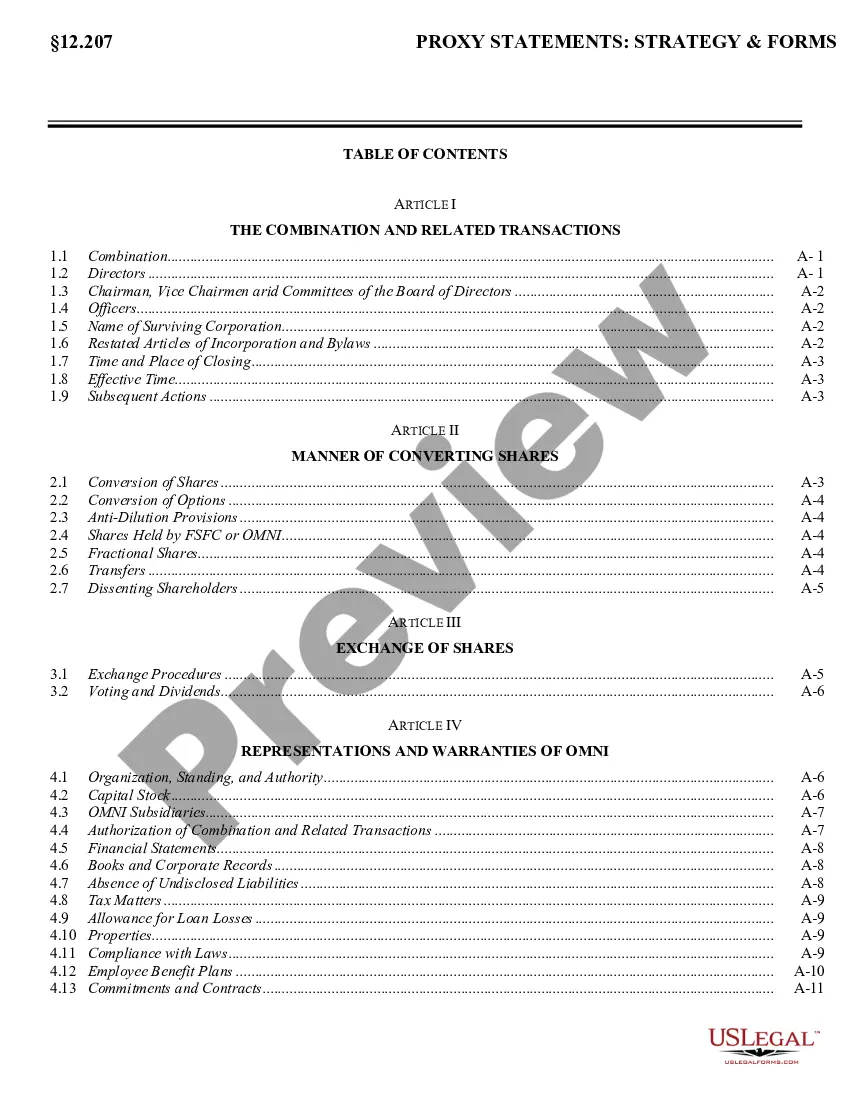

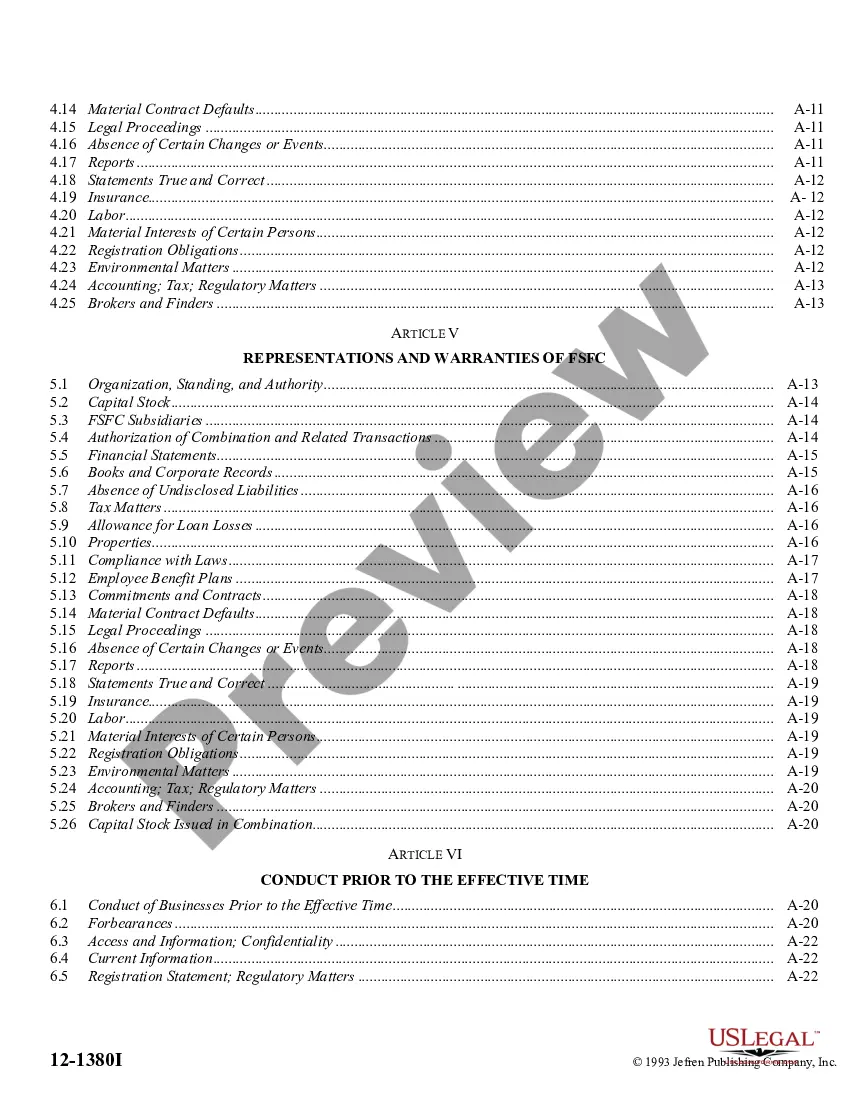

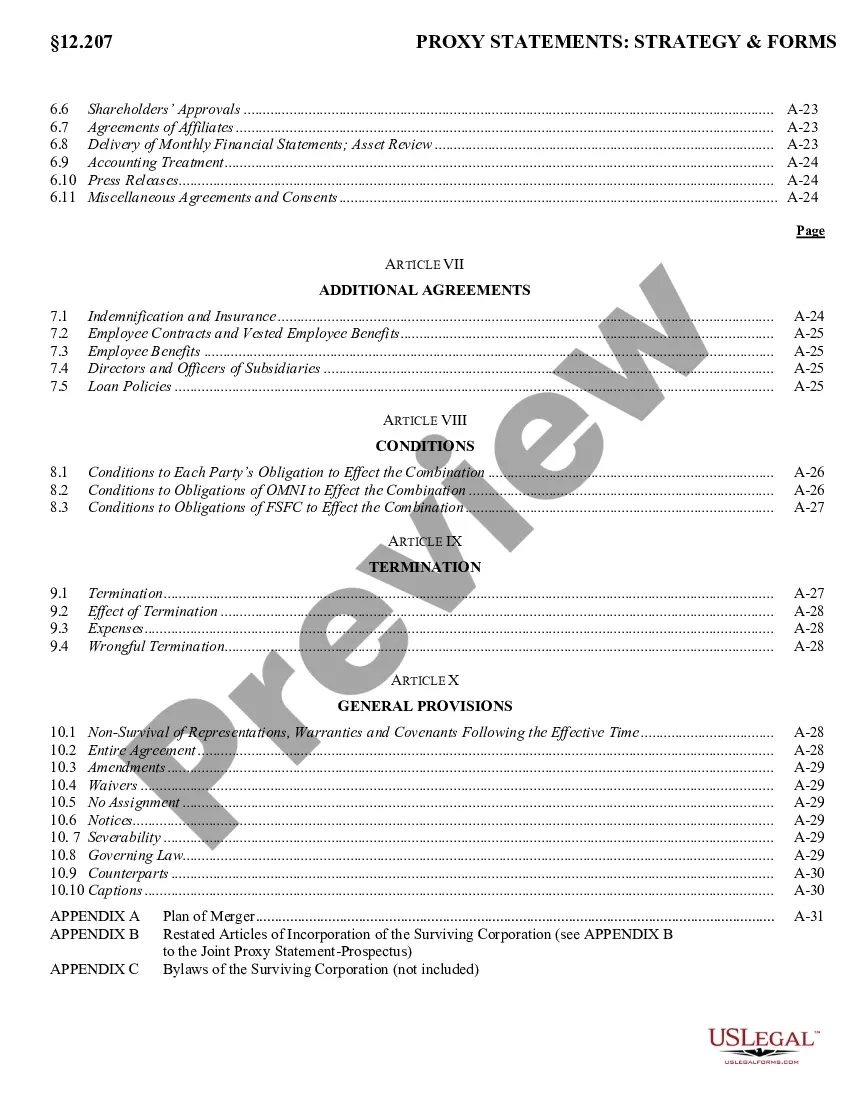

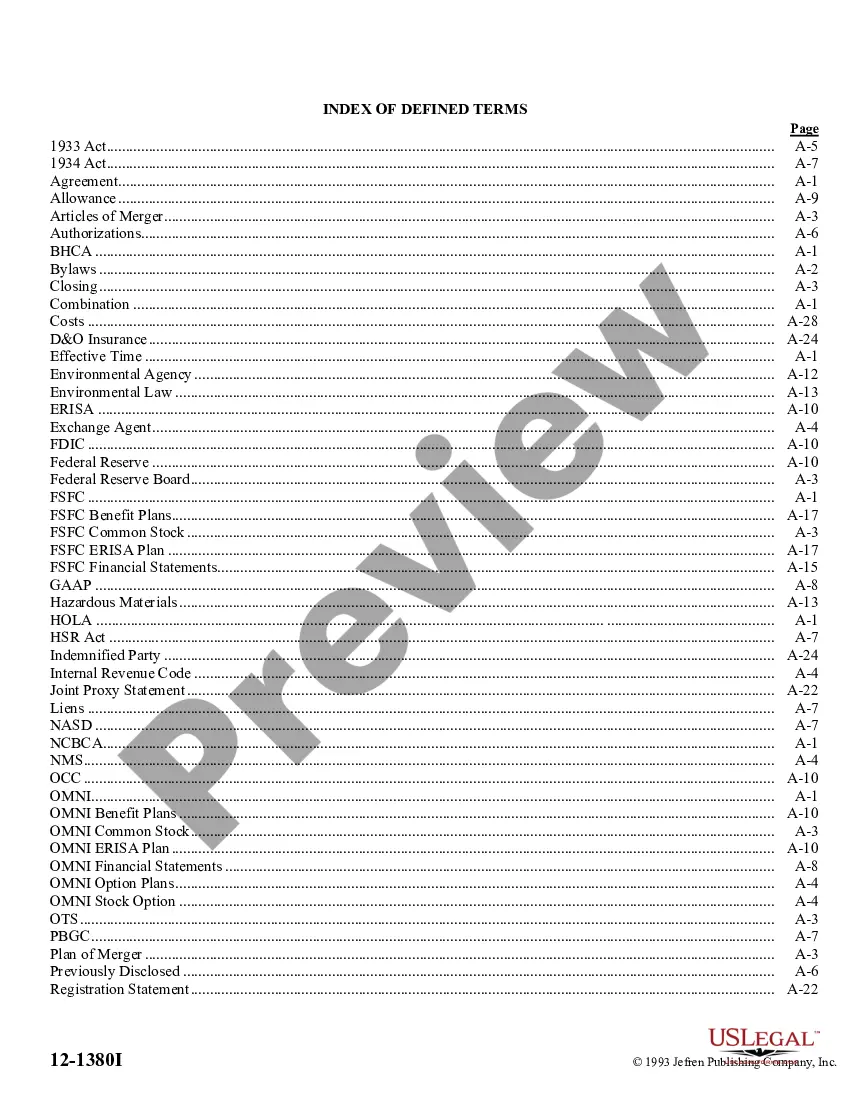

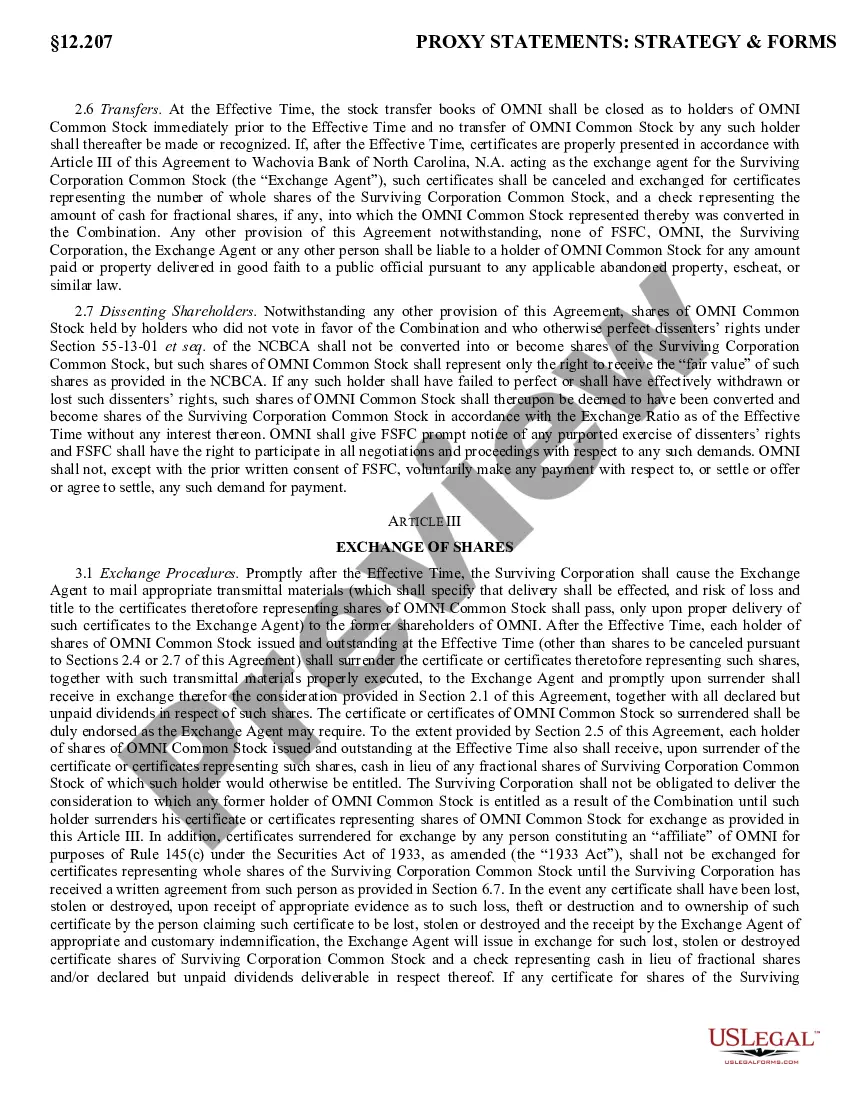

The North Carolina Agreement of Combination refers to a legal document executed between two or more business entities to combine their resources, assets, operations, or ownership. This agreement is designed to facilitate mergers, acquisitions, consolidations, or joint ventures with the purpose of maximizing efficiencies, reducing operational costs, or expanding market reach. It can be a critical tool for businesses seeking to strengthen their market position or explore new growth opportunities. One type of North Carolina Agreement of Combination is the Merger Agreement. This agreement involves the combination of two or more companies into a single entity, where one company typically absorbs the others. This type of agreement allows businesses to pool their assets, talents, and market share, resulting in increased competitiveness, synergies, and economies of scale. Another type is the Acquisition Agreement, where one company acquires another, usually through the purchase of its outstanding shares or assets. This agreement enables the