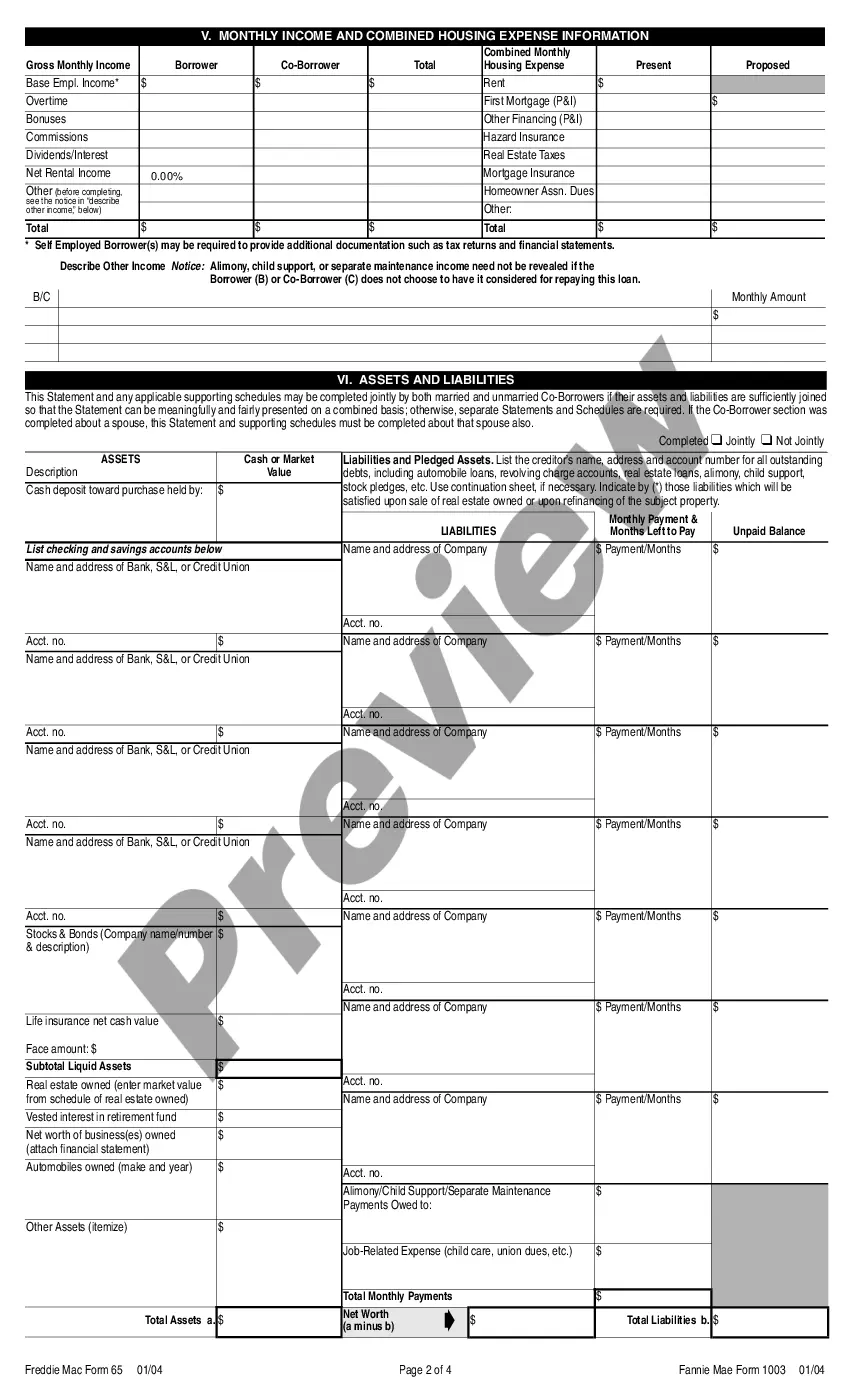

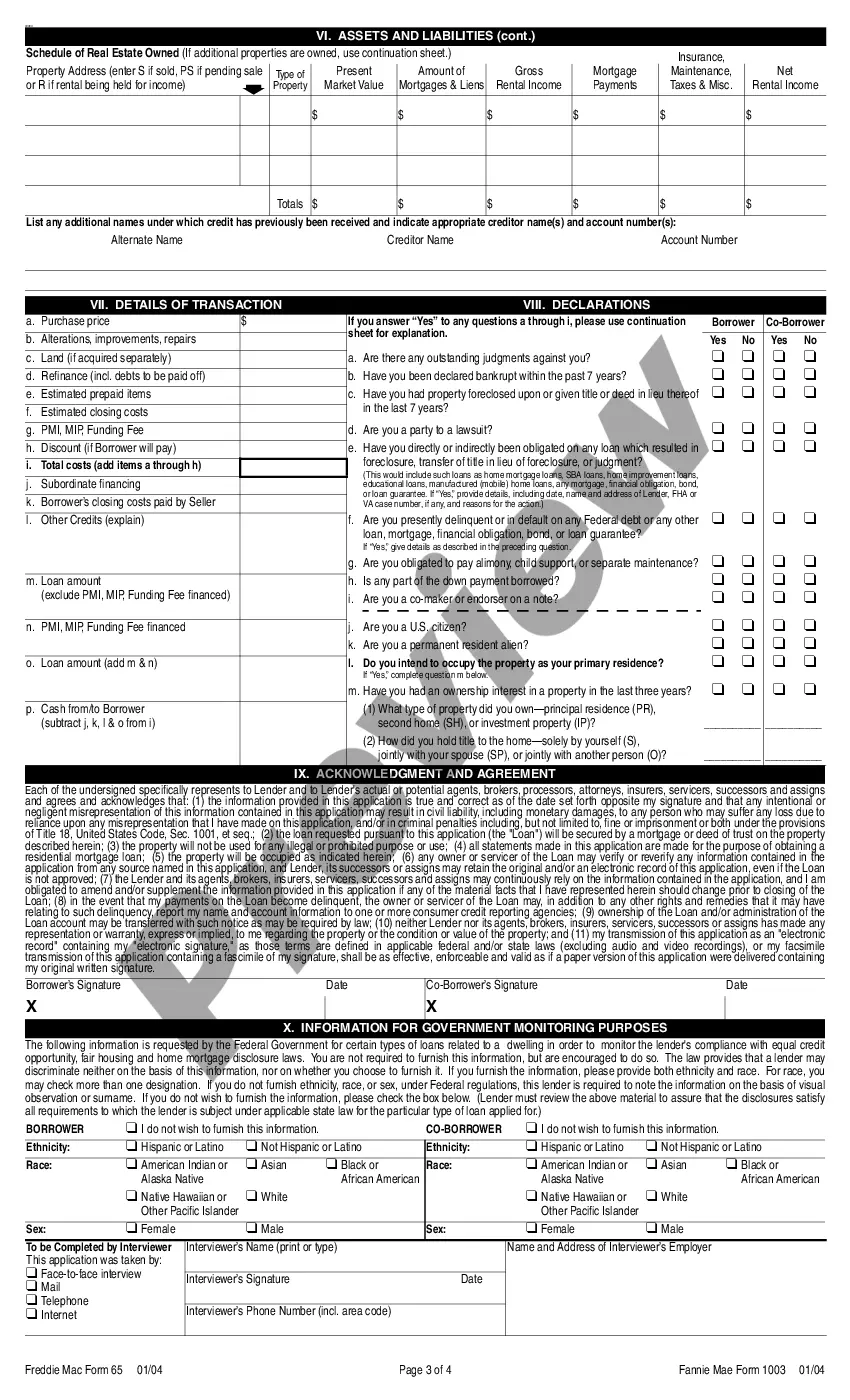

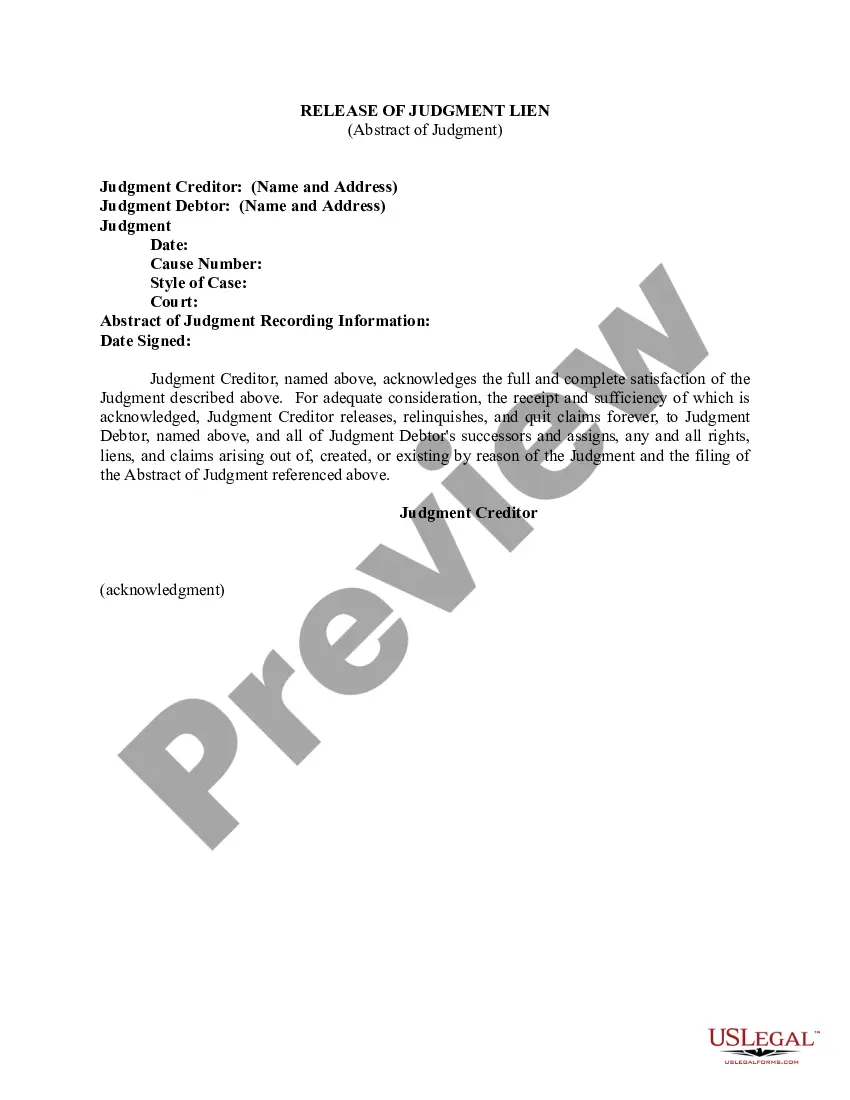

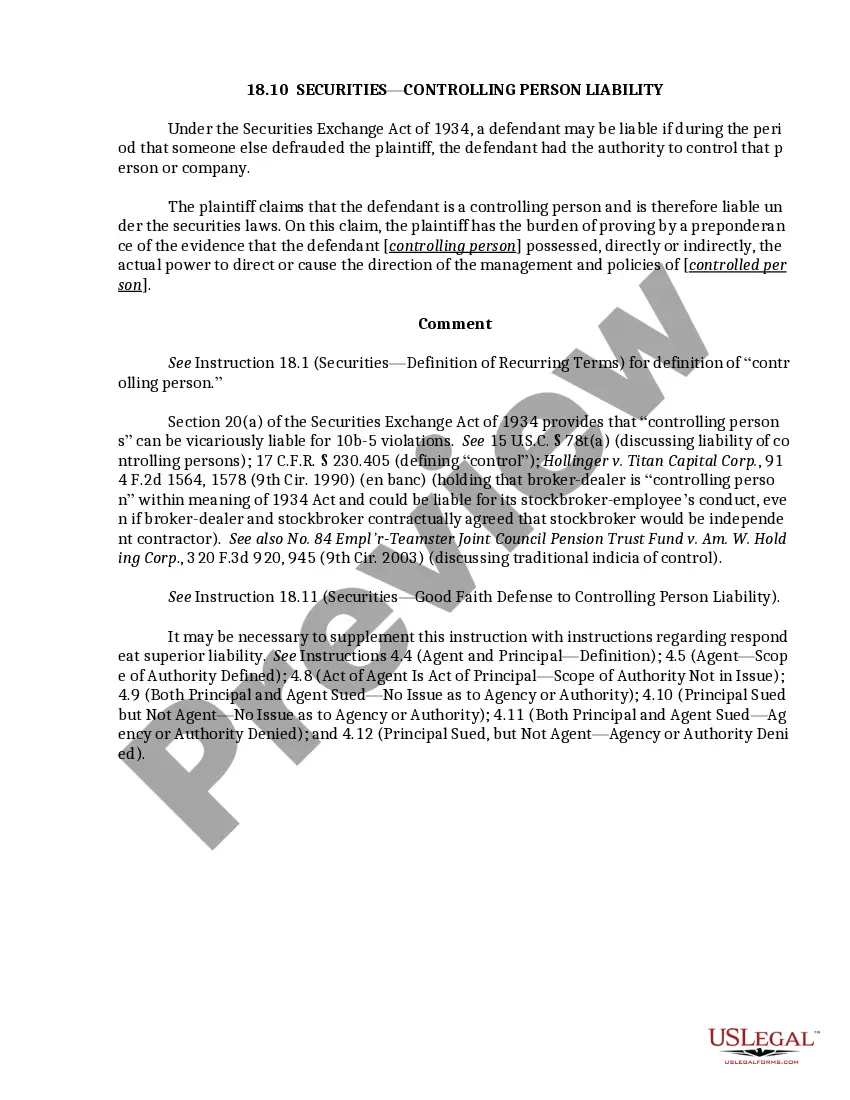

The North Carolina Uniform Residential Loan Application is a standardized form used by borrowers in North Carolina to apply for a mortgage loan. This application is used by lenders to collect essential borrower information in a consistent format, allowing for efficient loan processing. By providing relevant keywords for this topic, we can highlight the key features and different types of North Carolina Uniform Residential Loan Applications available. Keywords: North Carolina, Uniform Residential Loan Application, mortgage, loan, borrowers, lenders, standardized form, essential information, loan processing. Description: The North Carolina Uniform Residential Loan Application serves as a vital document for individuals seeking mortgage loans in North Carolina. This standardized