A North Carolina Employee Notice to Correct IRA Compliance is a formal written communication provided by an employer to an employee informing them of a violation or potential violation of employment eligibility verification requirements as per the Immigration Reform and Control Act (IRA). This notice serves as a means to address and rectify any noncompliance issues promptly while ensuring legal compliance within the state of North Carolina. Keywords: North Carolina, Employee Notice, Correct, IRA Compliance, Immigration Reform and Control Act, employment eligibility verification, violation, noncompliance, legal compliance. Types of North Carolina Employee Notice to Correct IRA Compliance: 1. Initial Notice: This is the first notice given to an employee suspected of noncompliance with IRA requirements. It outlines the specific violation or issue and provides the employee with an opportunity to correct the problem within a certain timeframe. 2. Follow-up Notice: If an employee fails to correct the noncompliance issue within the given timeframe or engages in repeated violations, a follow-up notice may be issued. It reiterates the original violation, highlights the employee's failure to comply, and may outline potential consequences or further actions if the issue remains unresolved. 3. Final Notice: If the employee fails to correct the noncompliance issue after receiving the initial and follow-up notices, a final notice may be issued. This notice outlines the severity of the violation, the potential consequences, which may include termination or legal actions, and emphasizes the urgency and importance of immediate corrective action. 4. Compliance Acknowledgement Notice: In some cases, an employer may issue a notice to an employee to confirm and document that the employee has taken appropriate steps to correct the IRA compliance issue. This notice serves as proof that the employee has rectified the noncompliance problem and is in good standing with the employer. Note: The specific names or types of North Carolina Employee Notice to Correct IRA Compliance may vary based on individual company policies, industry regulations, or legal requirements.

North Carolina Employee Notice to Correct IRCA Compliance

Description

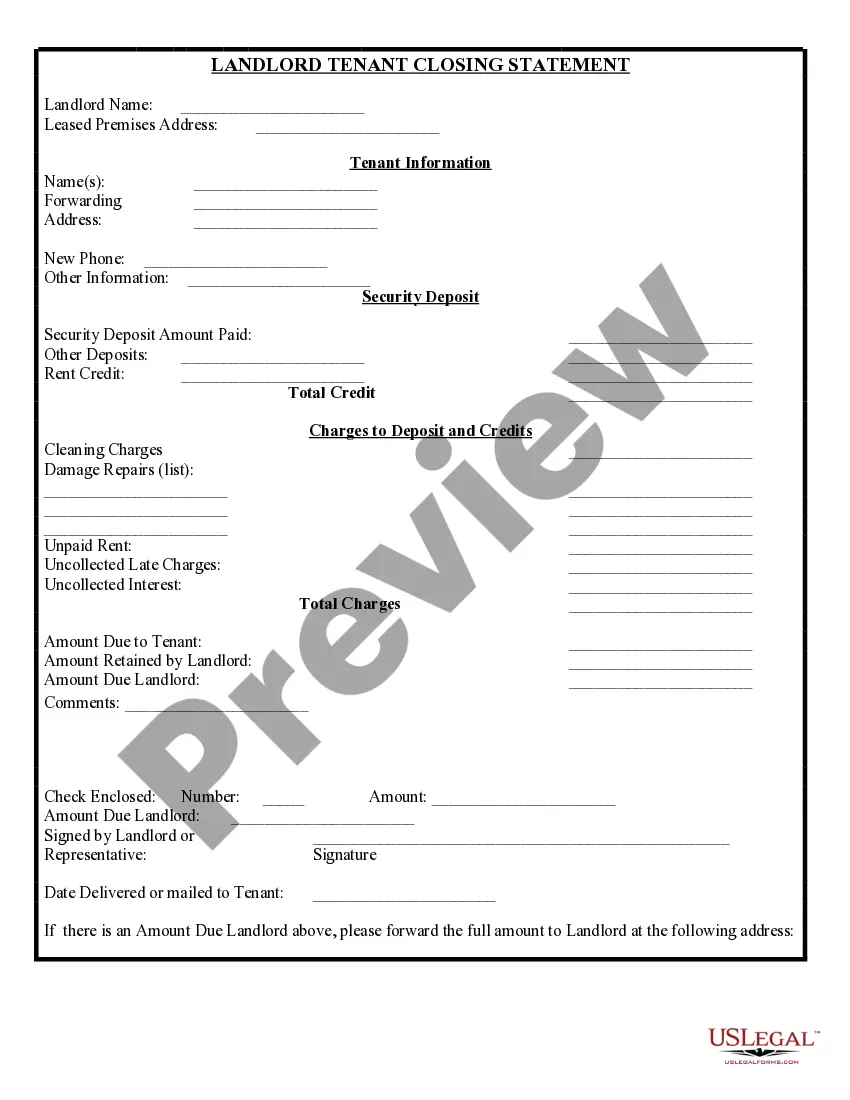

How to fill out North Carolina Employee Notice To Correct IRCA Compliance?

You are able to devote hrs on the web looking for the legal document format that fits the state and federal requirements you will need. US Legal Forms supplies 1000s of legal types that happen to be examined by experts. It is possible to acquire or printing the North Carolina Employee Notice to Correct IRCA Compliance from our assistance.

If you already have a US Legal Forms account, you are able to log in and click on the Acquire button. Next, you are able to comprehensive, change, printing, or indicator the North Carolina Employee Notice to Correct IRCA Compliance. Every legal document format you purchase is your own permanently. To get yet another copy associated with a obtained form, go to the My Forms tab and click on the corresponding button.

If you use the US Legal Forms site for the first time, keep to the straightforward recommendations below:

- Initial, be sure that you have chosen the correct document format for that county/area that you pick. Read the form description to ensure you have selected the proper form. If readily available, utilize the Review button to search from the document format at the same time.

- In order to find yet another edition from the form, utilize the Research area to discover the format that meets your needs and requirements.

- After you have identified the format you need, click Purchase now to move forward.

- Find the prices strategy you need, key in your references, and sign up for a free account on US Legal Forms.

- Complete the transaction. You can utilize your credit card or PayPal account to purchase the legal form.

- Find the formatting from the document and acquire it for your system.

- Make adjustments for your document if required. You are able to comprehensive, change and indicator and printing North Carolina Employee Notice to Correct IRCA Compliance.

Acquire and printing 1000s of document web templates while using US Legal Forms Internet site, that offers the most important collection of legal types. Use professional and status-distinct web templates to tackle your organization or person needs.