North Carolina Adoption of Stock Option Plan of WSFS Financial Corporation

Description

How to fill out Adoption Of Stock Option Plan Of WSFS Financial Corporation?

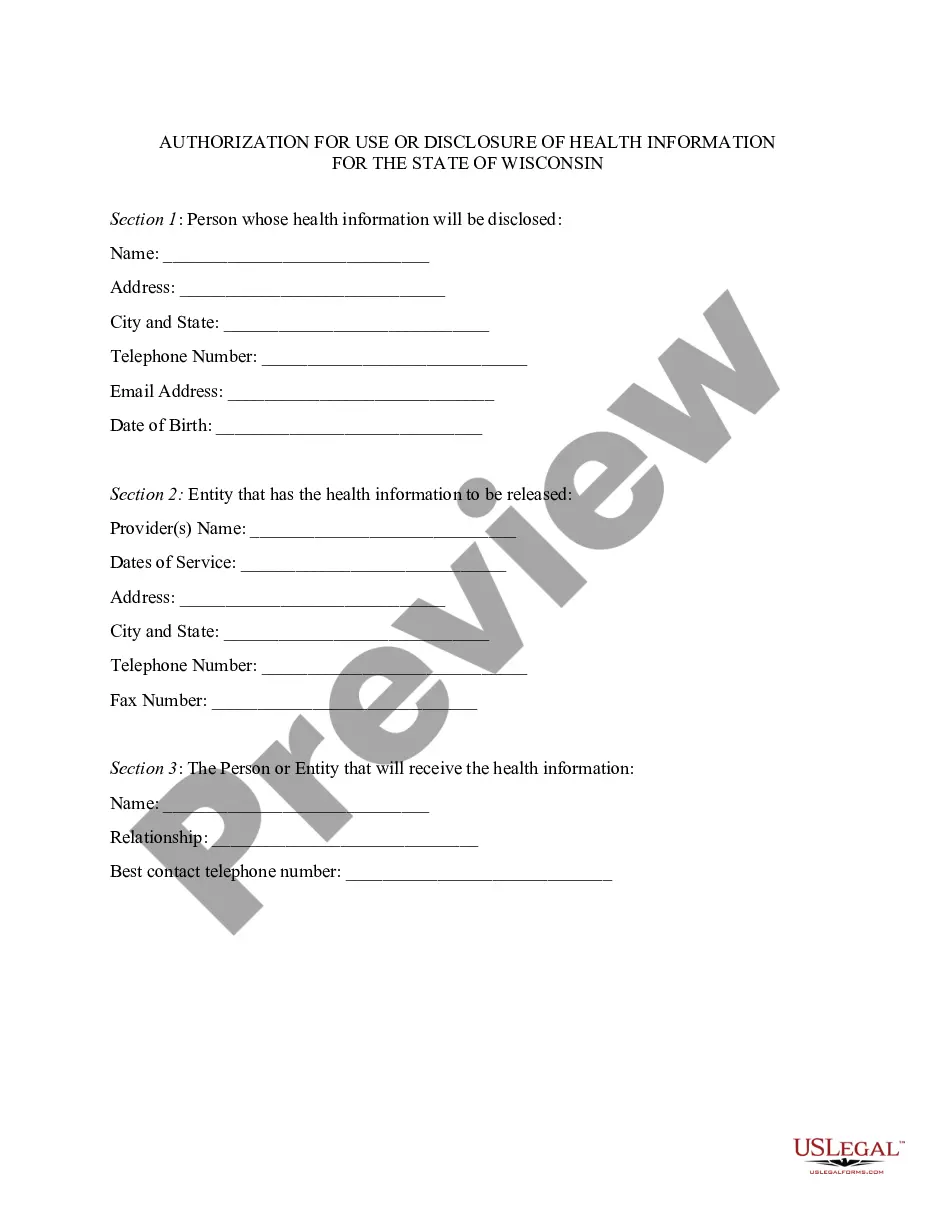

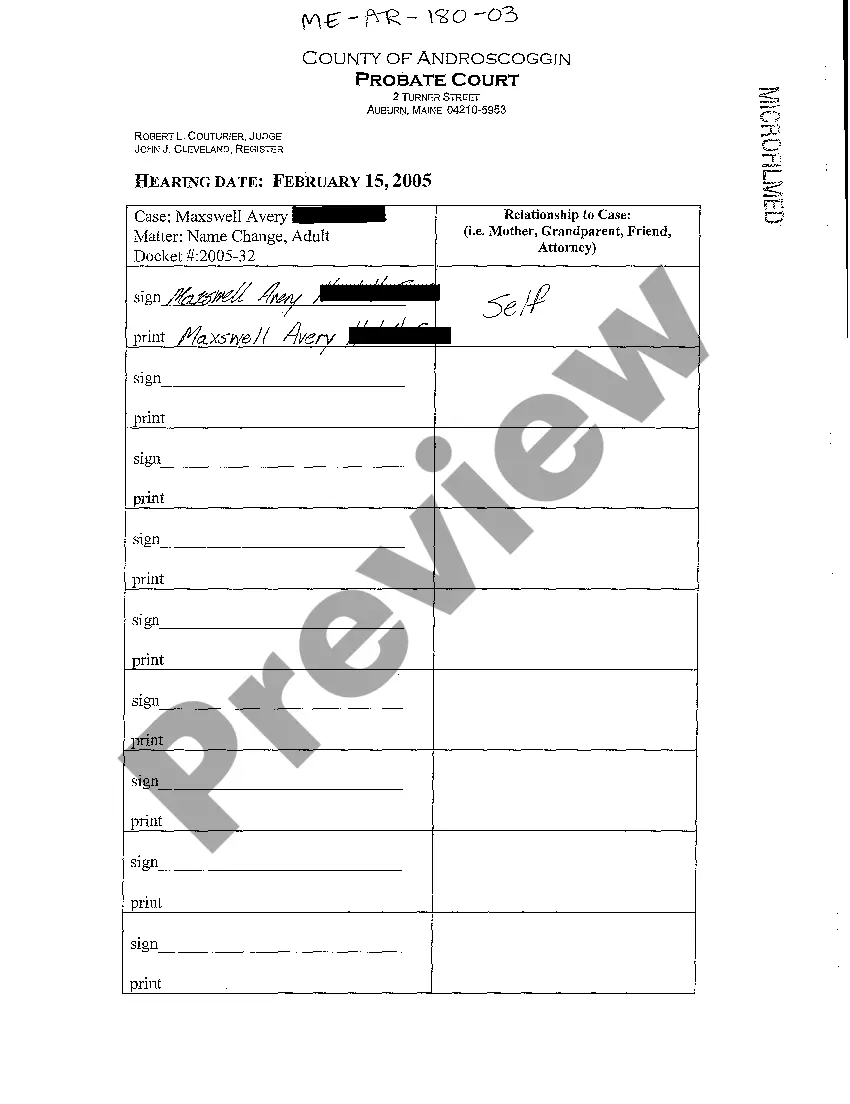

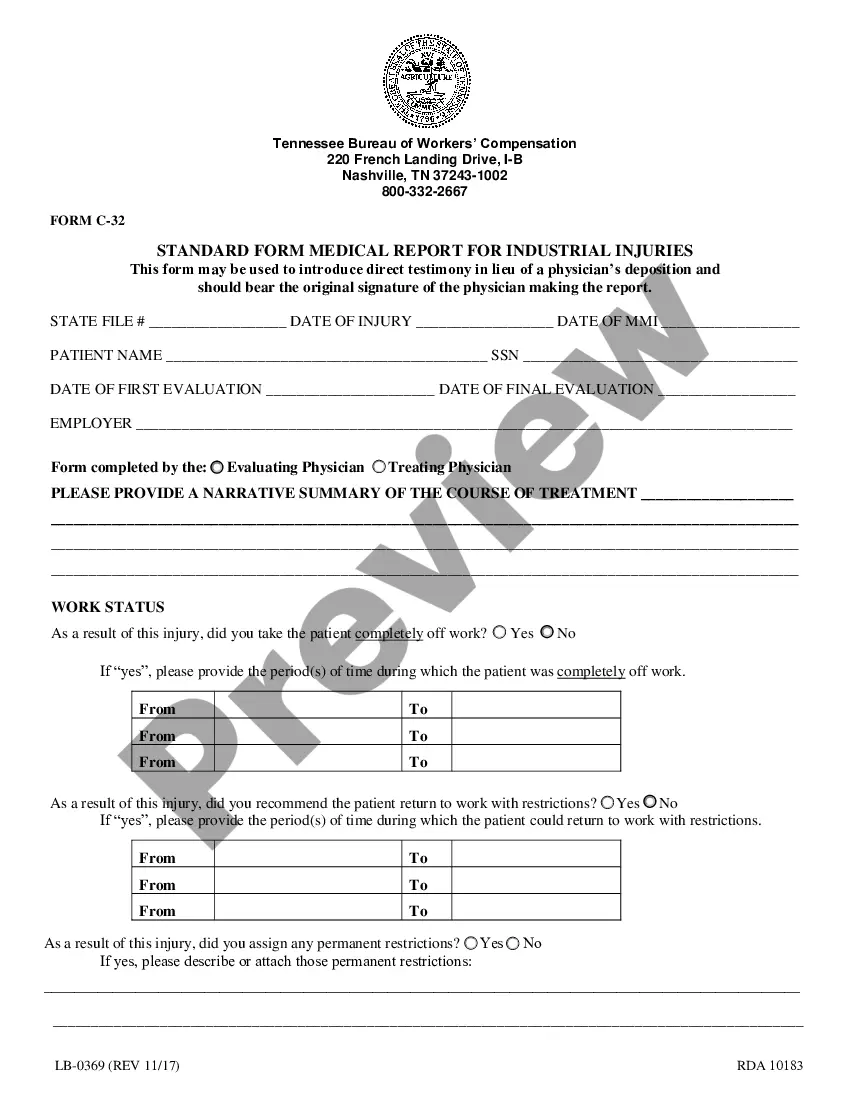

It is possible to invest several hours on the Internet attempting to find the legitimate papers format which fits the federal and state needs you need. US Legal Forms provides 1000s of legitimate forms which are analyzed by specialists. It is simple to obtain or print out the North Carolina Adoption of Stock Option Plan of WSFS Financial Corporation from the service.

If you currently have a US Legal Forms accounts, you can log in and then click the Down load switch. Following that, you can full, modify, print out, or indication the North Carolina Adoption of Stock Option Plan of WSFS Financial Corporation. Each and every legitimate papers format you buy is your own property forever. To obtain an additional version of the obtained type, proceed to the My Forms tab and then click the corresponding switch.

