The North Carolina Agreement and Plan of Merger by The News Corporation Ltd, HMC Acquisition, and Heritage Media is a legal document outlining the terms and conditions of a merger between these companies. This agreement is specific to mergers taking place in North Carolina. The North Carolina Agreement and Plan of Merger (NC APM) is a binding contract that governs the merger process, ensuring that all parties involved adhere to the agreed-upon terms. This document details the steps and procedures to be followed, including the exchange of shares, the transfer of assets, and the integration of operations. Keywords: North Carolina Agreement and Plan of Merger, The News Corporation Ltd, HMC Acquisition, Heritage Media, merger, legal document, terms and conditions, binding contract, parties involved, shares, assets, operations. Different Types of North Carolina Agreement and Plan of Merger: 1. Stock-for-Stock Merger: This type of merger involves the exchange of shares between the merging entities. The NC APM for a stock-for-stock merger would outline the exchange ratio, valuation methods, and any restrictions or conditions on the share exchange. 2. Cash Merger: In a cash merger, one company acquires another by offering cash to the shareholders of the target company. The NC APM for a cash merger would specify the cash consideration to be paid, the deadlines for payment, and any additional terms or conditions related to the cash transaction. 3. Asset Acquisition: Instead of merging companies as a whole, an asset acquisition involves one company purchasing specific assets or business divisions of another. The NC APM for an asset acquisition would highlight the assets to be acquired, the purchase price, and any legal aspects related to the transfer of those assets. 4. Reverse Merger: A reverse merger occurs when a private company merges with a publicly traded company, allowing the private entity to become publicly listed. The NC APM for a reverse merger would address the process of combining operations, regulatory compliance, and any other unique considerations associated with this type of merger. 5. Cross-Border Merger: If the merging entities are located in different countries, a cross-border merger agreement may be required. In such cases, the NC APM would incorporate international laws, tax implications, and compliance requirements specific to both the home country and North Carolina. Keywords (additional): stock-for-stock merger, cash merger, asset acquisition, reverse merger, cross-border merger, exchange ratio, cash consideration, asset transfer, private company, publicly traded company, international laws, tax implications, compliance requirements.

North Carolina Agreement and Plan of Merger by The News Corporation Ltd, HMC Acquisition, and Heritage Media

