North Carolina Guardianship Expenditures refer to the various costs associated with the guardianship process in the state of North Carolina. When an individual is deemed legally incapacitated and unable to make decisions for themselves, a guardian may be appointed to make decisions on their behalf regarding medical, financial, and personal matters. Guardianship expenditures in North Carolina can include: 1. Legal Fees: The initial process of filing for guardianship involves legal fees for preparing and submitting the necessary documents. This may include attorney consultation fees, court filing fees, and other related costs. 2. Attorney Fees: Once a guardian is appointed, ongoing legal services may be required to ensure compliance with legal obligations, preparing financial reports, or responding to legal challenges. These services may incur additional attorney fees. 3. Assessment Costs: In order to establish the need for guardianship, a comprehensive assessment of the individual's capacity may be required. Costs associated with hiring professionals such as doctors, psychologists, or social workers to conduct assessments may be included in guardianship expenditures. 4. Guardian Training: North Carolina requires guardians to complete a training program to understand their legal responsibilities and obligations. The costs associated with attending these training programs, which may include registration fees, materials, and travel expenses, can be considered as guardianship expenditures. 5. Fiduciary Fees: In some cases, a guardian may hire a professional fiduciary to manage the ward's finances. These fiduciary services come with associated costs like management fees, accounting fees, and financial planning fees. 6. Caregiver Expenses: If the incapacitated individual requires residential care or assistance, the costs associated with caregiving services are considered guardianship expenditures. This includes fees for in-home caregivers, assisted living facilities, nursing homes, or other necessary living arrangements. 7. Miscellaneous Costs: Various smaller expenses might arise during the guardianship process, such as postage fees, copy fees, transportation expenses, or document notarization fees. These additional costs can also be included in the overall guardianship expenditures. It is important to note that the specific expenditures may vary depending on the circumstances and the complexity of the guardianship situation. Guardianship expenditures are typically paid from the ward's estate or their income if deemed appropriate by the court. The guardian is responsible for ensuring that these expenditures are reasonable, necessary, and in the best interest of the ward.

