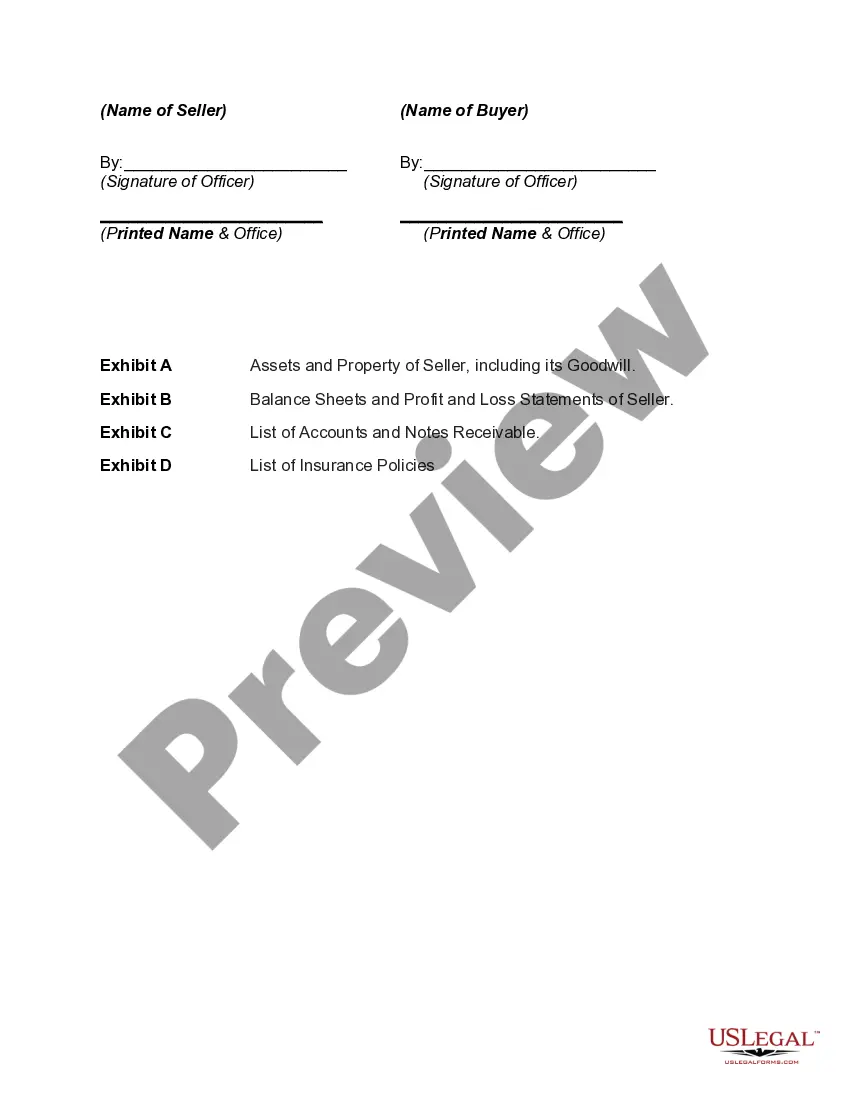

The North Carolina Agreement for Sale of Assets of Corporation is a legal document that outlines the terms and conditions surrounding the sale of assets owned by a corporation in the state of North Carolina. This agreement is essential for both the buyer and seller as it ensures the smooth transfer of assets while protecting the rights and interests of all involved parties. In general, the North Carolina Agreement for Sale of Assets of Corporation typically includes the following key provisions: 1. Parties Involved: It identifies the buyer and seller involved in the transaction. The buyer is usually a different corporation or individual acquiring the assets from the selling corporation. 2. Asset Description: This section provides a detailed description of the assets being sold, including but not limited to properties, equipment, inventory, intellectual property, and other tangible or intangible assets. 3. Purchase Price: The agreement specifies the purchase price or consideration for the assets being sold. This could include a lump sum payment or installment payments extended over a period. 4. Terms and Conditions: It outlines the terms and conditions of the sale, including any representations and warranties made by the seller regarding the assets' condition, legal title, and absence of liens or encumbrances. 5. Closing Date and Deliverables: The agreement specifies the date when the transaction will be completed, also known as the closing date. It may include a list of deliverables, such as documents, certificates, or deeds that need to be exchanged between the buyer and seller on or before the closing date. 6. Allocation of Purchase Price: If applicable, this section outlines the allocation of the purchase price among the various assets being sold for tax and accounting purposes. 7. Assumption of Liabilities: The agreement addresses whether the buyer will assume any of the seller's liabilities, such as outstanding loans or contracts related to the assets being sold. 8. Indemnification: This provision protects the buyer from any undisclosed liabilities or damages related to the assets being sold and holds the seller responsible for indemnifying the buyer in case of any claims. Other types of North Carolina Agreements for Sale of Assets of Corporation can include: 1. North Carolina Agreement for Sale of Real Property: This specific agreement focuses on the sale of real estate assets owned by a corporation in North Carolina, such as land, buildings, or any associated fixtures. 2. North Carolina Agreement for Sale of Intellectual Property: This type of agreement specifically addresses the sale of intellectual property assets held by a corporation in North Carolina, including patents, trademarks, copyrights, and trade secrets. 3. North Carolina Agreement for Sale of Business: This comprehensive agreement encompasses the sale of an entire business, including its assets, liabilities, goodwill, customer lists, and other related elements. These agreements can vary depending on the specific requirements and nature of the assets being sold. It is essential to consult with a qualified legal professional to draft or review the agreement to ensure it complies with North Carolina laws and adequately protects the interests of all parties involved.

North Carolina Agreement for Sale of Assets of Corporation

Description

How to fill out North Carolina Agreement For Sale Of Assets Of Corporation?

If you need to total, download, or print out authorized record layouts, use US Legal Forms, the greatest assortment of authorized kinds, which can be found online. Utilize the site`s basic and hassle-free look for to find the documents you need. Numerous layouts for organization and personal uses are categorized by classes and says, or keywords and phrases. Use US Legal Forms to find the North Carolina Agreement for Sale of Assets of Corporation with a handful of clicks.

Should you be previously a US Legal Forms consumer, log in to the accounts and click on the Download button to obtain the North Carolina Agreement for Sale of Assets of Corporation. You can even access kinds you previously saved in the My Forms tab of your own accounts.

Should you use US Legal Forms for the first time, follow the instructions listed below:

- Step 1. Make sure you have selected the shape for that right city/land.

- Step 2. Use the Preview choice to check out the form`s articles. Do not overlook to see the information.

- Step 3. Should you be unhappy with the type, make use of the Research area towards the top of the screen to discover other types from the authorized type web template.

- Step 4. Upon having identified the shape you need, click on the Get now button. Choose the costs prepare you favor and add your accreditations to register for an accounts.

- Step 5. Approach the purchase. You may use your Мisa or Ьastercard or PayPal accounts to accomplish the purchase.

- Step 6. Select the structure from the authorized type and download it in your gadget.

- Step 7. Total, modify and print out or indication the North Carolina Agreement for Sale of Assets of Corporation.

Each and every authorized record web template you buy is your own property eternally. You have acces to each type you saved inside your acccount. Select the My Forms segment and select a type to print out or download once again.

Remain competitive and download, and print out the North Carolina Agreement for Sale of Assets of Corporation with US Legal Forms. There are thousands of specialist and condition-certain kinds you may use for the organization or personal requirements.