North Carolina Purchase Invoice

Description

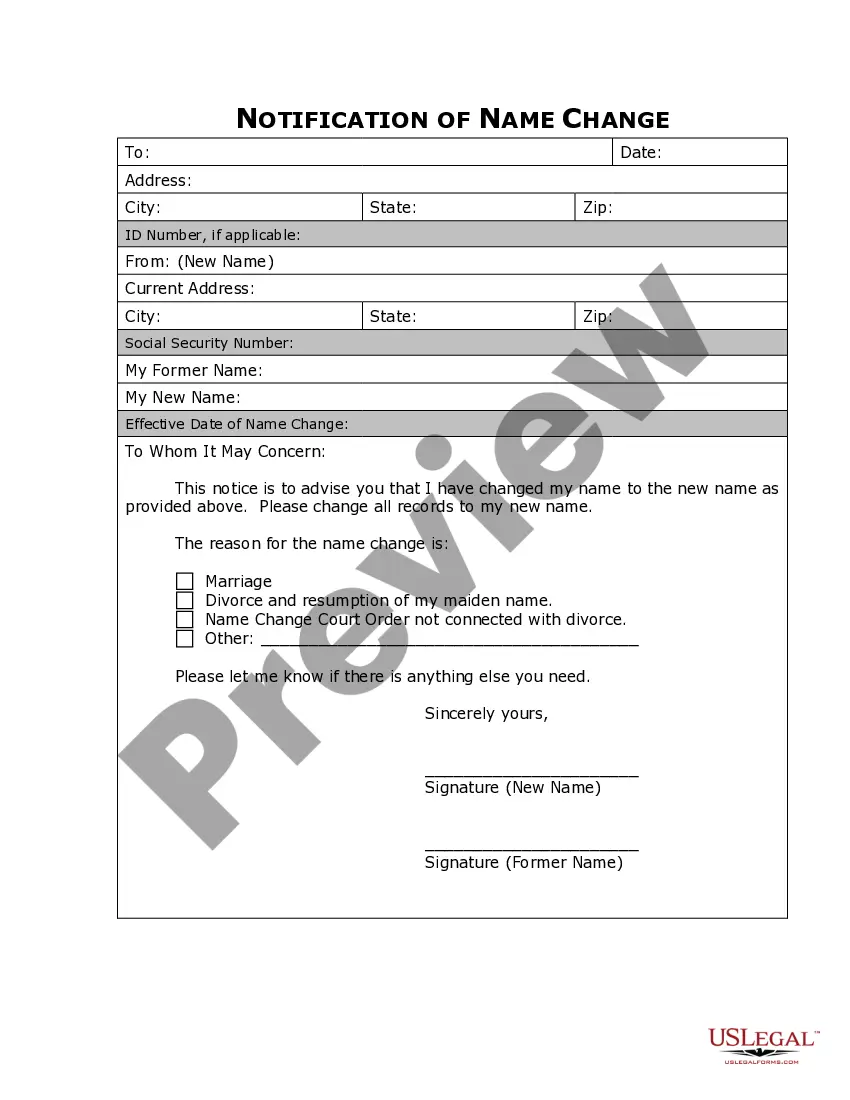

How to fill out Purchase Invoice?

US Legal Forms - one of the largest collections of legal templates in the USA - offers a range of legal document templates that you can download or print.

By using the website, you can access thousands of forms for business and personal use, categorized by types, states, or keywords. You can find the latest versions of forms like the North Carolina Purchase Invoice in moments.

If you already have a monthly subscription, Log In and download the North Carolina Purchase Invoice from the US Legal Forms library. The Download button will appear on every form you view.

Once you are satisfied with the form, confirm your selection by clicking on the Purchase now button. Next, choose your preferred payment plan and provide your credentials to create an account.

Process the purchase. Use your credit card or PayPal account to finalize the transaction. Choose the format and download the form to your device. Make edits. Complete, modify, print, and sign the downloaded North Carolina Purchase Invoice. Each template you add to your account does not expire and is yours forever. Therefore, if you wish to download or print another version, simply go to the My documents section and click on the document you desire.

- You have access to all previously downloaded forms in the My documents section of your account.

- If you are using US Legal Forms for the first time, here are simple steps to guide you.

- Ensure you have selected the correct form for your city/state.

- Click the Review button to check the form’s details.

- Read the form description to confirm that you have chosen the right document.

- If the form does not fulfill your needs, utilize the Search bar at the top of the screen to find one that fits.

Form popularity

FAQ

Yes, if you earn income in North Carolina but live elsewhere, you need to file a nonresident return. This ensures that you report all income earned within the state, complying with tax regulations. Filing a nonresident return relates directly to your North Carolina Purchase Invoice activities. Helpful resources are available on platforms like uSlegalforms to assist you in navigating this process.

Yes, North Carolina offers direct file options for eligible taxpayers. This allows you to submit your tax return directly to the state without using a third-party service. Direct filing can simplify the management of your North Carolina Purchase Invoice and tax matters overall. You may want to check uSlegalforms for step-by-step guides on how to direct file effectively.

The NC-3 form, which summarizes all employee wage information, does not have to be filed electronically, but electronic filing is encouraged. Filing electronically can help expedite your submission and minimize mistakes. If you are managing multiple North Carolina Purchase Invoices or tax documents, consider adopting e-filing for efficiency. Platforms like uSlegalforms can facilitate this process easily.

Form D-400 is North Carolina's individual income tax return form. All residents and certain nonresidents must file this form if they earn income in the state. Filing the D-400 correctly is essential to meeting your tax obligations and processing your North Carolina Purchase Invoice. Use reliable platforms such as uSlegalforms to obtain the most recent version of the D-400 and understand the filing process.

The NC tax filing D-400 is the primary individual income tax form for residents of North Carolina. It is used to report income, claim deductions, and calculate tax owed or refunds due. Understanding the D-400 is vital for accurately processing your North Carolina Purchase Invoice and ensuring compliance. For detailed help with the D-400, you can explore resources on platforms like uSlegalforms.

In North Carolina, you can e-file various forms, including the D-400 tax return and other related documents. The e-filing option streamlines your filing experience, allowing for quicker processing times and quicker refunds. Be sure to check the specific e-file requirements for each form to ensure compliance. For broader coverage, consider using uSlegalforms to access all necessary forms for your North Carolina Purchase Invoice.

Yes, North Carolina offers an e-file form for taxpayers looking to file their tax returns online. This option provides a convenient way to submit your forms without mailing them. It helps you save time and track the status of your North Carolina Purchase Invoice easily. If you need assistance, platforms like uSlegalforms provide resources to guide you through the e-filing process.

Local procurement is often referred to as community procurement. This concept emphasizes sourcing goods and services from local vendors to support the community's economy. Engaging in local procurement can enhance your ability to issue a North Carolina Purchase Invoice and build relationships within your locality.

Procurement refers to the process of obtaining goods or services from an external source. This can involve the acquisition of supplies, materials, or contracts necessary for business operations. For vendors in North Carolina, understanding procurement is crucial when issuing a North Carolina Purchase Invoice to ensure compliance.

P&C stands for Purchases and Contracts in procurement terminology. It relates to the division responsible for overseeing the procurement process in North Carolina. Vendors must be aware of the P&C guidelines when preparing their North Carolina Purchase Invoice to align with state requirements.