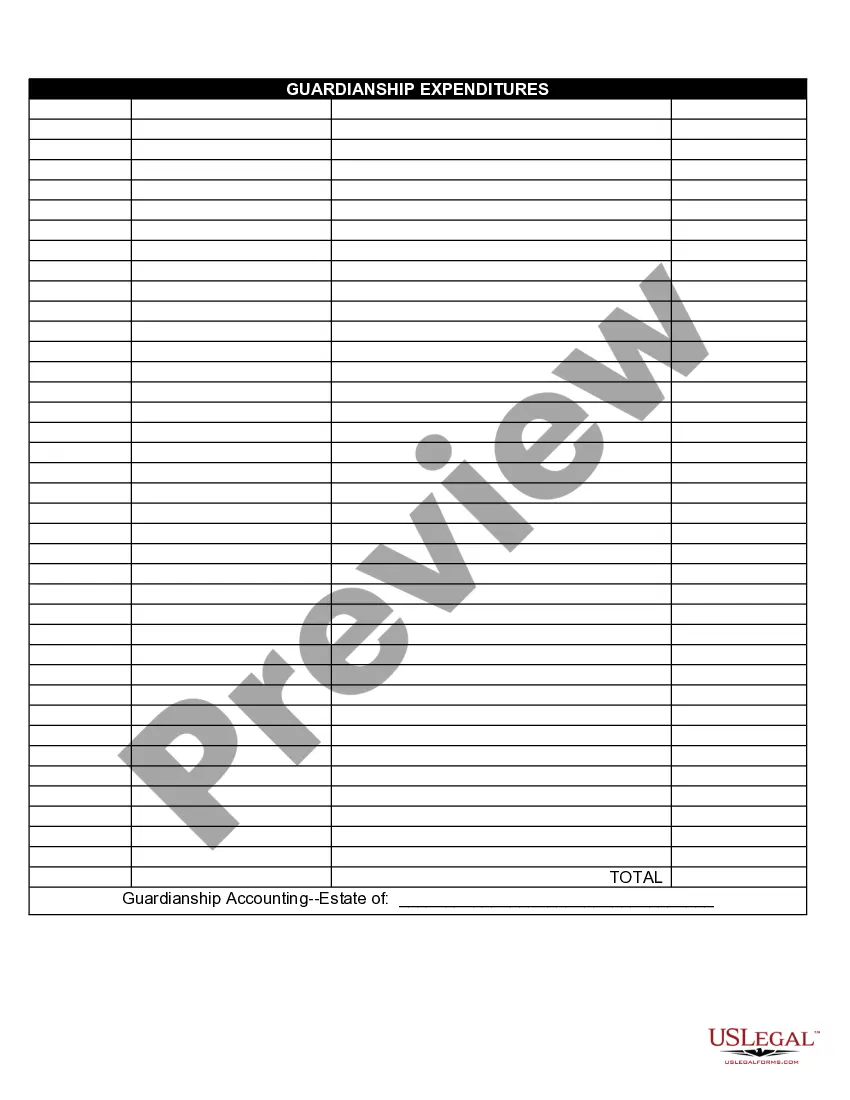

North Carolina Guardianship Expenditures

Description

How to fill out North Carolina Guardianship Expenditures?

It is possible to spend several hours online searching for the legitimate document template that suits the federal and state needs you need. US Legal Forms supplies 1000s of legitimate varieties which can be examined by pros. You can actually download or produce the North Carolina Guardianship Expenditures from our services.

If you already have a US Legal Forms bank account, it is possible to log in and click on the Obtain key. After that, it is possible to total, change, produce, or indicator the North Carolina Guardianship Expenditures. Each legitimate document template you get is yours for a long time. To obtain an additional copy associated with a purchased type, go to the My Forms tab and click on the related key.

If you are using the US Legal Forms web site initially, stick to the basic instructions under:

- First, ensure that you have selected the proper document template for the state/town of your choice. See the type outline to make sure you have picked out the appropriate type. If offered, use the Review key to appear with the document template at the same time.

- If you would like discover an additional variation of your type, use the Look for area to obtain the template that meets your needs and needs.

- Upon having identified the template you desire, just click Buy now to continue.

- Find the pricing prepare you desire, key in your qualifications, and register for a merchant account on US Legal Forms.

- Full the financial transaction. You can use your Visa or Mastercard or PayPal bank account to pay for the legitimate type.

- Find the file format of your document and download it to the gadget.

- Make alterations to the document if required. It is possible to total, change and indicator and produce North Carolina Guardianship Expenditures.

Obtain and produce 1000s of document layouts making use of the US Legal Forms Internet site, which offers the greatest assortment of legitimate varieties. Use professional and state-certain layouts to deal with your organization or personal requirements.

Form popularity

FAQ

There is a $120 filing fee, as well as a $30 fee for the sheriff to serve the respondent with the petition. The clerk of superior court determines who is responsible for payment of fees and costs. The filing fee and sheriff's service of process fee may be required at the time of filing.

Custody describes a biological parent caring for a child, but guardianship is given to someone other than a biological parent. In some cases, a child may even be under the guardianship of one person while in custody of a parent. Guardianship of a Minor in North Carolina - Breeden Law Office breedenfirm.com ? guardianship-for-children breedenfirm.com ? guardianship-for-children

To obtain guardianship, you must apply to the Clerk of Superior Court in the county where the child lives. The application form, provided by the clerk's office, requires a preliminary inventory of the ward's assets and liabilities.

Guardianship Salary in North Carolina. $97,700 is the 25th percentile. Salaries below this are outliers. $172,700 is the 75th percentile.

In its simplest terms, guardianship in North Carolina is defined by the North Carolina Judicial Branch as ?a legal relationship in which a person is appointed by the court to make decisions and act on behalf of a person who does not have adequate capacity to make such decisions involving the management of personal ...

You must file a complete petition for guardianship with the Clerk of the Superior Court. Immediately following filing this petition, you must properly serve the allegedly incompetent adult, otherwise known as the respondent. You may also need to serve the respondent's closest family members.

The essential difference between guardianship and power of attorney is one of choice. With a power of attorney, you work with your attorney before you need help to choose your caregiver and make a plan. With guardianship, a court order by a judge determines your future care choices. What is the Difference Between Guardianship and Power of Attorney? hoplerwilms.com ? blog ? 2021/07/02 ? what-is-t... hoplerwilms.com ? blog ? 2021/07/02 ? what-is-t...

Guardianship Salary in North Carolina Annual SalaryMonthly PayTop Earners$173,126$14,42775th Percentile$172,700$14,391Average$134,758$11,22925th Percentile$97,700$8,141

5) How long does guardianship last? The individual under guardianship remains under guardianship until their competency is restored through court proceedings, or until they die. Frequently Asked Questions (FAQs) about North Carolina Guardianship ... rethinkingguardianshipnc.org ? sites ? 2021/06 rethinkingguardianshipnc.org ? sites ? 2021/06