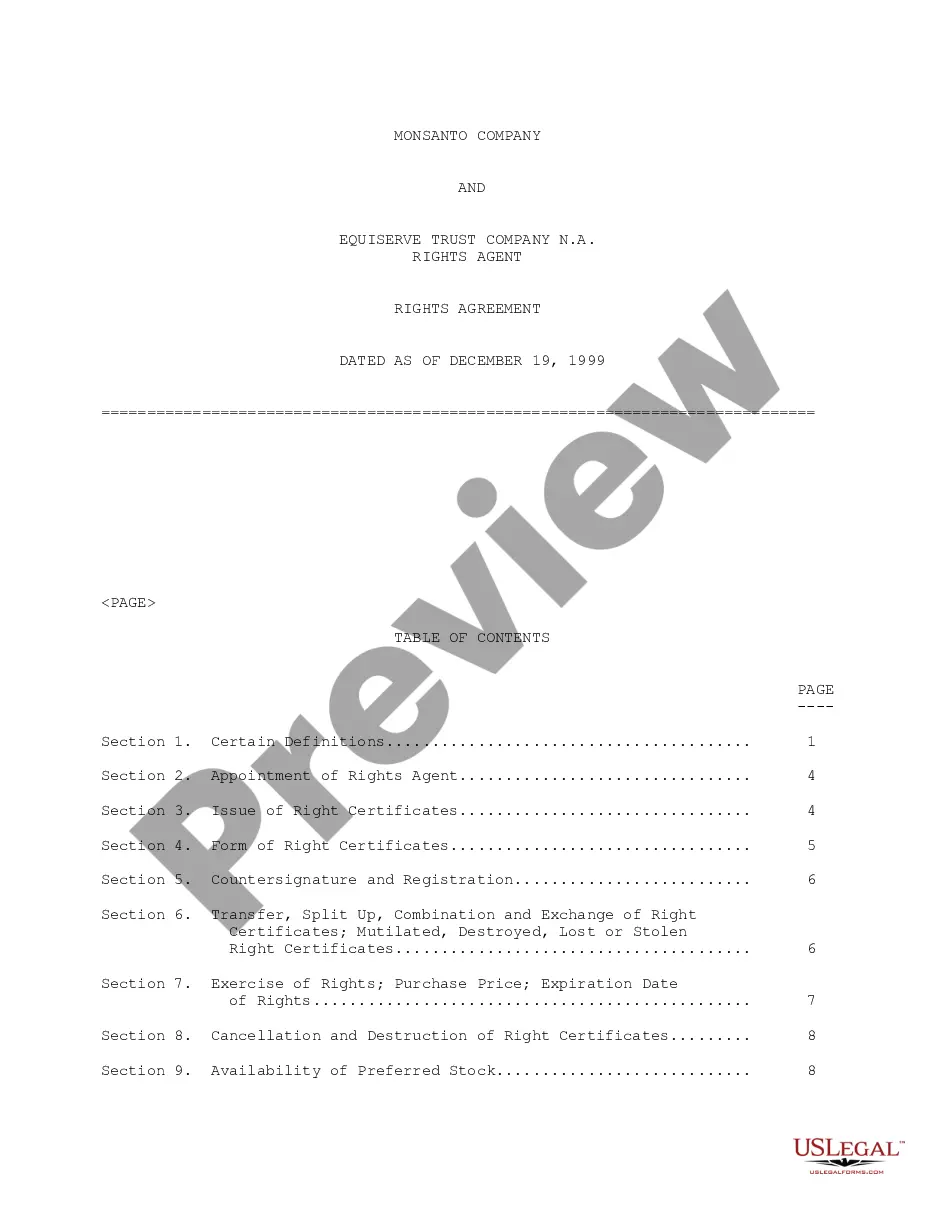

North Carolina Proposal to approve restricted stock plan

Description

How to fill out Proposal To Approve Restricted Stock Plan?

Choosing the right authorized file format could be a have difficulties. Naturally, there are a lot of layouts available online, but how do you find the authorized kind you will need? Utilize the US Legal Forms site. The assistance offers a large number of layouts, for example the North Carolina Proposal to approve restricted stock plan, which you can use for business and personal needs. Each of the types are examined by experts and meet state and federal requirements.

Should you be currently authorized, log in to the account and then click the Download option to have the North Carolina Proposal to approve restricted stock plan. Make use of your account to appear through the authorized types you possess bought earlier. Check out the My Forms tab of your own account and acquire yet another backup of the file you will need.

Should you be a fresh end user of US Legal Forms, listed below are easy guidelines that you should follow:

- Initial, be sure you have chosen the right kind to your area/area. You may check out the form making use of the Review option and read the form explanation to make certain it is the right one for you.

- If the kind does not meet your preferences, use the Seach discipline to get the right kind.

- When you are certain that the form is proper, click the Buy now option to have the kind.

- Pick the costs program you need and enter the essential information. Design your account and buy your order making use of your PayPal account or Visa or Mastercard.

- Select the file formatting and down load the authorized file format to the device.

- Comprehensive, edit and produce and sign the received North Carolina Proposal to approve restricted stock plan.

US Legal Forms will be the greatest catalogue of authorized types where you can discover a variety of file layouts. Utilize the company to down load skillfully-created papers that follow status requirements.

Form popularity

FAQ

The US federal tax laws do not generally address the level of approval required for equity awards, but the tax rules that govern the qualification of so-called incentive stock options require that the options be granted under a shareholder-approved plan.

Corporate actions include stock splits, dividends, mergers and acquisitions, rights issues and spin-offs. All of these are major decisions that typically need to be approved by the company's board of directors and authorized by its shareholders.

A stock option plan must be adopted by the company's directors and, in some cases, approved by the company's shareholders.

Once you have a plan in place, you can simply make amendments to increase the number of shares in the option pool on an as-needed basis. The initial plan and any expansions must be approved by your board of directors and then by shareholders.

Failure to get board approval Let's start with an obvious one that founders routinely miss in the early days: Stock option grants must be approved by the board. If the board doesn't approve (either at a board meeting or by unanimous written consent), the stock options haven't actually been granted.

Vesting helps employers encourage employees to stay through the vesting period in order to take ownership of the options granted to them. Your options don't truly belong to you until you have met the requirements of the vesting schedule.