North Carolina Re-Employment of Veterans

Description

How to fill out Re-Employment Of Veterans?

If you require extensive, download, or create legal document templates, utilize US Legal Forms, the largest collection of legal forms, which can be accessed online.

Take advantage of the site’s simple and user-friendly search to find the documents you need. Numerous templates for commercial and personal needs are sorted by categories and states or keywords.

Use US Legal Forms to obtain the North Carolina Re-Employment of Veterans with just a few clicks.

Every legal document template you purchase is yours indefinitely. You will have access to every form you downloaded in your account. Select the My documents section and choose a form to print or download again.

Be proactive and download and print the North Carolina Re-Employment of Veterans with US Legal Forms. There are thousands of professional and state-specific forms available for your business or personal needs.

- If you are already a US Legal Forms user, Log In to your account and click on the Download button to retrieve the North Carolina Re-Employment of Veterans.

- You can also access forms you previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have selected the form for the correct city/state.

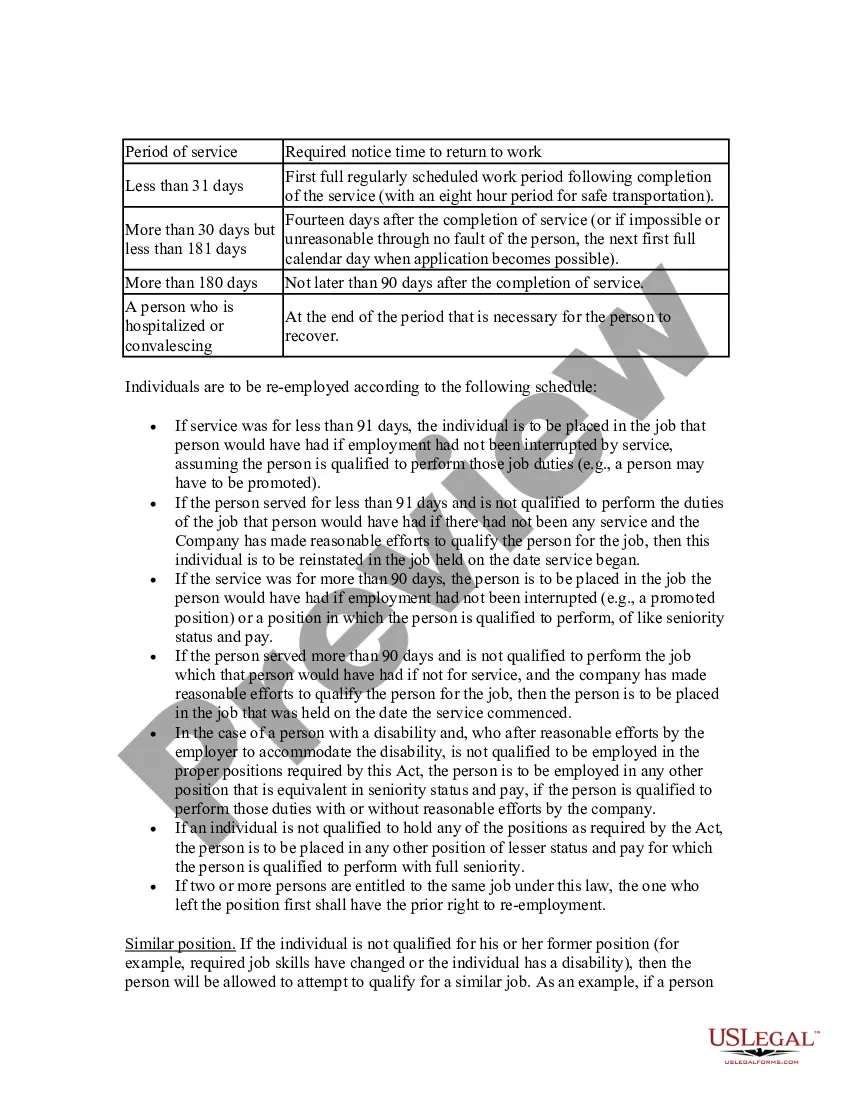

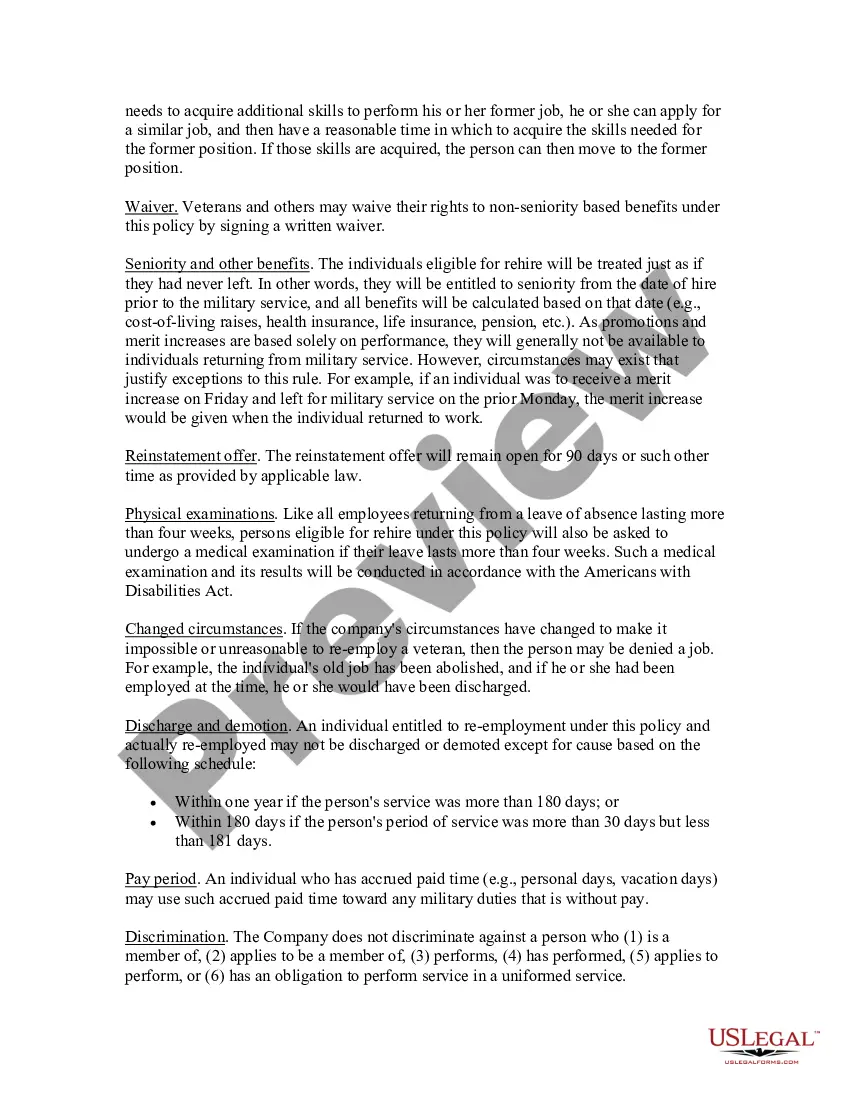

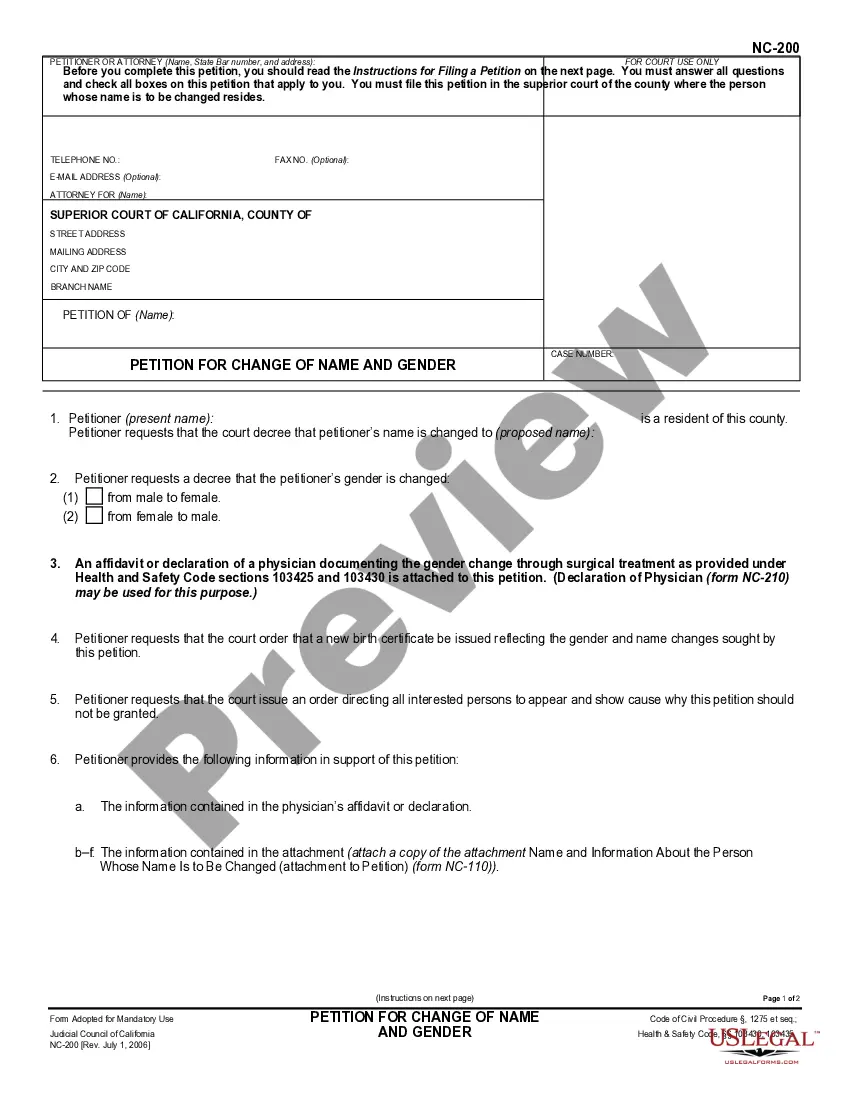

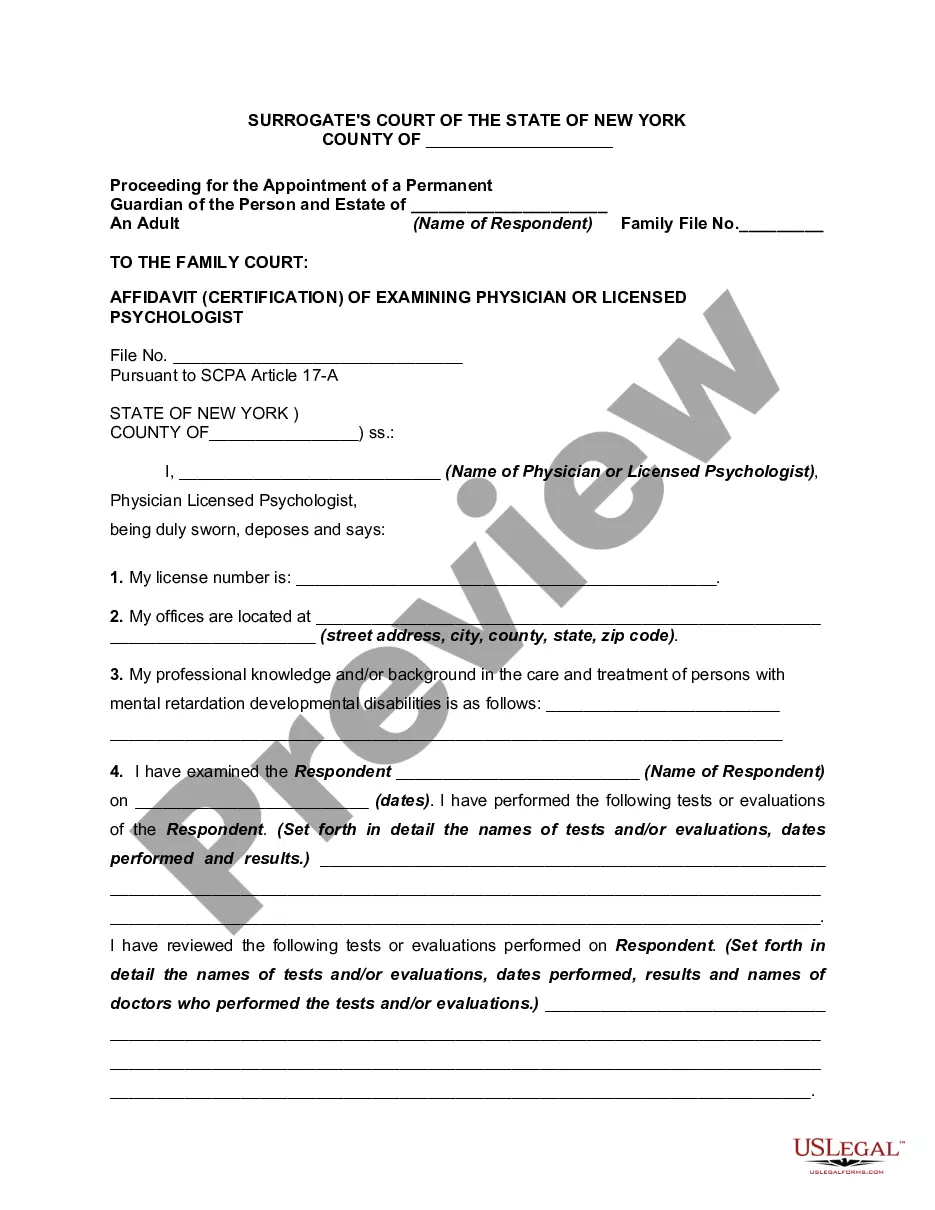

- Step 2. Use the Preview feature to review the form’s content. Don’t forget to read the description.

- Step 3. If you are not satisfied with the form, use the Search box at the top of the screen to find alternative versions of the legal form template.

- Step 4. Once you have located the form you want, click the Buy now button. Choose the payment plan you prefer and provide your information to register for an account.

- Step 5. Process the transaction. You can use your credit card or PayPal account to complete the purchase.

- Step 6. Select the format of the legal form and download it to your device.

- Step 7. Fill out, edit, and print or sign the North Carolina Re-Employment of Veterans.

Form popularity

FAQ

The Disabled Veterans Property Tax Exclusion is for veterans who have been found permanently and totally disabled by the US Department of Veterans Affairs. The exclusion applies to a residence owned and occupied by a qualified veteran. The first $45,000 of appraised value of the residence is excluded from taxation.