Description

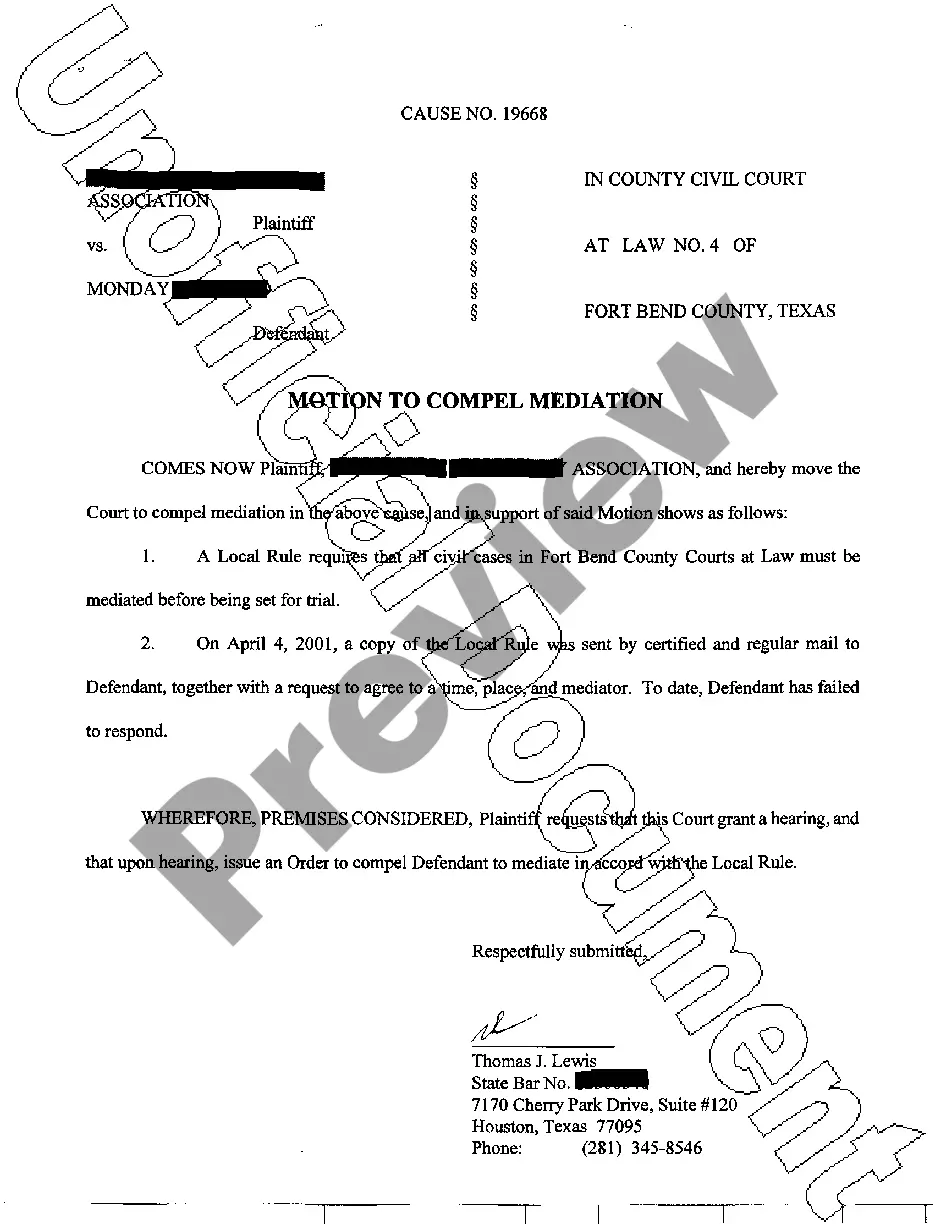

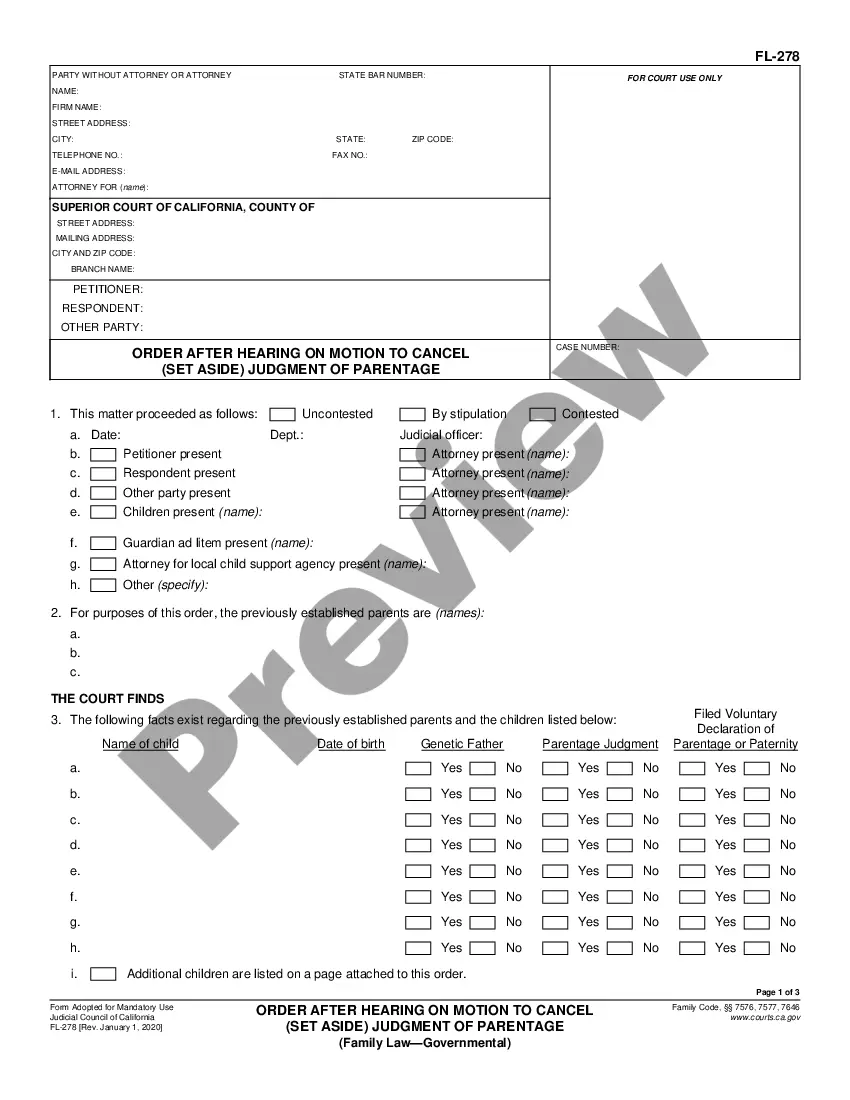

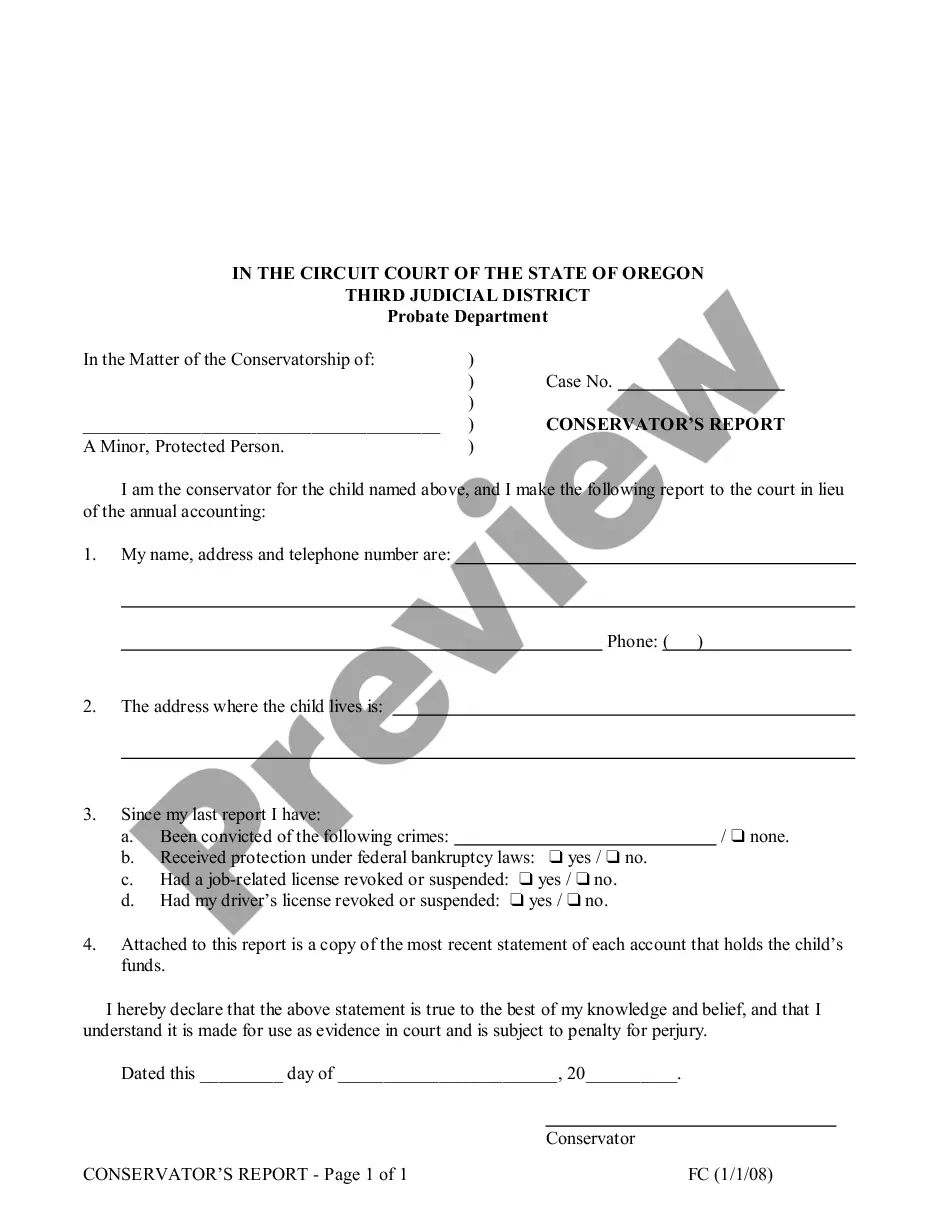

How to fill out North Carolina Agreement And Plan Of Merger By The News Corporation Ltd, HMC Acquisition, And Heritage Media?

Have you been in the place that you need documents for both company or individual purposes almost every working day? There are tons of authorized record themes available on the Internet, but locating kinds you can trust isn`t effortless. US Legal Forms gives a large number of kind themes, much like the North Carolina Agreement and Plan of Merger by The News Corporation Ltd, HMC Acquisition, and Heritage Media, which can be published in order to meet state and federal needs.

If you are presently informed about US Legal Forms site and get a merchant account, simply log in. Following that, it is possible to obtain the North Carolina Agreement and Plan of Merger by The News Corporation Ltd, HMC Acquisition, and Heritage Media design.

If you do not come with an bank account and need to begin using US Legal Forms, adopt these measures:

- Discover the kind you will need and make sure it is for your proper metropolis/state.

- Make use of the Preview option to examine the shape.

