The North Carolina Complex Will — Credit Shelter Marital Trust for Spouse is a legal instrument used in estate planning to protect assets and provide for a surviving spouse. This type of trust is designed to take advantage of the estate tax exclusion and maximize the amount of assets that can be transferred to heirs without incurring estate taxes. In a North Carolina Complex Will, a Credit Shelter Marital Trust is established upon the death of the first spouse. This trust ensures that a portion of the deceased spouse's assets, up to the federal estate tax exclusion limit, is sheltered from estate taxes. By utilizing this trust, the surviving spouse can benefit from the trust's income and assets during their lifetime while preserving the remaining assets for the beneficiaries. There are a few different variations of the North Carolina Complex Will — Credit Shelter Marital Trust for Spouse. One variation is a testamentary trust, which is created within the will and only takes effect upon the death of the first spouse. Another option is a revocable living trust, which is established during the lifetime of the individuals and can be modified or revoked. The purpose of the North Carolina Complex Will — Credit Shelter Marital Trust for Spouse is to provide financial security for the surviving spouse while minimizing estate taxes upon their death. By sheltering a portion of the assets from estate taxes, this trust ensures that more wealth can be transferred to the intended beneficiaries. It also allows for specific instructions on how the assets should be managed and distributed after the surviving spouse's passing. In summary, the North Carolina Complex Will — Credit Shelter Marital Trust for Spouse is a crucial tool in estate planning to protect assets, reduce estate taxes, and provide for the financial well-being of the surviving spouse. It is essential to consult with an experienced estate planning attorney to determine the most suitable type of trust and establish a comprehensive plan that meets your specific needs.

