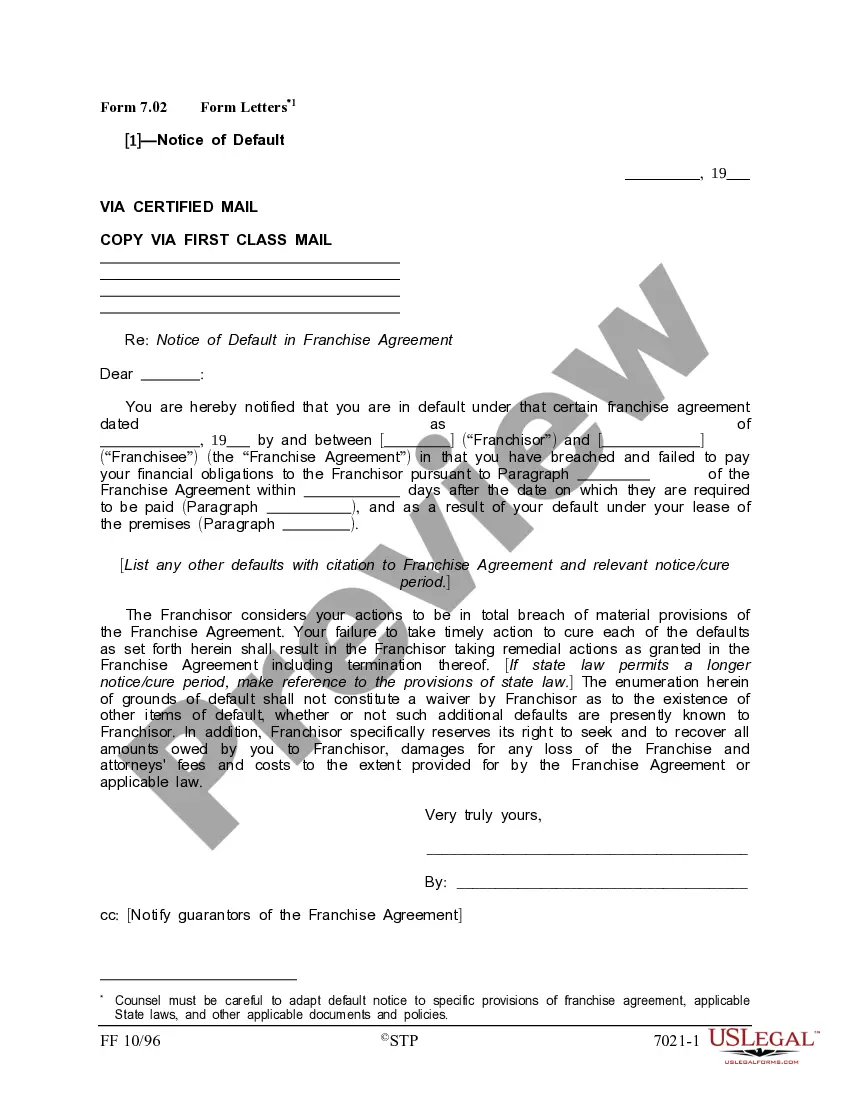

North Carolina Form Letters — Notice of Default: A Comprehensive Overview In the realm of debt collection and foreclosure proceedings, the North Carolina Form Letters — Notice of Default serve as crucial legal documents. These letters are designed to officially notify the borrower of their default status, alerting them to the potential consequences if the situation remains unresolved. By law, these notices must adhere to specific guidelines, ensuring fairness and clarity in the communication process. Key Features and Components: 1. Purpose: The primary objective of the North Carolina Form Letters — Notice of Default is to inform the borrower that they have failed to meet their loan repayment obligations. It acts as an initial step before initiating formal foreclosure proceedings. 2. Legal Requirement: In North Carolina, lenders are obligated by law to issue a Notice of Default to the borrower after a specific period of missed payments, typically varying from 15 to 45 days. This notice serves as a formal declaration of the default status. 3. Content: The Notice of Default must contain precise information to accurately convey the borrower's standing. Key elements commonly included are: borrower's name and contact details, loan information, specific default amount, the due date of the outstanding balance, and a deadline by which the borrower must rectify the default. 4. Consequences: The Notice of Default provides a clear overview of the potential consequences if the borrower fails to address the default situation promptly. These consequences often include initiating foreclosure proceedings, reporting the default to credit agencies, and potential legal action. Types of North Carolina Form Letters — Notice of Default: 1. Pre-Foreclosure Notice of Default: This is the initial notice sent to the borrower, notifying them of their default status before any foreclosure proceedings officially begin. It provides an opportunity for the borrower to rectify the situation and bring the loan current. 2. Acceleration Notice of Default: If the borrower fails to respond or rectify the default situation within the given timeframe, the lender may send an Acceleration Notice of Default. This notice informs the borrower that the entire loan amount is now due, accelerating the foreclosure process. 3. Notice of Default Cure Period Extension: In some cases, borrowers may initiate communication with the lender, requesting an extension to cure the default. If the lender grants this request, they may issue a Notice of Default Cure Period Extension, allowing the borrower more time to rectify the default situation. In conclusion, the North Carolina Form Letters — Notice of Default play a vital role in the foreclosure process, ensuring proper communication between lenders and borrowers. These letters prioritize legal compliance and provide borrowers with an opportunity to rectify their default status before facing severe consequences. Lenders must carefully draft these letters to meet the specific requirements outlined by North Carolina's legal framework surrounding debt collection and foreclosure procedures.

North Carolina Form Letters - Notice of Default

Description

How to fill out North Carolina Form Letters - Notice Of Default?

Have you been in the situation that you need to have files for both enterprise or individual functions virtually every time? There are a variety of lawful document layouts available online, but finding types you can rely is not easy. US Legal Forms offers a huge number of kind layouts, like the North Carolina Form Letters - Notice of Default, which are written to fulfill federal and state requirements.

If you are already familiar with US Legal Forms site and also have an account, just log in. Next, it is possible to acquire the North Carolina Form Letters - Notice of Default design.

If you do not provide an profile and wish to begin using US Legal Forms, abide by these steps:

- Get the kind you require and make sure it is for your appropriate town/state.

- Use the Review key to review the shape.

- Look at the information to ensure that you have selected the right kind.

- When the kind is not what you are seeking, use the Search area to find the kind that suits you and requirements.

- Once you get the appropriate kind, click Purchase now.

- Choose the pricing plan you would like, complete the desired information and facts to produce your money, and pay money for your order making use of your PayPal or charge card.

- Decide on a convenient document structure and acquire your copy.

Locate all of the document layouts you possess bought in the My Forms menu. You can aquire a further copy of North Carolina Form Letters - Notice of Default at any time, if needed. Just click on the needed kind to acquire or print out the document design.

Use US Legal Forms, the most extensive assortment of lawful types, to save lots of some time and prevent mistakes. The service offers skillfully created lawful document layouts that can be used for a variety of functions. Make an account on US Legal Forms and commence creating your lifestyle easier.