North Carolina Memo - Using Self-Employed Independent Contractors

Description

How to fill out Memo - Using Self-Employed Independent Contractors?

You can take hours online seeking the legal document template that meets the state and federal requirements you require.

US Legal Forms provides thousands of legal templates that are evaluated by professionals.

You can easily obtain or generate the North Carolina Memo - Utilizing Self-Employed Independent Contractors from my offerings.

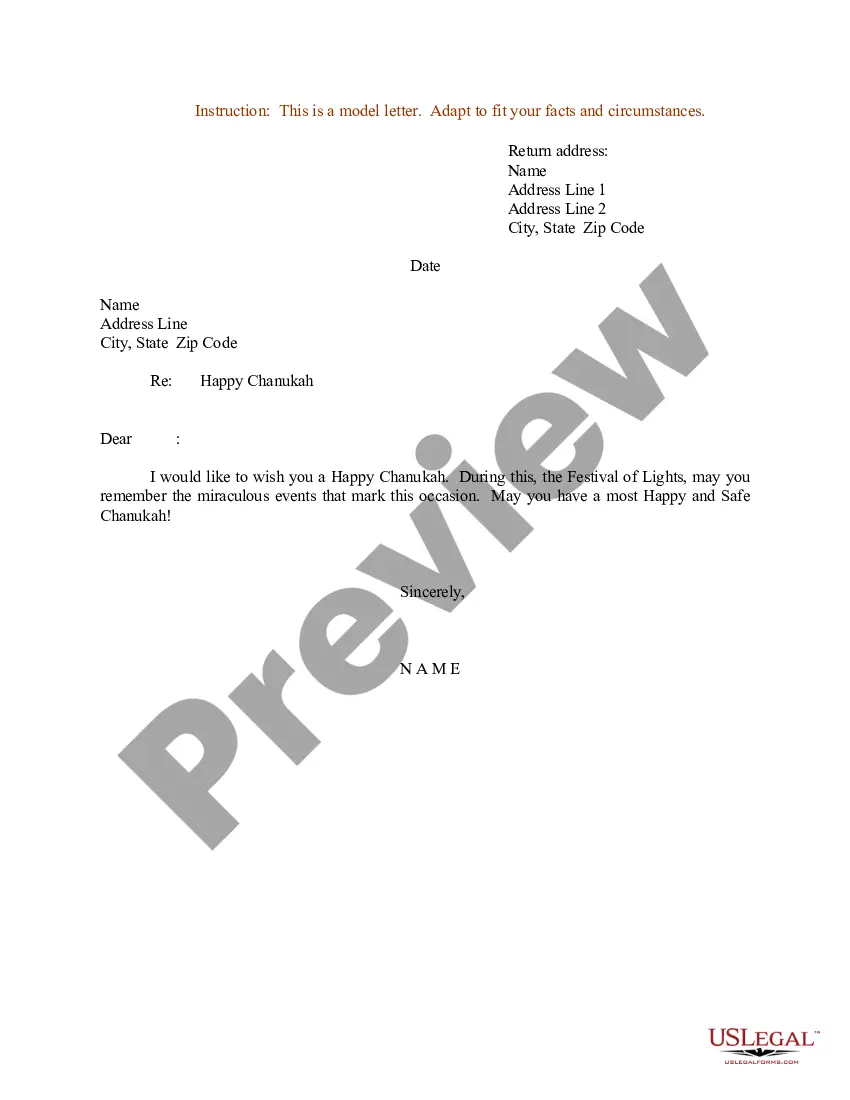

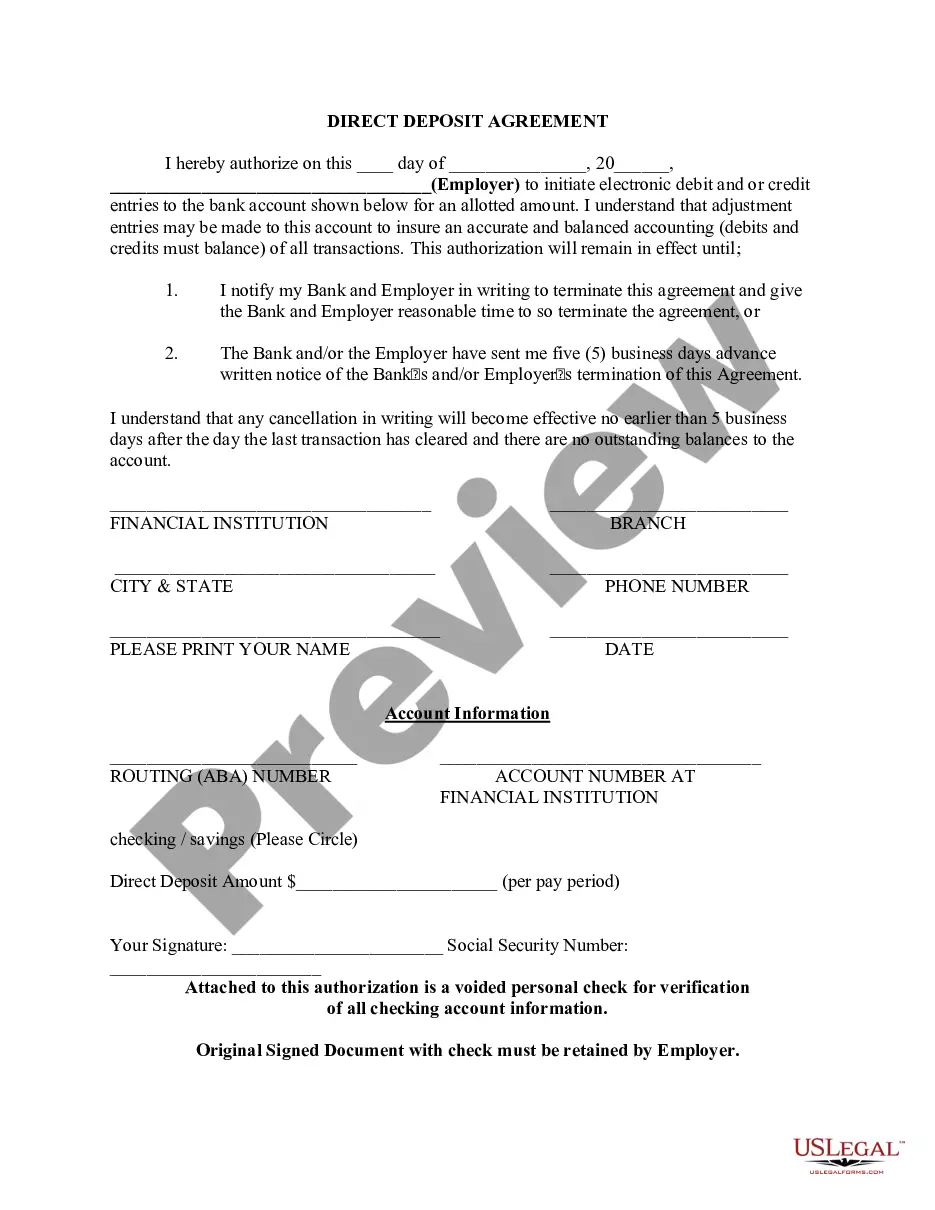

First, ensure that you have selected the correct document template for the region/area you choose. Check the form description to confirm you have chosen the right form. If available, use the Preview button to view the document template as well.

- If you have a US Legal Forms account, you can sign in and click on the Download button.

- Then, you can fill out, modify, generate, or sign the North Carolina Memo - Utilizing Self-Employed Independent Contractors.

- Every legal document template you acquire is yours indefinitely.

- To obtain another copy of any purchased form, go to the My documents section and click on the corresponding button.

- If this is your first time using the US Legal Forms website, follow the simple instructions below.

Form popularity

FAQ

Proving self-employment in North Carolina can involve various documents. Common proof includes tax returns, bank statements reflecting business income, and contracts with clients. Many individuals also use a business license or employer identification number (EIN) as valid evidence of self-employment. Keeping organized records is crucial for establishing your status as a self-employed independent contractor.

To set yourself up as a self-employed taxpayer with the IRS, you simply start paying estimated taxes (on Form 1040-ES, Estimated Tax for Individuals) and file Schedule C, Profit or Loss From Business, and Schedule SE, Self-Employment Tax, with your Form 1040 tax return each April.