North Carolina Complex Will - Credit Shelter Marital Trust for Spouse

Description

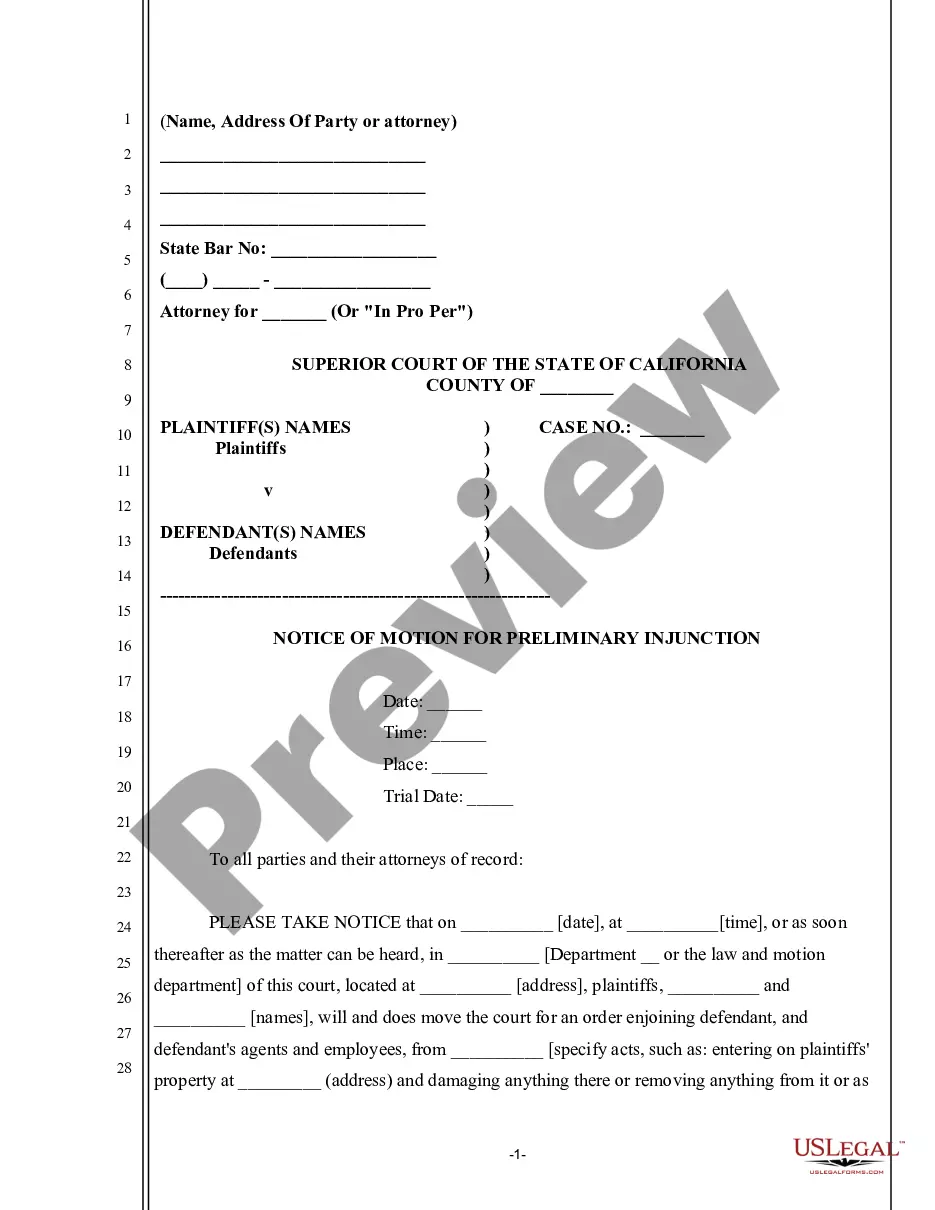

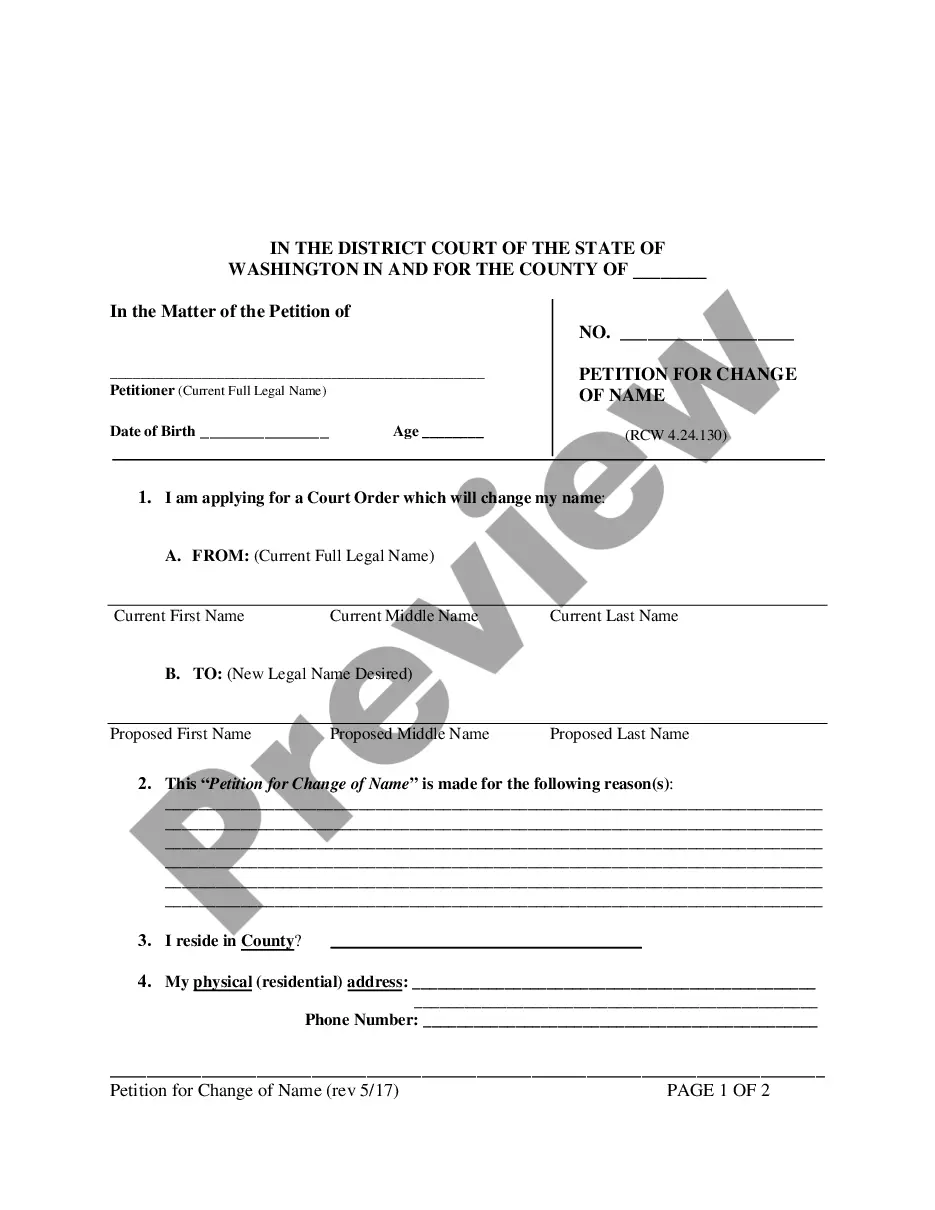

How to fill out North Carolina Complex Will - Credit Shelter Marital Trust For Spouse?

Discovering the right lawful record format might be a have difficulties. Obviously, there are tons of layouts available online, but how do you obtain the lawful kind you will need? Utilize the US Legal Forms web site. The support provides thousands of layouts, for example the North Carolina Complex Will - Credit Shelter Marital Trust for Spouse, which can be used for organization and private demands. All the types are checked out by professionals and meet state and federal needs.

If you are currently listed, log in for your account and then click the Download switch to find the North Carolina Complex Will - Credit Shelter Marital Trust for Spouse. Utilize your account to appear with the lawful types you might have acquired in the past. Check out the My Forms tab of your account and have an additional version from the record you will need.

If you are a fresh consumer of US Legal Forms, here are simple instructions that you should stick to:

- Initially, ensure you have chosen the appropriate kind for the metropolis/area. You may examine the shape utilizing the Review switch and read the shape explanation to ensure this is basically the right one for you.

- In the event the kind is not going to meet your requirements, utilize the Seach discipline to get the proper kind.

- When you are certain that the shape is acceptable, select the Acquire now switch to find the kind.

- Pick the pricing plan you would like and enter the needed information. Build your account and buy your order using your PayPal account or credit card.

- Select the file file format and acquire the lawful record format for your product.

- Total, edit and print out and indication the acquired North Carolina Complex Will - Credit Shelter Marital Trust for Spouse.

US Legal Forms may be the biggest collection of lawful types that you can find numerous record layouts. Utilize the service to acquire professionally-made files that stick to condition needs.

