Title: Exploring the North Carolina Resolution of Meeting of LLC Members to Borrow Capital from Designated Bank Introduction: The North Carolina Resolution of Meeting of LLC Members to Borrow Capital from a Designated Bank is an essential document that formalizes the decision-making process within a Limited Liability Company (LLC) operating in the State of North Carolina. This resolution outlines the procedures required for an LLC to obtain capital through borrowing from a designated bank. To better understand this process, we will delve into the details, types, and significance of this resolution. Keywords: North Carolina, Resolution of Meeting, LLC Members, Borrow Capital, Designated Bank 1. Purpose of the Resolution: The North Carolina Resolution of Meeting of LLC Members to Borrow Capital from Designated Bank serves as a written acknowledgment of the LLC's intention to seek additional funds through a borrowing arrangement. It outlines the decision-making process, the terms of borrowing, and the responsibilities of the LLC members involved. 2. Key Components: The resolution must include the following vital elements: — Identification of the LLC and the specific meeting during which the resolution is discussed. — Statement of the purpose for borrowing capital, such as financing expansion, acquiring assets, or developing new projects. — Designation of a specific bank or financial institution from which the LLC intends to borrow capital. — Resolution approval mechanism, including voting protocol and quorum requirements. — Terms of the proposed borrowing, including borrowing amount, interest rates, repayment period, and associated collateral. — Designation of authorized signatories who can execute relevant documents on behalf of the LLC. 3. Types of North Carolina Resolution of Meeting of LLC Members to Borrow Capital from Designated Bank: While there might not be specific types, variations of this resolution can arise based on the unique requirements and circumstances of each LLC. These may include: — Short-term borrowing resolutionForcesCs seeking temporary capital injections to address immediate financing needs. — Long-term borrowing resolutionForcesCs planning large-scale investments or projects that require substantial capital over an extended period. — Line of credit borrowing resolution: For LCS in need of a pre-approved credit line from which they can borrow as necessary, ensuring financial flexibility. 4. Significance and Legal Implications: Adhering to the North Carolina Resolution of Meeting of LLC Members to Borrow Capital from Designated Bank is crucial for several reasons: — Protects the interests of LLC members by ensuring a transparent and accountable process for borrowing capital. — Legally binding document that solidifies the LLC's intent to borrow and binds members in fulfilling their obligations related to the borrowing. — Promotes responsible financial management, as members must evaluate the potential risks and benefits associated with borrowing funds. — Facilitates communication and alignment among LLC members, ensuring everyone is aware of the borrowing decision. Conclusion: The North Carolina Resolution of Meeting of LLC Members to Borrow Capital from Designated Bank plays a fundamental role in formalizing the borrowing process for LCS operating in North Carolina. By adhering to this resolution, LLC members can streamline decision-making, protect their rights, and ensure responsible financial management within the organization. Implementing this resolution correctly is crucial to maintain the legal and financial integrity of the LLC.

North Carolina Resolution of Meeting of LLC Members to Borrow Capital from Designated Bank