acquiring company to gain control over the target company's operations, customer base, intellectual property, or other valuable resources. Acquisitions are often aimed at expanding market reach, diversifying product offerings, or eliminating competition. The North Carolina Agreement of Combination may also encompass Consolidation Agreements, which involve the integration of two or more companies to form a new entity. Consolidations can lead to increased market presence, enhanced operational efficiency, and shared resources. This type of agreement typically requires careful restructuring and coordination of the involved entities, ensuring a smooth transition and minimal disruption to business operations. Joint Venture Agreements are another form of the North Carolina Agreement of Combination. In this arrangement, two or more companies temporarily combine their resources, assets, or expertise to undertake a specific project or venture. Joint ventures provide an opportunity for businesses to leverage each other's strengths, share risks and costs, and access new markets or technologies. While the North Carolina Agreement of Combination can vary based on the specific circumstances and objectives of the participating entities, they all share the common goal of achieving strategic synergies and creating value through collaboration. These agreements are complex in nature, requiring detailed negotiations, legal expertise, and compliance with state and federal regulations. In summary, the North Carolina Agreement of Combination is a legal document that enables businesses to merge, acquire, consolidate, or form joint ventures to achieve various strategic objectives. It offers an avenue for companies to combine their resources, expand market reach, increase operational efficiency, or diversify product offerings. With different types of agreements such as Merger, Acquisition, Consolidation, and Joint Venture, businesses can forge comprehensive strategies to drive growth and success.

The North Carolina Agreement of Combination refers to a legal document executed between two or more business entities to combine their resources, assets, operations, or ownership. This agreement is designed to facilitate mergers, acquisitions, consolidations, or joint ventures with the purpose of maximizing efficiencies, reducing operational costs, or expanding market reach. It can be a critical tool for businesses seeking to strengthen their market position or explore new growth opportunities. One type of North Carolina