Form popularity

FAQ

This trust is irrevocable and will pass to beneficiaries other than the surviving spouse (usually their children). The surviving spouse must follow the trust's plan without overly benefiting from its operation, but this trust often passes income to the surviving spouse to live on for the rest of their life.

While a person can leave their marital partner out of their will, the surviving spouse may still be entitled to something called an ?elective share.? In this article, our Charlotte estate planning lawyers explain the most important things to know about elective shares and the disinheritance of a spouse in North ...

If he did not have a will, state statutes, known as intestacy laws, would provide who has priority to inherit the assets. In our example, if the husband had a will then the house would pass to whomever is to receive his assets pursuant to that will. That may very well be his wife, even if her name is not on the title.

No. Credit Shelter Trusts are a popular tool for estate planning, and there are two main types of CSTs, the Marital Gift Trust and the Qualified Terminable Interest Property Trust (QTIP). Both of these Trusts preserve wealth via estate tax exemptions.

Upon the death of the surviving spouse, the trust transfers to the heirs, who are exempt from the estate tax that would have resulted from a combined inheritance. Disadvantages of a CST include formation costs and the surviving spouse's lack of control.

If the person who dies is not survived by a child, a grandchild, or a parent, the spouse takes the entire estate, both real and personal property.

Spouses in North Carolina Inheritance Law If you have no living parents or descendants, your spouse will inherit all of your intestate property. If you die with parents but no descendants, your spouse will inherit half of intestate real estate and the first $100,000 of personal property.

If you die without a surviving spouse, your assets will generally pass to your children. If you have no children, your parents will receive the estate. This pattern continues through siblings, grandparents, aunts and uncles, and their descendants.