form ensures consistency and accuracy in collecting borrower information, making the loan application process smoother for lenders and borrowers alike. By utilizing various relevant keywords, we can explore the purpose and types of North Carolina Uniform Residential Loan Applications. Types of North Carolina Uniform Residential Loan Applications: 1. Initial Purchase Application: This type of application is used by borrowers who are purchasing a home for the first time, providing all the necessary details regarding their financial situation, employment history, income, assets, and liabilities. It assists lenders in assessing the borrower's creditworthiness and determining suitable loan options. 2. Refinance Application: Borrowers interested in refinancing their existing mortgage can complete a North Carolina Uniform Residential Loan Application tailored specifically for refinancing purposes. This application enables borrowers to provide updated financial information, reasons for refinancing, and details about their current mortgage terms. 3. Home Equity Loan Application: Borrowers aiming to access their home equity by applying for a loan can utilize the North Carolina Uniform Residential Loan Application designed for home equity purposes. This application collects information on the value of the property, current mortgage details, and the borrower's financial standing, enabling lenders to evaluate the viability of the loan and assess potential risks. 4. Construction Loan Application: Individuals seeking funding for construction or renovation projects can complete a North Carolina Uniform Residential Loan Application particular to construction loans. This application provides an overview of the project, budget estimates, and detailed construction plans. Lenders utilize this application to evaluate the borrower's ability to manage the project and determine loan terms accordingly. Regardless of the specific type, the North Carolina Uniform Residential Loan Application primarily aims to collect fundamental borrower information, including personal details, employment history, income, and assets. It also captures pertinent financial information such as outstanding debts, monthly expenses, and credit history. This standardized approach streamlines the loan application process, expediting the lender's assessment and decision-making procedures. In conclusion, the North Carolina Uniform Residential Loan Application is a crucial tool for borrowers seeking mortgage loans in North Carolina. By providing a consistent format to collect essential borrower information, this application helps lenders make informed decisions and ensures a smoother process for acquiring a mortgage loan. Different types of applications cater to specific loan purposes, such as initial purchases, refinancing, home equity loans, and construction loans.

