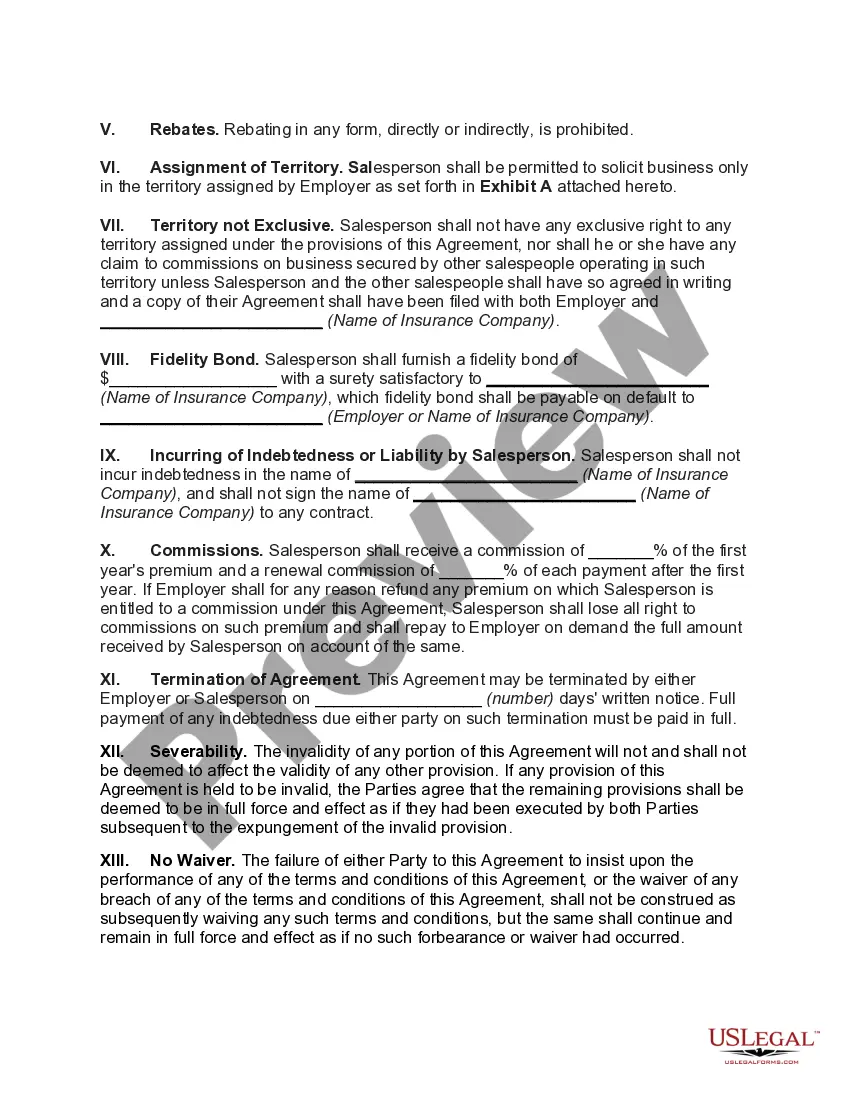

The North Carolina Employment Agreement between a General Agent and Salesperson for the Sale of Insurance is a legally binding document that outlines the terms and conditions of employment in the insurance industry in the state of North Carolina. This agreement governs the relationship between the general agent (employer) and the salesperson (employee), providing clarity on various aspects such as job responsibilities, compensation, termination, and non-compete clauses. The agreement ensures that both parties involved are aware of their rights and obligations and serves as a foundation for a productive and mutually beneficial working relationship. It is crucial to understand that there may be different types of North Carolina Employment Agreements between General Agents and Salespersons — Sale of Insurance, which may vary depending on the type of insurance being sold, such as life insurance, property insurance, or health insurance. Key Elements of a North Carolina Employment Agreement between General Agent and Salesperson — Sale of Insurance: 1. Parties Involved: Clearly state the names and contact information of the general agent (employer) and the salesperson (employee) involved in the agreement. 2. Job Responsibilities: Describe in detail the salesperson's duties and responsibilities, including prospecting for new clients, marketing and promoting insurance products, providing customer service, and maintaining client records. 3. Compensation: Outline the salesperson's compensation structure, including base salary, commission rates, bonus programs, and any additional benefits or incentives. Ensure clarity on how commissions are calculated and when payments will be made. 4. Non-Compete Clause: Specify any restrictions on the salesperson's ability to compete with the general agent during or after their employment term. This clause may include limitations on soliciting clients, working for direct competitors, or operating a similar business within a specific geographical area and time frame. 5. Term and Termination: Define the length of the employment agreement, whether it is an ongoing arrangement or for a fixed term. Include provisions for termination by either party, notice periods, severance packages, and any conditions under which immediate termination may occur. 6. Confidentiality and Non-Disclosure: Address the protection of proprietary information, client data, trade secrets, and other confidential information obtained during employment. Outline the salesperson's obligations to maintain confidentiality both during and after their employment term. 7. Insurance Licensing and Compliance: Specify the salesperson's obligation to obtain and maintain appropriate insurance licenses and certifications required by state laws and regulatory agencies, ensuring compliance with all industry regulations. It is essential to consult legal counsel or an experienced professional when drafting or entering into a North Carolina Employment Agreement between a General Agent and Salesperson–Sale of Insurance. This will ensure compliance with specific state and industry regulations and protect the rights and interests of both parties involved.

