The North Carolina Master Agreement between Credit Suisse Financial Products and Bank One National Association is a legally binding contract that outlines the terms and conditions governing the financial relationship between the two parties. This agreement serves as a framework for conducting various financial transactions and business operations in the state of North Carolina. Keywords: North Carolina Master Agreement, Credit Suisse Financial Products, Bank One National Association, terms and conditions, financial relationship, framework, financial transactions, business operations. There are different types of North Carolina Master Agreements between Credit Suisse Financial Products and Bank One National Association, including: 1. North Carolina Master Repurchase Agreement: This agreement governs the repurchase (repo) transactions between the parties, where Credit Suisse acts as the seller and Bank One acts as the buyer of certain securities. The agreement establishes the terms for the sale and subsequent repurchase of the securities, including interest rates, collateral requirements, and settlement dates. 2. North Carolina Master Securities Loan Agreement: This agreement facilitates securities lending transactions between the parties. Credit Suisse, as the lender, lends securities to Bank One, the borrower, under certain agreed-upon terms. The agreement specifies the quantity and type of securities, fees, duration of the loan, and conditions for the return of the borrowed securities. 3. North Carolina Master Derivatives Agreement: This agreement regulates the derivatives transactions entered into by both parties. It covers various types of derivatives, such as options, futures, swaps, and forwards. The agreement defines the rights and obligations of each party, including valuation, margin requirements, netting agreements, and terms for the termination of the derivatives contracts. 4. North Carolina Master Securities Purchase Agreement: This agreement outlines the terms for the purchase and sale of securities between Credit Suisse and Bank One. It covers aspects such as price, quantity, settlement date, representations and warranties, governing law, and dispute resolution procedures. These different types of North Carolina Master Agreements provide a comprehensive framework for Credit Suisse Financial Products and Bank One National Association to engage in diverse financial transactions while ensuring clarity, enforceability, and accountability.

North Carolina Master Agreement between Credit Suisse Financial Products and Bank One National Association

