This due diligence form is a detailed summary to be completed for each acquisition or divestiture agreement performed within the company regarding business transactions.

North Carolina Acquisition Divestiture Merger Agreement Summary

Description

How to fill out North Carolina Acquisition Divestiture Merger Agreement Summary?

Choosing the best authorized file template could be a have a problem. Obviously, there are plenty of layouts available online, but how can you get the authorized type you need? Utilize the US Legal Forms site. The support delivers thousands of layouts, such as the North Carolina Acquisition Divestiture Merger Agreement Summary, that you can use for organization and personal requirements. Every one of the types are checked by experts and meet up with federal and state demands.

In case you are presently listed, log in to your bank account and then click the Down load key to find the North Carolina Acquisition Divestiture Merger Agreement Summary. Make use of your bank account to check throughout the authorized types you may have purchased earlier. Go to the My Forms tab of the bank account and acquire yet another duplicate from the file you need.

In case you are a brand new customer of US Legal Forms, here are easy recommendations for you to adhere to:

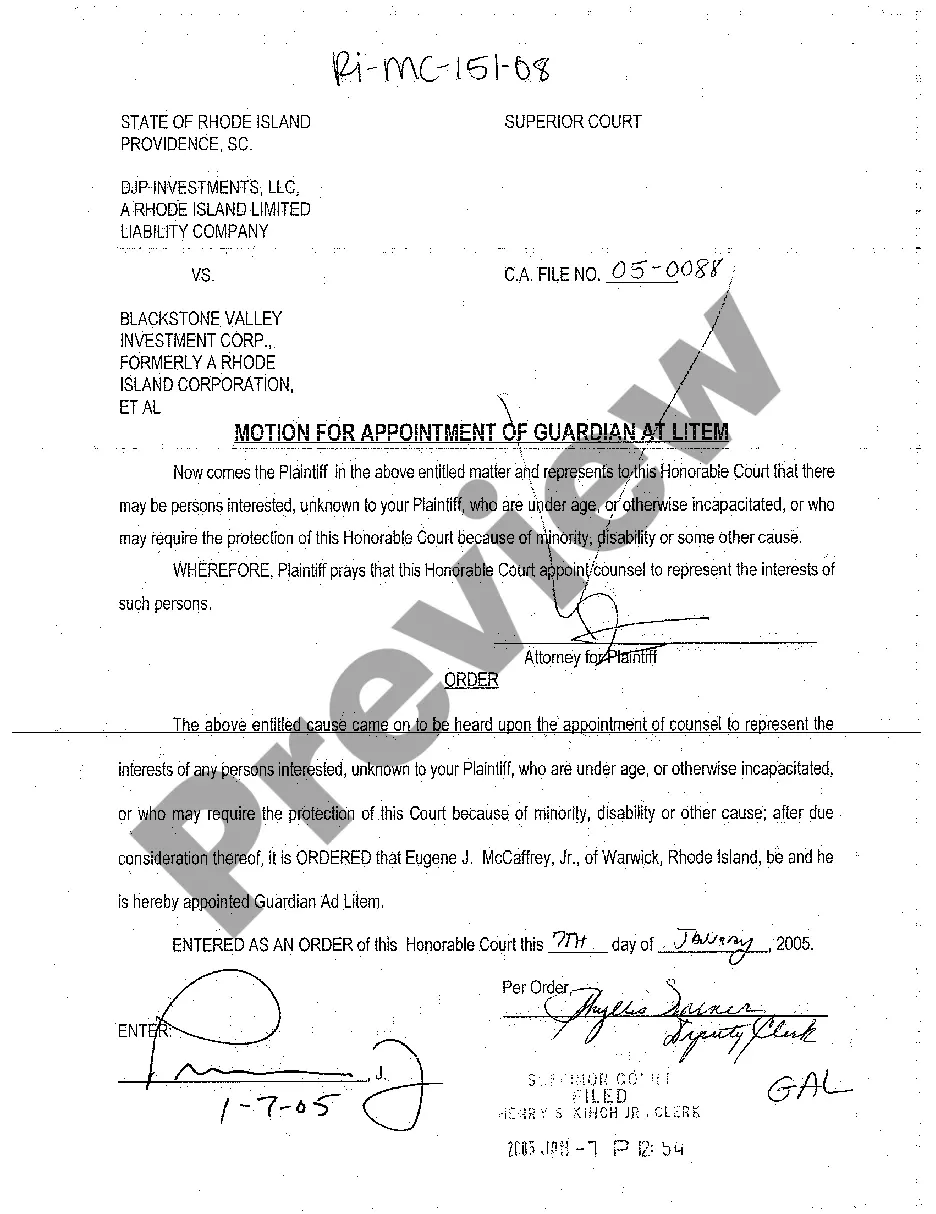

- Very first, ensure you have chosen the appropriate type to your metropolis/county. You can examine the shape using the Preview key and read the shape explanation to make certain it will be the right one for you.

- In the event the type will not meet up with your preferences, utilize the Seach discipline to get the appropriate type.

- When you are certain the shape would work, select the Purchase now key to find the type.

- Select the pricing program you desire and enter the necessary information. Create your bank account and pay money for the order utilizing your PayPal bank account or Visa or Mastercard.

- Choose the data file format and download the authorized file template to your product.

- Total, edit and printing and sign the acquired North Carolina Acquisition Divestiture Merger Agreement Summary.