North Carolina Employment Agreement between General Agent as Employer and Salesperson - Sale of Insurance

Description

How to fill out North Carolina Employment Agreement Between General Agent As Employer And Salesperson - Sale Of Insurance?

Are you presently in a circumstance where you require documents for either business or personal reasons on a daily basis.

There are numerous legal document templates available online, but locating trustworthy ones is not simple.

US Legal Forms provides a vast array of template options, including the North Carolina Employment Agreement between General Agent as Employer and Salesperson – Sale of Insurance, designed to comply with federal and state regulations.

Once you find the appropriate form, click on Purchase now.

Select your preferred pricing plan, enter the required information to create your account, and pay for your order using PayPal or a credit card. Choose a convenient file format and download your copy. Access all the document templates you have purchased in the My documents section. You can obtain an additional copy of the North Carolina Employment Agreement between General Agent as Employer and Salesperson – Sale of Insurance anytime by simply selecting the desired form to download or print the template. Utilize US Legal Forms, the most extensive collection of legal forms, to save time and avoid mistakes. The service offers properly crafted legal document templates that can be used for various purposes. Create an account on US Legal Forms and start making your life a little easier.

- If you are already acquainted with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the North Carolina Employment Agreement between General Agent as Employer and Salesperson – Sale of Insurance template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the form you need and verify that it is for the correct city/region.

- Click the Review button to examine the form.

- Read the overview to confirm you have selected the correct form.

- If the form does not meet your needs, use the Search section to find a form that fits your requirements.

Form popularity

FAQ

Employment contracts in North Carolina are generally enforceable as long as they meet legal requirements and are clear in their terms. A well-drafted North Carolina Employment Agreement between General Agent as Employer and Salesperson - Sale of Insurance increases the likelihood of enforceability. Should disputes arise, the clarity of the agreement can play a significant role in how a court interprets and upholds its provisions.

Generally, an employment agreement can be assigned, but this depends on its specific terms. In the case of a North Carolina Employment Agreement between General Agent as Employer and Salesperson - Sale of Insurance, the agreement may include clauses that restrict or allow assignment. It's essential to review the contract and, if necessary, consult with a legal professional to navigate these situations correctly.

An employment contract in North Carolina outlines the relationship between an employer and employee, detailing roles, responsibilities, and compensation. Specifically, a North Carolina Employment Agreement between General Agent as Employer and Salesperson - Sale of Insurance defines commission structures and performance expectations. It serves as a vital document to protect both parties in their business dealings.

In North Carolina, a contract is legally binding when it involves mutual agreement, consideration, and lawful purpose. Both parties must have the capacity to enter into the contract and intend to create a legal obligation. For those working under a North Carolina Employment Agreement between General Agent as Employer and Salesperson - Sale of Insurance, it’s important to ensure these elements are clearly outlined to avoid disputes.

When a company is sold, contracts like the North Carolina Employment Agreement between General Agent as Employer and Salesperson - Sale of Insurance generally remain valid. The new owner typically inherits these contracts, maintaining their binding nature. It is important to review these agreements during the sale to ensure that all obligations and rights are preserved.

Yes, employment contracts are legal in North Carolina and are widely used to outline the terms of employment. A well-drafted North Carolina Employment Agreement between General Agent as Employer and Salesperson - Sale of Insurance provides clarity of expectations for both parties. Utilizing resources like uslegalforms can help ensure that your agreements are legally sound and fully compliant with state regulations.

Employment contracts usually continue in force when a company is sold, unless explicitly stated otherwise in the sale agreement. The North Carolina Employment Agreement between General Agent as Employer and Salesperson - Sale of Insurance must be honored by the new owner, which helps maintain stability for employees. It's advisable to review the terms during the sale process to avoid misunderstandings.

When a business is sold, employees typically transfer to the new owner under their existing employment agreements. The terms of the North Carolina Employment Agreement between General Agent as Employer and Salesperson - Sale of Insurance remain intact, safeguarding employee rights. However, it is crucial to communicate with your employees about any changes, ensuring a smooth transition.

To create a North Carolina Employment Agreement between General Agent as Employer and Salesperson - Sale of Insurance, start by defining the roles and responsibilities of both parties. Include essential terms such as compensation, work hours, and termination conditions. You can use online platforms like uslegalforms to access templates that guide you through the process, ensuring everything complies with North Carolina laws.

An agreement between an employer and employee succinctly outlines the expectations, responsibilities, and requirements associated with a job. This document is crucial for fostering a clear understanding of roles and performance metrics. The North Carolina Employment Agreement between General Agent as Employer and Salesperson - Sale of Insurance serves as an essential tool in detailing these expectations, ensuring both parties are on the same page.

Interesting Questions

More info

Agreement Loan Agreement Term Templates by Category.