Description

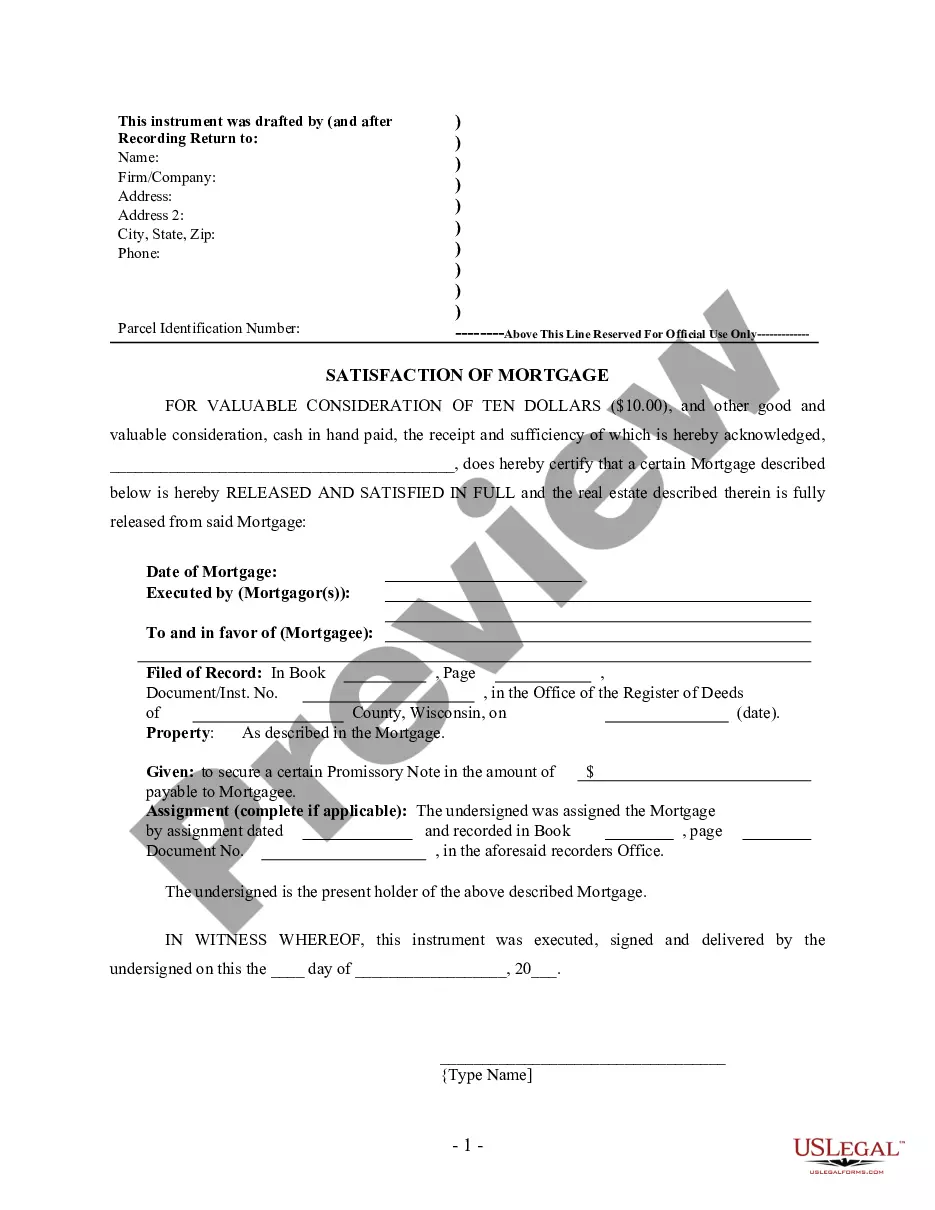

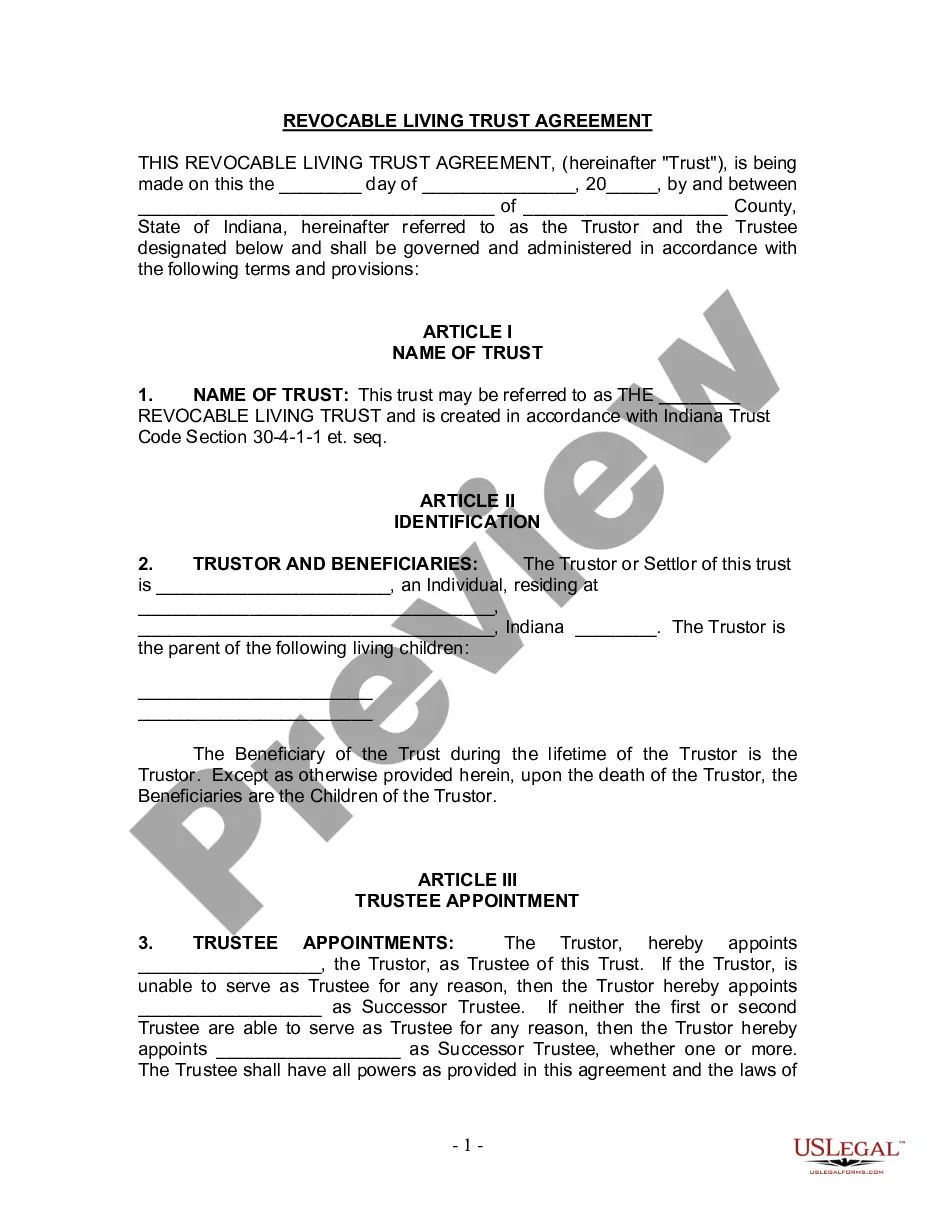

How to fill out North Carolina Master Agreement Between Credit Suisse Financial Products And Bank One National Association?

If you need to total, acquire, or printing legitimate record web templates, use US Legal Forms, the most important selection of legitimate types, which can be found online. Use the site`s simple and easy convenient look for to find the documents you need. Various web templates for company and person purposes are sorted by classes and claims, or keywords and phrases. Use US Legal Forms to find the North Carolina Master Agreement between Credit Suisse Financial Products and Bank One National Association in a handful of clicks.

If you are already a US Legal Forms client, log in to your profile and then click the Obtain button to find the North Carolina Master Agreement between Credit Suisse Financial Products and Bank One National Association. Also you can entry types you earlier delivered electronically inside the My Forms tab of your profile.

If you use US Legal Forms for the first time, follow the instructions listed below:

- Step 1. Make sure you have chosen the shape for your right metropolis/region.

- Step 2. Utilize the Review option to look through the form`s content. Don`t forget to read the explanation.

- Step 3. If you are unsatisfied using the form, utilize the Lookup discipline towards the top of the monitor to locate other types of your legitimate form format.

- Step 4. Upon having found the shape you need, select the Get now button. Pick the rates program you prefer and put your credentials to sign up on an profile.

- Step 5. Approach the transaction. You can utilize your charge card or PayPal profile to accomplish the transaction.

- Step 6. Find the format of your legitimate form and acquire it on your system.

- Step 7. Complete, edit and printing or signal the North Carolina Master Agreement between Credit Suisse Financial Products and Bank One National Association.

Each legitimate record format you get is the one you have for a long time. You possess acces to every single form you delivered electronically within your acccount. Go through the My Forms segment and select a form to printing or acquire again.

Compete and acquire, and printing the North Carolina Master Agreement between Credit Suisse Financial Products and Bank One National Association with US Legal Forms. There are thousands of expert and express-certain types you may use for the company or person requires.