North Carolina Accord and Satisfaction Release Agreement Regarding Dispute between Two Corporations and Shareholders Regarding Obligations under Stock Option Agreement In North Carolina, an Accord and Satisfaction Release Agreement is a legally binding document that arises when there is a dispute between two corporations and shareholders regarding their obligations under a Stock Option Agreement. This agreement aims to settle the dispute amicably by outlining the terms and conditions for fulfilling the obligations stated in the Stock Option Agreement. Key elements of a North Carolina Accord and Satisfaction Release Agreement include: 1. Parties involved: The agreement will identify the two corporations and their respective shareholders who are party to the dispute. 2. Stock Option Agreement: The agreement will reference the original Stock Option Agreement between the corporations and shareholders, which outlines the terms and conditions related to stock options and the parties' respective obligations. 3. Dispute resolution: The Accord and Satisfaction Release Agreement will outline the dispute that has arisen under the Stock Option Agreement. It may relate to issues such as the exercise of stock options, pricing, vesting schedules, or any other matter stipulated in the original agreement. 4. Settlement terms: The agreement will establish the specific terms of the settlement intended to resolve the dispute. These terms could include a payment or transfer of shares, a revised vesting schedule, or any other mutually agreeable resolution. 5. Release and discharge: Both parties will release and discharge each other from any claims, demands, or liabilities arising from the dispute related to the Stock Option Agreement. This clause ensures that once the agreement is executed, neither party can pursue legal action against the other for the specific dispute mentioned in the agreement. Different types of North Carolina Accord and Satisfaction Release Agreements within this context may include: 1. Stock Option Pricing Dispute Agreement: This agreement focuses on resolving disputes specifically related to the price at which stock options are exercised or purchased. 2. Vesting Schedule Modification Agreement: This type of agreement addresses disputes regarding the vesting of stock options and proposes modifications to the existing vesting schedule to reach a mutually satisfactory resolution. 3. Payment or Shares Transfer Agreement: In cases where the dispute primarily revolves around monetary compensation or share ownership, this agreement outlines the terms of payment or share transfers to settle the dispute. 4. General Accord and Satisfaction Release Agreement: This type of agreement encompasses a broader range of disputes under the Stock Option Agreement. It may cover multiple issues such as pricing, vesting, exercise, and any other obligations arising from the agreement. It is crucial to consult legal professionals experienced in North Carolina corporate law when drafting or executing a North Carolina Accord and Satisfaction Release Agreement. They will ensure the agreement aligns with the state's legal requirements and protects the rights and obligations of all parties involved in the dispute.

North Carolina Accord and Satisfaction Release Agreement Regarding Dispute between Two Corporations and Shareholders Regarding Obligations under Stock Option Agreement