US Legal Forms will be the most significant catalogue of authorized types for which you can find different file layouts. Utilize the service to download professionally-produced paperwork that adhere to express demands.

Form popularity

FAQ

Acquisition Offer means an offer made by an acquiring person to acquire shares, or any class of shares, of a company; Sample 1.

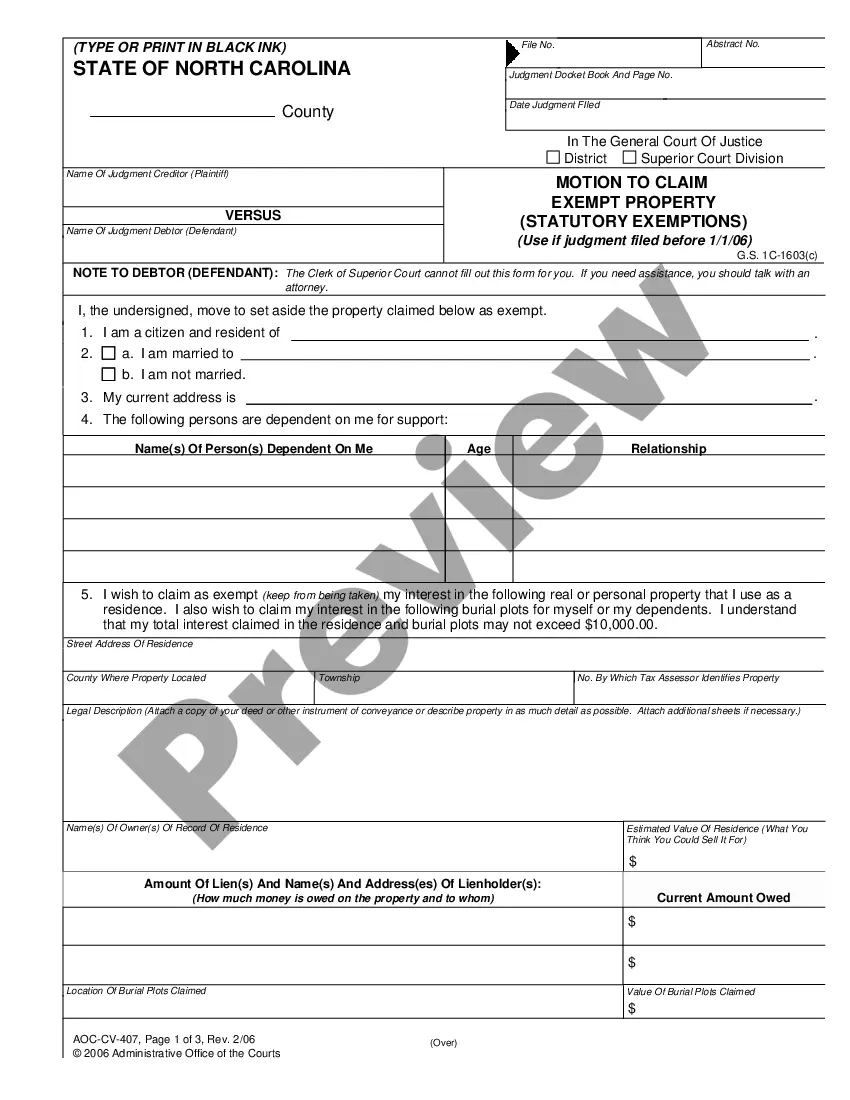

A divestment strategy is the way to go when a particular business line doesn't perform to expectations and becomes a liability instead of an asset. Organizations may also turn to a divestiture strategy to prevent insolvency, reduce debts and maintain a low debt-to-equity ratio.

1. acquisition agreement - contract governing the merger of two or more companies. merger agreement. contract - a binding agreement between two or more persons that is enforceable by law.

An acquisition agreement is a critical contract when one company decides to purchase another company. Each merger and acquisition transaction will have unique terms and can vary widely from one another. It is essential to have a valid acquisition agreement that fully represents the terms of your particular deal.

A divestiture is when a company or government disposes of all or some of its assets by selling, exchanging, closing them down, or through bankruptcy. As companies grow, they may become involved in too many business lines, so divestiture is the way to stay focused and remain profitable.

The acquisition example includes purchasing whole foods in 2017 by Amazon for $13.7 billion. Company AT&T bought Time Warner Inc. in 2016 for $85.4 billion. The following acquisition examples outline the most common types of acquisitions.

What are the various legal documents involved in an acquisition?Deal structure whether it is an acquisition of the stock or assets of the business.Purchase price.Earnout terms (if any)Escrow terms amount and duration until release.Assets included or excluded in the sale.Liabilities included or excluded in the sale.More items...

Divestitures are the flip side of corporate growth involving mergers and acquisitions. Divestiture involves a corporation's sale of one or more of its constituent parts (i.e., a branch, subsidiary or facility) or some or all of its productive assets in an effort to reduce its size.

Unfortunately for most parties involved, no. A contract cannot survive the death of either party unless it's assigned under a corporate agreement (such as stock purchase agreements)--which has its own set of issues--or if the contract is supported by consideration produced before the termination.

Relation to mergers and acquisitions (M&A)Divestiture transactions are often lumped in with the mergers and acquisitions process. Learn how mergers and acquisitions and deals are completed.