North Carolina Payroll Deduction Authorization Form

Description

How to fill out Payroll Deduction Authorization Form?

Are you in a position where you need to have documentation for various corporate or particular purposes almost every day.

There are numerous official document templates accessible online, but finding ones you can rely on is not simple.

US Legal Forms provides a vast array of form templates, such as the North Carolina Payroll Deduction Authorization Form, that are crafted to meet federal and state requirements.

Select the pricing plan you need, fill in the required information to create your account, and make a purchase using your PayPal or Visa or Mastercard.

Choose a convenient document format and download your copy. Find all of the document templates you have purchased in the My documents section. You can obtain an additional copy of the North Carolina Payroll Deduction Authorization Form at any time, if needed. Just select the desired form to download or print the document template. Utilize US Legal Forms, one of the most extensive collections of official forms, to save time and avoid mistakes. This service offers professionally crafted legal document templates that you can utilize for various purposes. Create an account on US Legal Forms and begin simplifying your life.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- After that, you can download the North Carolina Payroll Deduction Authorization Form template.

- If you do not have an account and wish to start using US Legal Forms, follow these instructions.

- Find the form you need and ensure it is for the correct city/area.

- Utilize the Review button to evaluate the form.

- Read the description to make sure you have selected the correct form.

- If the form is not what you are looking for, use the Search area to find the form that matches your requirements.

- Once you find the correct form, click on Buy now.

Form popularity

FAQ

Payroll authorization refers to the process of obtaining permission from employees to deduct certain amounts from their paychecks. This could relate to tax withholdings, benefits, or other deductions. The North Carolina Payroll Deduction Authorization Form is specifically designed for this purpose, ensuring employers collect the necessary approvals consistent with state law. Clarity and communication are vital during this process.

Authorization means giving permission for something to happen. In the context of payroll, it refers to the approval needed for deductions or transactions to occur. The North Carolina Payroll Deduction Authorization Form serves as a clear means for employees to grant this permission. By understanding authorization, you ensure proper handling of payroll and deductions.

Form D-400 is the individual income tax return form used by residents of North Carolina to report their yearly income. If you complete the North Carolina Payroll Deduction Authorization Form, ensure that the withholding amounts shown on your D-400 align with your actual earnings. This form must be filed annually, and accurate information helps avoid discrepancies with tax liabilities. You can find more details on the North Carolina Department of Revenue website.

Whether to fill out NC-4 or NC-4EZ depends on your tax situation. The NC-4 is for employees with more complex withholding needs, while the NC-4EZ is suitable for employees seeking simpler deductions. Completing the North Carolina Payroll Deduction Authorization Form will help you choose the correct version. Your employer can provide guidance on which form best matches your profile.

Your employer can take a maximum of 10% of your weekly or monthly gross pay (your pay before tax and National Insurance) if you work in retail. This is to cover any mistakes or shortfalls, for example with cash or stock. This limit does not apply to your final pay if you leave your job.

The amount the employer withholds from an employee's gross pay for taxes, wage garnishment and company benefits are called payroll deductions. Some examples include 401(k) contributions, Medicare and Social Security tax, income tax and health insurance premiums.

A. No, your employer cannot legally make such a deduction from your wages if, by reason of mistake or accident a cash shortage, breakage, or loss of company property/equipment occurs.

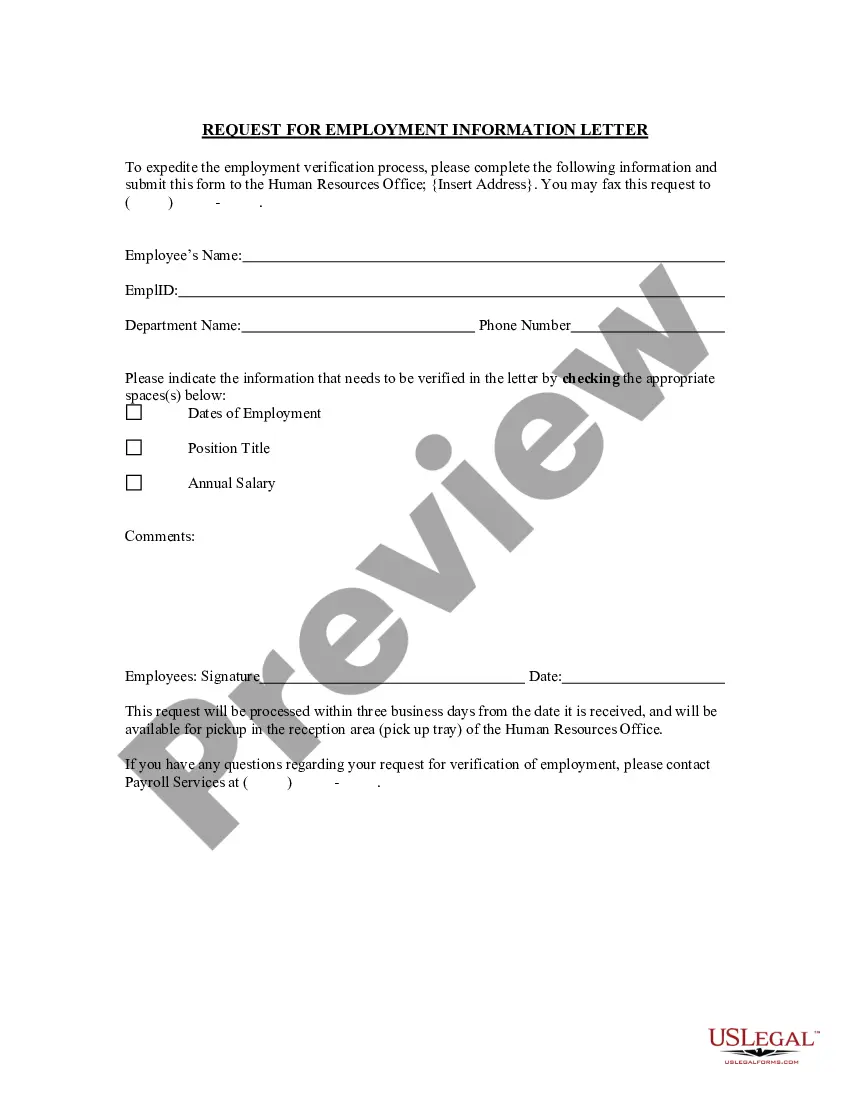

A payroll deduction authorization form is a written agreement an employee must sign if they want certain voluntary deductions taken from their paycheck. These forms should be as clear and specific as possible so employees know how much money voluntary deductions will take out of their paycheck.

No, your employer cannot legally make such a deduction from your wages if, by reason of mistake or accident a cash shortage, breakage, or loss of company property/equipment occurs.

Is it Legal to Dock Pay for Poor Performance or for Mistakes? Generally, no an employer cannot engage in docking pay or fining employees for poor performance or mistakes, shortages, or damages. However, if the employee agreed in writing that a deduction could be made, the employer may be able to do so.