If you use the US Legal Forms website the very first time, adhere to the easy recommendations under:

- First, be sure that you have selected the right papers format for the region/city of your choosing. Look at the type information to ensure you have picked the right type. If readily available, use the Preview switch to appear through the papers format at the same time.

- If you wish to discover an additional model from the type, use the Lookup field to obtain the format that suits you and needs.

- Upon having found the format you need, click Buy now to carry on.

- Pick the prices plan you need, type in your credentials, and register for a free account on US Legal Forms.

- Total the financial transaction. You should use your Visa or Mastercard or PayPal accounts to cover the legitimate type.

- Pick the structure from the papers and obtain it to your product.

- Make modifications to your papers if possible. It is possible to full, modify and indication and print out North Carolina Adoption of Stock Option Plan of WSFS Financial Corporation.

Down load and print out 1000s of papers templates utilizing the US Legal Forms web site, that provides the largest selection of legitimate forms. Use specialist and status-distinct templates to deal with your company or specific needs.

Form popularity

FAQ

WSFS common stock is traded on the NASDAQ stock exchange under the symbol WSFS. Resources - Investor FAQs | WSFS Financial Corporation WSFS Investor Relations ? investor-faq WSFS Investor Relations ? investor-faq

WSFS Financial Corp: Competitors Wells Fargo & Co Headquarters. 233,834. $82.9B. The Charles Schwab Corp Headquarters. 36,600. $22.3B. M&T Bank Corp Headquarters. 22,210. $8.6B. Fulton Financial Corp Headquarters. 3,300. $1.1B.

WSFS Financial Corporation is a financial services company. Its primary subsidiary, WSFS Bank, a federal savings bank, is the largest and longest-standing locally managed bank and trust company headquartered in Delaware and the Greater Delaware Valley.

WSFS celebrated its 35th year of being a publicly traded company with Chairman, President and CEO Rodger Levenson, joined by members of the executive leadership team, Associates and friends of WSFS, ringing The Nasdaq Stock Market Opening Bell.