North Carolina Schedule 14D-9 - Solicitation - Recommendation Statement

Description

How to fill out Schedule 14D-9 - Solicitation - Recommendation Statement?

It is possible to devote time online looking for the legal document format that fits the state and federal demands you require. US Legal Forms offers 1000s of legal types that are reviewed by experts. You can easily download or print out the North Carolina Schedule 14D-9 - Solicitation - Recommendation Statement from my support.

If you already have a US Legal Forms bank account, it is possible to log in and click on the Obtain switch. After that, it is possible to comprehensive, modify, print out, or indication the North Carolina Schedule 14D-9 - Solicitation - Recommendation Statement. Every legal document format you get is your own property for a long time. To obtain an additional backup of the purchased kind, visit the My Forms tab and click on the related switch.

If you work with the US Legal Forms website the first time, keep to the easy directions listed below:

- Initially, ensure that you have selected the right document format for your state/area of your choosing. Browse the kind explanation to make sure you have chosen the correct kind. If readily available, make use of the Preview switch to check from the document format at the same time.

- If you wish to discover an additional edition in the kind, make use of the Research discipline to find the format that suits you and demands.

- Once you have identified the format you want, click on Get now to proceed.

- Pick the prices prepare you want, key in your references, and register for an account on US Legal Forms.

- Total the financial transaction. You can utilize your charge card or PayPal bank account to purchase the legal kind.

- Pick the structure in the document and download it in your product.

- Make modifications in your document if needed. It is possible to comprehensive, modify and indication and print out North Carolina Schedule 14D-9 - Solicitation - Recommendation Statement.

Obtain and print out 1000s of document themes using the US Legal Forms web site, which provides the biggest assortment of legal types. Use specialist and state-distinct themes to deal with your company or person requirements.

Form popularity

FAQ

A tender offer is only open for a limited period of time and is made to each individual security holder. That means each security holder can decide for him or herself whether to tender his or her securities. In addition, the terms of the tender offer, such as the price offered to purchase securities, are fixed.

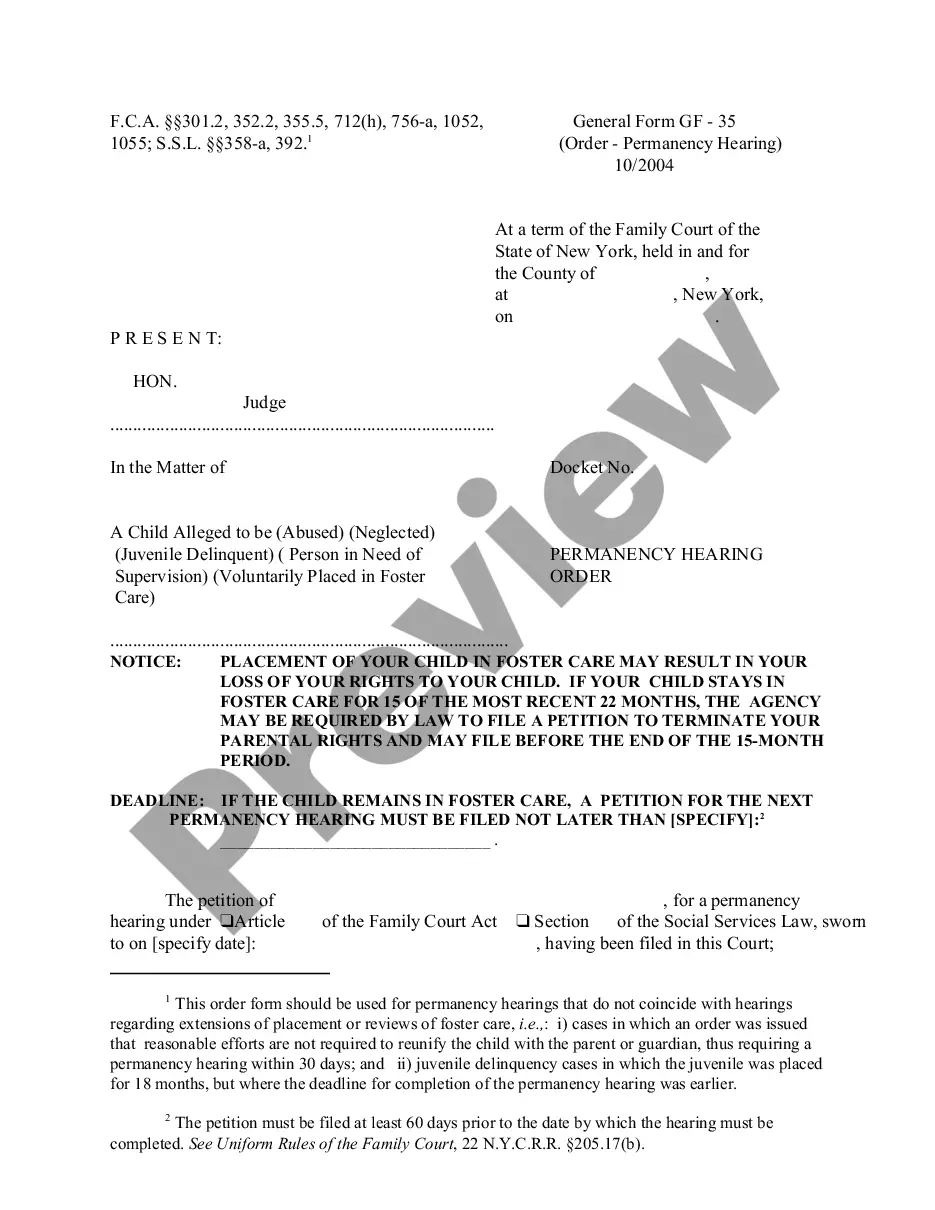

The target must file a Schedule 14D-9. Within 10 business days of the commencement of a tender offer, the target company's board of directors must disseminate a statement to its security holders disclosing the target company's position with respect to the offer.

Schedule 14D-9 is a filing with the Securities and Exchange Commission (SEC) when an interested party, such as an issuer, a beneficial owner of securities, or a representative of either, makes a solicitation or recommendation statement to the shareholders of another company with respect to a tender offer.

What Is a Schedule TO-C? A schedule TO-C is filed with the Securities Exchange Commission (SEC) when any written communications take place relating to a tender offer. Schedule TO-C is a subset of the Schedule TO filing?also referred to as a tender offer statement.

The term Schedule 13E-4 refers to a form that public companies were required to file with the Securities and Exchange Commission (SEC) when they made tender offers for their own securities. The form, known as an issuer tender offer statement, was required under the Securities Exchange Act of 1934.