North Carolina Stock Option Agreement of Turn stone Systems, Inc. is a legal document that outlines the terms and conditions associated with stock options offered by Turn stone Systems, Inc. to its employees or individuals related to the company. This agreement enables employees to purchase shares of the company's stock at a predetermined price within a specified timeframe. Here are some relevant details and keywords related to the North Carolina Stock Option Agreement of Turn stone Systems, Inc.: 1. Terms and Conditions: The agreement entails the specific terms and conditions that govern the stock options, including the vesting schedule, exercise price, expiration date, and any restrictions on the options. 2. Grant of Stock Options: This section describes the number of stock options being granted to the employee and the grant date. It often mentions the purpose of granting stock options, such as incentivizing employee performance or retaining valuable talent. 3. Vesting Schedule: The agreement outlines the vesting schedule, which determines when the employee gains ownership rights over the granted stock options. It typically includes a time-based vesting period or may be tied to specific performance milestones. 4. Exercise Price: The exercise price is the predetermined price at which an employee can purchase the company's stock when exercising their stock options. The agreement states this price and any provisions for changes in the exercise price over time. 5. Expiration Date: The expiration date denotes the last date by which employees can exercise their stock options. If they fail to do so before this date, the options become worthless. 6. Option Exercise: This section outlines the process and procedures for exercising stock options, including deadlines, necessary paperwork, and payment methods. 7. Tax Considerations: The agreement may include provisions related to the tax implications of exercising stock options. It can explain the employee's responsibility for taxes and any withholding obligations by the company. Types of North Carolina Stock Option Agreement of Turn stone Systems, Inc.: 1. Employee Stock Option Agreement: This agreement is granted to the company's employees and contains provisions and guidelines specific to their employment relationship. It may outline additional terms related to employment, termination, or change of control events. 2. Non-Employee Stock Option Agreement (Consultants, Board Members, etc.): Turn stone Systems, Inc. may also offer stock options to non-employees, such as consultants or board members. This type of agreement will have its own set of terms and conditions tailored for individuals in non-employee roles. 3. Incentive Stock Option Agreement: This type of agreement is designed to qualify for favorable tax treatment under the U.S. Internal Revenue Code. It typically includes additional requirements and restrictions for employees to meet to benefit from this tax advantage. In summary, the North Carolina Stock Option Agreement of Turn stone Systems, Inc. is a comprehensive legal document that outlines the terms, rights, and conditions associated with stock options offered by the company to its employees or other individuals. It covers aspects such as grants, vesting schedules, exercise prices, expiration dates, and tax considerations.

North Carolina Stock Option Agreement of Turnstone Systems, Inc.

Description

How to fill out North Carolina Stock Option Agreement Of Turnstone Systems, Inc.?

Are you in the place where you require papers for either enterprise or individual functions virtually every working day? There are a lot of lawful document templates available on the net, but getting versions you can rely on isn`t simple. US Legal Forms delivers a huge number of kind templates, like the North Carolina Stock Option Agreement of Turnstone Systems, Inc., which can be published in order to meet federal and state specifications.

In case you are previously informed about US Legal Forms web site and have an account, simply log in. After that, you may obtain the North Carolina Stock Option Agreement of Turnstone Systems, Inc. template.

If you do not provide an bank account and want to begin to use US Legal Forms, follow these steps:

- Obtain the kind you require and ensure it is for your proper town/state.

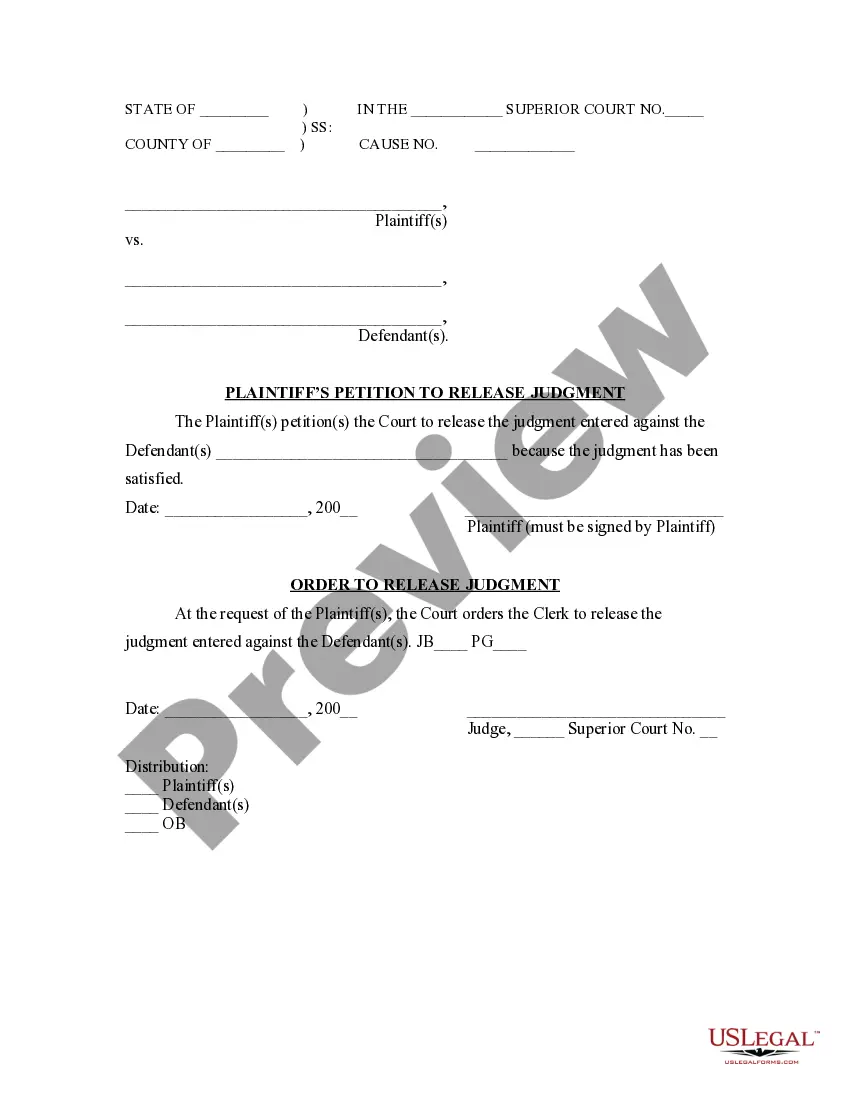

- Take advantage of the Review button to analyze the shape.

- Read the outline to ensure that you have selected the right kind.

- In the event the kind isn`t what you are seeking, take advantage of the Look for area to discover the kind that meets your needs and specifications.

- If you discover the proper kind, simply click Get now.

- Select the rates prepare you want, fill out the necessary information and facts to create your bank account, and pay money for your order using your PayPal or charge card.

- Select a hassle-free document formatting and obtain your backup.

Discover every one of the document templates you possess purchased in the My Forms menu. You may get a more backup of North Carolina Stock Option Agreement of Turnstone Systems, Inc. at any time, if possible. Just click on the required kind to obtain or produce the document template.

Use US Legal Forms, one of the most comprehensive selection of lawful varieties, in order to save time as well as prevent faults. The assistance delivers professionally produced lawful document templates that you can use for a range of functions. Create an account on US Legal Forms and initiate creating your daily life a little easier.