North Carolina Agreement between Co-lessees as to Payment of Rent and Taxes: Explained In North Carolina, when multiple individuals share a lease agreement for a property, it is crucial to establish clear guidelines regarding the payment of rent and taxes. This helps to avoid conflicts and ensure that all co-lessees fulfill their financial responsibilities. A North Carolina Agreement between Co-lessees as to Payment of Rent and Taxes outlines the terms and conditions agreed upon by the co-lessees, ensuring clarity and fairness in their financial obligations. There are different types of North Carolina Agreements between Co-lessees as to Payment of Rent and Taxes that individuals can consider based on their specific circumstances. Here are a few common types: 1. Equal Split Agreement: This type of agreement requires all co-lessees to split the rent and taxes equally, regardless of the size or amenities of each individual's living space. It ensures a fair distribution of expenses, particularly when the property is equally shared among the co-lessees. 2. Proportional Split Agreement: In this agreement, the rent and taxes are divided based on each co-lessee's share of the living space or number of bedrooms they occupy. This method accounts for variations in the size or desirability of the leased areas and ensures a more proportional distribution of expenses. 3. Customized Agreement: Some co-lessees may opt for a customized agreement, tailoring the payment arrangements to their unique needs and preferences. This agreement allows flexibility in determining the contribution of rent and taxes by considering factors such as income, financial circumstances, or any other mutually agreed-upon criteria. Regardless of the type of agreement chosen, it is essential that certain key elements are included: 1. Clarifying the Payment Obligations: The agreement should clearly state the exact amount of rent and taxes to be paid by each co-lessee and the frequency of payments (e.g., monthly, quarterly). 2. Allocation of Additional Expenses: The agreement can also address how additional expenses, such as utilities, maintenance costs, or any other relevant fees, will be divided among the co-lessees. 3. Consequences of Non-payment: The agreement should specify the consequences, such as penalties or possible legal actions, if a co-lessee fails to fulfill their payment obligations promptly. 4. Duration and Termination: It is important to include the duration of the agreement and outline the conditions under which it can be terminated, such as with notice or in case of breach of the terms. North Carolina Agreement between Co-lessees as to Payment of Rent and Taxes ensures transparency, accountability, and a fair distribution of financial responsibilities among all tenants. It is advisable to consult with a legal professional to customize the agreement to best suit the specific needs and circumstances of the co-lessees involved. This agreement promotes harmonious cohabitation and helps to maintain a healthy landlord-tenant relationship.

