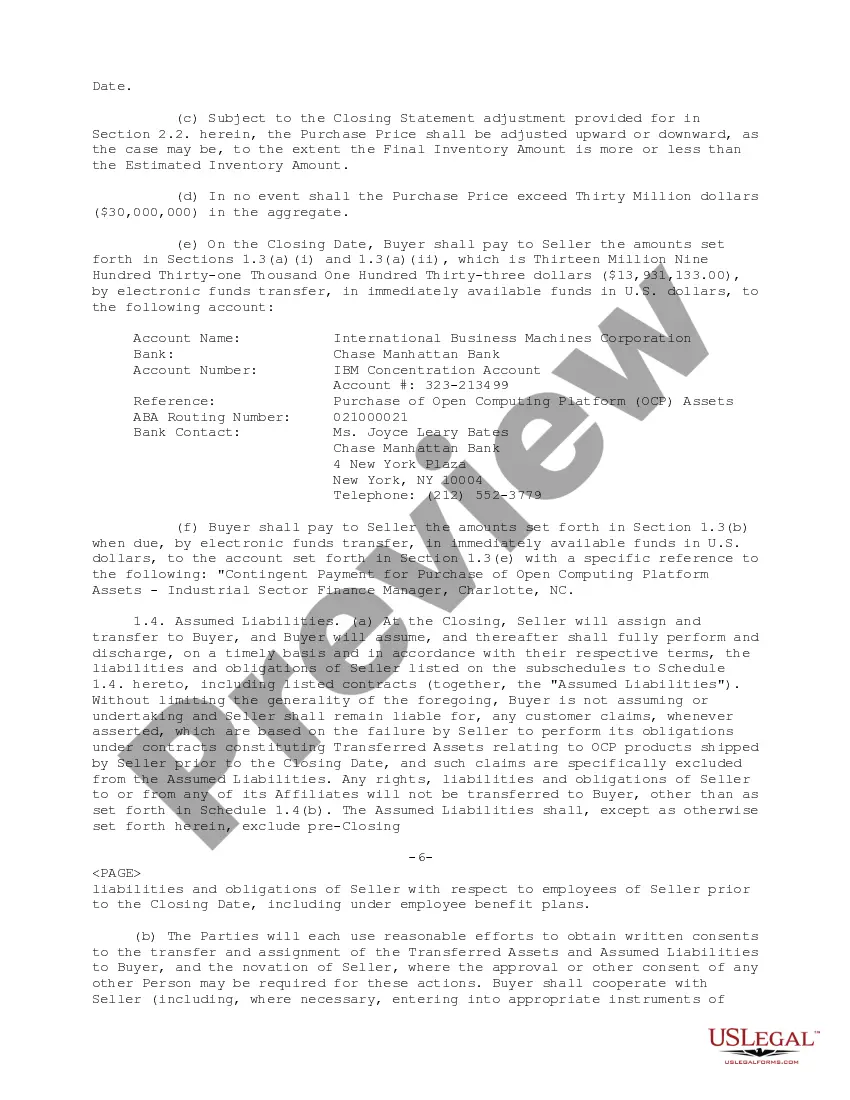

North Carolina Sample Asset Purchase Agreement between Radius Corporation and International Business Machines Corporation This sample asset purchase agreement outlines the terms and conditions of the transaction between Radius Corporation, the seller, and International Business Machines Corporation (IBM), the buyer. The agreement covers the transfer of certain assets from Radius Corporation to IBM. Key terms and conditions of the agreement include: 1. Purchase Price: The purchase price for the assets being transferred shall be determined based on the valuation conducted by a mutually agreed upon independent third-party appraiser. 2. Assets Included: The agreement specifies the assets being sold, which may include tangible assets such as equipment, inventory, and licenses, as well as intangible assets like intellectual property rights, trademarks, and customer contracts. 3. Excluded Assets: The agreement identifies any assets that shall be excluded from the transaction, such as certain accounts receivable or liabilities. 4. Representations and Warranties: Both parties make various representations and warranties regarding their respective authority, legal status, and the accuracy of the provided information. 5. Closing Conditions: The agreement sets forth the conditions that must be met before the closing of the transaction can occur. These conditions may include obtaining necessary governmental approvals or consents, as well as the absence of any material adverse changes in the business. 6. Confidentiality: The parties agree to maintain the confidentiality of any non-public information disclosed during the negotiation and execution of the agreement. 7. Indemnification: The agreement establishes the indemnification obligations of both parties in relation to any breaches or claims arising from the transaction. Different types of North Carolina Sample Asset Purchase Agreement between Radius Corporation and International Business Machines Corporation may include: 1. Non-Disclosure Agreement (NDA): A separate NDA might be required at the initial stages of the negotiation process to ensure the protection of proprietary information disclosed between the parties. 2. Letter of Intent (LOI): This document can precede the asset purchase agreement and outlines the basic terms and conditions of the proposed transaction, providing a framework for future negotiation. 3. Bill of Sale: Following the asset purchase agreement, a bill of sale can be executed to effectuate the transfer of the assets and establish the buyer's ownership. 4. Transition Services Agreement: In some cases, a separate agreement may be required to outline the provision of transition services by the seller to the buyer for a specified period post-closing. It's important to note that the provided descriptions and terms are general in nature and may vary depending on the specific circumstances of the asset purchase agreement. Legal advice from qualified professionals is recommended when drafting or reviewing such agreements.

North Carolina Sample Asset Purchase Agreement between RadiSys Corporation and International Business Machines Corporation - Sample

Description

How to fill out North Carolina Sample Asset Purchase Agreement Between RadiSys Corporation And International Business Machines Corporation - Sample?

You are able to devote hours online searching for the legal file web template that suits the federal and state requirements you require. US Legal Forms supplies 1000s of legal types which can be reviewed by experts. It is possible to acquire or print the North Carolina Sample Asset Purchase Agreement between RadiSys Corporation and International Business Machines Corporation - Sample from our services.

If you currently have a US Legal Forms bank account, you may log in and click the Acquire button. Next, you may comprehensive, revise, print, or signal the North Carolina Sample Asset Purchase Agreement between RadiSys Corporation and International Business Machines Corporation - Sample. Each and every legal file web template you purchase is the one you have forever. To acquire another duplicate of the purchased develop, visit the My Forms tab and click the corresponding button.

If you work with the US Legal Forms web site for the first time, adhere to the straightforward recommendations under:

- First, make sure that you have selected the right file web template for that area/city of your liking. Read the develop explanation to ensure you have selected the correct develop. If accessible, use the Preview button to appear from the file web template also.

- In order to find another edition of your develop, use the Research area to find the web template that suits you and requirements.

- Once you have discovered the web template you want, click on Acquire now to continue.

- Pick the prices plan you want, type your accreditations, and sign up for a free account on US Legal Forms.

- Complete the financial transaction. You should use your bank card or PayPal bank account to purchase the legal develop.

- Pick the structure of your file and acquire it in your gadget.

- Make modifications in your file if necessary. You are able to comprehensive, revise and signal and print North Carolina Sample Asset Purchase Agreement between RadiSys Corporation and International Business Machines Corporation - Sample.

Acquire and print 1000s of file layouts using the US Legal Forms website, that offers the largest collection of legal types. Use expert and state-particular layouts to tackle your organization or individual demands.