North Carolina Exempt Survey

Description

How to fill out Exempt Survey?

You may spend hours online searching for the proper legal document format that meets the state and federal requirements you need.

US Legal Forms provides a wide range of legal templates that are examined by experts.

You can easily obtain or print the North Carolina Exempt Survey from the service.

To find another version of the form, utilize the Research section to locate the format that fulfills your requirements.

- If you already possess a US Legal Forms account, you can Log In and click the Obtain button.

- After that, you can complete, modify, print, or sign the North Carolina Exempt Survey.

- Every legal document format you download is yours forever.

- To acquire another copy of the downloaded form, navigate to the My documents tab and click the appropriate button.

- If you are using the US Legal Forms site for the first time, follow the simple steps below.

- First, make sure you have selected the correct document format for the area/city of your choice. Check the form description to ensure you have chosen the appropriate form.

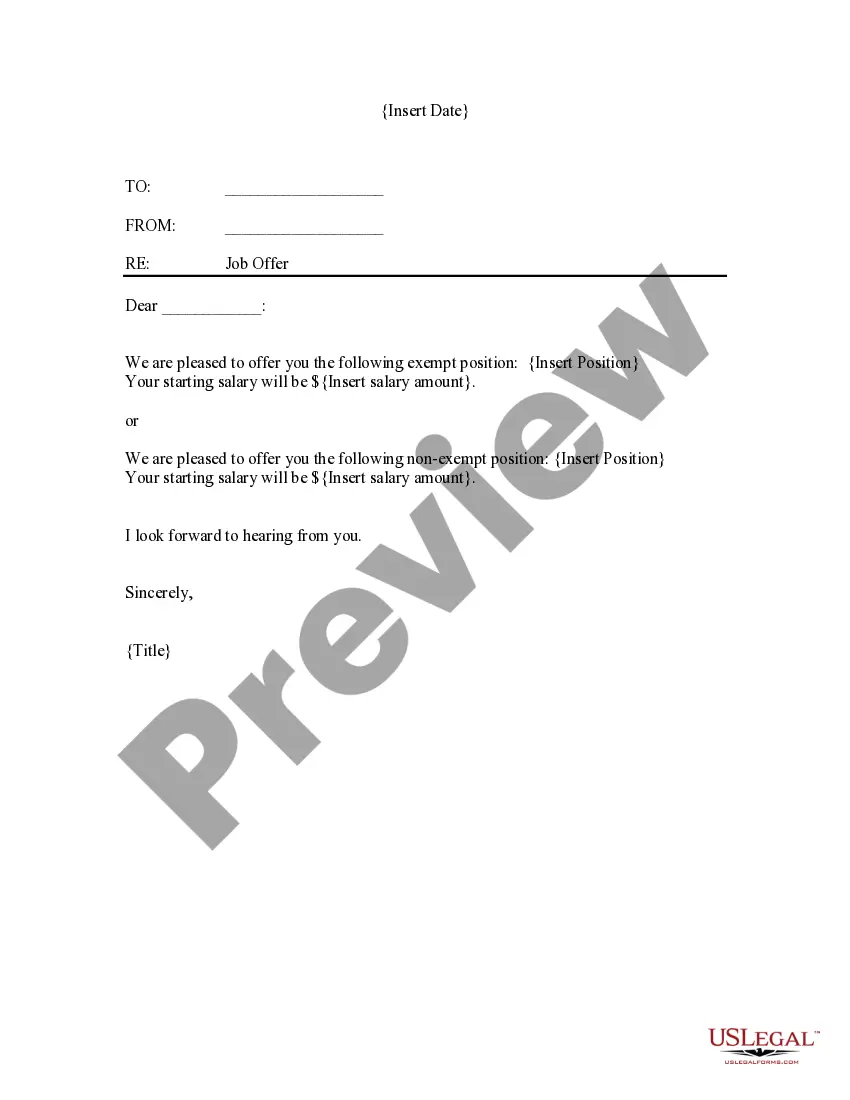

- If available, use the Review button to preview the document format as well.

Form popularity

FAQ

You can do this by submitting a letter requesting non-profit status. This letter must include your NC non-profit's EIN, the organization's name, as well as a description of the non-profit's activities. You will also need to submit Form E-585.

If you resided in the state for more than 183 days in the state during the tax year, you will be considered a resident. A Nonresident of North Carolina is an individual that was not domiciled nor maintained a permanent place of abode in North Carolina during the tax year.

How to fill out the North Carolina Certificate of ExemptionStep 1 Begin by downloading the North Carolina Certificate of Exemption Form E-595E.Step 2 Indicate whether the Multistate Supplemental form is being attached.Step 3 Check whether the certificate is for a single purchase.More items...?

Contact the Taxpayer Assistance and Collection Center at 1-877-252-3052 (toll-free) or fax your request to (919) 715-2999. Include in the request, your name or company name, address, telephone number, and exemption number.

You can do this by submitting a letter requesting non-profit status. This letter must include your NC non-profit's EIN, the organization's name, as well as a description of the non-profit's activities. You will also need to submit Form E-585.

Your sales and use tax account ID number is the 9-digit number issued to you by the Department of Revenue at the time of registration. You can find your sales and use tax account ID number on your registration certificate or coupon booklet.

In North Carolina, the law requires you to file a tax return if you are making money from a job or property in North Carolina, no matter where you happen to live.

Typically, though, you can be exempt from withholding tax only if two things are true:You got a refund of all your federal income tax withheld last year because you had no tax liability.You expect the same thing to happen this year.

A13. North Carolina law requires income tax to be withheld from all wages; however, the law does allow an exemption from withholding if certain conditions are met. Because your circumstances may change from year to year, an exempt status is good for only one year at a time.