Description

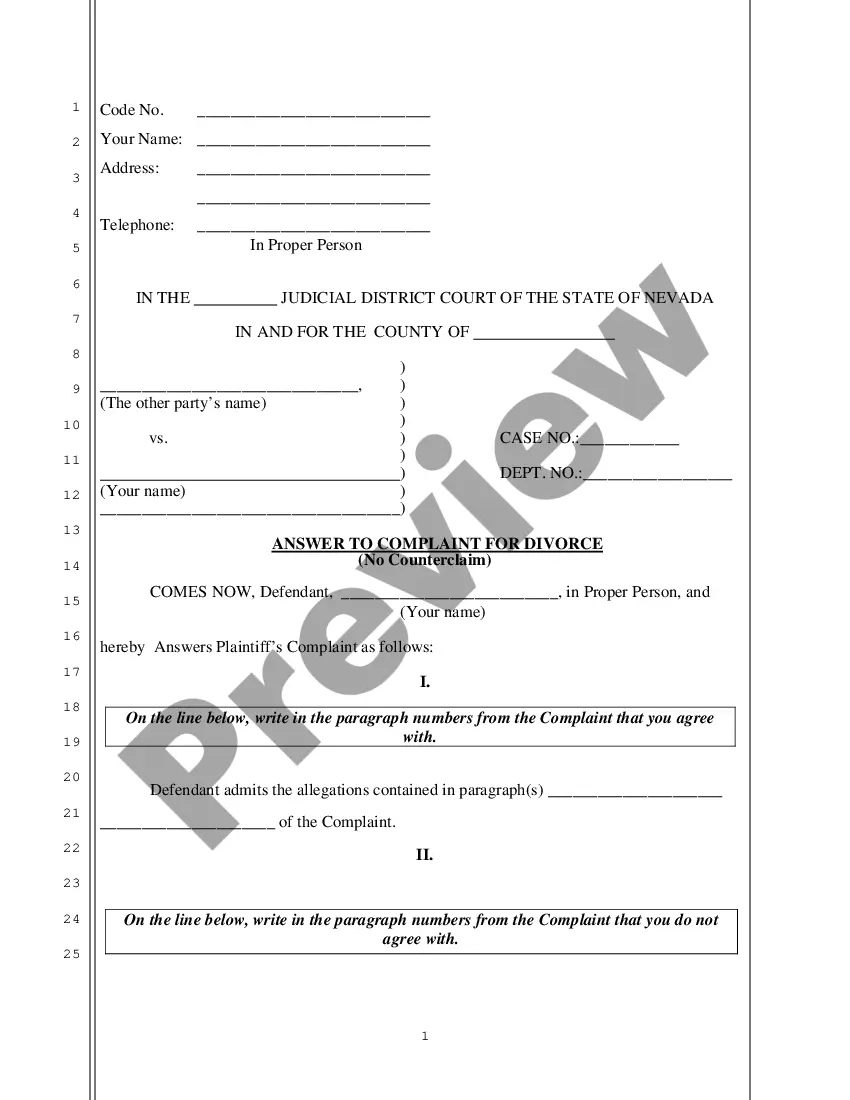

How to fill out Accord And Satisfaction Release Agreement Regarding Dispute Between Two Corporations And Shareholders Regarding Obligations Under Stock Option Agreement?

Are you presently in a place where you require papers for either company or individual uses just about every day time? There are a variety of authorized papers templates available on the net, but getting ones you can rely on isn`t straightforward. US Legal Forms provides thousands of form templates, just like the North Carolina Accord and Satisfaction Release Agreement Regarding Dispute between Two Corporations and Shareholders Regarding Obligations under Stock Option Agreement, that happen to be published to fulfill federal and state requirements.

When you are previously informed about US Legal Forms website and also have an account, simply log in. Following that, you are able to down load the North Carolina Accord and Satisfaction Release Agreement Regarding Dispute between Two Corporations and Shareholders Regarding Obligations under Stock Option Agreement template.

If you do not come with an accounts and wish to begin using US Legal Forms, abide by these steps:

- Obtain the form you require and make sure it is for that correct town/state.

- Use the Preview switch to analyze the form.

- Browse the information to ensure that you have chosen the proper form.

- If the form isn`t what you`re trying to find, take advantage of the Search area to obtain the form that meets your needs and requirements.

- If you discover the correct form, just click Acquire now.

- Select the costs strategy you need, fill out the specified information and facts to generate your bank account, and buy your order utilizing your PayPal or Visa or Mastercard.

- Decide on a convenient file file format and down load your copy.

Locate every one of the papers templates you have bought in the My Forms menu. You can aquire a further copy of North Carolina Accord and Satisfaction Release Agreement Regarding Dispute between Two Corporations and Shareholders Regarding Obligations under Stock Option Agreement whenever, if needed. Just select the needed form to down load or printing the papers template.

Use US Legal Forms, probably the most considerable collection of authorized types, to save lots of some time and prevent mistakes. The assistance provides expertly created authorized papers templates that can be used for a selection of uses. Create an account on US Legal Forms and begin generating your daily life a little easier.

Form popularity

FAQ

Thelma owes Louise $100,000 under a contract. Thelma owns a beach house which she promises to give Louise in settlement of the debt and Louise promises to accept the house in settlement of the debt instead of the $100,000. This new agreement is an .

An and satisfaction is a legal contract whereby two parties agree to discharge a tort claim, contract, or other liability for an amount based on terms that differ from the original amount of the contract or claim. and satisfaction is also used to settle legal claims prior to bringing them to court.

And satisfaction is a settlement of an unliquidated debt. For example, a builder is contracted to build a homeowner a garage for $35,000. The contract called for $17,500 prior to starting construction, to disburse $10,000 during various stages of construction, and to make a final payment of $7,500 at completion.

An and satisfaction occurs when the parties involved in a dispute reach a new agreement to resolve the dispute. This agreement may involve a compromise, such as a payment of less than the full amount owed or a release of certain claims.

Under most state law, a valid and satisfaction requires four elements as a minimum, usually, (1) proper subject matter, (2) competent parties, (3) meeting of the minds of the parties and (4) adequate consideration.

An and satisfaction occurs when the parties involved in a dispute reach a new agreement to resolve the dispute. This agreement may involve a compromise, such as a payment of less than the full amount owed or a release of certain claims.

A release is a abandonment of a right, which may be given gratuitously (for free) or for inadequate consideration, while an and satisfaction is the discharge of a debt or claim by the acceptance of some payment which is agreed to constitute full satisfaction Holman v. Simborg, 152 Ill. App.

554, 561 (2001), for the rule that three elements must exist for there to be an ? and satisfaction?: (a) there must be a (good faith) dispute about the existence or extent of liability, (b) after the dispute arises, the parties must enter into an agreement in which one party must agree to pay more than that party ...