North Carolina Insurance Agents Stock Option Plan is a type of employee benefit plan that offers insurance agents in North Carolina the opportunity to purchase company stocks at a predetermined price within a specific timeframe. This plan aims to provide incentives to insurance agents, allowing them to share in the company's success by investing in company stocks. The North Carolina Insurance Agents Stock Option Plan is designed to attract, motivate, and retain top talent within the insurance industry. It serves as an additional compensation opportunity for insurance agents, enhancing their overall compensation package. By granting stock options, insurance companies encourage agents to align their interests with the company's performance and long-term growth. The plan grants insurance agents the right to purchase a specific number of company stocks, commonly known as stock options, typically at a discounted price, also known as the exercise price or strike price. These options can usually be exercised after a predetermined vesting period, during which the insurance agent must remain employed by the company. The North Carolina Insurance Agents Stock Option Plan acts as an investment opportunity for insurance agents, allowing them to potentially benefit from the increase in the company's stock value over time. If the company's stock price rises above the exercise price, the insurance agent can exercise their options and purchase company stocks at a lower rate, ultimately benefiting from the price difference. Different types of stock options can be offered under the North Carolina Insurance Agents Stock Option Plan. Some commonly used types include: 1. Non-Qualified Stock Options (SOS): These are the most common type of stock options offered to insurance agents. SOS are typically granted at a discount and are subject to certain tax implications. 2. Incentive Stock Options (SOS): These options are typically only offered to key employees or high-performing insurance agents. SOS provide certain tax advantages as they are subject to potentially lower capital gains tax rates. 3. Restricted Stock Units (RSS): While not technically stock options, RSS are another form of equity compensation that can be used in the North Carolina Insurance Agents Stock Option Plan. RSS grant insurance agents the right to receive company stocks after a specific vesting period, usually subject to performance or time-based conditions. North Carolina Insurance Agents Stock Option Plan serves as a valuable tool for insurance companies to attract and retain talented agents while incentivizing their hard work and dedication. By offering these stock options, insurance companies create a mutually beneficial relationship with insurance agents, through which both parties can potentially profit from the success and growth of the company.

North Carolina Insurance Agents Stock option plan

Description

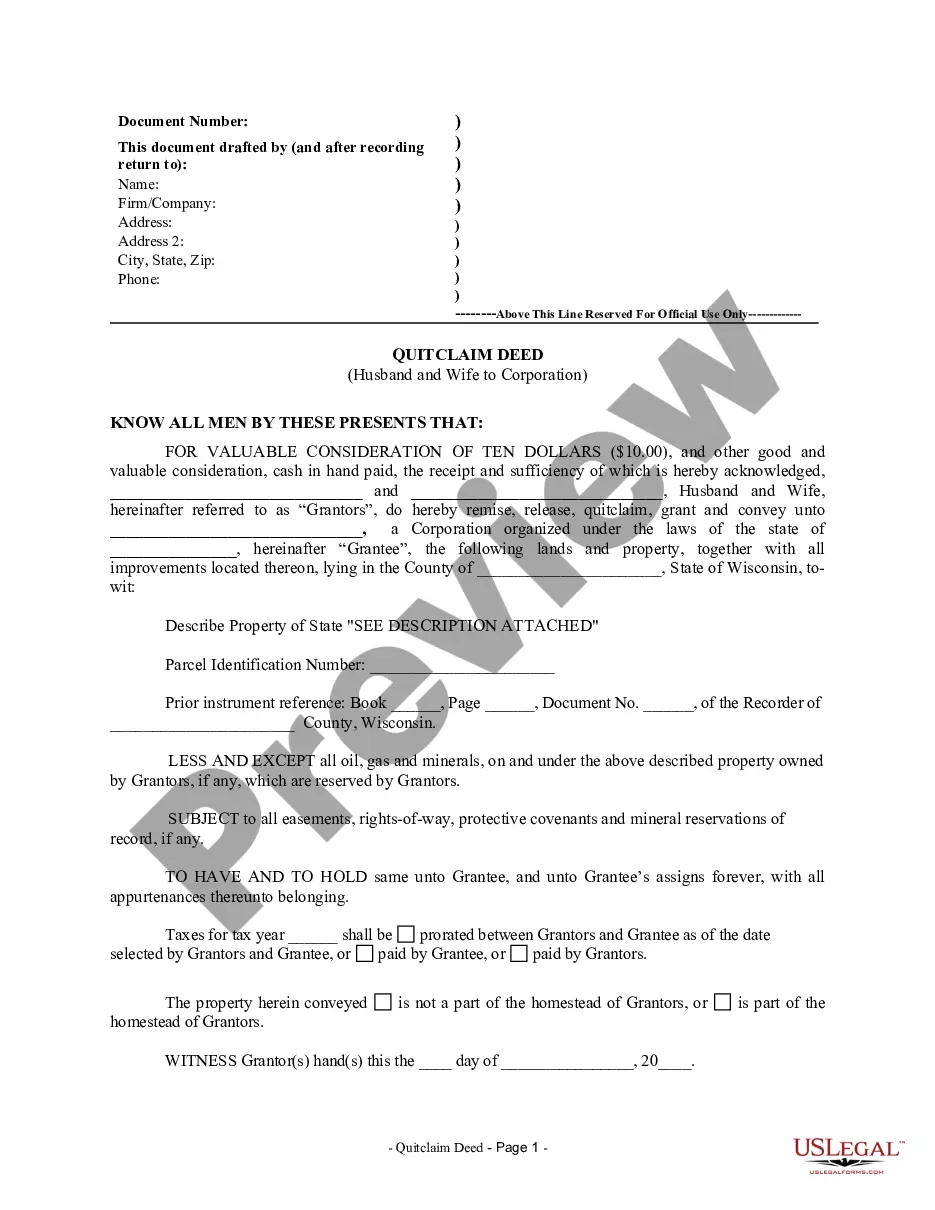

How to fill out North Carolina Insurance Agents Stock Option Plan?

If you need to complete, down load, or produce legitimate papers templates, use US Legal Forms, the most important collection of legitimate forms, which can be found on the web. Utilize the site`s simple and hassle-free search to get the documents you need. Different templates for organization and individual uses are sorted by groups and says, or keywords. Use US Legal Forms to get the North Carolina Insurance Agents Stock option plan in just a number of mouse clicks.

In case you are already a US Legal Forms buyer, log in in your account and then click the Obtain key to have the North Carolina Insurance Agents Stock option plan. You can even access forms you earlier downloaded within the My Forms tab of the account.

Should you use US Legal Forms initially, refer to the instructions under:

- Step 1. Be sure you have chosen the shape for the correct metropolis/land.

- Step 2. Take advantage of the Preview choice to look over the form`s content material. Don`t overlook to see the information.

- Step 3. In case you are not satisfied together with the develop, take advantage of the Search discipline on top of the screen to discover other versions in the legitimate develop template.

- Step 4. Upon having identified the shape you need, click the Acquire now key. Select the pricing strategy you favor and include your credentials to sign up for an account.

- Step 5. Process the financial transaction. You can utilize your charge card or PayPal account to complete the financial transaction.

- Step 6. Find the file format in the legitimate develop and down load it in your product.

- Step 7. Comprehensive, revise and produce or sign the North Carolina Insurance Agents Stock option plan.

Every legitimate papers template you buy is your own property eternally. You might have acces to every develop you downloaded within your acccount. Click the My Forms portion and choose a develop to produce or down load once more.

Be competitive and down load, and produce the North Carolina Insurance Agents Stock option plan with US Legal Forms. There are millions of specialist and condition-particular forms you can use for your personal organization or individual requirements.