If you are an independent contractor, then you are self-employed. The earnings of a person who is working as an independent contractor are subject to self-employment tax.

How do I create an Independent Contractor Agreement?State the location.Describe the type of service required.Provide the contractor's and client's details.Outline compensation details.State the agreement's terms.Include any additional clauses.State the signing details.14-Feb-2022

The difference between the two designations is how they earn income: Independent contractors do specific tasks for clients for a set fee. Sole proprietors may do contract work, but may also have other revenue streams, like selling their own products to customers.

During President Donald Trump's administration, the DOL issued a final rule clarifying when workers are independent contractors versus employees. The rule applied an economic-reality test that primarily considers whether the worker operates his or her own business or is economically dependent on the hiring entity.

Simply put, being an independent contractor is one way to be self-employed. Being self-employed means that you earn money but don't work as an employee for someone else.

The difference between the two designations is how they earn income: Independent contractors do specific tasks for clients for a set fee. Sole proprietors may do contract work, but may also have other revenue streams, like selling their own products to customers.

' All sole proprietors are, by definition, self-employed. But not all self-employed persons are sole proprietors.

Independent contractors are self-employed workers who provide services for an organisation under a contract for services. Independent contractors are not employees and are typically highly skilled, providing their clients with specialist skills or additional capacity on an as needed basis.