Agreement of Combination is the Merger Agreement. This agreement involves the combination of two or more companies into a single entity, where one company typically absorbs the others. This type of agreement allows businesses to pool their assets, talents, and market share, resulting in increased competitiveness, synergies, and economies of scale. Another type is the Acquisition Agreement, where one company acquires another, usually through the purchase of its outstanding shares or assets. This agreement enables the acquiring company to gain control over the target company's operations, customer base, intellectual property, or other valuable resources. Acquisitions are often aimed at expanding market reach, diversifying product offerings, or eliminating competition. The North Carolina Agreement of Combination may also encompass Consolidation Agreements, which involve the integration of two or more companies to form a new entity. Consolidations can lead to increased market presence, enhanced operational efficiency, and shared resources. This type of agreement typically requires careful restructuring and coordination of the involved entities, ensuring a smooth transition and minimal disruption to business operations. Joint Venture Agreements are another form of the North Carolina Agreement of Combination. In this arrangement, two or more companies temporarily combine their resources, assets, or expertise to undertake a specific project or venture. Joint ventures provide an opportunity for businesses to leverage each other's strengths, share risks and costs, and access new markets or technologies. While the North Carolina Agreement of Combination can vary based on the specific circumstances and objectives of the participating entities, they all share the common goal of achieving strategic synergies and creating value through collaboration. These agreements are complex in nature, requiring detailed negotiations, legal expertise, and compliance with state and federal regulations. In summary, the North Carolina Agreement of Combination is a legal document that enables businesses to merge, acquire, consolidate, or form joint ventures to achieve various strategic objectives. It offers an avenue for companies to combine their resources, expand market reach, increase operational efficiency, or diversify product offerings. With different types of agreements such as Merger, Acquisition, Consolidation, and Joint Venture, businesses can forge comprehensive strategies to drive growth and success.