The North Carolina Plan of Merger refers to a legally binding document outlining the agreement between ID Recap, Inc. and Interment, Inc. to merge and combine their operations in North Carolina. This plan serves as a blueprint for the merger process, covering various aspects such as financial terms, management structure, and the rights and obligations of both companies. Under the North Carolina Plan of Merger, ID Recap, Inc. and Interment, Inc. aim to consolidate their resources, expertise, and market presence to achieve synergistic growth and expansion in the dental services' industry. By coming together, the companies anticipate enhanced operational efficiency, increased market share, and improved profitability. The plan addresses key elements such as the exchange of shares or assets between the two companies, the treatment of existing shareholders, and the integration of business operations. It outlines the steps and procedures to be followed to complete the merger, including obtaining necessary regulatory approvals, conducting due diligence, and finalizing the legal documentation. Furthermore, the North Carolina Plan of Merger may encompass different types or provisions depending on the specific details and goals of the merger between ID Recap, Inc. and Interment, Inc. Some potential variations may include: 1. Stock-for-Stock Merger: In this type of merger, the shareholders of both companies exchange their shares based on a predetermined ratio. This plan of merger would detail the specifics of the share swap and the valuation method. 2. Asset Acquisition: Instead of a merger involving shares, ID Recap, Inc. may acquire specific assets or divisions of Interment, Inc. This plan of merger would outline the transfer of assets, liabilities, and contractual obligations. 3. Triangular Merger: In a triangular merger, a subsidiary of ID Recap, Inc. may be formed to acquire Interment, Inc. This plan would clarify the legal structure and the transfer of ownership from Interment, Inc. to the newly created subsidiary. 4. Statutory Merger: Under this type of merger, ID Recap, Inc. and Interment, Inc. would merge into a newly formed corporation. The plan of merger would specify the rights, interests, and entitlements of the shareholders and stakeholders of both companies following the merger. 5. Reverse Merger: In a reverse merger, Interment, Inc. may acquire ID Recap, Inc. This plan of merger would outline the reversal of ownership and the financial arrangements between the two entities. These various types of North Carolina Plans of Merger represent distinct approaches to combining the operations and assets of ID Recap, Inc. and Interment, Inc. The specific type chosen would depend on the strategic goals, legal considerations, and financial implications desired by the leadership of both companies.

North Carolina Plan of Merger between ID Recap, Inc. and InterDent, Inc.

Description

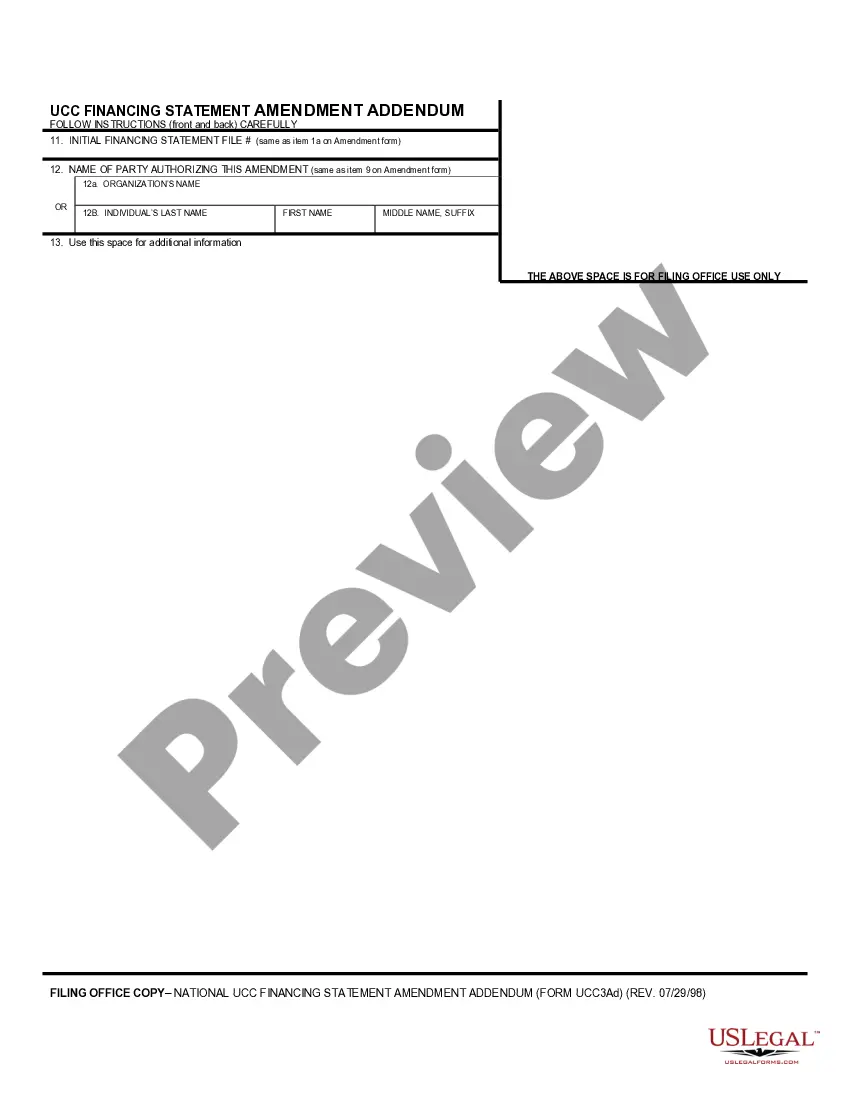

How to fill out North Carolina Plan Of Merger Between ID Recap, Inc. And InterDent, Inc.?

You can devote hrs on-line trying to find the lawful papers web template which fits the federal and state needs you need. US Legal Forms provides a huge number of lawful varieties which are evaluated by experts. You can easily download or printing the North Carolina Plan of Merger between ID Recap, Inc. and InterDent, Inc. from our service.

If you already have a US Legal Forms profile, it is possible to log in and click the Download switch. Following that, it is possible to full, modify, printing, or indicator the North Carolina Plan of Merger between ID Recap, Inc. and InterDent, Inc.. Every single lawful papers web template you get is yours permanently. To obtain another backup of the acquired develop, check out the My Forms tab and click the related switch.

If you use the US Legal Forms website initially, follow the simple directions under:

- Initially, make certain you have chosen the right papers web template for that region/metropolis that you pick. See the develop description to make sure you have picked the appropriate develop. If accessible, use the Preview switch to look from the papers web template at the same time.

- In order to locate another model from the develop, use the Look for field to get the web template that meets your needs and needs.

- Once you have found the web template you desire, click on Get now to move forward.

- Select the rates plan you desire, type your qualifications, and sign up for a merchant account on US Legal Forms.

- Full the financial transaction. You can utilize your Visa or Mastercard or PayPal profile to cover the lawful develop.

- Select the file format from the papers and download it in your device.

- Make adjustments in your papers if needed. You can full, modify and indicator and printing North Carolina Plan of Merger between ID Recap, Inc. and InterDent, Inc..

Download and printing a huge number of papers layouts utilizing the US Legal Forms website, which provides the greatest assortment of lawful varieties. Use specialist and status-distinct layouts to handle your organization or individual needs.