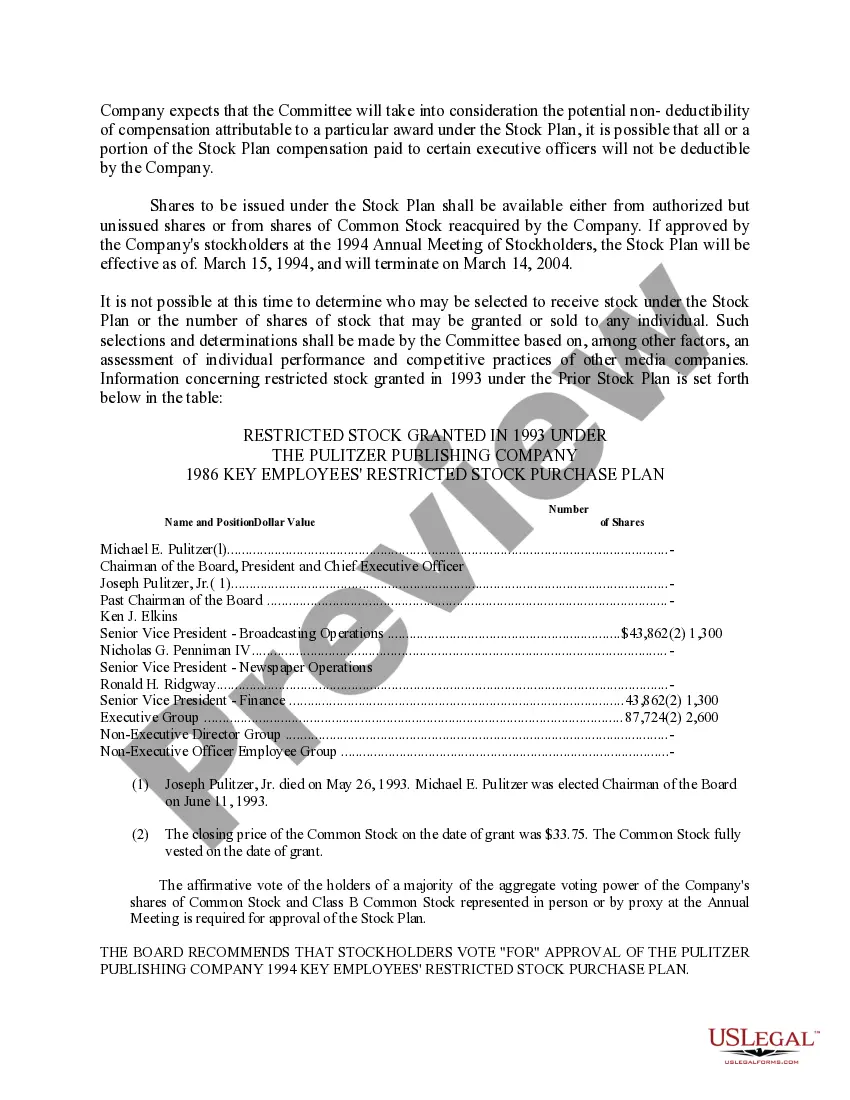

The North Carolina Approval of Key Employees' Restricted Stock Purchase Plan of The Pulitzer Publishing Co. is a comprehensive and beneficial program established to reward and motivate key employees of the esteemed publishing company. This plan grants eligible employees the opportunity to acquire company stock through a restricted stock purchase agreement, subject to certain restrictions and conditions. The plan ensures that key employees have a vested interest in the company's success and enables them to actively contribute to its growth and profitability. Under this plan, key employees are specifically identified based on their significant contributions to the company's operations, long-term commitment, and potential to drive future success. The eligibility criteria may vary depending on factors such as job position, tenure, performance, and overall impact on the organization. The North Carolina Approval of Key Employees' Restricted Stock Purchase Plan encompasses multiple types based on specific parameters. These variations offer flexibility and customization, tailoring the plan to fit the distinctive needs of different key employees and accommodate varying levels of responsibility and contributions. Some notable types of plans are as follows: 1. Tiered Vesting Plan: This plan applies a gradual vesting schedule, where the percentage of the restricted stock that becomes fully owned by employees increases over time. For example, an employee may be entitled to 25% of the restricted stock after one year, 50% after two years, and so on, until the stock is fully vested. 2. Performance-Based Plan: In this type of plan, the acquisition of restricted stock is contingent upon achieving predetermined performance goals. Key employees must fulfill specific targets, such as revenue growth, market share expansion, or innovation targets, to qualify for the purchase of company stock. 3. Seniority-Based Plan: This plan considers the length of service as a primary factor for eligibility and stock ownership. Key employees who have dedicated a substantial amount of time and loyalty to the company may be granted the opportunity to participate and acquire restricted stock. 4. Restricted Stock Unit (RSU) Plan: In contrast to direct stock purchase, this stock-based compensation plan awards recipients with units that represent an equivalent value of company stock. Upon meeting specific conditions, RSS are converted into actual shares, providing key employees with tangible ownership of the company. These are just a few examples of the North Carolina Approval of Key Employees' Restricted Stock Purchase Plan variations that The Pulitzer Publishing Co. may offer. By implementing such a program, the company fosters employee loyalty, encourages long-term commitment, and aligns the interests of key employees with that of the organization, ultimately driving growth and success in the highly competitive publishing industry.

North Carolina Approval of Key Employees' Restricted Stock Purchase Plan of The Pulitzer Publishing Co.

Description

How to fill out North Carolina Approval Of Key Employees' Restricted Stock Purchase Plan Of The Pulitzer Publishing Co.?

You are able to devote hrs on the web trying to find the lawful record design that fits the state and federal specifications you want. US Legal Forms provides 1000s of lawful forms that are analyzed by experts. You can actually acquire or print out the North Carolina Approval of Key Employees' Restricted Stock Purchase Plan of The Pulitzer Publishing Co. from our service.

If you currently have a US Legal Forms profile, you may log in and then click the Obtain switch. Following that, you may comprehensive, revise, print out, or sign the North Carolina Approval of Key Employees' Restricted Stock Purchase Plan of The Pulitzer Publishing Co.. Every single lawful record design you get is yours for a long time. To obtain another duplicate of the acquired type, check out the My Forms tab and then click the related switch.

Should you use the US Legal Forms web site for the first time, follow the straightforward recommendations under:

- Initially, make certain you have chosen the best record design for your area/area of your choice. Look at the type information to ensure you have picked the appropriate type. If readily available, utilize the Preview switch to check through the record design also.

- If you want to find another edition of your type, utilize the Search industry to get the design that meets your requirements and specifications.

- Once you have found the design you would like, simply click Acquire now to move forward.

- Select the pricing program you would like, enter your credentials, and register for a free account on US Legal Forms.

- Total the transaction. You can use your Visa or Mastercard or PayPal profile to fund the lawful type.

- Select the format of your record and acquire it to your system.

- Make adjustments to your record if possible. You are able to comprehensive, revise and sign and print out North Carolina Approval of Key Employees' Restricted Stock Purchase Plan of The Pulitzer Publishing Co..

Obtain and print out 1000s of record layouts while using US Legal Forms Internet site, which offers the largest selection of lawful forms. Use skilled and condition-distinct layouts to tackle your company or individual requirements.