North Carolina Employment of Executive with Salary Plus Cash Equivalent to Stock Dividends and Retirement Benefits The North Carolina employment market offers various opportunities for executives with attractive compensation packages, including salaries, cash equivalent to stock dividends, and retirement benefits. This combination of incentives ensures high-level professionals are rewarded financially and provided with comprehensive retirement planning options. Executives who secure employment in North Carolina can expect a competitive salary commensurate with their qualifications and experience. These salaries typically exceed industry averages to attract top talent and ensure their expertise is appropriately valued within the organization. In addition to salaries, executives may also receive cash equivalents to stock dividends. This aspect of compensation aims to align executives' incentives with the success of the company's stock performance. By providing cash equivalents tied to stock dividends, companies motivate their executive team to drive growth and maximize shareholder value. This arrangement also allows executives to actively participate in the company's financial success and increases their personal financial stake in its performance. Furthermore, North Carolina employers understand the importance of retirement planning and strive to offer comprehensive benefits packages to their executives. Retirement benefits may include options such as 401(k) plans, pension funds, stock options, and performance-based bonuses. These benefits aim to secure executives' financial futures and reward their commitment to the organization's long-term success. Types of North Carolina Employment of Executive with Salary Plus Cash Equivalent to Stock Dividends and Retirement Benefits: 1. Corporate Executives: This category includes C-level executives, such as Chief Executive Officers (CEOs), Chief Financial Officers (CFOs), Chief Operating Officers (COOs), and other high-ranking officers. They are responsible for overseeing the overall operations, financial performance, and strategic direction of the organization. 2. Divisional or Departmental Executives: These executives hold leadership positions within specific divisions or departments of larger companies. They are responsible for driving success within their respective areas and often report to the corporate executive team. 3. Nonprofit Executives: Nonprofit organizations in North Carolina also offer executive positions with salary, cash equivalents to stock dividends, and retirement benefits. These executives lead organizations focused on social causes, aiming to make a positive impact on the community while also providing attractive compensation packages. 4. Start-Up Executives: North Carolina has a thriving start-up ecosystem, offering opportunities for executives to join early-stage companies. These positions often come with the promise of substantial equity ownership, allowing executives to benefit from the potential growth and success of the start-up. In conclusion, North Carolina provides an enticing employment landscape for executives. Offering generous salaries, cash equivalents tied to stock dividends, and comprehensive retirement benefits, companies in North Carolina attract and retain top-level professionals across various industries. This compensation structure ensures executives are rewarded for their expertise, aligning their interests with the organization's success while securing their financial future.

North Carolina Employment of Executive with Salary Plus Cash Equivalent to Stock Dividends and Retirement Benefits

