North Carolina Nominee Agreement

Description

How to fill out Nominee Agreement?

Selecting the appropriate authorized document template can be a challenge. Of course, there are numerous formats available online, but how do you locate the official form you require.

Utilize the US Legal Forms website. The platform provides thousands of templates, including the North Carolina Nominee Agreement, which can be used for business and personal purposes. All templates are reviewed by experts and comply with federal and state regulations.

If you are already registered, Log In to your account and click the Download button to obtain the North Carolina Nominee Agreement. Use your account to review the official forms you have previously purchased. Navigate to the My documents section of your account and download another copy of the document you require.

Select the document format and download the authorized document template to your device. Complete, modify, print, and sign the obtained North Carolina Nominee Agreement. US Legal Forms is the largest repository of legal forms where you can find a variety of document templates. Utilize the service to download professionally-crafted papers that comply with state requirements.

- First, ensure you have selected the correct form for your area/region.

- You can preview the form using the Review button and read the form description to confirm it is suitable for your needs.

- If the form does not meet your criteria, use the Search field to find the appropriate form.

- Once you are confident that the form is right, click on the Buy now button to acquire the form.

- Choose the pricing plan you prefer and input the necessary information.

- Create your account and finalize the purchase using your PayPal account or credit card.

Form popularity

FAQ

You need to create a trust document (it's similar to a will), naming someone to take over as trustee after your death (called a successor trustee). Thenand this is crucialyou must transfer ownership of your property to yourself as the trustee of the trust.

While there is no set deadline for when an executor must settle an estate in North Carolina, as previously stated it can take several years for this to happen, the executor is responsible for meeting several key deadlines throughout probate proceedings.

Unlike South Carolina and many other states, real property in North Carolina does not typically pass through probate. When a decedent dies intestate (without a Will), title to the decedent's non-survivorship real property is vested in his or heir heirs as of the time of death G.S. 28A-15-2(b).

Will Probate Be Necessary? Probate court proceedings are required only if the deceased person owned assets in his or her name alone. Other assets can usually be transferred to their new owners without probate.

State law allows for two years for the will to be entered into the court records. However, an heir may file sooner if the executor fails to file within 60 days of the death of the person.

Your entire estate will pass to and be divided equally among your parents. If there is only one parent, he or she receives everything. All property and possessions are divided evenly among the children. If there is only one child, he or she receives everything.

Heirs property is land that is jointly owned by descendants of a deceased person whose estate was never handled in probate court and is passed down from generation to generation. These joint owners (heirs) have the right to use the property, but none of them have a clear title.

The executor can sell property without getting all of the beneficiaries to approve. However, notice will be sent to all the beneficiaries so that they know of the sale but they don't have to approve of the sale.

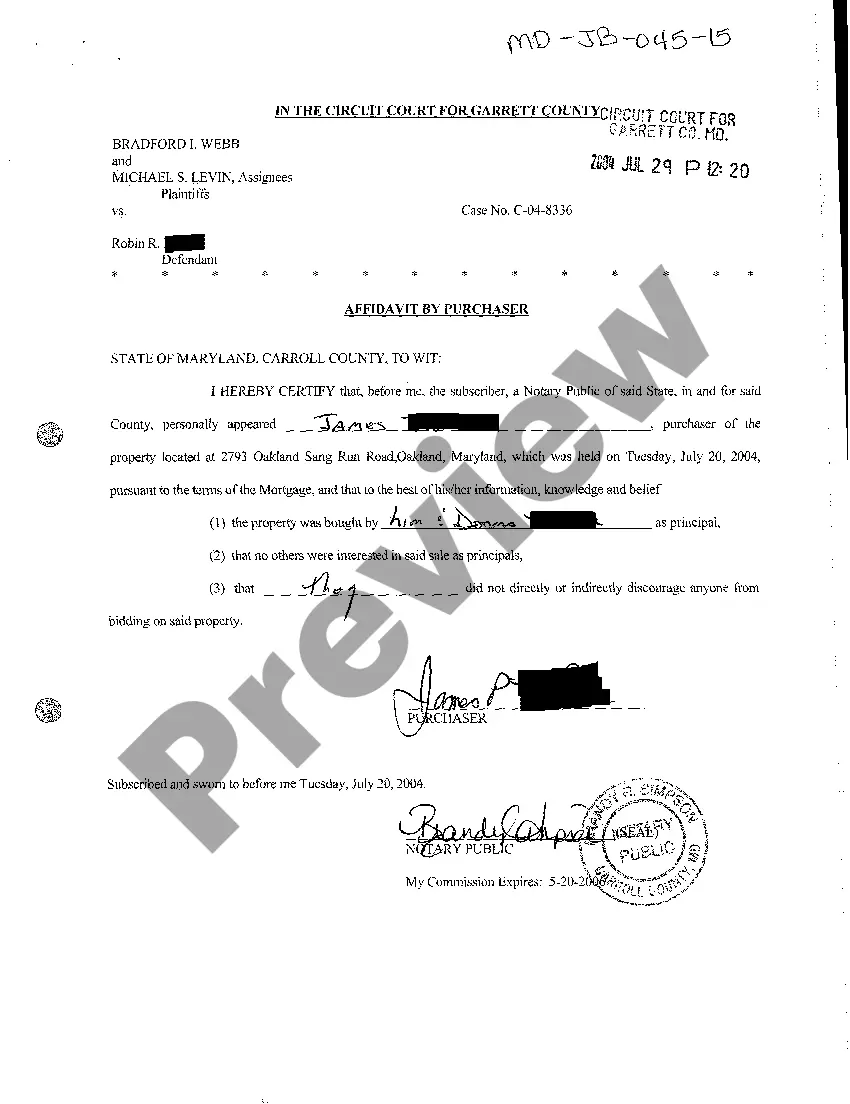

Claiming Personal Property With an Affidavit If the value of the estate isn't too large, North Carolina offers an unusual procedure, which lets you get approval from the local probate (superior) court to wind up the estate without formal probate. All you need to do is to file one simple form with the court.

Living Trusts In North Carolina, you can make a living trust to avoid probate for virtually any asset you ownreal estate, bank accounts, vehicles, and so on. You need to create a trust document (it's similar to a will), naming someone to take over as trustee after your death (called a successor trustee).