#1 Best State for Disabled Veterans: Texas The benefits offered to disabled veterans in Texas are simply unmatched by any other state. For example, Texas is one of just two states with full property tax exemptions for 100% scheduler or TDIU disabled veterans (in addition to veterans with a 100% P&T rating).

Shultz, a two-star general for the U.S. Army, told CBS News the transition is "pretty tough." Finding a job after their military service affects nearly 200,000 veterans every year. Only one in four U.S. veterans have a job lined up after leaving the armed forces, according to the Pew Research Center.

Veterans continue to struggle to gain employment because of culture gaps between civilian society and their military pasts, as well as a lack of seamless integration amongst Veteran care programs. Years ago companies and small businesses would give priority to veterans for work from their State's Unemployment Office.

The Disabled Veterans Property Tax Exclusion is for veterans who have been found permanently and totally disabled by the US Department of Veterans Affairs. The exclusion applies to a residence owned and occupied by a qualified veteran. The first $45,000 of appraised value of the residence is excluded from taxation.

North Carolina Veteran Financial BenefitsIncome Tax.Property Tax.Vehicle Highway Tax.State Employment Veterans Preference.North Carolina Assistive Technology Program (NCATP)Business Link North Carolina (BLNC)Hunting and Fishing Licenses.Active Duty Hunting & Fishing.

Summary of North Carolina Military and Veterans Benefits: North Carolina offers special benefits for Service members, Veterans and their Families including property tax exemptions, state employment preferences, education and tuition assistance, vehicle tags, as well as hunting and fishing license privileges.

North Carolina is the most military friendly state in the nation. Governor Cooper is proud that North Carolina has the third largest military presence in the country, as well as more than 720,000 veterans who call our state home.

Takeaway: even though more than half of veterans say they want to do something new, they are much more likely to be hired in similar industries as other veterans. Takeaway: veterans are applying to jobs in industries, like defense and space, that have better hiring rates for veterans.

North Carolina is the most military friendly state in the nation. Governor Cooper is proud that North Carolina has the third largest military presence in the country, as well as more than 720,000 veterans who call our state home.