North Carolina Agreement between Co-lessees as to Payment of Rent and Taxes

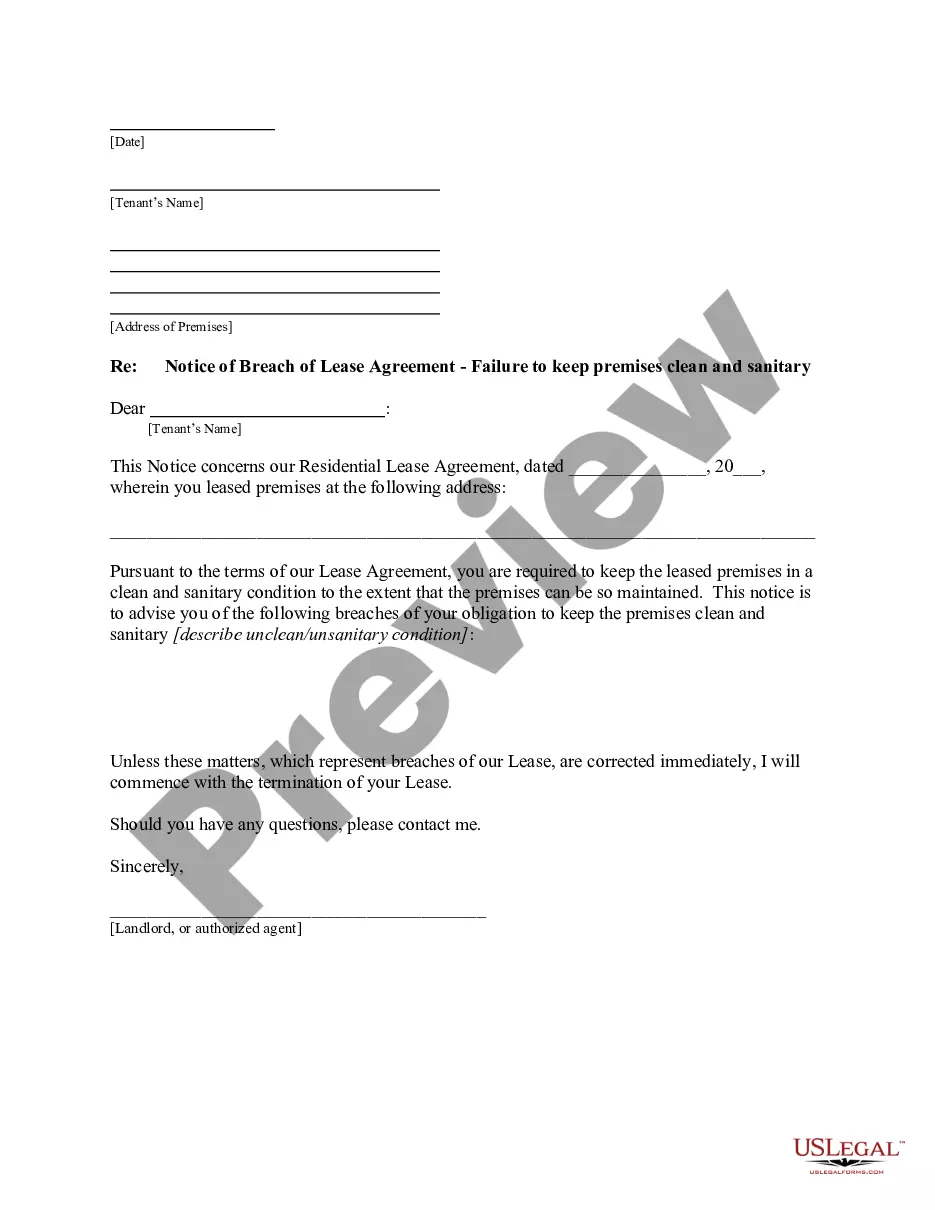

Description

How to fill out North Carolina Agreement Between Co-lessees As To Payment Of Rent And Taxes?

If you want to full, down load, or print legal record web templates, use US Legal Forms, the most important assortment of legal kinds, that can be found on the web. Make use of the site`s basic and convenient research to obtain the papers you require. A variety of web templates for company and personal purposes are sorted by categories and says, or keywords and phrases. Use US Legal Forms to obtain the North Carolina Agreement between Co-lessees as to Payment of Rent and Taxes with a few clicks.

When you are already a US Legal Forms consumer, log in to the profile and then click the Acquire key to get the North Carolina Agreement between Co-lessees as to Payment of Rent and Taxes. You can also accessibility kinds you earlier downloaded from the My Forms tab of your own profile.

If you are using US Legal Forms the first time, follow the instructions under:

- Step 1. Make sure you have chosen the form for your proper metropolis/country.

- Step 2. Utilize the Preview method to look over the form`s articles. Don`t overlook to read the outline.

- Step 3. When you are not satisfied together with the kind, make use of the Lookup field on top of the display to locate other models in the legal kind web template.

- Step 4. After you have discovered the form you require, go through the Purchase now key. Pick the prices strategy you favor and include your references to register on an profile.

- Step 5. Process the transaction. You can utilize your Мisa or Ьastercard or PayPal profile to finish the transaction.

- Step 6. Select the file format in the legal kind and down load it in your system.

- Step 7. Comprehensive, edit and print or signal the North Carolina Agreement between Co-lessees as to Payment of Rent and Taxes.

Each and every legal record web template you purchase is the one you have eternally. You might have acces to every single kind you downloaded with your acccount. Select the My Forms area and decide on a kind to print or down load once more.

Contend and down load, and print the North Carolina Agreement between Co-lessees as to Payment of Rent and Taxes with US Legal Forms. There are millions of professional and condition-distinct kinds you may use for your company or personal requirements.