Description

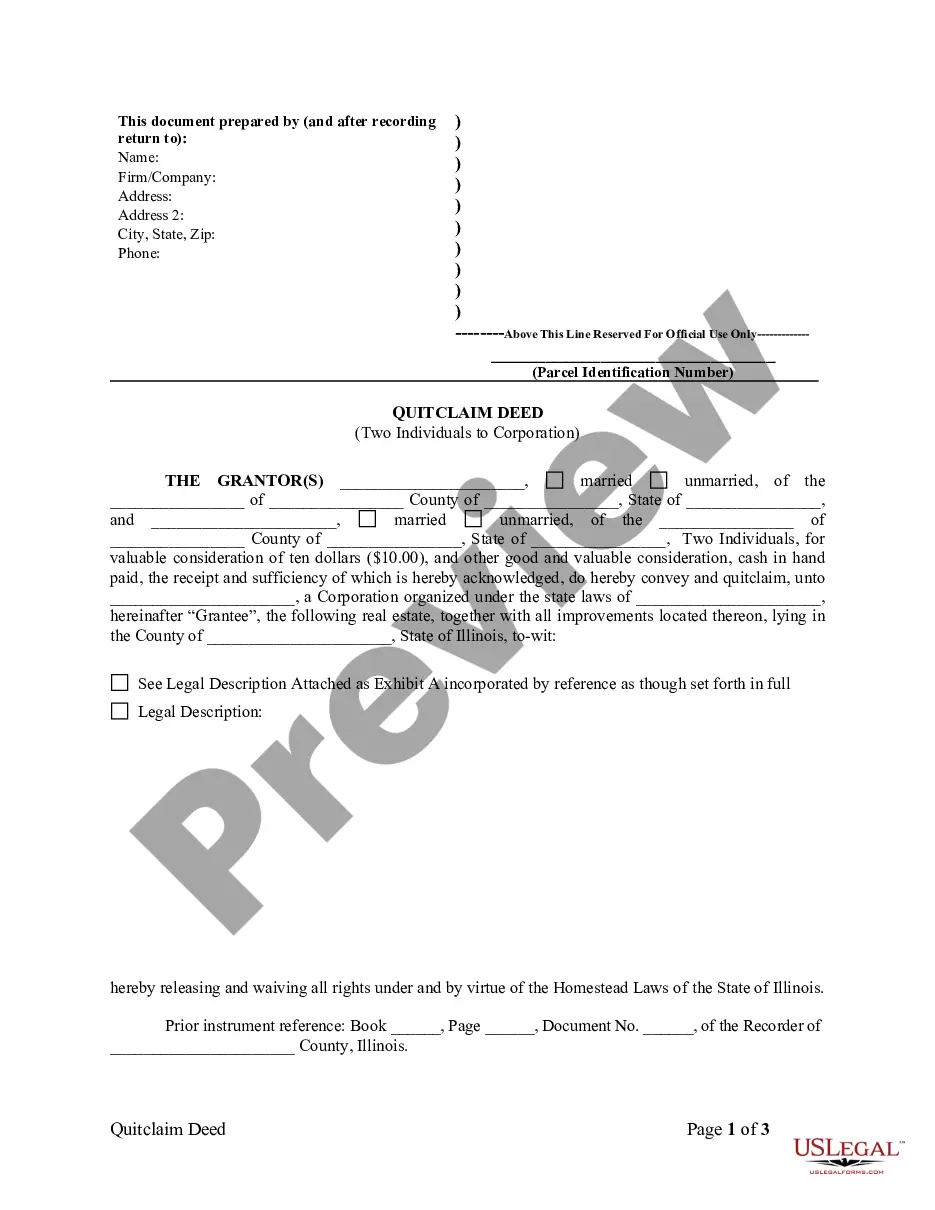

How to fill out North Carolina Resolution Of Meeting Of LLC Members To Borrow Capital From Designated Bank?

Are you currently within a place that you will need papers for possibly company or individual purposes just about every day? There are plenty of lawful record layouts available online, but discovering kinds you can depend on isn`t simple. US Legal Forms offers a huge number of form layouts, much like the North Carolina Resolution of Meeting of LLC Members to Borrow Capital from Designated Bank, which are published to satisfy state and federal requirements.

When you are currently familiar with US Legal Forms site and also have a merchant account, simply log in. Afterward, you are able to acquire the North Carolina Resolution of Meeting of LLC Members to Borrow Capital from Designated Bank template.

If you do not provide an bank account and want to start using US Legal Forms, follow these steps:

- Find the form you need and make sure it is for that right metropolis/county.

- Take advantage of the Preview switch to check the shape.

- See the explanation to ensure that you have chosen the correct form.

- If the form isn`t what you`re looking for, utilize the Look for industry to discover the form that suits you and requirements.

- If you discover the right form, click Get now.

- Pick the prices program you would like, fill out the specified information to generate your money, and purchase the order with your PayPal or Visa or Mastercard.

- Choose a convenient document structure and acquire your version.

Discover all the record layouts you might have purchased in the My Forms menu. You may get a more version of North Carolina Resolution of Meeting of LLC Members to Borrow Capital from Designated Bank any time, if necessary. Just select the necessary form to acquire or printing the record template.

Use US Legal Forms, by far the most comprehensive selection of lawful kinds, to save some time and steer clear of errors. The support offers professionally created lawful record layouts that you can use for a range of purposes. Generate a merchant account on US Legal Forms and commence generating your life easier.