- Browse the outline to ensure that you have selected the correct kind.

- In case the kind isn`t what you are seeking, take advantage of the Look for discipline to find the kind that meets your needs and needs.

- If you discover the proper kind, simply click Get now.

- Choose the rates program you want, submit the necessary information to create your money, and pay for an order using your PayPal or bank card.

- Select a hassle-free paper formatting and obtain your duplicate.

Discover every one of the record themes you may have bought in the My Forms menu. You can get a more duplicate of North Carolina Agreement and Plan of Merger by The News Corporation Ltd, HMC Acquisition, and Heritage Media whenever, if needed. Just click on the necessary kind to obtain or print out the record design.

Use US Legal Forms, one of the most extensive collection of authorized types, to conserve time and prevent errors. The service gives professionally created authorized record themes that can be used for a range of purposes. Create a merchant account on US Legal Forms and commence creating your life a little easier.

Form popularity

FAQ

Your Operating Agreement gives confidence and impacts the price to those who would offer you riches to merge, acquire, or buy your business. The Operating Agreement protects the owner's personal assets.

In contract law, a merger clause, or integration clause, absorbs an inferior form of contract into a superior form of contract on the same subject matter, making the final written contract complete and binding.

A merger is an agreement that unites two existing companies into one new company. There are several types of mergers and also several reasons why companies complete mergers. Mergers and acquisitions (M&A) are commonly done to expand a company's reach, expand into new segments, or gain market share.

?parties? means Parent, Merger Sub and the Company.

What is an Agreement Of Merger? An agreement of merger is a legal document that establishes the terms and conditions to combine two or more businesses into one new entity. The business owners of the merging companies agree to sell all their stock and assets to the newly formed company for an agreed upon price.

An integration clause?sometimes called a merger clause or an entire agreement clause?is a legal provision in Contract Law that states that the terms of a contract are the complete and final agreement between the parties.