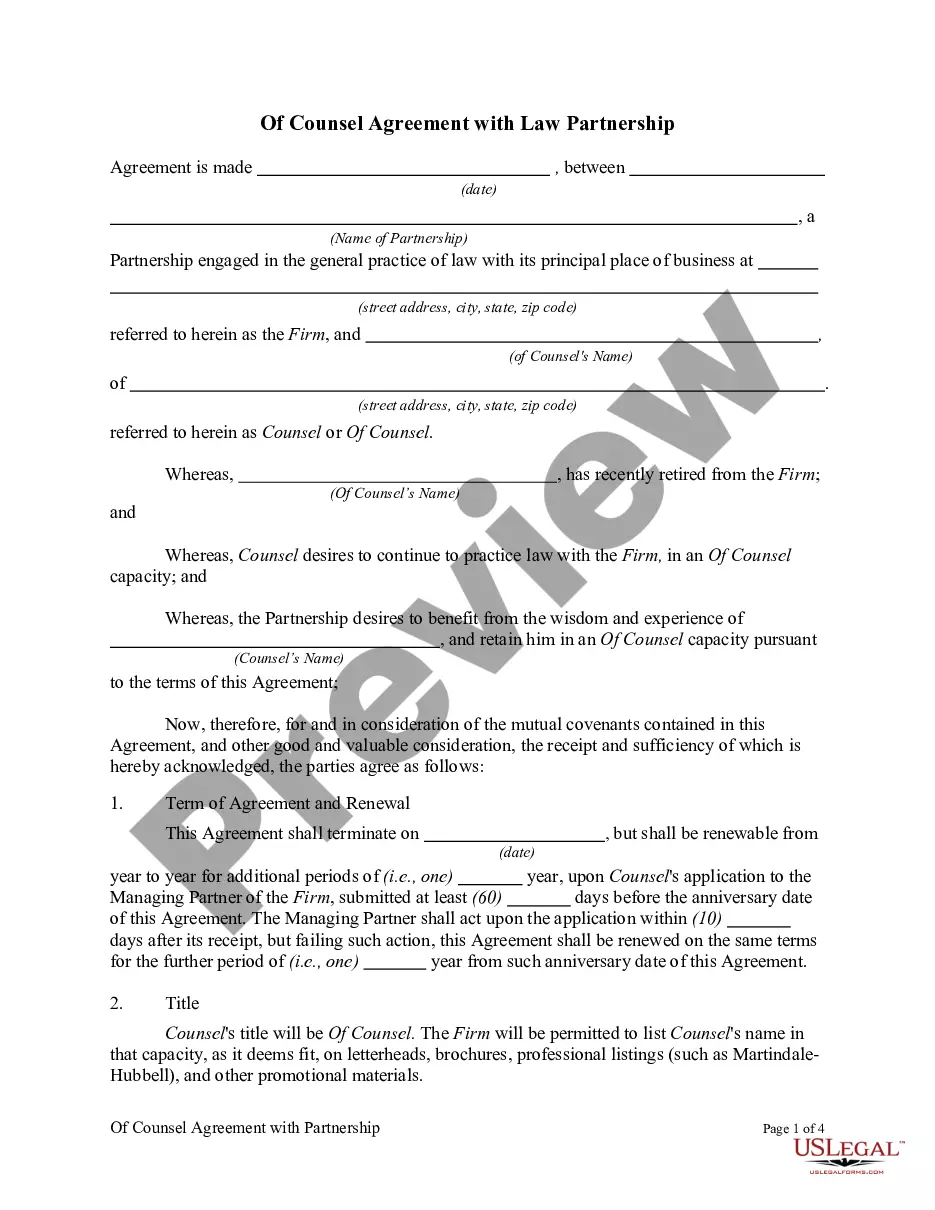

North Carolina Uniform Residential Loan Application

Description

How to fill out North Carolina Uniform Residential Loan Application?

Are you within a position that you need papers for possibly company or personal reasons nearly every time? There are a variety of legal file layouts accessible on the Internet, but getting types you can rely on is not easy. US Legal Forms provides a huge number of develop layouts, such as the North Carolina Uniform Residential Loan Application, that are published to meet state and federal requirements.

In case you are already acquainted with US Legal Forms internet site and get your account, just log in. Afterward, you can down load the North Carolina Uniform Residential Loan Application web template.

Should you not provide an account and would like to begin to use US Legal Forms, follow these steps:

- Discover the develop you will need and make sure it is for the proper town/region.

- Make use of the Preview option to review the shape.

- Look at the description to ensure that you have chosen the appropriate develop.

- When the develop is not what you`re looking for, utilize the Look for discipline to discover the develop that suits you and requirements.

- Whenever you discover the proper develop, click Buy now.

- Choose the costs program you would like, fill in the desired information to make your account, and buy the order using your PayPal or bank card.

- Choose a hassle-free paper formatting and down load your backup.

Find every one of the file layouts you may have bought in the My Forms food selection. You may get a additional backup of North Carolina Uniform Residential Loan Application whenever, if needed. Just select the essential develop to down load or printing the file web template.

Use US Legal Forms, one of the most comprehensive variety of legal forms, to save time and prevent mistakes. The service provides professionally made legal file layouts which can be used for a range of reasons. Produce your account on US Legal Forms and commence producing your way of life easier.