North Carolina Wage Withholding Authorization

Description

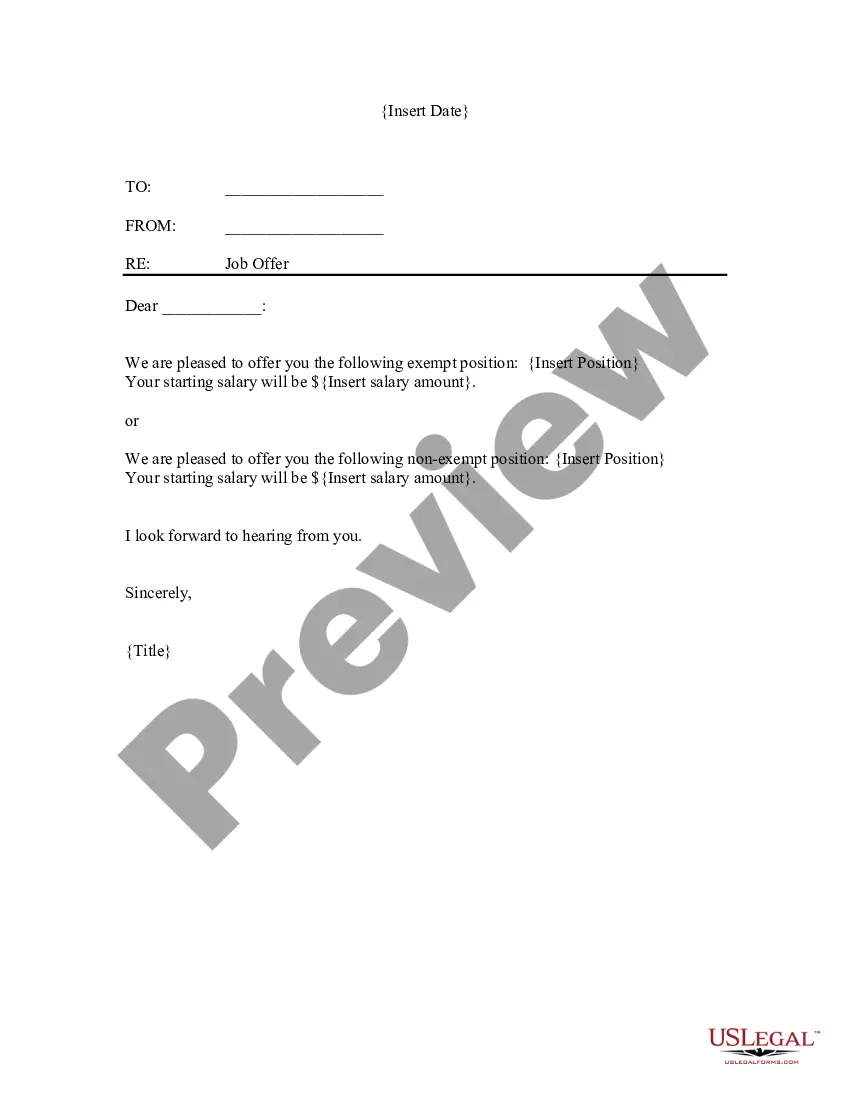

How to fill out Wage Withholding Authorization?

US Legal Forms - one of the largest collections of authentic templates in the USA - provides a broad selection of legitimate document formats you can purchase or create.

Through the website, you can access numerous forms for business and personal use, organized by categories, states, or keywords. You can obtain the latest versions of forms like the North Carolina Wage Withholding Authorization in minutes.

If you already hold a subscription, Log In and retrieve the North Carolina Wage Withholding Authorization from your US Legal Forms library. The Download button will appear on every form you view. You can find all previously downloaded forms in the My documents section of your account.

Complete the payment process. Use a credit card, debit card, or PayPal account to finalize the transaction.

Choose the format and download the form to your device. Make modifications. Fill out, edit, and print the downloaded North Carolina Wage Withholding Authorization. Each template added to your account has no expiration date and is yours indefinitely. Therefore, to download or print another copy, simply go to the My documents section and click on the form you require.

- Ensure you have selected the correct form for your city/state.

- Click on the Preview button to review the content of the form.

- Examine the form summary to confirm you have chosen the correct one.

- If the form does not meet your needs, use the Search field at the top of the page to find one that does.

- If satisfied with the form, confirm your choice by clicking the Buy Now button.

- Next, select the payment option you prefer and provide your information to register for an account.

Form popularity

FAQ

To be exempt from withholding, both of the following must be true: You owed no federal income tax in the prior tax year, and. You expect to owe no federal income tax in the current tax year.

You are entitled to be paid your wages for the hours you worked up to the date you leave your job. Generally it is unlawful to withhold pay from workers who do not work their full notice unless your employment contract allows the employer to make deductions from pay.

Some of the types of deductions which are authorized under federal and state law include: meals, housing and transportation, debts owed the employer, debts owed to third parties (through the process of garnishment); debts owed to the government (such as back taxes and federally-subsidized student loans), child support

The income earned for services performed in North Carolina by the spouse of a servicemember who is legally domiciled in a state other than North Carolina is exempt from North Carolina income tax if (1) the servicemember is present in North Carolina solely in compliance with military orders; (2) the spouse is in North

A payroll deduction authorization form is a written agreement an employee must sign if they want certain voluntary deductions taken from their paycheck. These forms should be as clear and specific as possible so employees know how much money voluntary deductions will take out of their paycheck.

What Is a Wage Deduction Authorization Agreement? A wage deduction authorization agreement is a legal document that permits youthe employerto deduct the agreed-upon amount from an employee's salary. The reasons for the salary reduction vary.

In general, an employer is not permitted to deduct from an employee's wages unless the deduction is authorized by law, such as with court-ordered child support or state or federal taxes. However, if an employee agrees in writing to have wages deducted for a lawful purpose, then deductions are permitted.

So can an employer withhold pay? The answer is yes, but only under certain circumstances. If the employee has breached their employment contract, the employer is legally allowed to withhold payment. This includes going on strike, choosing to work to rule, or deducting overpayment.

If you earn less than the income tax thresholds laid out by the IRS, you do not owe any tax. If you do not owe any tax, your employer should not withhold money from your paycheck to pay the IRS on your behalf. You can stop this withholding by filing for an exemption from withholding on your W-4.

Mandatory deductions: Federal and state income tax, FICA taxes, and wage garnishments. Post-tax deductions: Garnishments, Roth IRA retirement plans and charitable donations. Voluntary deductions: Life insurance, job-related expenses and retirement plans.