Form popularity

FAQ

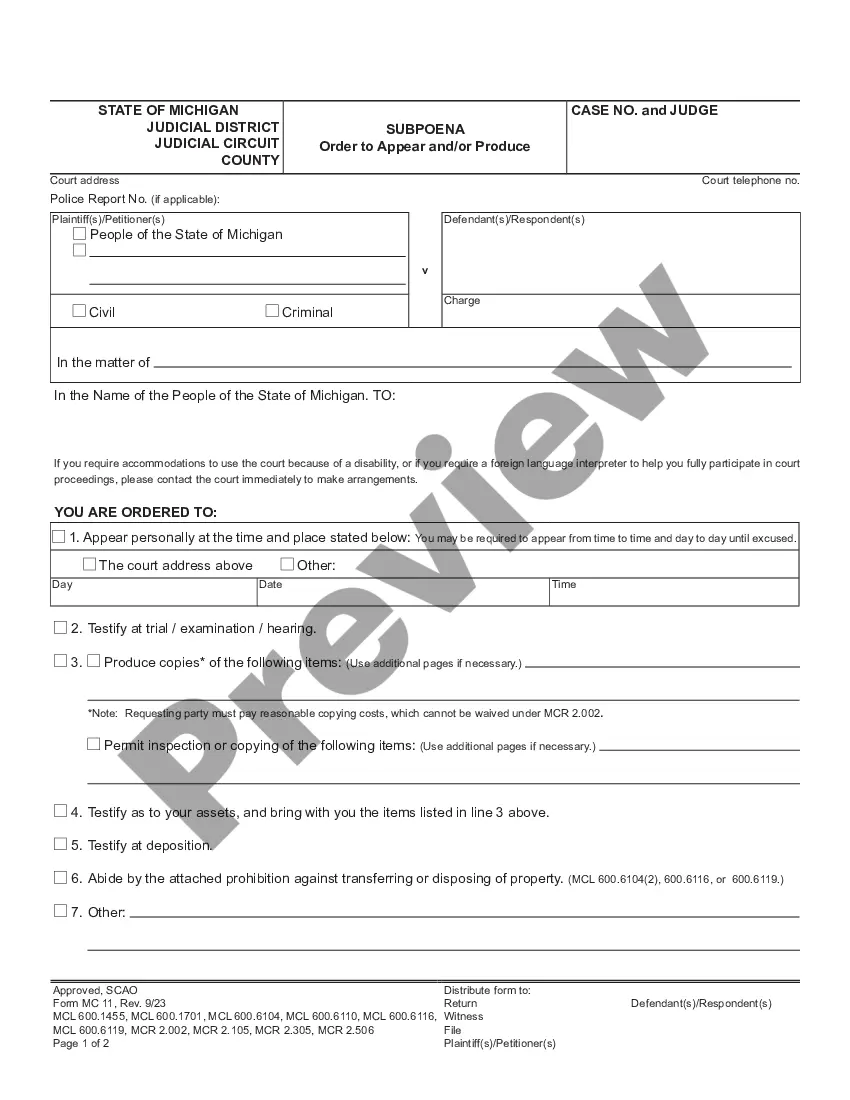

The banking resolution document is drafted and adopted by a company's members or Board of Directors to define the relationship, responsibilities and privileges that the members or directors maintain with respect to the company's banking needs.

When you create a resolution to authorize borrowing on a line of credit, you need to include the following information:The legal name of the corporation.The name of the bank where the corporation is authorized to borrow from.Maximum loan amount that may be borrowed from the bank.Interest rate (numerical)More items...

A board resolution template is a manner of documenting decisions made by the company's Shareholders or Board of Directors. The decision can cover anything relevant to the affairs of the organization like a decision extending loans to other companies or when voting for a new member to join the board.

A corporate resolution is a document that formally records the important binding decisions into which a company enters. These decisions are made by such stakeholders as the corporation's managers, directors, officers or owners.

The only way a member of an LLC may be removed is by submitting a written notice of withdrawal unless the articles of organization or the operating agreement for the LLC in question details a procedure for members to vote out others.

RESOLVED THAT the company do hereby obtain and avail financial assistance/Credit facility of an amount not exceeding (Loan or Credit/Overdraft amount) from (Name, Branch and Address of the bank) in order to meet the (requirements of the company), and such loan shall be obtained on such terms and conditions as specified

Loan Resolution means that certain Resolution adopted by the Board of the City on November 13, 2017, authorizing a loan under a loan agreement between the Borrower and the Issuer to finance the Project.

Follow these steps for a smooth process when you add an owner to an LLC.Understand the Consequences.Review Your Operating Agreement.Decide on the Specifics.Prepare and Vote on an Amendment to Add Owner to LLC.Amend the Articles of Organization (if Necessary)File any Required Tax Forms.

Letter of Resolution means a letter advising the party accused, and any person who, in writing informed or complained to the Executive Director concerning any such violation, that the alleged violation has been resolved and the manner by which it was resolved.

It is a legal document adopted by a corporation's board of directors containing information about the parties who may sign checks and borrow money from financial institutions. Borrowing resolutions are more commonly known as corporate resolutions.