profits equally, or each partner can receive a different base salary and then the partners will split any remaining profits.