Description

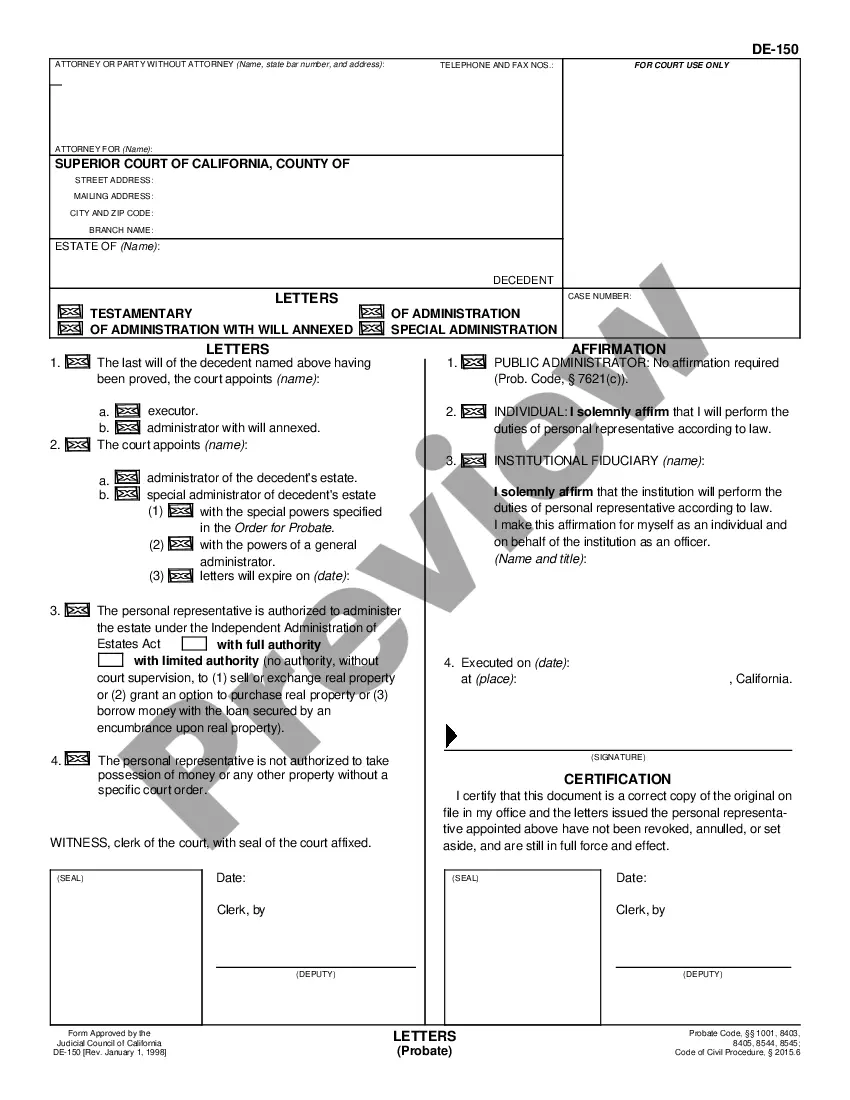

How to fill out North Carolina Employment Of Executive With Salary Plus Cash Equivalent To Stock Dividends And Retirement Benefits?

Discovering the right legal document format can be quite a have a problem. Naturally, there are a variety of themes accessible on the Internet, but how would you get the legal develop you want? Make use of the US Legal Forms internet site. The services provides a huge number of themes, for example the North Carolina Employment of Executive with Salary Plus Cash Equivalent to Stock Dividends and Retirement Benefits, that you can use for company and personal requirements. Each of the types are checked by specialists and satisfy federal and state requirements.

In case you are currently listed, log in to the accounts and click the Acquire button to get the North Carolina Employment of Executive with Salary Plus Cash Equivalent to Stock Dividends and Retirement Benefits. Use your accounts to appear throughout the legal types you possess purchased earlier. Proceed to the My Forms tab of your own accounts and have one more duplicate in the document you want.

In case you are a new user of US Legal Forms, listed here are simple guidelines that you should comply with:

- First, make certain you have selected the correct develop for your town/area. You can check out the form making use of the Preview button and study the form information to guarantee it is the best for you.

- In the event the develop does not satisfy your needs, use the Seach area to find the appropriate develop.

- When you are certain that the form is proper, click the Acquire now button to get the develop.

- Choose the pricing program you desire and type in the necessary information. Design your accounts and purchase the transaction with your PayPal accounts or Visa or Mastercard.

- Pick the document structure and obtain the legal document format to the device.

- Comprehensive, modify and printing and signal the acquired North Carolina Employment of Executive with Salary Plus Cash Equivalent to Stock Dividends and Retirement Benefits.

US Legal Forms is the biggest library of legal types that you will find different document themes. Make use of the company to obtain skillfully-manufactured papers that comply with express requirements.

Form popularity

FAQ

If you have five or more years of membership service, you are vested and may be entitled to a monthly retirement benefit (and health insurance, if applicable) once you reach an age that qualifies you. This potentially extends to your elected beneficiaries and survivors.

Salaried employees in North Carolina who are non-exempt have the right to receive the state's minimum wage. In North Carolina, salaried employees are covered by federal laws including the Fair Labor Standards Act (FLSA), the Family and Medical Leave Act (FMLA), and the Occupational Safety and Health Act (OSHA).

TSERS is a Defined Benefit Plan, which means retirement benefits are based on salary, years of service and a retirement factor. The formula for TSERS is: Average salary based on the 48 highest consecutive months of earnings. Multiplied by a Retirement Factor of 1.82% (set by state statute)

Under TSERS, the State controls the investments and assumes all of the investment risks. The plan funds are invested by professional money managers selected by TSERS. The ORP is a defined contribution plan. The value of your benefit is not based on a predetermined formula.

You may retire with unreduced service retirement benefits after: you reach age 65 and complete five years of creditable service, or. you reach age 60 and complete 25 years of creditable service, or. you complete 30 years of creditable service, at any age.

Optional $10,000 Contributory Death Benefit When you retire, we will mail you a Form 333 (Choosing the Contributory Death Benefit for Retired Members). To enroll, you must make your election within 60 days of the effective date of your retirement.

The formula used in calculating the maximum annual retirement benefit is the average of the employee's salary during the four highest paid years in a row times a retirement factor set by the NC General Assembly times the total number of years and months of creditable service.

State Health Plan retiree group coverage begins on the first day of the month after your effective date of retirement. If under 65 (and not Medicare-eligible), you will be automatically enrolled in the health plan you were enrolled in as an active employee along with any covered dependents.