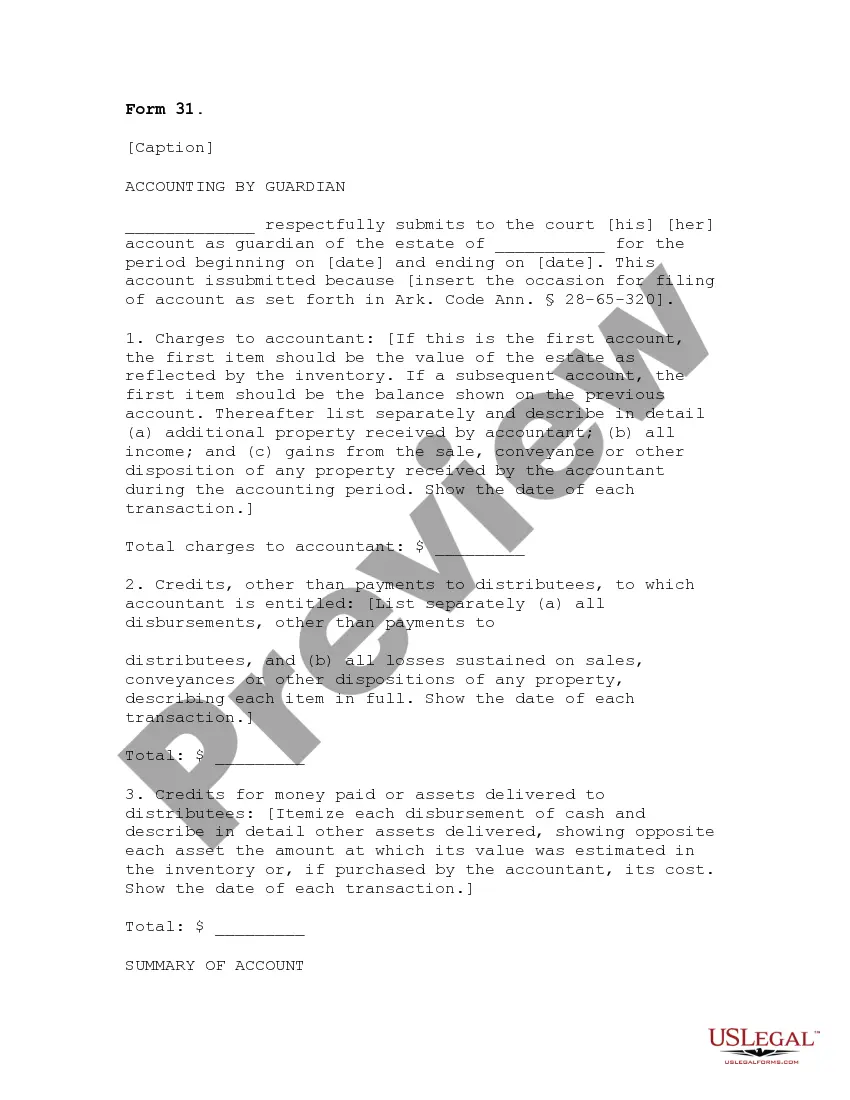

The North Carolina Quick start Loan and Security Agreement between Silicon Valley Bank and print, Inc. is a legally binding document that outlines the terms and conditions of a financial arrangement between the two parties. This agreement is specifically designed for businesses operating in North Carolina and provides a quick and hassle-free loan approval process. The North Carolina Quick start Loan offers various types of loans, tailored to meet the specific needs of print, Inc. These loan types could include: 1. Working Capital Loan: This type of loan is intended to provide funding for day-to-day operations, covering expenses such as payroll, inventory, and overhead costs. Silicon Valley Bank extends this loan to print, Inc. based on their financial health and projected business growth. 2. Equipment Financing Loan: print, Inc. may also have the option to secure a loan specifically for acquiring new equipment or upgrading existing machinery. This loan enables print, Inc. to invest in state-of-the-art printing equipment, software licenses, and other related assets essential for business expansion. 3. Commercial Real Estate Loan: If print, Inc. is looking to expand their operations or invest in new facilities in North Carolina, they can apply for a commercial real estate loan through the North Carolina Quick start Loan. This loan provides print, Inc. with the necessary capital to purchase or lease commercial properties. The Security Agreement is a crucial aspect of this financial arrangement. It serves to protect Silicon Valley Bank's interests by establishing collateral against the loan. The collateral provided by print, Inc. can consist of tangible assets such as equipment, real estate, inventory, or even intellectual property rights. This agreement ensures that in the event of a default, Silicon Valley Bank has the right to seize and liquidate the collateral to recover the loan amount. Overall, the North Carolina Quick start Loan and Security Agreement between Silicon Valley Bank and print, Inc. is a strategic financial arrangement that provides print, Inc. with much-needed capital for growth and expansion. With flexible loan options tailored to print, Inc.'s requirements, this agreement enables them to thrive in the competitive printing industry while contributing to the economic development of North Carolina.

North Carolina Quickstart Loan and Security Agreement between Silicon Valley Bank and iPrint, Inc.

Description

How to fill out North Carolina Quickstart Loan And Security Agreement Between Silicon Valley Bank And IPrint, Inc.?

If you have to full, acquire, or printing authorized papers templates, use US Legal Forms, the greatest collection of authorized types, that can be found on the Internet. Utilize the site`s basic and hassle-free search to find the documents you need. Numerous templates for organization and person functions are sorted by groups and states, or key phrases. Use US Legal Forms to find the North Carolina Quickstart Loan and Security Agreement between Silicon Valley Bank and iPrint, Inc. with a number of mouse clicks.

When you are already a US Legal Forms consumer, log in for your profile and then click the Obtain button to have the North Carolina Quickstart Loan and Security Agreement between Silicon Valley Bank and iPrint, Inc.. Also you can access types you earlier downloaded in the My Forms tab of your own profile.

If you are using US Legal Forms the very first time, follow the instructions under:

- Step 1. Make sure you have chosen the form for your correct city/nation.

- Step 2. Take advantage of the Review solution to check out the form`s information. Do not neglect to learn the information.

- Step 3. When you are not happy with all the form, make use of the Search discipline on top of the screen to discover other versions of the authorized form template.

- Step 4. When you have found the form you need, go through the Buy now button. Opt for the rates strategy you like and add your accreditations to sign up for the profile.

- Step 5. Process the financial transaction. You can use your Мisa or Ьastercard or PayPal profile to complete the financial transaction.

- Step 6. Pick the structure of the authorized form and acquire it in your system.

- Step 7. Complete, modify and printing or signal the North Carolina Quickstart Loan and Security Agreement between Silicon Valley Bank and iPrint, Inc..

Every authorized papers template you buy is your own permanently. You have acces to every single form you downloaded with your acccount. Select the My Forms area and select a form to printing or acquire once again.

Remain competitive and acquire, and printing the North Carolina Quickstart Loan and Security Agreement between Silicon Valley Bank and iPrint, Inc. with US Legal Forms. There are thousands of specialist and state-certain types you can use to your organization or person needs.